|

IFN712S-INTERNATIONAL FINANCE-2ND OPP-JAN 2025 |

|

1 Page 1 |

▲back to top |

n Am I BI A u n IVE Rs ITY

OF SCIEnCE Ano TECHn OLOGY

FACULTY OF COMMERCE, HUMAN SCIENCESAND EDUCATION

DEPARTMENT OF ECONOMICS, ACCOUNTING AND FINANCE

QUALIFICATION: BACHELOR OF ECONOMICS

QUALIFICATION CODE: O7BEC0

LEVEL: 7

COURSE CODE: IFN712S

COURSE NAME: INTERNATIONAL FINANCE

SESSION: JANUARY 2025

DURATION: 3 HOURS

PAPER: THEORY

MARKS: 100

SECOND OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINER(S) Ms K. Kavezeri

MODERATOR: Mr I. Nashivela

INSTRUCTIONS

1. Answer ALL the questions.

2. Write clearly and neatly.

3. Number the answers clearly.

PERMISSIBLE MATERIALS

1. Pens/pencils/erasers

2. Calculator

3. Ruler

THIS QUESTION PAPER CONSISTS OF 7 PAGES (Including this front page)

|

2 Page 2 |

▲back to top |

QUESTION 1

[25 Marks]

Select the letter that best represents your choice.

1. GNP equals GDP

A) minus net receipts of factor income from the rest of the world.

B) plus receipts of factor income from the rest of the world.

C) minus receipts of factor income from the rest of the world.

D) plus net receipts of factor income from the rest of the world.

E) minus depreciation.

2. Which one of the following expressions is the MOST accurate?

A) CA= EX- IM

B) CA= IM - EX

C) CA= EX= IM

D) CA= EX+ IM

E) CA- IM= EX

3. Government savings, sg, is equal to

A) T - G.

B) T + G.

C) T = G.

D) T + G -1.

E)T - G = I.

4. Every international transaction automatically enters the balance of payments

A) once either as a credit or as a debit.

B) twice, once as a credit and once as a debit.

C) once as a credit.

D) twice, both times as debit.

E)three times, once as a credit, once as a debit, and once as an exchange.

5. The Japanese currency is called the

A) DM.

B) Yen.

C) Euro.

D) Dollar.

E) Pound.

2

|

3 Page 3 |

▲back to top |

6. How many British pounds would it cost to buy a pair of American designer jeans

costing $45 if the exchange rate is 1.80 dollars per British pound?

A) 10 British pounds

B) 25 British pounds

C) 20 British pounds

D) 30 British pounds

E) 40 British pounds

7. Which one of the following statements is the MOST accurate?

A) A depreciation of a country's currency makes its goods cheaper for foreigners.

B) A depreciation of a country's currency makes its goods more expensive for foreigners.

C) A depreciation of a country's currency makes its goods cheaper for its own residents.

D) A depreciation of a country's currency makes its goods cheaper.

E) An appreciation of a country's currency makes its goods more expensive.

8. Forward and spot exchange rates

A) are necessarily equal.

B) do not move closely together.

C) are always such that the forward exchange rate is higher.

D) move closely together and are equal on the value date.

E) are unrelated to the value date.

9. Futures contracts differ from forward contracts in that

A) future contracts ensures you will receive a certain amount of foreign currency at a specified

future date.

B) future contracts bind you into your end of the deal.

C) future contracts allow you to sell your contract on an organized futures exchange.

D) future contracts are a disadvantage if your views about the future spot exchange rate are to

change.

E) futures contracts don't allow you to realize a profit of a loss right away.

10. What is the expected dollar rate of return on euro deposits if today's exchange rate is

$1.10 per euro, next year's expected exchange rate is $1.166 per euro, the dollar

interest rate is 10%, and the euro interest rate is 5%?

A) 10%

B) 11%

C)-1%

D)O%

E) 15%

3

|

4 Page 4 |

▲back to top |

11. Individuals base their demand for an asset on

A) the expected return the asset offers compared with the returns offered by other assets.

B) the riskiness of the asset's expected return.

C) the asset's liquidity.

D) the expected return, how risky that expected return is, and the asset's liquidity.

E) the aesthetic qualities of the asset.

12. The aggregate demand for money can be expressed by

A) Md= p X L(R,Y).

B) Md = Lx P(R,Y).

C) Md= p X Y(R, L).

D) Md= Rx L(P,Y).

E) Md = R x L(R,P).

13. If there is an excess supply of money

A) the interest rate falls.

B) the interest rate rises.

C) the real money supply shifts left to make an equilibrium.

D) the real money supply shifts right to make an equilibrium.

E) the interest rate stays constant, but consumer confidence falters.

14. A permanent increase in a country's money supply

A) causes a more than proportional increase in its price level.

B) causes a less than proportional increase in its price level.

C) causes a proportional increase in its price level.

D) leaves its price level constant in long-run equilibrium.

E) causes an inversely proportional fall in its price level.

15. After a permanent increase in the money supply

A) the exchange rate overshoots in the short run.

B) the exchange rate overshoots in the long run.

C) the exchange rate smoothly depreciates in the short run.

D) the exchange rate smoothly appreciates in the short run.

E) the exchange rate remains the same.

16. Which of the following statements is the MOST accurate? In general

A) the monetary approach to the exchange rate is a long run theory.

B) the monetary approach to the exchange rate is a short run theory.

C) the monetary approach to the exchange rate is both a short and long run theory.

D) the monetary approach to the exchange rate neither long run nor short run theory.

E) the monetary approach to the exchange rate is considered less practical than the law of one

price.

4

|

5 Page 5 |

▲back to top |

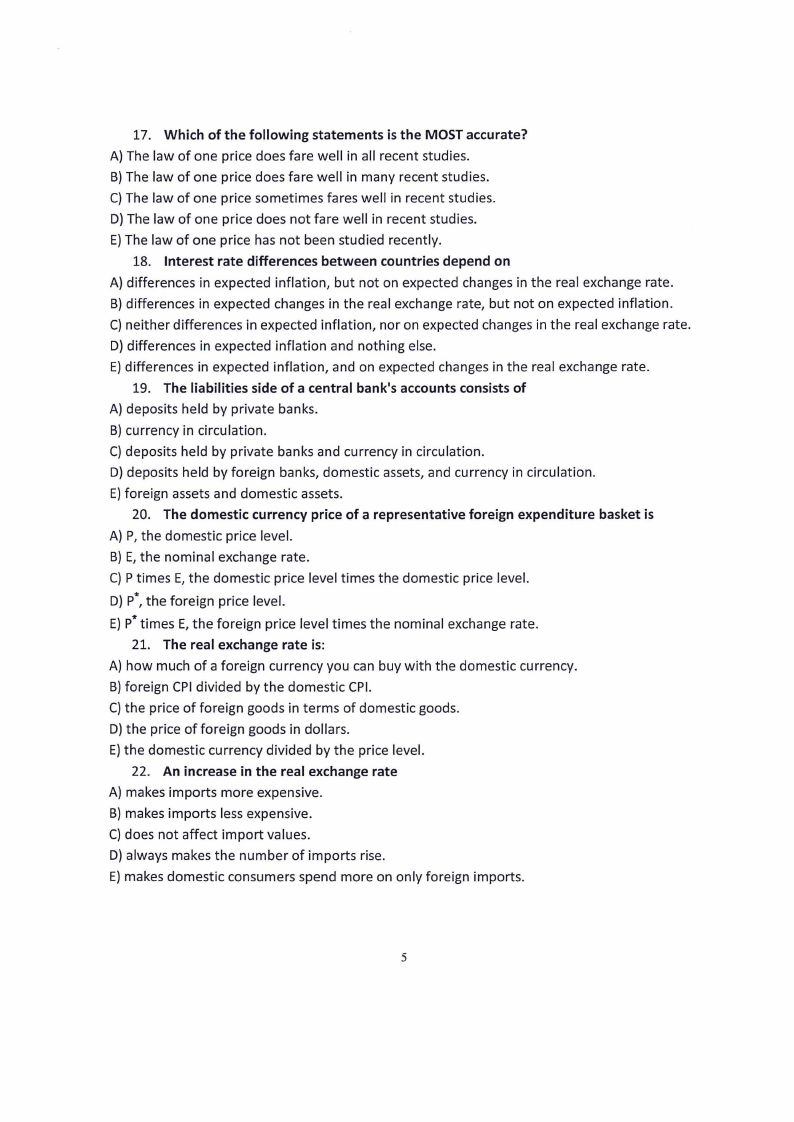

17. Which of the following statements is the MOST accurate?

A) The law of one price does fare well in all recent studies.

B) The law of one price does fare well in many recent studies.

C) The law of one price sometimes fares well in recent studies.

D) The law of one price does not fare well in recent studies.

E) The law of one price has not been studied recently.

18. Interest rate differences between countries depend on

A) differences in expected inflation, but not on expected changes in the real exchange rate.

B) differences in expected changes in the real exchange rate, but not on expected inflation.

C) neither differences in expected inflation, nor on expected changes in the real exchange rate.

D) differences in expected inflation and nothing else.

E) differences in expected inflation, and on expected changes in the real exchange rate.

19. The liabilities side of a central bank's accounts consists of

A) deposits held by private banks.

B) currency in circulation.

C) deposits held by private banks and currency in circulation.

D) deposits held by foreign banks, domestic assets, and currency in circulation.

E) foreign assets and domestic assets.

20. The domestic currency price of a representative foreign expenditure basket is

A) P, the domestic price level.

B) E, the nominal exchange rate.

C) P times E, the domestic price level times the domestic price level.

D) p*, the foreign price level.

E) p" times E, the foreign price level times the nominal exchange rate.

21. The real exchange rate is:

A) how much of a foreign currency you can buy with the domestic currency.

B) foreign CPI divided by the domestic CPI.

C) the price of foreign goods in terms of domestic goods.

D) the price of foreign goods in dollars.

E)the domestic currency divided by the price level.

22. An increase in the real exchange rate

A) makes imports more expensive.

B) makes imports less expensive.

C) does not affect import values.

D) always makes the number of imports rise.

E) makes domestic consumers spend more on only foreign imports.

5

|

6 Page 6 |

▲back to top |

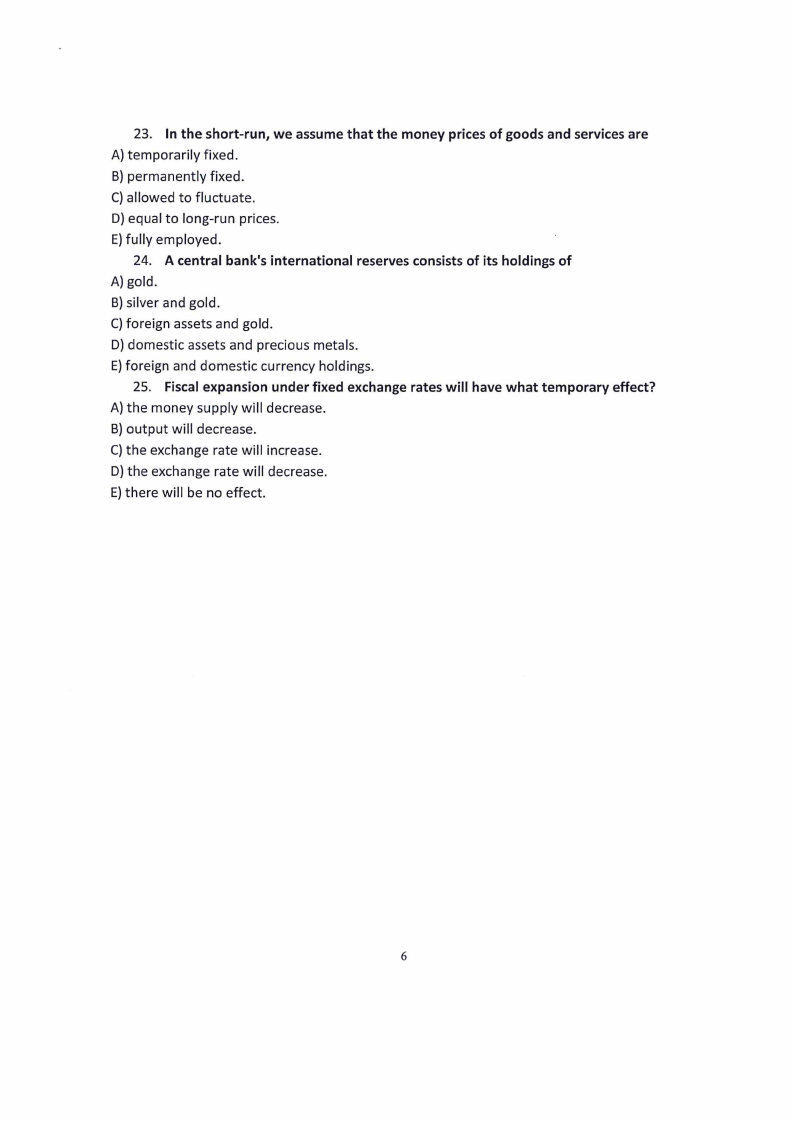

23. In the short-run, we assume that the money prices of goods and services are

A) temporarily fixed.

B) permanently fixed.

C) allowed to fluctuate.

D) equal to long-run prices.

E)fully employed.

24. A central bank's international reserves consists of its holdings of

A)gold.

B) silver and gold.

C) foreign assets and gold.

D) domestic assets and precious metals.

E)foreign and domestic currency holdings.

25. Fiscal expansion under fixed exchange rates will have what temporary effect?

A) the money supply will decrease.

B) output will decrease.

C) the exchange rate will increase.

D) the exchange rate will decrease.

E)there will be no effect.

6

|

7 Page 7 |

▲back to top |

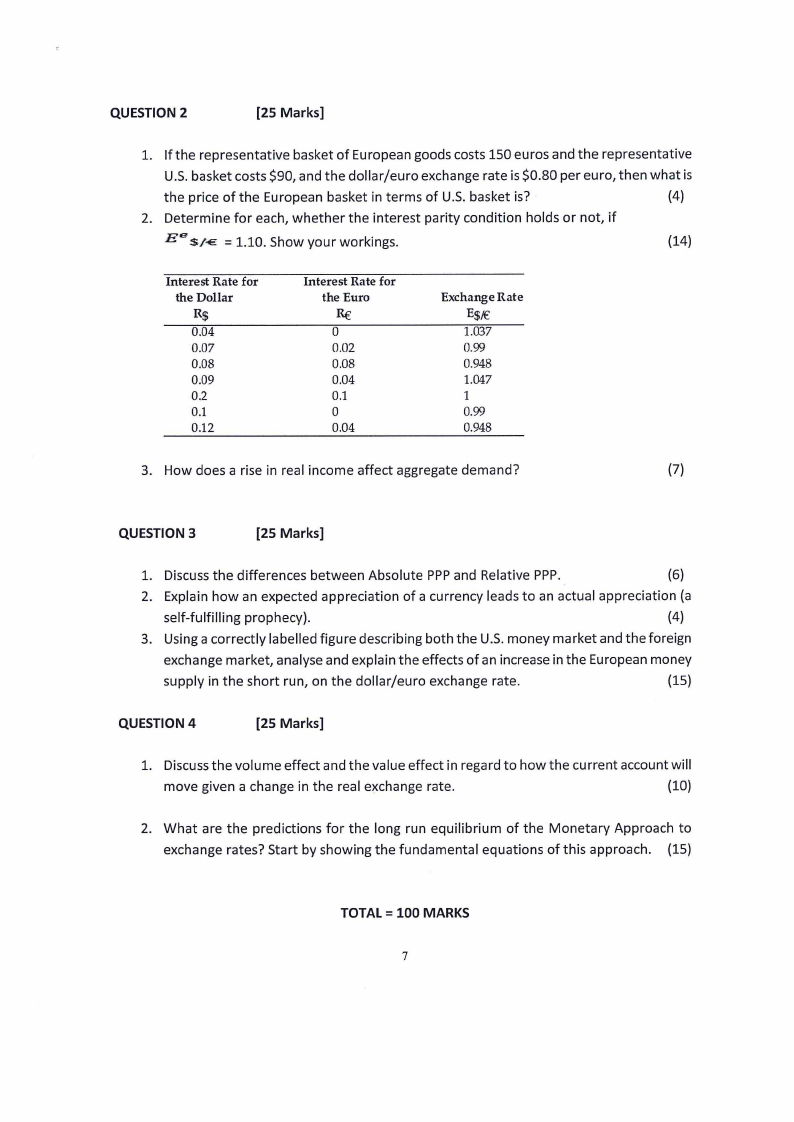

QUESTION 2

[25 Marks]

1. If the representative basket of European goods costs 150 euros and the representative

U.S. basket costs $90, and the dollar/euro exchange rate is $0.80 per euro, then what is

the price of the European basket in terms of U.S. basket is?

(4)

2. Determine for each, whether the interest parity condition holds or not, if

E 0 $/-€ = 1.10. Show your workings.

(14)

Interest Rate for

the Dollar

R$

0.04

0.07

0.08

0.09

0.2

0.1

0.12

Interest Rate for

the Euro

Rf

0

0.02

0.08

0.04

0.1

0

0.04

Exchange Rate

E$/€

1.037

0.99

0.948

1.047

1

0.99

0.948

3. How does a rise in real income affect aggregate demand?

(7)

QUESTION 3

[25 Marks]

1. Discuss the differences between Absolute PPPand Relative PPP.

(6)

2. Explain how an expected appreciation of a currency leads to an actual appreciation (a

self-fulfilling prophecy).

(4)

3. Using a correctly labelled figure describing both the U.S. money market and the foreign

exchange market, analyse and explain the effects of an increase in the European money

supply in the short run, on the dollar/euro exchange rate.

(15)

QUESTION 4

[25 Marks]

1. Discussthe volume effect and the value effect in regard to how the current account will

move given a change in the real exchange rate.

(10)

2. What are the predictions for the long run equilibrium of the Monetary Approach to

exchange rates? Start by showing the fundamental equations of this approach. (15)

TOTAL = 100 MARKS

7