|

FEO810S- FINANCIAL ECONOMICS- 1ST OPP- JUNE 2023 |

|

1 Page 1 |

▲back to top |

nAm I BIA u n IVERSITY

OF SCIEnCEAno TECHnOLOGY

FACULTYOF COMMERCEH, UMANSCIENCES AND

EDUCATION

DEPARTMENTOF ACCOUNTING, ECONOMICSA_ ND FINANCE

QUALIFICATION: BACHELOR OF ECONOMICS HONOURS

QUALIFICATION CODE:

08BECH

LEVEL: 8

COURSECODE: FEO810S

COURSENAME:FINANCIAL ECONOMICS

SESSION: JUNE 2023

PAPER:THEORY AND CALCULATIONS

DURATION: 3 HOURS

MARKS: 100

FIRST OPPORTUNITYEXAMINATIONQUESTION PAPER

EXAMINER Dr. G. Kavari

MODERATOR: Dr. R. Kamati

INSTRUCTIONS

1. Answer ALL the questions in blue or black ink. STRICTLYNO PENCIL

2. Start each question on a new page, number the answers correctly and show all your

working/ assumptions.

3. Write clearly and neatly. Roundoff only final answers to two (2) decimal places

4. Questions relating to this examination may be raised in the initial 30 minutes after

the start of the paper. Thereafter, candidates must use their initiative to deal with

any perceived error or ambiguities and any assumptions made by the candidate should

be clearly stated.

PERMISSIBLEMATERIALS

1. Silent, non-programmable calculators

THIS QUESTION PAPERCONSISTS OF _5_ PAGES(Including this front

page)

|

2 Page 2 |

▲back to top |

QUESTION 1

[25 MARKS]

Supposethe Bank of Namibia has issued N$15 million in the Namibian bond market

in order to raise sufficient funds from potential investors. Study the following

bond market information available to all potential investors.

The bond issued XYZ, with a nominal value of N$15 million and carrying a 25% p.a.

coupon which matures on 30 June 2024 and with coupon dates 30 June and 31

December, is traded (and settled) on 15 July 2022 at a yield of 14. 5%. Register

closes one month before interest dates. Bond trades cum interest - there are

169 days left before the next coupon date.

REQUIRED:

MARKS

i) Determine the number of full six-month coupon payments due

2

before and at maturity.

ii) Determine the number of days from last interest date to

2

next interest date.

iii) Determine the number of days from settlement date to next

2

interest date.

iv) Determine the number of days between last interest date and 2

settlement date (= accrued days for a cum interest bond).

v) Write down the relevant formula applicable for cum interest

2

bond.

Using above information about trading conditions in the bond market,

calculate the following.

vi) All-in price (AIP)

5

vii) Accrued interest (AI)

3

|

3 Page 3 |

▲back to top |

viii) Clean price (CP)

2

ix) All-in consideration (AIC)

5

QUESTION 2

[25 MARKS]

The U.S. financial system is generally considered to be the well-developed, well-

regulated in the world, coupled with sophisticated financial products. The U.S

Monetary Aggregate is divided into 16 components, categorised into 4 groups,

representing Ml, M2, M3 and L, respectively.

REQUIRED:

MARKS

i) List the 16 components of the Monetary Aggregate in the

8

United States. Briefly, examine each component.

ii) What is meant by the financial system?

4

iii) Appraise the five (5) core functions performed by the

5

financial system.

iv) Mention four (4) money market funds in the Namibian

4

contexts.

4

v) Define monetary aggregate in the Namibian context.

|

4 Page 4 |

▲back to top |

QUESTION 3

[25 MARKS]

Available evidence suggests that financial development including stock market

development is correlated with current and future economic growth, capital

accumulation, and productivity improvements. The development of the bond and

stock markets plays a significant role in the development of all economies.

REQUIRED:

i) Mention three (3) indicators of financial development.

ii) Specify a simple econometric model to demonstrate the

relationship between the dependent variable and

independent variables when modelling the relationship

between financial development and economic growth.

MARKS

3

5

iii) Indicate the expected signs of the coefficients to be

5

estimated in the model specified above.

iv) What is meant by corporate bonds?

4

v)

Debate the three (3) signs that it's time to sell your bonds.

6

vi) Mention any two (2) most popular stock indices for trading

2

around the world.

QUESTION 4

[25 MARKS]

The London Inter-Bank Offered Rate (LIBOR) is an interest rate average

calculated from estimates submitted by the leading banks in London. Each bank

estimates what it would be charged were it to borrow from other banks. It is the

primary benchmark for short-term interest rates around the world.

I REQUIRED:

I MARKSI

|

5 Page 5 |

▲back to top |

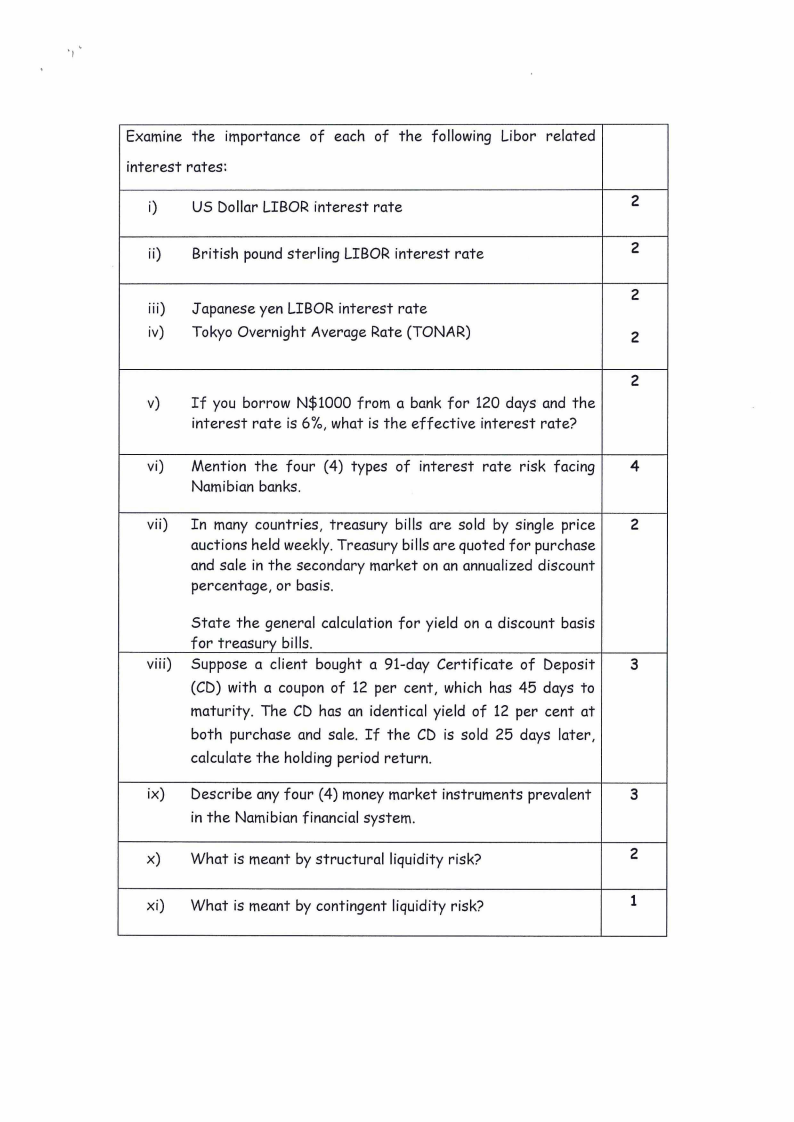

Examine the importance of each of the following Libor related

interest rates:

i) US Dollar LIBOR interest rate

2

ii) British pound sterling LIBOR interest rate

2

2

iii) Japanese yen LIBOR interest rate

iv) Tokyo Overnight Average Rate (TONAR)

2

2

v) If you borrow N$1000 from a bank for 120 days and the

interest rate is 6 %, what is the effective interest rate?

vi) Mention the four (4) types of interest rate risk facing

4

Namibian banks.

vii) In many countries, treasury bills are sold by single price

2

auctions held weekly. Treasury bills are quoted for purchase

and sale in the secondary market on an annualized discount

percentage, or basis.

State the general calculation for yield on a discount basis

for treasury bills.

viii) Suppose a client bought a 91-day Certificate of Deposit

3

(CD) with a coupon of 12 per cent, which has 45 days to

maturity. The CD has an identical yield of 12 per cent at

both purchase and sale. If the CD is sold 25 days later,

calculate the holding period return.

ix) Describe any four (4) money market instruments prevalent

3

in the Namibian financial system.

x) What is meant by structural liquidity risk?

2

xi) What is meant by contingent liquidity risk?

1