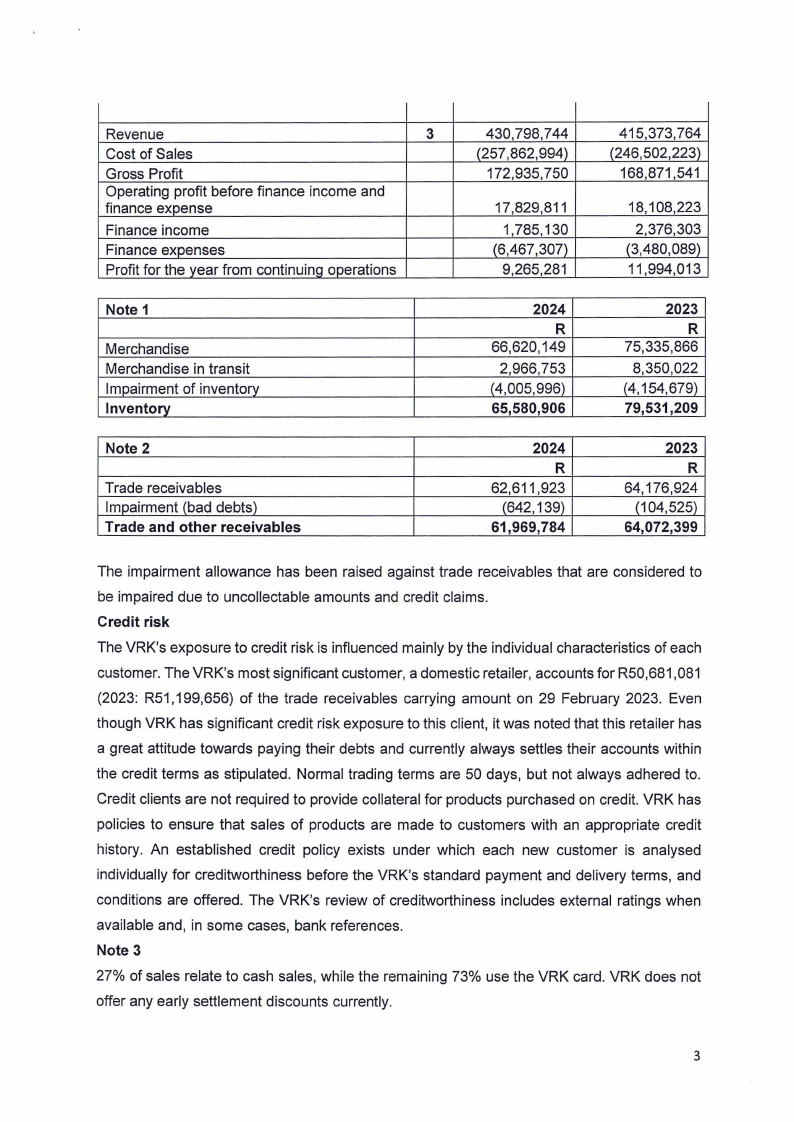

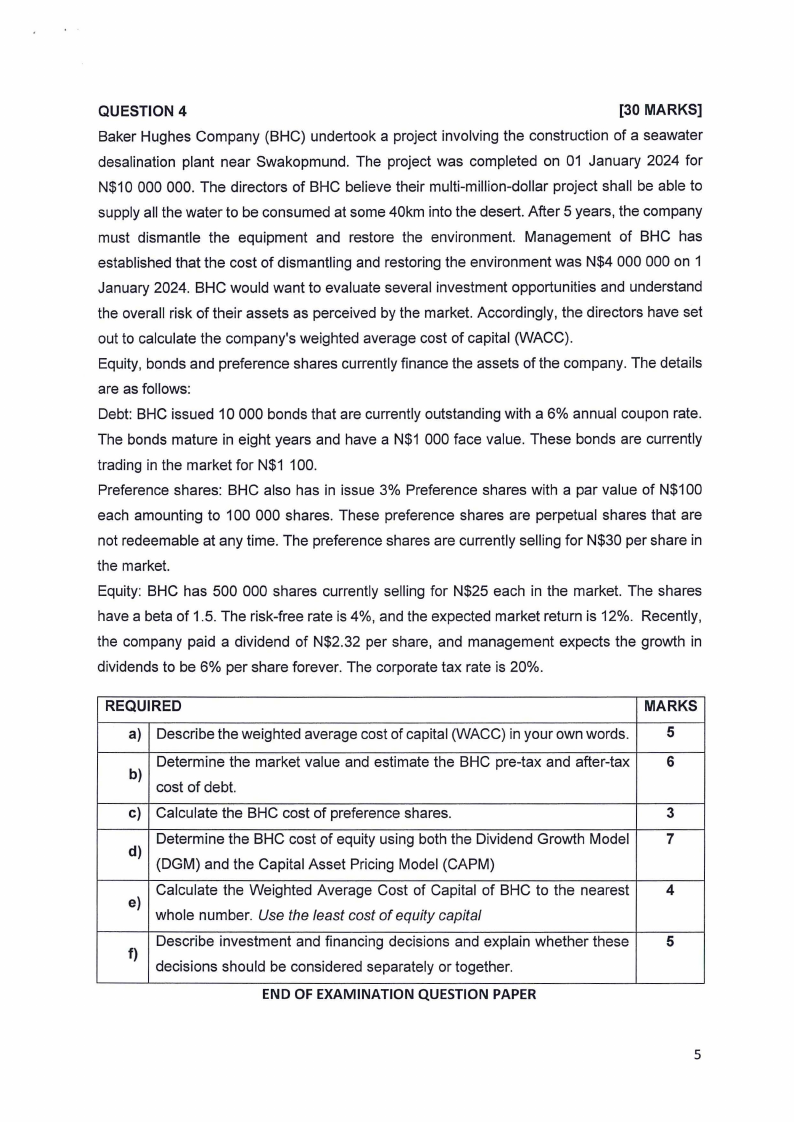

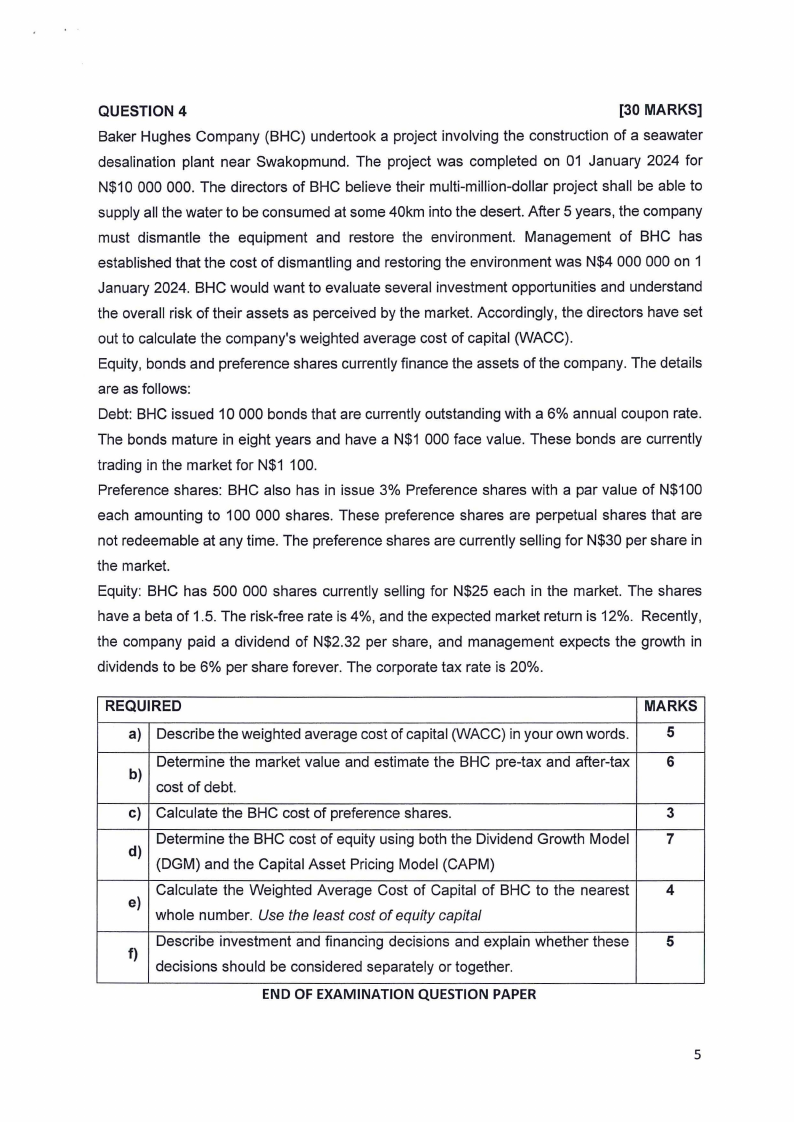

QUESTION 4

[30 MARKS]

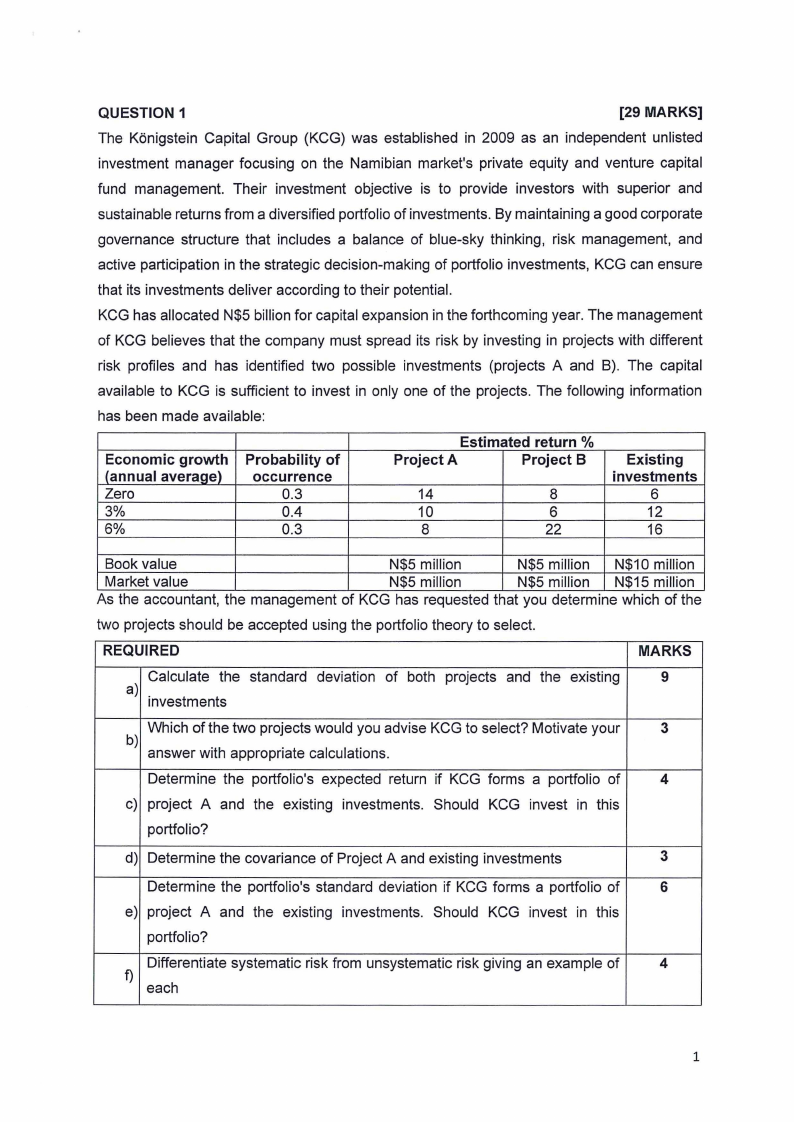

Baker Hughes Company (BHC) undertook a project involving the construction of a seawater

desalination plant near Swakopmund. The project was completed on 01 January 2024 for

N$10 000 000. The directors of BHC believe their multi-million-dollar project shall be able to

supply all the water to be consumed at some 40km into the desert. After 5 years, the company

must dismantle the equipment and restore the environment. Management of BHC has

established that the cost of dismantling and restoring the environment was N$4 000 000 on 1

January 2024. BHC would want to evaluate several investment opportunities and understand

the overall risk of their assets as perceived by the market. Accordingly, the directors have set

out to calculate the company's weighted average cost of capital (WACC).

Equity, bonds and preference shares currently finance the assets of the company. The details

are as follows:

Debt: BHC issued 10 000 bonds that are currently outstanding with a 6% annual coupon rate.

The bonds mature in eight years and have a N$1 000 face value. These bonds are currently

trading in the market for N$1 100.

Preference shares: BHC also has in issue 3% Preference shares with a par value of N$100

each amounting to 100 000 shares. These preference shares are perpetual shares that are

not redeemable at any time. The preference shares are currently selling for N$30 per share in

the market.

Equity: BHC has 500 000 shares currently selling for N$25 each in the market. The shares

have a beta of 1.5. The risk-free rate is 4%, and the expected market return is 12%. Recently,

the company paid a dividend of N$2.32 per share, and management expects the growth in

dividends to be 6% per share forever. The corporate tax rate is 20%.

REQUIRED

MARKS

a) Describe the weighted average cost of capital (WACC) in your own words.

5

Determine the market value and estimate the BHC pre-tax and after-tax

6

b)

cost of debt.

c) Calculate the BHC cost of preference shares.

3

Determine the BHC cost of equity using both the Dividend Growth Model

7

d)

(DGM) and the Capital Asset Pricing Model (CAPM)

Calculate the Weighted Average Cost of Capital of BHC to the nearest

4

e)

whole number. Use the least cost of equity capital

Describe investment and financing decisions and explain whether these

5

f)

decisions should be considered separately or together.

END OF EXAMINATION QUESTION PAPER

5