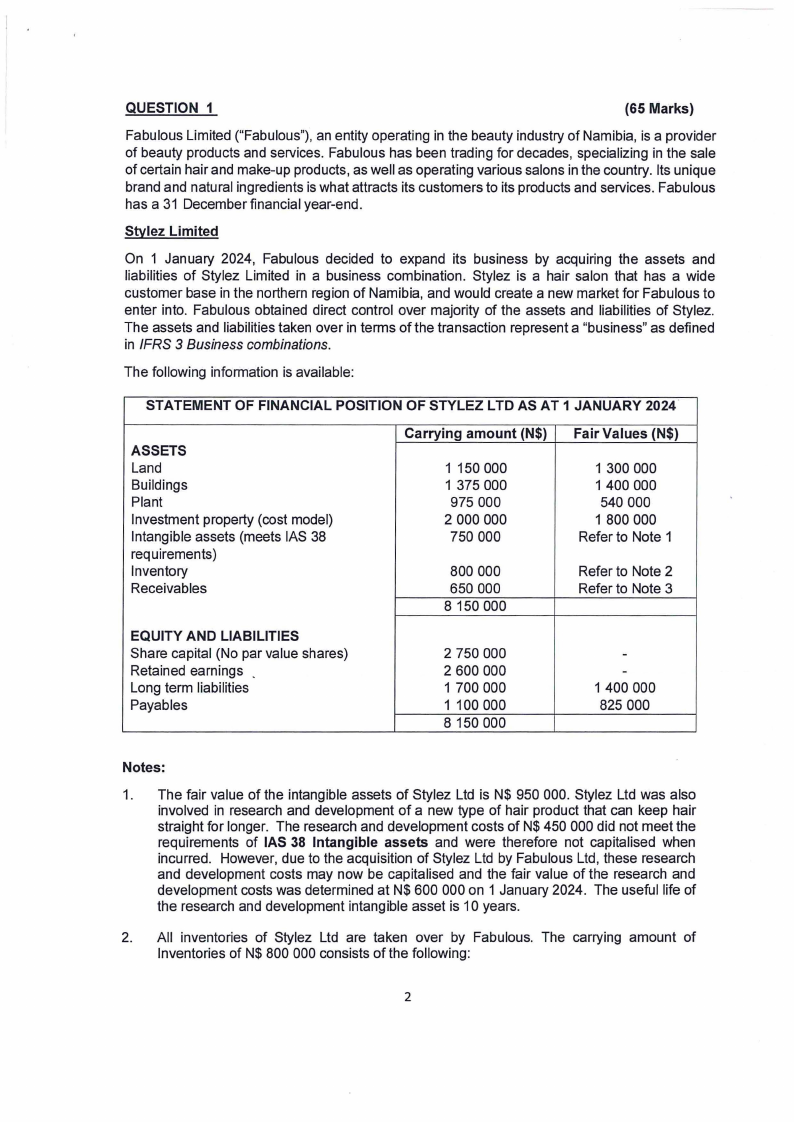

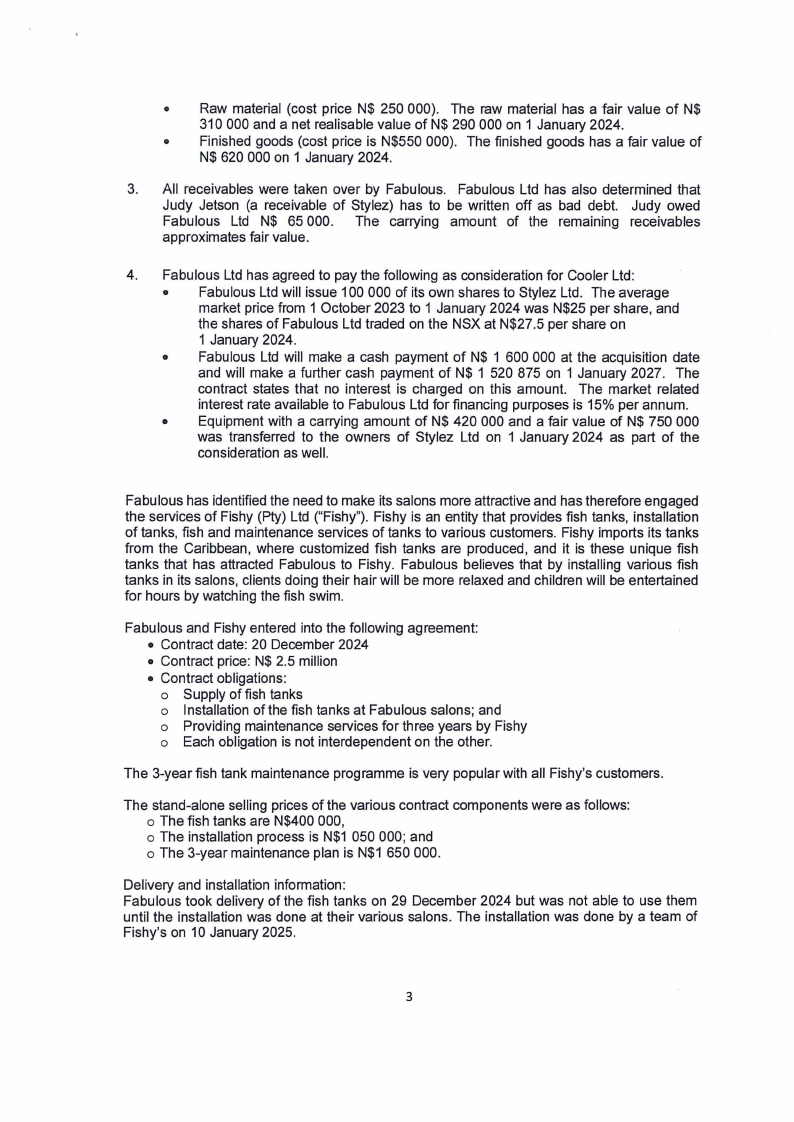

• Raw material (cost price N$ 250 000). The raw material has a fair value of N$

31O000 and a net realisable value of N$ 290 000 on 1 January 2024.

• Finished goods (cost price is N$550 000). The finished goods has a fair value of

N$ 620 000 on 1 January 2024.

3. All receivables were taken over by Fabulous. Fabulous Ltd has also determined that

Judy Jetson (a receivable of Stylez) has to be written off as bad debt. Judy owed

Fabulous Ltd N$ 65 000. The carrying amount of the remaining receivables

approximates fair value.

4. Fabulous Ltd has agreed to pay the following as consideration for Cooler Ltd:

• Fabulous Ltd will issue 100 000 of its own shares to Stylez Ltd. The average

market price from 1 October 2023 to 1 January 2024 was N$25 per share, and

the shares of Fabulous Ltd traded on the NSX at N$27.5 per share on

1 January 2024.

• Fabulous Ltd will make a cash payment of N$ 1 600 000 at the acquisition date

and will make a further cash payment of N$ 1 520 875 on 1 January 2027. The

contract states that no interest is charged on this amount. The market related

interest rate available to Fabulous Ltd for financing purposes is 15% per annum.

• Equipment with a carrying amount of N$ 420 000 and a fair value of N$ 750 000

was transferred to the owners of Stylez Ltd on 1 January 2024 as part of the

consideration as well.

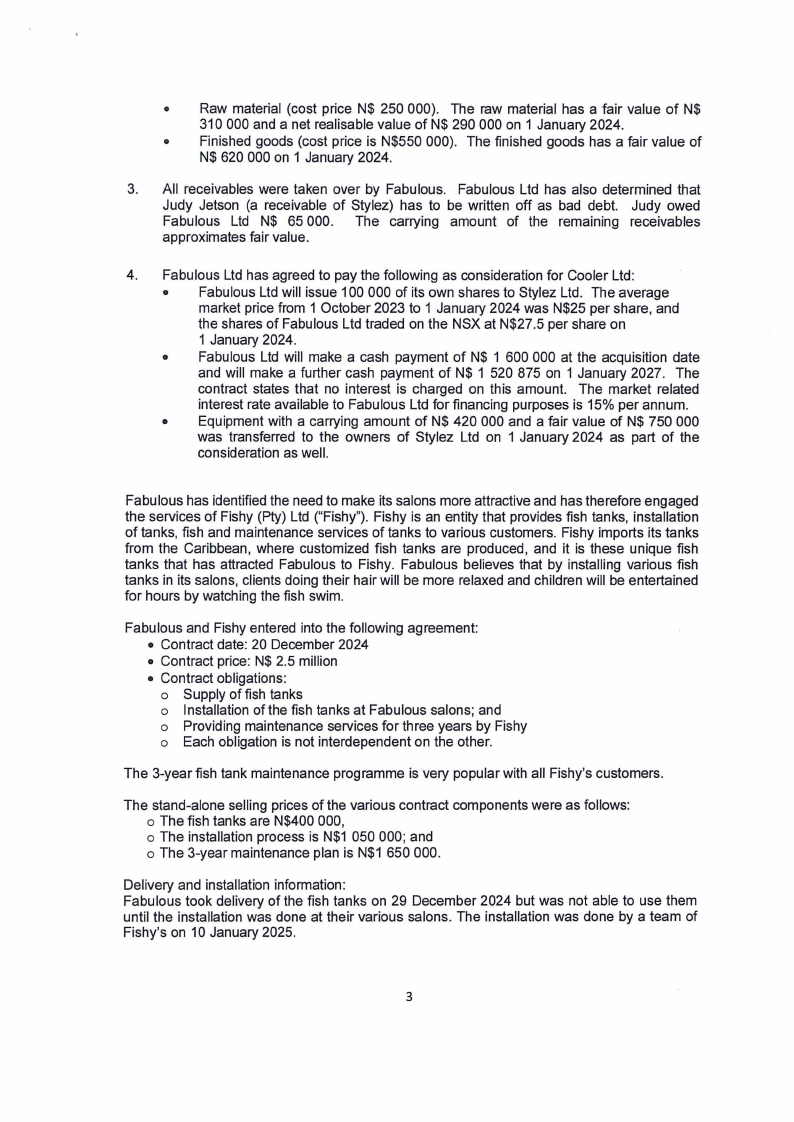

Fabulous has identified the need to make its salons more attractive and has therefore engaged

the services of Fishy (Pty) Ltd ("Fishy"). Fishy is an entity that provides fish tanks, installation

of tanks, fish and maintenance services of tanks to various customers. Fishy imports its tanks

from the Caribbean, where customized fish tanks are produced, and it is these unique fish

tanks that has attracted Fabulous to Fishy. Fabulous believes that by installing various fish

tanks in its salons, clients doing their hair will be more relaxed and children will be entertained

for hours by watching the fish swim.

Fabulous and Fishy entered into the following agreement:

• Contract date: 20 December 2024

• Contract price: N$ 2.5 million

• Contract obligations:

o Supply of fish tanks

o Installation of the fish tanks at Fabulous salons; and

o Providing maintenance services for three years by Fishy

o Each obligation is not interdependent on the other.

The 3-year fish tank maintenance programme is very popular with all Fishy's customers.

The stand-alone selling prices of the various contract components were as follows:

o The fish tanks are N$400 000,

o The installation process is N$1 050 000; and

o The 3-year maintenance plan is N$1 650 000.

Delivery and installation information:

Fabulous took delivery of the fish tanks on 29 December 2024 but was not able to use them

until the installation was done at their various salons. The installation was done by a team of

Fishy's on 1OJanuary 2025.

3