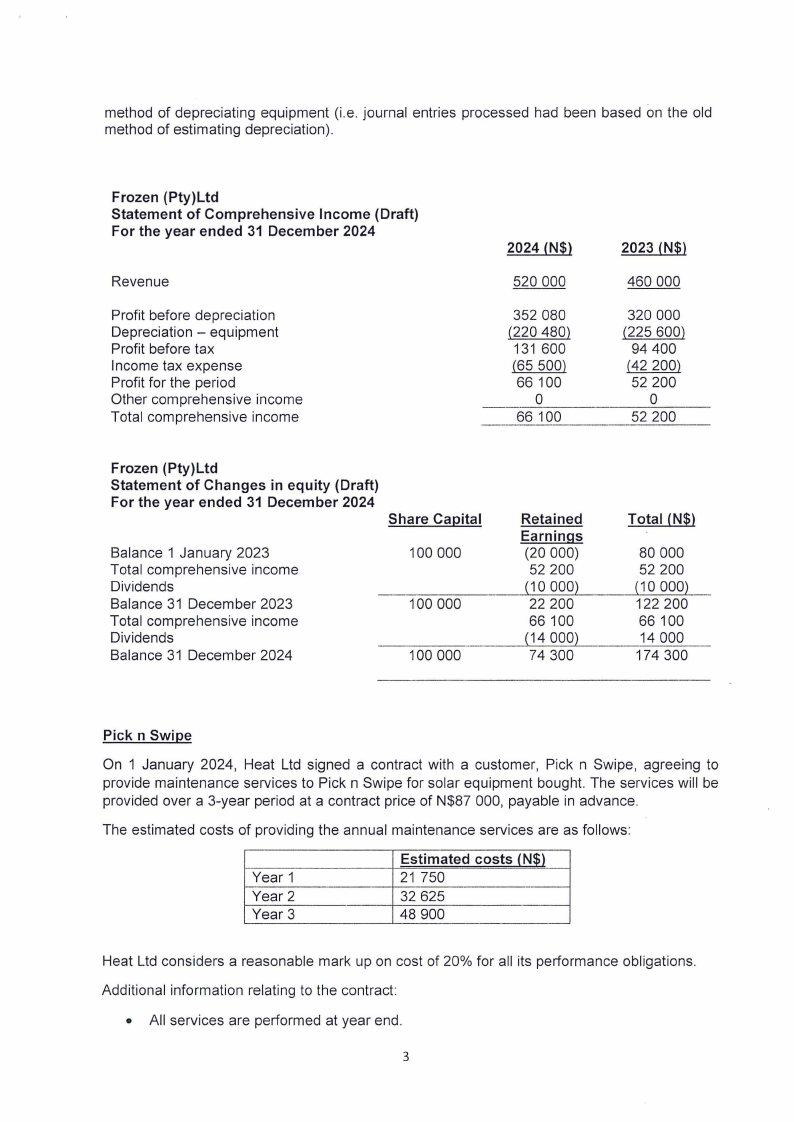

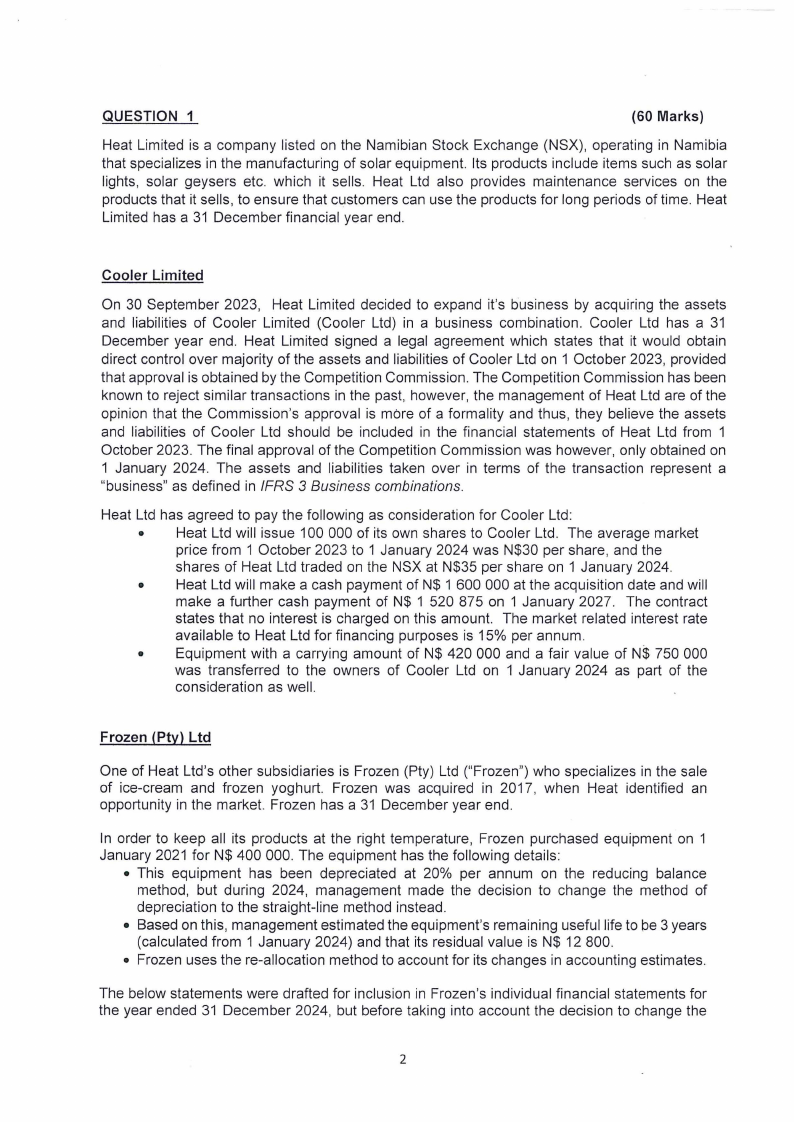

QUESTION 1

(60 Marks)

Heat Limited is a company listed on the Namibian Stock Exchange (NSX), operating in Namibia

that specializes in the manufacturing of solar equipment. Its products include items such as solar

lights, solar geysers etc. which it sells. Heat Ltd also provides maintenance services on the

products that it sells, to ensure that customers can use the products for long periods of time. Heat

Limited has a 31 December financial year end.

Cooler Limited

On 30 September 2023, Heat Limited decided to expand it's business by acquiring the assets

and liabilities of Cooler Limited (Cooler Ltd) in a business combination. Cooler Ltd has a 31

December year end. Heat Limited signed a legal agreement which states that it would obtain

direct control over majority of the assets and liabilities of Cooler Ltd on 1 October 2023, provided

that approval is obtained by the Competition Commission. The Competition Commission has been

known to reject similar transactions in the past, however, the management of Heat Ltd are of the

opinion that the Commission's approval is more of a formality and thus, they believe the assets

and liabilities of Cooler Ltd should be included in the financial statements of Heat Ltd from 1

October 2023. The final approval of the Competition Commission was however, only obtained on

1 January 2024. The assets and liabilities taken over in terms of the transaction represent a

"business" as defined in IFRS 3 Business combinations.

Heat Ltd has agreed to pay the following as consideration for Cooler Ltd:

• Heat Ltd will issue 100 000 of its own shares to Cooler Ltd. The average market

price from 1 October 2023 to 1 January 2024 was N$30 per share, and the

shares of Heat Ltd traded on the NSX at N$35 per share on 1 January 2024.

• Heat Ltd will make a cash payment of N$ 1 600 000 at the acquisition date and will

make a further cash payment of N$ 1 520 875 on 1 January 2027. The contract

states that no interest is charged on this amount. The market related interest rate

available to Heat Ltd for financing purposes is 15% per annum.

• Equipment with a carrying amount of N$ 420 000 and a fair value of N$ 750 000

was transferred to the owners of Cooler Ltd on 1 January 2024 as part of the

consideration as well.

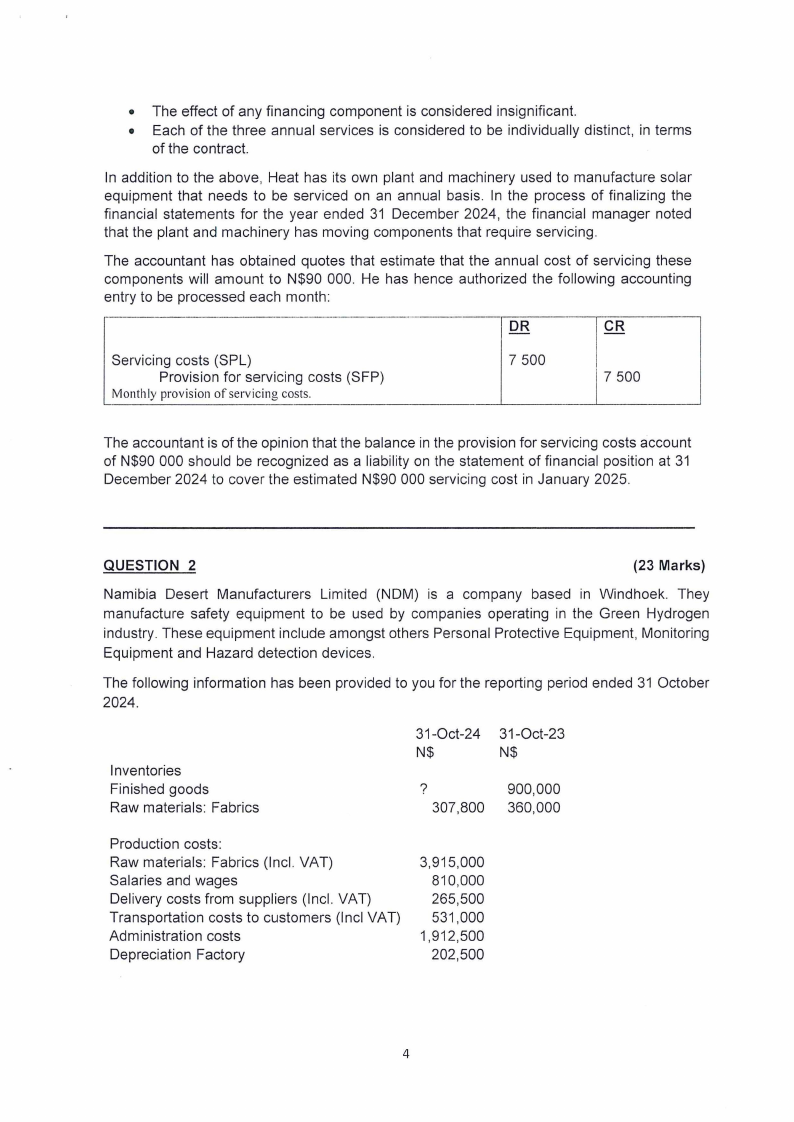

Frozen (Pty) Ltd

One of Heat Ltd's other subsidiaries is Frozen (Pty) Ltd ("Frozen") who specializes in the sale

of ice-cream and frozen yoghurt. Frozen was acquired in 2017, when Heat identified an

opportunity in the market. Frozen has a 31 December year end.

In order to keep all its products at the right temperature, Frozen purchased equipment on 1

January 2021 for N$ 400 000. The equipment has the following details:

• This equipment has been depreciated at 20% per annum on the reducing balance

method, but during 2024, management made the decision to change the method of

depreciation to the straight-line method instead.

• Based on this, management estimated the equipment's remaining useful life to be 3 years

(calculated from 1 January 2024) and that its residual value is N$ 12 800.

• Frozen uses the re-allocation method to account for its changes in accounting estimates.

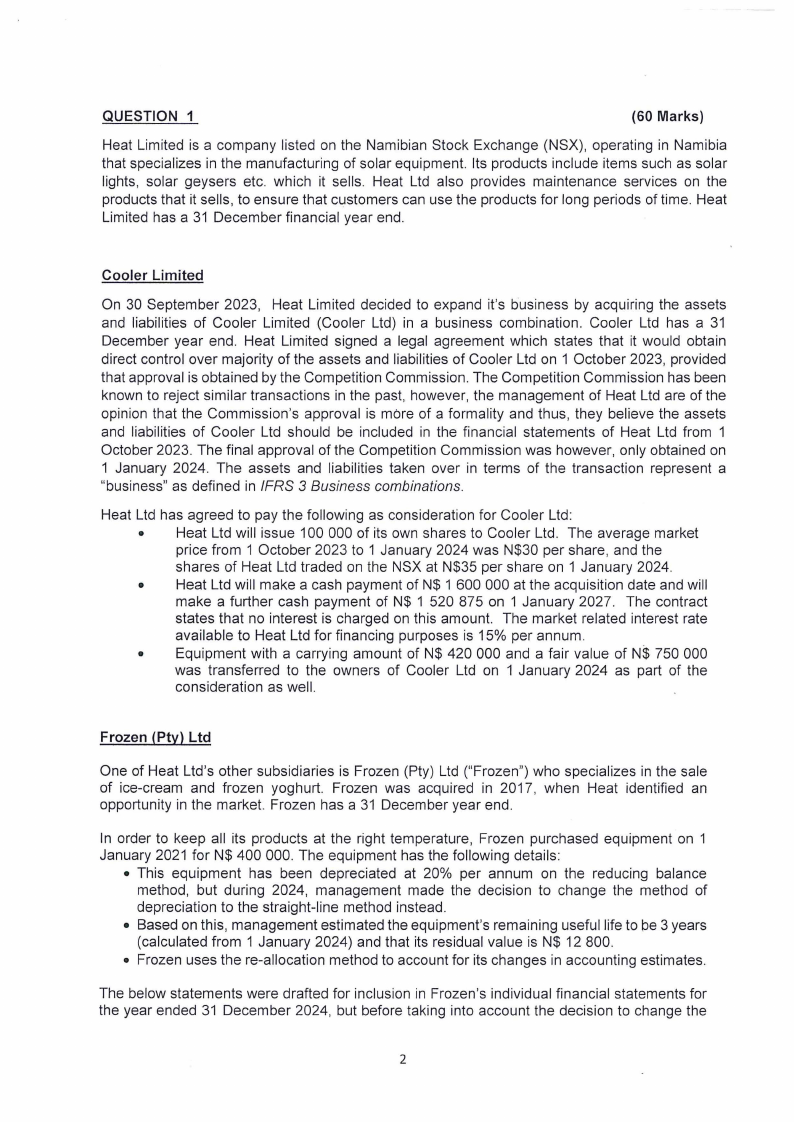

The below statements were drafted for inclusion in Frozen's individual financial statements for

the year ended 31 December 2024, but before taking into account the decision to change the

2