QUESTION 2

20 marks (48 min)

Quality Cement (Pty) Ltd is a Namibian resident company engaged in the production of cement

and major competitor of Ohorongo Cement and Alpha Cement. The company is an approved

manufacturer and has a 28 February year end. The company has been operating in Namibia for

the past 12 years. The following information relates to their 28 February 2023 year of assessment:

Net profit before tax: N$ 1 713 544

Additional information: Below amounts are included in the Net profit before tax unless stated

otherwise.

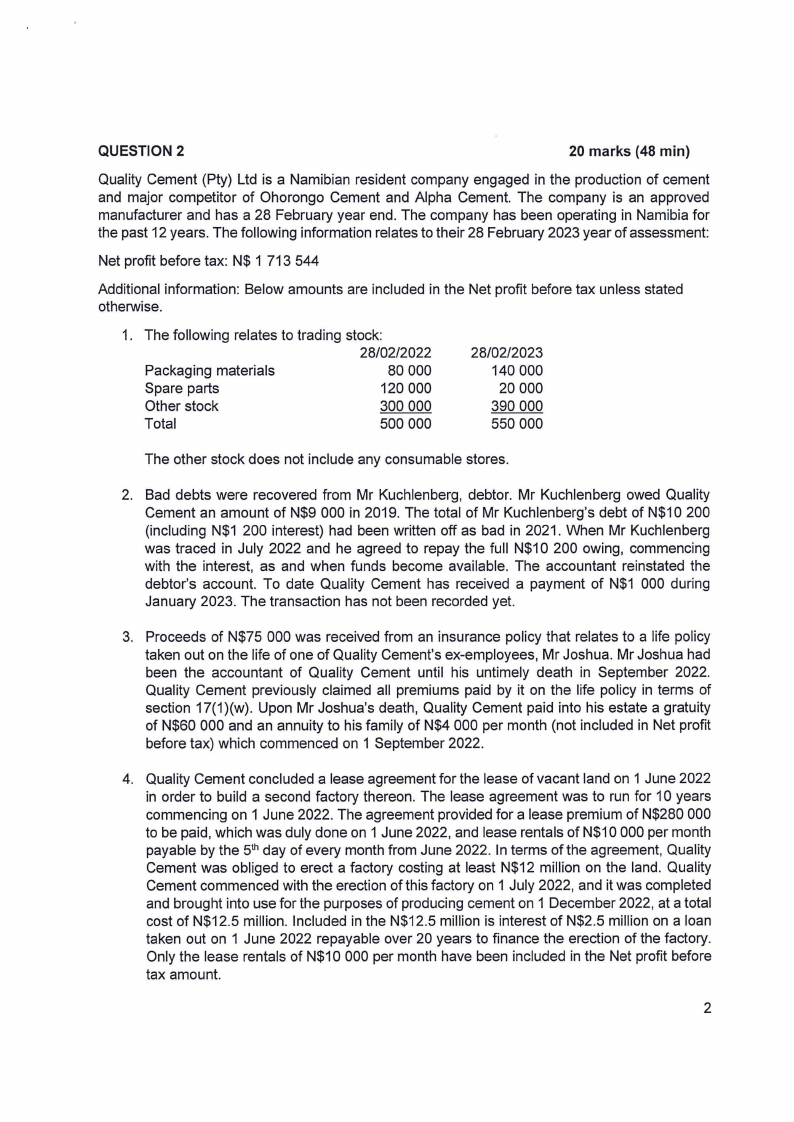

1. The following relates to trading stock:

28/02/2022

Packaging materials

80 000

Spare parts

120 000

Other stock

300 000

Total

500 000

28/02/2023

140 000

20 000

390 000

550 000

The other stock does not include any consumable stores.

2. Bad debts were recovered from Mr Kuchlenberg, debtor. Mr Kuchlenberg owed Quality

Cement an amount of N$9 000 in 2019. The total of Mr Kuchlenberg's debt of N$10 200

(including N$1 200 interest) had been written off as bad in 2021. When Mr Kuchlenberg

was traced in July 2022 and he agreed to repay the full N$10 200 owing, commencing

with the interest, as and when funds become available. The accountant reinstated the

debtor's account. To date Quality Cement has received a payment of N$1 000 during

January 2023. The transaction has not been recorded yet.

3. Proceeds of N$75 000 was received from an insurance policy that relates to a life policy

taken out on the life of one of Quality Cement's ex-employees, Mr Joshua. Mr Joshua had

been the accountant of Quality Cement until his untimely death in September 2022.

Quality Cement previously claimed all premiums paid by it on the life policy in terms of

section 17(1)(w). Upon Mr Joshua's death, Quality Cement paid into his estate a gratuity

of N$60 000 and an annuity to his family of N$4 000 per month (not included in Net profit

before tax) which commenced on 1 September 2022.

4. Quality Cement concluded a lease agreement for the lease of vacant land on 1 June 2022

in order to build a second factory thereon. The lease agreement was to run for 10 years

commencing on 1 June 2022. The agreement provided for a lease premium of N$280 000

to be paid, which was duly done on 1 June 2022, and lease rentals of N$10 000 per month

payable by the 5th day of every month from June 2022. In terms of the agreement, Quality

Cement was obliged to erect a factory costing at least N$12 million on the land. Quality

Cement commenced with the erection of this factory on 1 July 2022, and it was completed

and brought into use for the purposes of producing cement on 1 December 2022, at a total

cost of N$12.5 million. Included in the N$12.5 million is interest of N$2.5 million on a loan

taken out on 1 June 2022 repayable over 20 years to finance the erection of the factory.

Only the lease rentals of N$10 000 per month have been included in the Net profit before

tax amount.

2