|

LEM621S - LAND ECONOMICS - 2ND OPP - JAN 2020 |

|

1 Page 1 |

▲back to top |

é

NAMIBIA UNIVERSITY

OF SCIENCE AND TECHNOLOGY

FACULTY OF NATURAL RESOURCES AND SPATIAL SCIENCES

DEPARTMENT OF LAND AND PROPERTY SCIENCES

QUALIFICATION(S): BACHELOR OF PROPERTY STUDIES

DIPLOMA IN PROPERTY STUDIES

QUALIFICATION(S) CODE: OO8GBDPPRRSS

NQF LEVEL: . 6

COURSE CODE: LEM621S

EXAMS SESSION: JANUARY 2020

DURATION:

3 HOURS

COURSE NAME: LAND ECONOMICS

PAPER:

THEORY

MARKS:

100

SECOND OPPORTUNITY/SUPPLEMENTARY EXAMINATION QUESTION PAPER

EXAMINER(S) | UAURIKA KAHIREKE

MODERATOR: | SAMUEL ATO K. HAYFORD

INSTRUCTIONS

Read the entire question paper before answering the Questions.

Please write clearly and legibly!

The question paper contains a total of4 questions.

You must answer ALL QUESTIONS .

Make sure your Student Number is on the EXAMINATION BOOK(S).

PERMISSIBLE MATERIALS

1. Non-programmable Scientific Calculator

THIS QUESTION PAPER CONSISTS OF 4 PAGES (Including this front page and attached Appendix A)

|

2 Page 2 |

▲back to top |

* Land Economics

LEM621S

Question 1

a) Discuss the following significance of land as used in land economics.

i) Aconsumption good;

(4)

ii) Situation; and

(4)

iii) Property

(4)

b) Specify the six (6) qualities of an ideal investment and indicate the extent to which property

investment meets or doesn’t meet these qualities.

(13)

[25]

Question 2

a) Property tax revenue to support local authorities in developing countries is not fully tapped

to their highest potential. Discuss any five (5) of the challenges thereof.

(25)

b) — Explain the three (3) main modern canons of taxation

(5)

[30]

Question 3

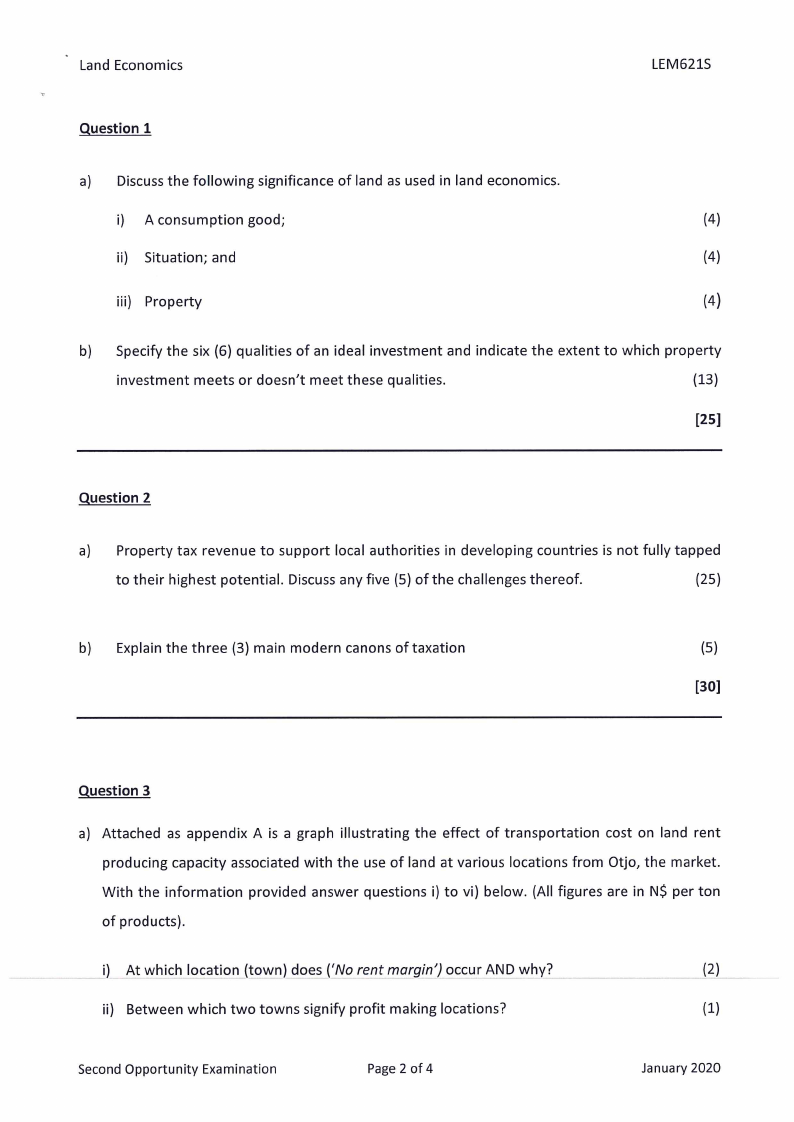

a) Attached as appendix A is a graph illustrating the effect of transportation cost on land rent

producing capacity associated with the use of land at various locations from Otjo, the market.

With the information provided answer questions i) to vi) below. (All figures are in NS per ton

of products).

i) At which location (town) does (‘No rent margin’) occur AND why?

(2)

ii) Between which two towns signify profit making locations?

(1)

Second Opportunity Examination

Page 2 of 4

January 2020

|

3 Page 3 |

▲back to top |

Land Economics

iii) How much is earned for land rent per ton for the use of land in Otavi?

LEM621S

(1)

iv) If operators of Otavi land are to enjoy any land rent, what is expected of them and by what

amount (in your opinion) will lead to that.

(3)

v) Estimate the amount of land rent per ton associated with the use of Okapuka and Otjinene

lands located at a distance of 15km and 25km respectively from the market.

(4)

vi) What is the amount of land rent associated with the ‘optimal location’

(1)

vii) At the ‘No rent margin’ what is the total cost of transportation per ton?

(1%)

viii) At the ‘No rent margin’ what is the total cost of production per ton including transport to

the market?

(1%)

[15]

Question 4

a) Briefly account for any four (4) principles usually applied in evaluating land/property tax

system.

(6)

b) The main Valuation Roll as provided under the Agricultural (Commercial) Land Reform Act of

1995, is not immune from errors; who may change the contents of the main valuation roll

and state the purposes for which the main valuation roll may be changed?

(5)

c) A proper valuation activity for property tax administration requires that several

preconditions are in place. Outline any of these preconditions?

(5)

d) One of the advantages of a Municipal Property Tax is a low compliance Costs. Outline what

it involves and how this advantage benefits a taxpayer.

(4)

e) Mention the significance of Variable tax rate and briefly explain the grounds on which its

application may be justified

(10)

[30]

Second Opportunity Examination

All the best of luck.

Page 3 of 4

January 2020

|

4 Page 4 |

▲back to top |