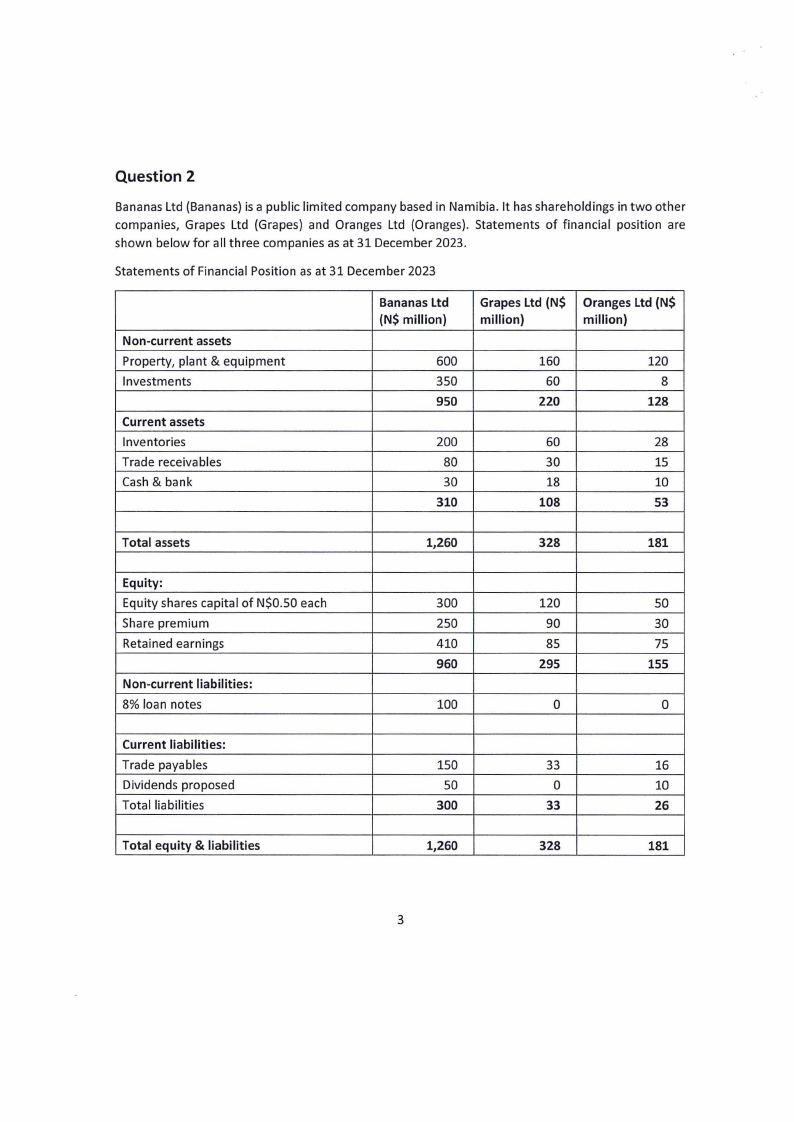

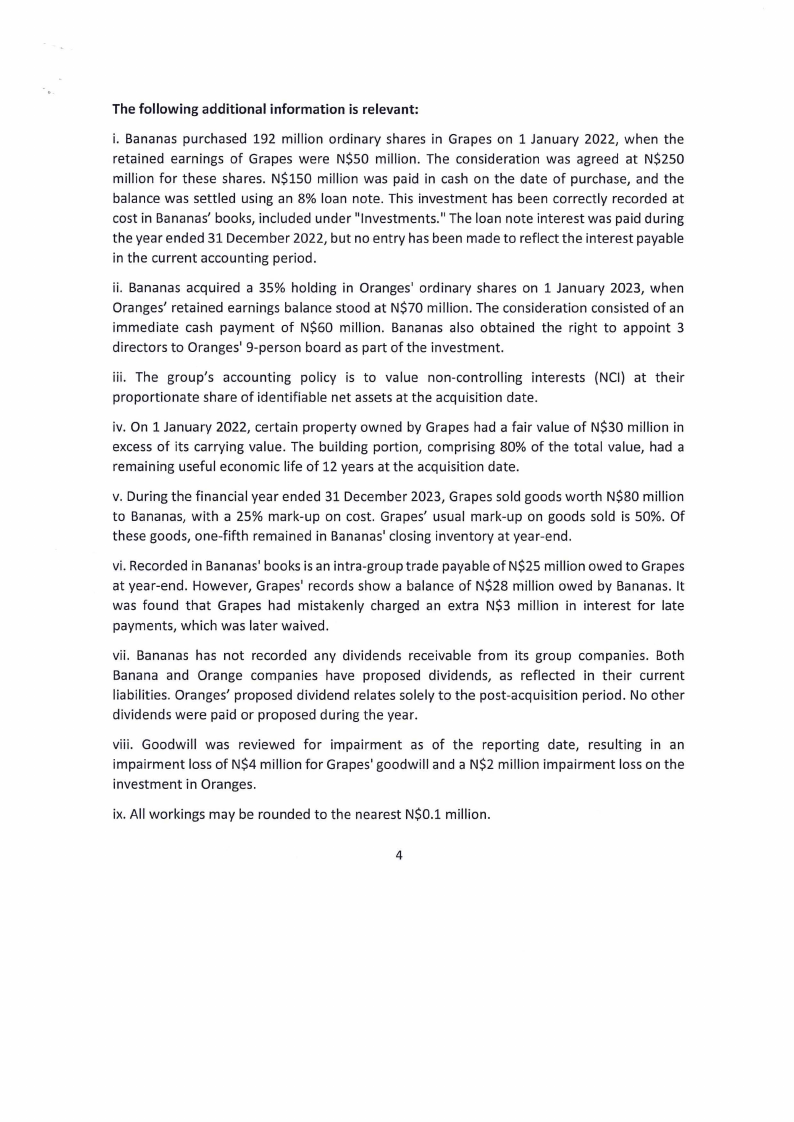

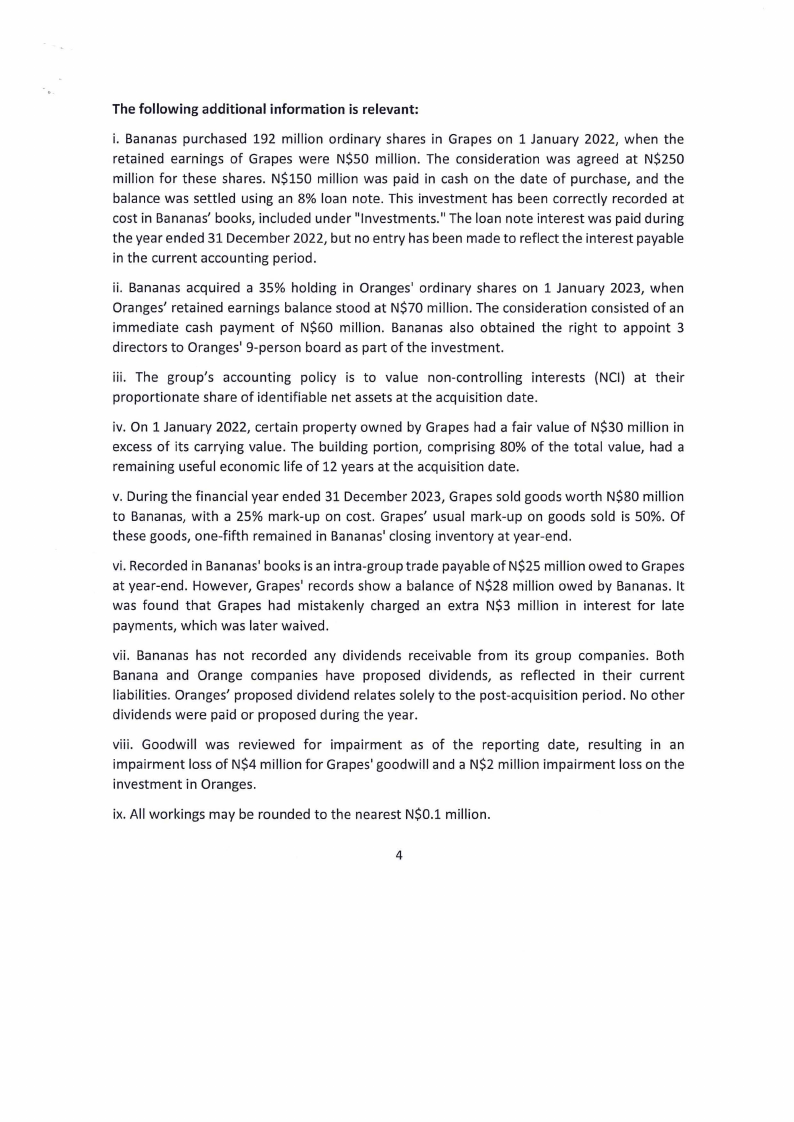

The following additional information is relevant:

i. Bananas purchased 192 million ordinary shares in Grapes on 1 January 2022, when the

retained earnings of Grapes were N$50 million. The consideration was agreed at N$250

million for these shares. N$150 million was paid in cash on the date of purchase, and the

balance was settled using an 8% loan note. This investment has been correctly recorded at

cost in Bananas' books, included under "Investments." The loan note interest was paid during

the year ended 31 December 2022, but no entry has been made to reflect the interest payable

in the current accounting period.

ii. Bananas acquired a 35% holding in Oranges' ordinary shares on 1 January 2023, when

Oranges' retained earnings balance stood at N$70 million. The consideration consisted of an

immediate cash payment of N$60 million. Bananas also obtained the right to appoint 3

directors to Oranges' 9-person board as part of the investment.

iii. The group's accounting policy is to value non-controlling interests (NCI) at their

proportionate share of identifiable net assets at the acquisition date.

iv. On 1 January 2022, certain property owned by Grapes had a fair value of N$30 million in

excess of its carrying value. The building portion, comprising 80% of the total value, had a

remaining useful economic life of 12 years at the acquisition date.

v. During the financial year ended 31 December 2023, Grapes sold goods worth N$80 million

to Bananas, with a 25% mark-up on cost. Grapes' usual mark-up on goods sold is 50%. Of

these goods, one-fifth remained in Bananas' closing inventory at year-end.

vi. Recorded in Bananas' books is an intra-group trade payable of N$25 million owed to Grapes

at year-end. However, Grapes' records show a balance of N$28 million owed by Bananas. It

was found that Grapes had mistakenly charged an extra N$3 million in interest for late

payments, which was later waived.

vii. Bananas has not recorded any dividends receivable from its group companies. Both

Banana and Orange companies have proposed dividends, as reflected in their current

liabilities. Oranges' proposed dividend relates solely to the post-acquisition period. No other

dividends were paid or proposed during the year.

viii. Goodwill was reviewed for impairment as of the reporting date, resulting in an

impairment loss of N$4 million for Grapes' goodwill and a N$2 million impairment loss on the

investment in Oranges.

ix. All workings may be rounded to the nearest N$0.l million.

4