|

FMH420S - FINANCIAL MGT FOR HOSP AND TOURISM - 2ND OPP - JAN 2020 |

|

1 Page 1 |

▲back to top |

NAMIBIA UNIVERSITY

OF SCIENCE AND TECHNOLOGY

FACULTY OF MANAGEMENT SCIENCES

DEPARTMENT OF HOSPITALITY AND TOURISM

QUALIFICATION: BACHELOR OF HOSPITALITY MANAGEMENT

QUALIFICATION CODE: 27BHMN

LEVEL: 7

COURSE CODE: FIMH4205

COURSE NAME: FINANCIAL MANAGEMENT FOR

HOSPITALITY AND TOURISM

SESSION: JANUARY 2020

DURATION: 3 HOURS

PAPER: THEORY AND CALCULATIONS

MARKS: 100

SECOND OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINER

L. Odada

MODERATOR | : Mushonga

INSTRUCTIONS

Answer ALL the questions in either blue or black ink only. NO pencil allowed.

Start each question on a new page

Write clearly, neatly and number the answers clearly.

Round off your answers to the nearest whole number

Questions relating to this examination may be raised in the initial 30 minutes after the start

of the paper. Thereafter, candidates must use their initiative to deal with any perceived

error or ambiguities & any assumptions made by the candidate should be clearly stated.

PERMISSIBLE MATERIALS

1. Scientific calculators

THIS QUESTION PAPER CONSISTS OF _5_ PAGES (Including this front page)

|

2 Page 2 |

▲back to top |

QUESTION 1

[24 MARKS]

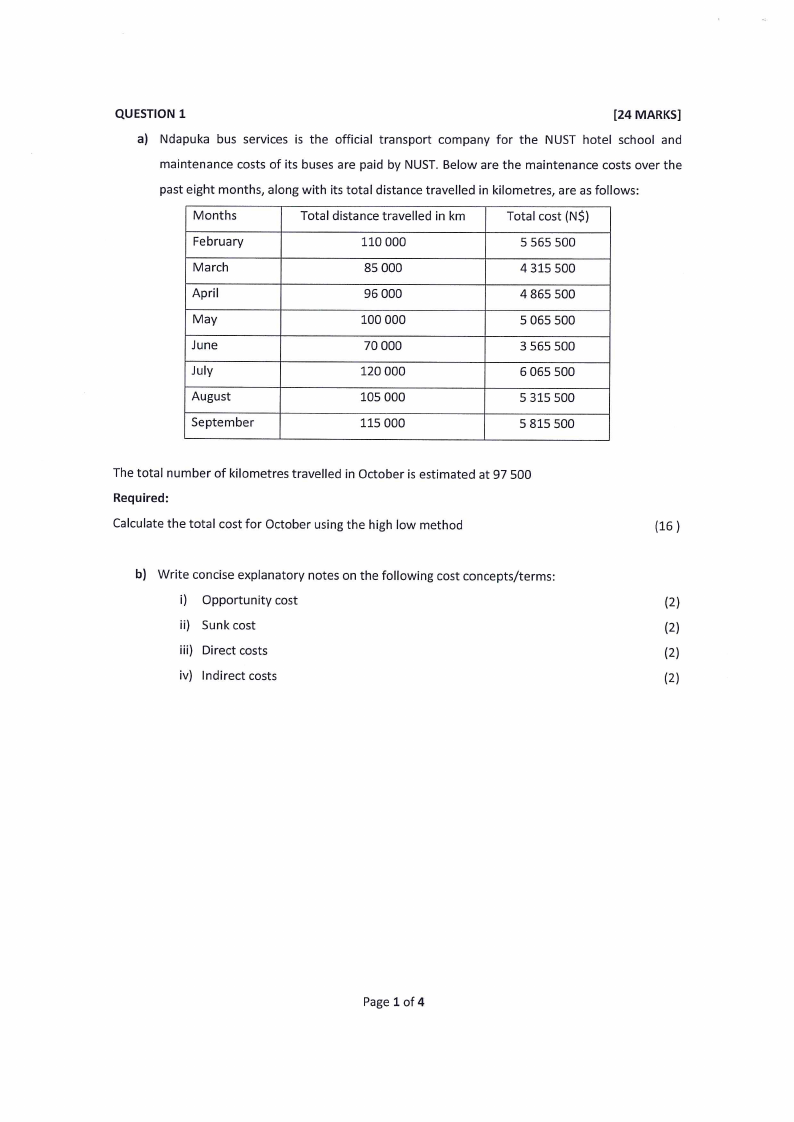

a) Ndapuka bus services is the official transport company for the NUST hotel school and

maintenance costs of its buses are paid by NUST. Below are the maintenance costs over the

past eight months, along with its total distance travelled in kilometres, are as follows:

Months

Total distance travelled in km

Total cost (NS)

February

110 000

5 565 500

March

85 000

4 315 500

April

96 000

4 865 500

May

100 000

5 065 500

June

70 000

3 565 500

July

120 000

6 065 500

August

105 000

5 315 500

September

115 000

5 815 500

The total number of kilometres travelled in October is estimated at 97 500

Required:

Calculate the total cost for October using the high low method

(16)

b) Write concise explanatory notes on the following cost concepts/terms:

i) Opportunity cost

(2)

ii) Sunk cost

(2)

iii) Direct costs

(2)

iv) Indirect costs

(2)

Page 1 of 4

|

3 Page 3 |

▲back to top |

QUESTION 2

[26 MARKS]

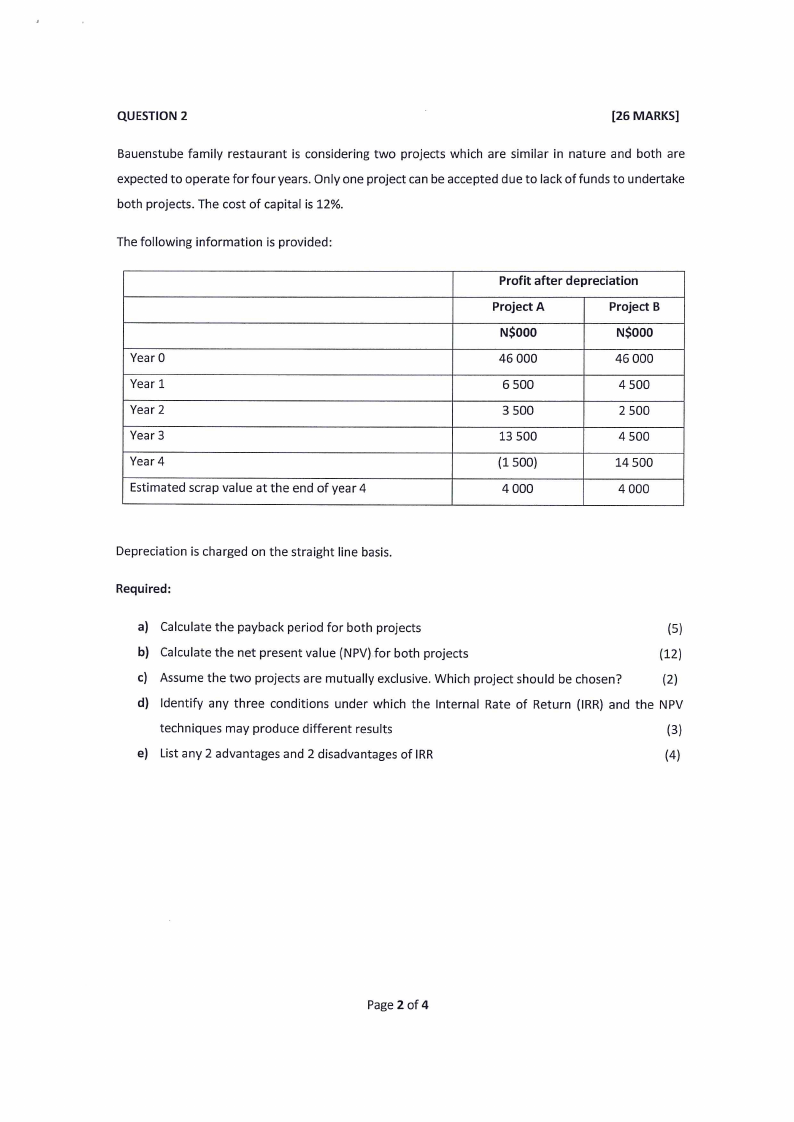

Bauenstube family restaurant is considering two projects which are similar in nature and both are

expected to operate for four years. Only one project can be accepted due to lack of funds to undertake

both projects. The cost of capital is 12%.

The following information is provided:

Year 0

Year 1

Year 2

Year 3

Year 4

Estimated scrap value at the end of year 4

Profit after depreciation

Project A

Project B

NSOO0O

NSOO0O

46 000

46 000

6 500

4500

3 500

2 500

13 500

4500

(1 500)

14 500

4 000

4000

Depreciation is charged on the straight line basis.

Required:

a) Calculate the payback period for both projects

(5)

b) Calculate the net present value (NPV).for both projects

(12)

c) Assume the two projects are mutually exclusive. Which project should be chosen?

(2)

d) Identify any three conditions under which the Internal Rate of Return (IRR) and the NPV

techniques may produce different results

(3)

e) List any 2 advantages and 2 disadvantages of IRR

(4)

Page 2 of 4

|

4 Page 4 |

▲back to top |

QUESTION 3

[25 Marks]

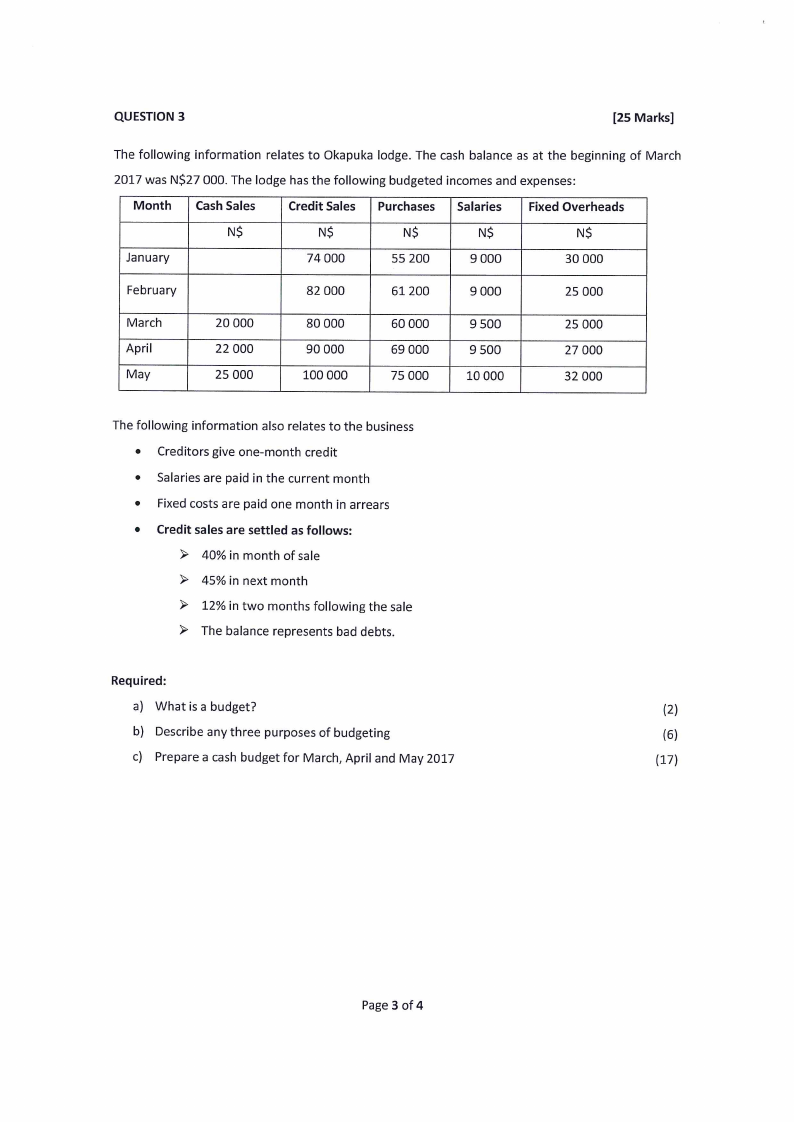

The following information relates to Okapuka lodge. The cash balance as at the beginning of March

2017 was NS$27 000. The lodge has the following budgeted incomes and expenses:

Month

Cash Sales

Credit Sales Purchases Salaries

Fixed Overheads

NS

January

NS

74 000

NS

55 200

NS

9 000

NS

30 000

February

82 000

61 200

9 000

25 000

March

April

May

20 000

22 000

25 000

80 000

90 000

100 000

60 000

69 000

75 000

9 500

9 500

10 000

25 000

27 000

32 000

The following information also relates to the business

e Creditors give one-month credit

e Salaries are paid in the current month

e Fixed costs are paid one month in arrears

e Credit sales are settled as follows:

> 40% in month of sale

> 45% in next month

> 12% in two months following the sale

> The balance represents bad debts.

Required:

a) What isa budget?

(2)

b) Describe any three purposes of budgeting

(6)

c) Prepare a cash budget for March, April and May 2017

(17)

Page 3 of 4

|

5 Page 5 |

▲back to top |

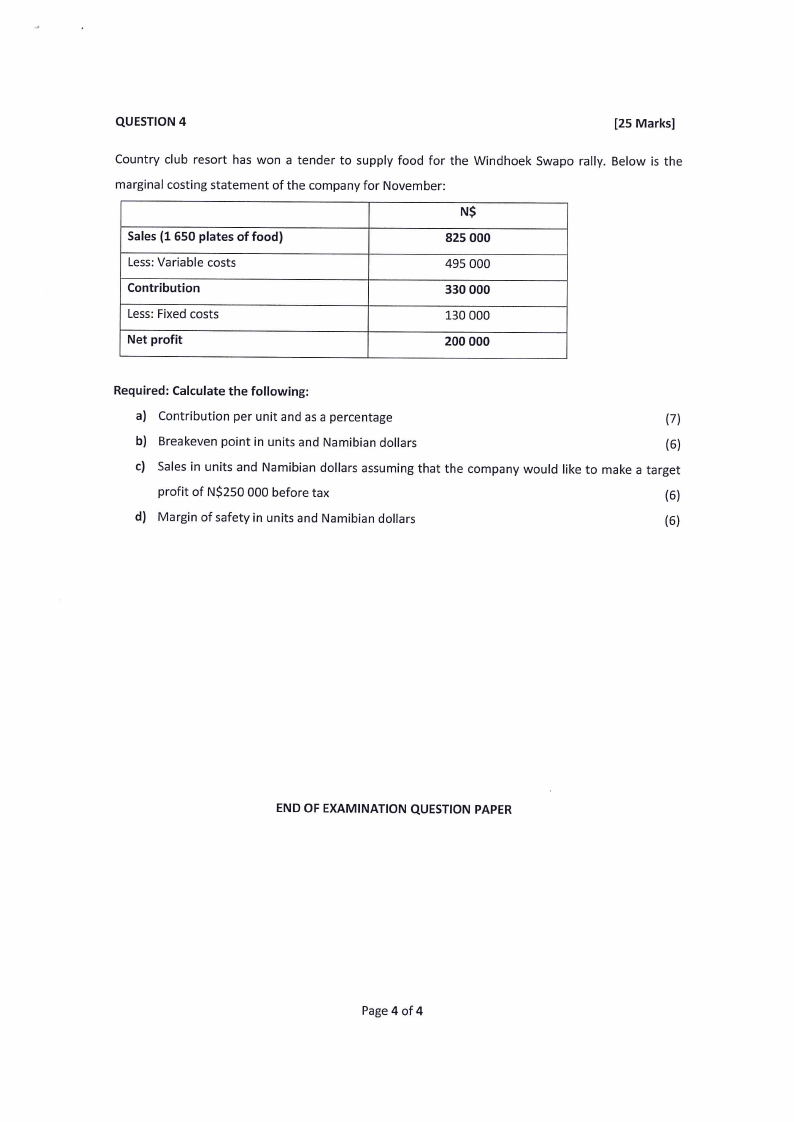

QUESTION 4

[25 Marks]

Country club resort has won a tender to supply food for the Windhoek Swapo rally. Below is the

marginal costing statement of the company for November:

N$

Sales (1 650 plates of food)

825 000

Less: Variable costs

495 000

Contribution

330 000

Less: Fixed costs

130 000

Net profit

200 000

Required: Calculate the following:

a) Contribution per unit and as a percentage

(7)

b) Breakeven point in units and Namibian dollars

(6)

c) Sales in units and Namibian dollars assuming that the company would like to make a target

profit of NS250 000 before tax

(6)

d) Margin of safety in units and Namibian dollars

(6)

END OF EXAMINATION QUESTION PAPER

Page 4 of 4

|

6 Page 6 |

▲back to top |