|

BAI620S - BUSINESS ACCOUNTING FOR INFORMATICS - 2ND OPP - JAN 2020 |

|

1 Page 1 |

▲back to top |

NAMIBIA UNIVERSITY

OF SCIENCE AND TECHNOLOGY

FACULTY OF MANAGEMENT SCIENCES

DEPARTMENT OF ACCOUNTING, ECONOMICS & FINANCE

QUALIFICATION: BACHELOR OF INFORMATICS

QUALIFICATION CODE: 07BAIF

COURSE CODE: BAI620S

LEVEL: 5

COURSE NAME: BUSINESS ACCOUNTING FOR

INFORMATICS

SESSION: JANUARY 2020

DURATION: 3 HOURS

PAPER: PRACTICAL AND THEORY

MARKS: 100

EXAMINERS:

SECOND OPPORTUNITY QUESTION PAPER

D Nkala and T Shindobo

moperatTor: | 2 Kamotho

INSTRUCTIONS

e This examination paper is made up of four (4) questions.

e Answer All the questions and in blue or black ink only.

e Show all your workings.

e Start each question on a new page in your answer booklet and show all your workings.

e Questions relating to this paper may be raised in the initial 30 minutes after the start of

the paper. Thereafter, candidates must use their initiative to deal with any perceived

error or ambiguities and any assumption made by the candidate should be clearly

stated.

PERMISSIBLE MATERIALS

Non-programmable calculator

THIS QUESTION PAPER CONSISTS OF 5 PAGES (Including this front page)

|

2 Page 2 |

▲back to top |

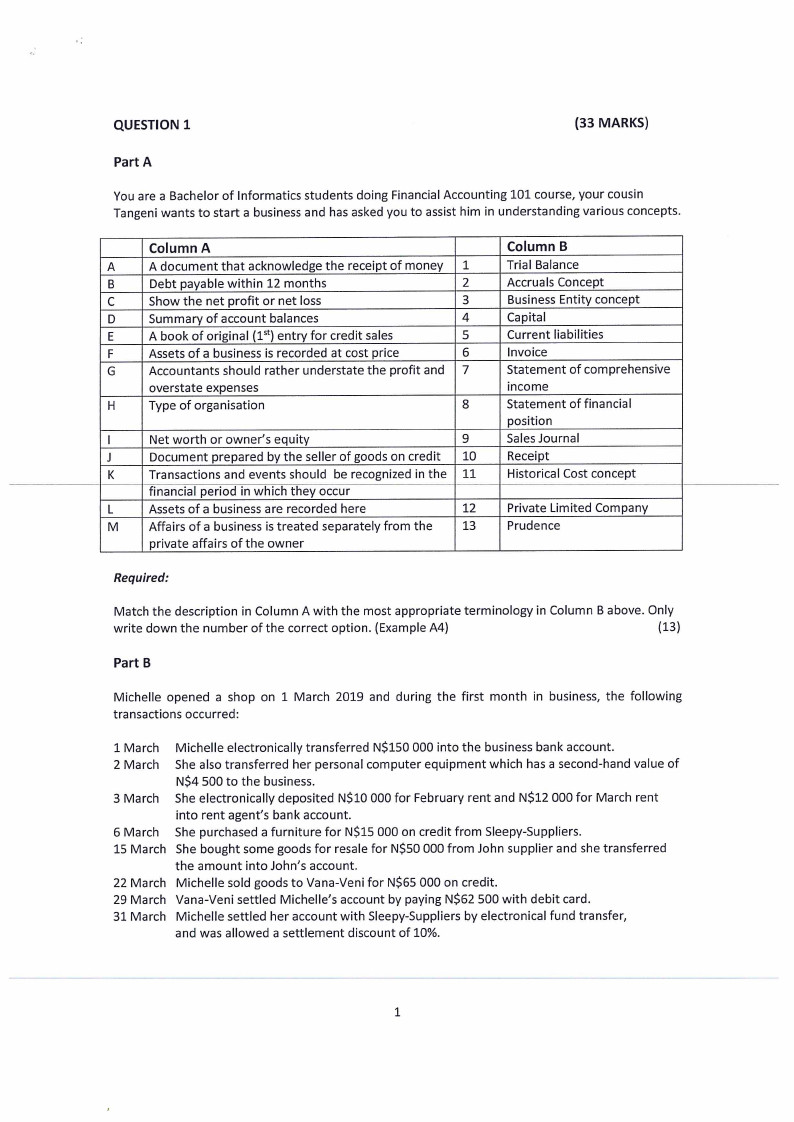

QUESTION 1

(33 MARKS)

PartA

You are a Bachelor of Informatics students doing Financial Accounting 101 course, your cousin

Tangeni wants to start a business and has asked you to assist him in understanding various concepts.

Column A

Column B

A

A document that acknowledge the receipt of money | 1

Trial Balance

B

Debt payable within 12 months

2

Accruals Concept

C

Show the net profit or net loss

3

Business Entity concept

D

Summary of account balances

4

Capital

E

A book of original (15') entry for credit sales

5

Current liabilities

F

Assets of a business is recorded at cost price

6

Invoice

G

Accountants should rather understate the profit and | 7

Statement of comprehensive

overstate expenses

income

H

Type of organisation

8

Statement of financial

position

I

Net worth or owner’s equity

9

Sales Journal

J

Document prepared by the seller of goods on credit | 10

Receipt

K

Transactions and events should be recognized in the | 11

Historical Cost concept

financial period in which they occur

a

L

Assets of a business are recorded here

12

Private Limited Company

M

Affairs of a business is treated separately from the

13

Prudence

private affairs of the owner

Required:

Match the description in Column A with the most appropriate terminology in Column B above. Only

write down the number of the correct option. (Example A4)

(13)

Part B

Michelle opened a shop on 1 March 2019 and during the first month in business, the following

transactions occurred:

1 March

2March

3 March

6 March

15 March

22 March

29 March

31 March

Michelle electronically transferred NS150 000 into the business bank account.

She also transferred her personal computer equipment which has a second-hand value of

NS4 500 to the business.

She electronically deposited NS10 000 for February rent and N$12 000 for March rent

into rent agent’s bank account.

She purchased a furniture for NS$15 000 on credit from Sleepy-Suppliers.

She bought some goods for resale for NS50 000 from John supplier and she transferred

the amount into John’s account.

Michelle sold goods to Vana-Veni for NS65 000 on credit.

Vana-Veni settled Michelle’s account by paying N$62 500 with debit card.

Michelle settled her account with Sleepy-Suppliers by electronical fund transfer,

and was allowed a settlement discount of 10%.

|

3 Page 3 |

▲back to top |

Required:

Enter the above transactions in Michelle’s ledger accounts, balance off all the accounts and bring

forward the balances as at 1 April 2019.

(20)

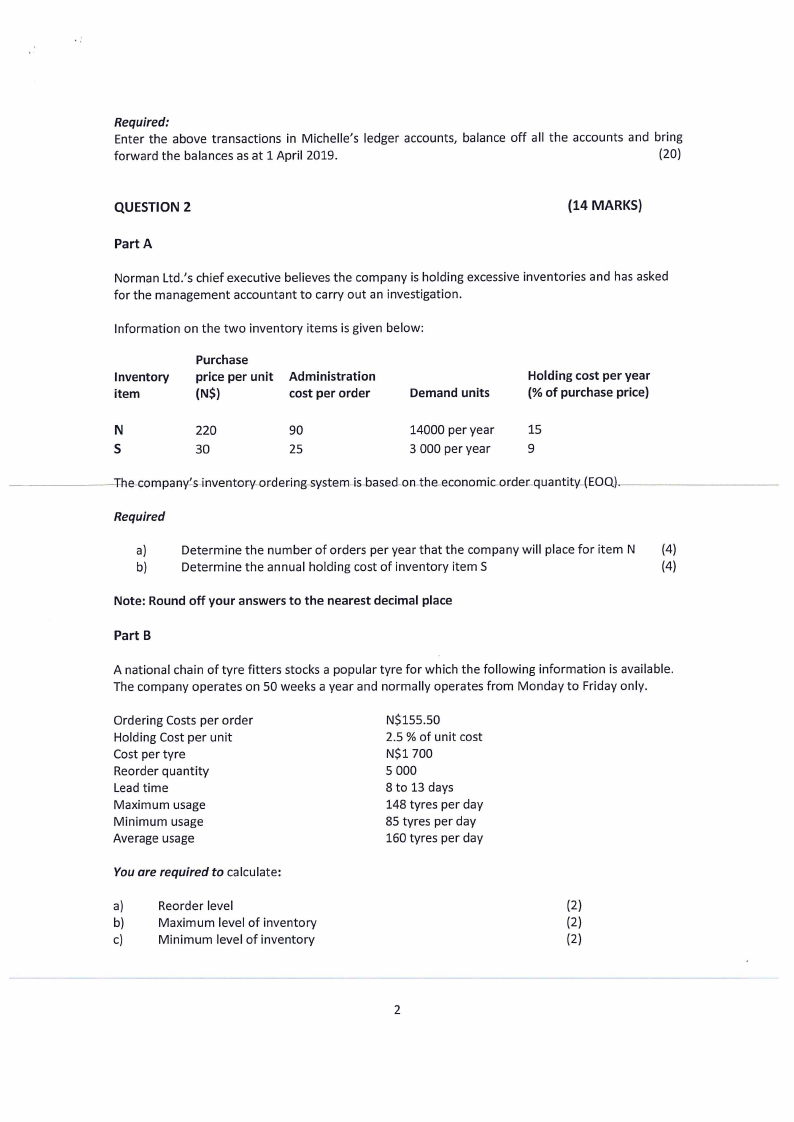

QUESTION 2

(14 MARKS)

PartA

Norman Ltd.’s chief executive believes the company is holding excessive inventories and has asked

for the management accountant to carry out an investigation.

Information on the two inventory items is given below:

Inventory

item

Purchase

price per unit

(NS)

Administration

cost per order

Demand units

Holding cost per year

(% of purchase price)

N

220

90

S

30

25

14000 per year

15

3 000 per year

9

____The-company’s inventosr ysty em _ is bo aser d-ondthe e er coni omin c org der quantity (EOQ)

Required

a)

Determine the number of orders per year that the company will place for item N

(4)

b)

Determine the annual holding cost of inventory item S

(4)

Note: Round off your answers to the nearest decimal place

Part B

A national chain of tyre fitters stocks a popular tyre for which the following information is available.

The company operates on 50 weeks a year and normally operates from Monday to Friday only.

Ordering Costs per order

Holding Cost per unit

Cost per tyre

Reorder quantity

Lead time

Maximum usage

Minimum usage

Average usage

NS155.50

2.5 % of unit cost

NS1 700

5 000

8 to 13 days

148 tyres per day

85 tyres per day

160 tyres per day

You are required to calculate:

a)

Reorder level

(2)

b)

Maximum level of inventory

(2)

c)

Minimum level of inventory

(2)

|

4 Page 4 |

▲back to top |

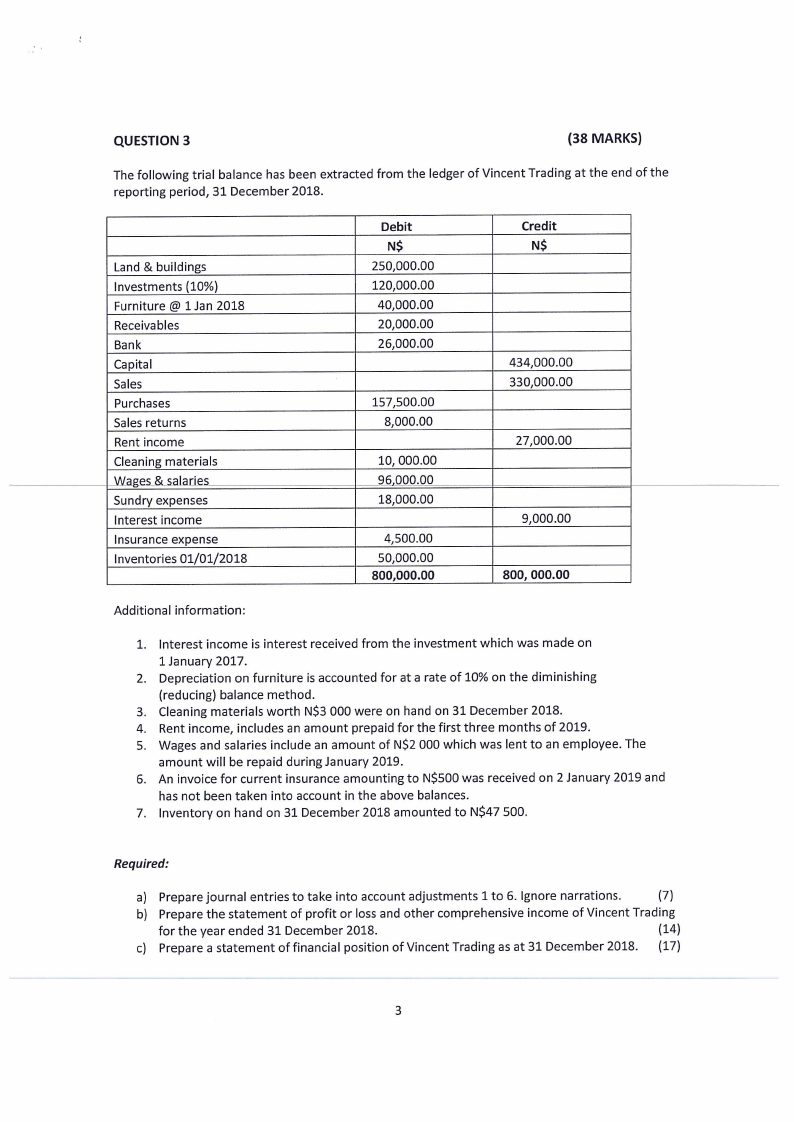

QUESTION 3

(38 MARKS)

The following trial balance has been extracted from the ledger of Vincent Trading at the end of the

reporting period, 31 December 2018.

Land & buildings

Investments (10%)

Furniture @ 1 Jan 2018

Receivables

Bank

Capital

Sales

Purchases

Sales returns

Rent income

Cleaning materials

| Wages & salaries

Sundry expenses

Interest income

Insurance expense

Inventories 01/01/2018

Debit

NS

250,000.00

120,000.00

40,000.00

20,000.00

26,000.00

157,500.00

8,000.00

10, 000.00

96,000.00

18,000.00

4,500.00

50,000.00

800,000.00

Credit

NS

434,000.00

330,000.00

27,000.00

9,000.00

800, 000.00

Additional information:

1. Interest income is interest received from the investment which was made on

1 January 2017.

2. Depreciation on furniture is accounted for at a rate of 10% on the diminishing

(reducing) balance method.

3. Cleaning materials worth NS3 000 were on hand on 31 December 2018.

4. Rent income, includes an amount prepaid for the first three months of 2019.

5. Wages and salaries include an amount of NS2 000 which was lent to an employee. The

amount will be repaid during January 2019.

6. An invoice for current insurance amounting to NS500 was received on 2 January 2019 and

has not been taken into account in the above balances.

7. Inventory on hand on 31 December 2018 amounted to N$47 500.

Required:

a) Prepare journal entries to take into account adjustments 1 to 6. Ignore narrations.

(7)

b) Prepare the statement of profit or loss and other comprehensive income of Vincent Trading

for the year ended 31 December 2018.

(14)

c) Prepare a statement of financial position of Vincent Trading as at 31 December 2018. (17)

|

5 Page 5 |

▲back to top |

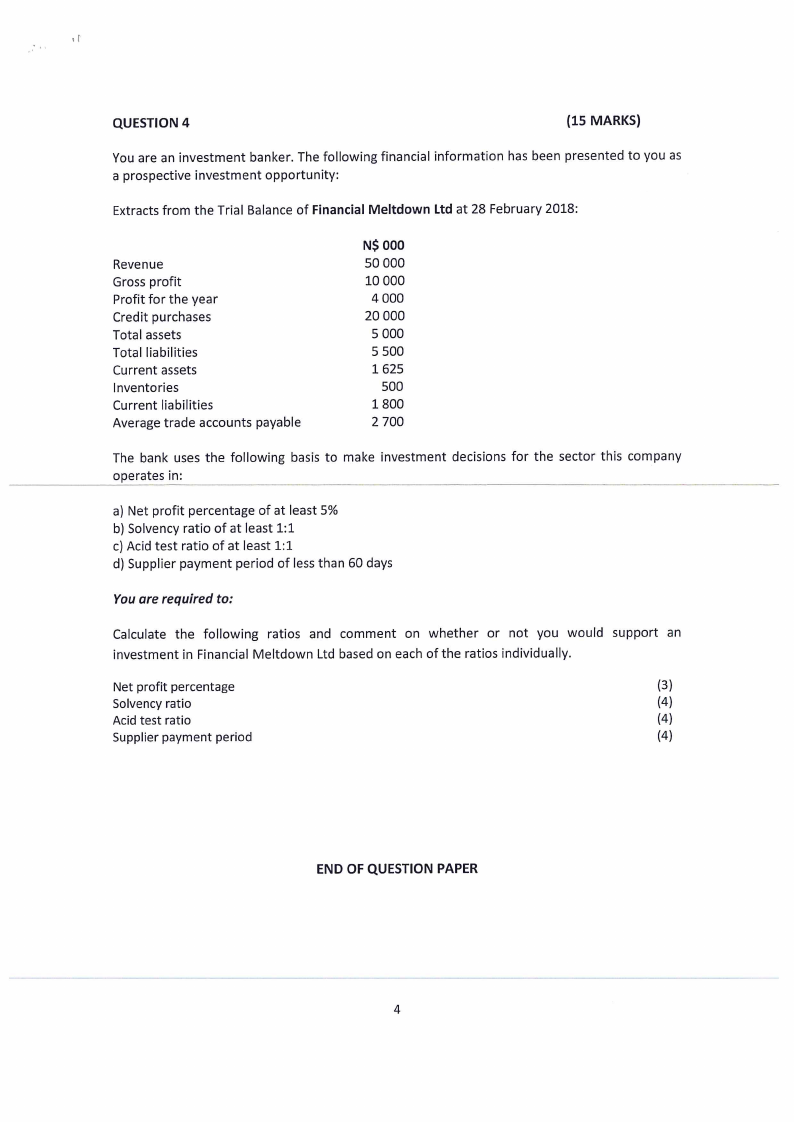

QUESTION 4

(15 MARKS)

You are an investment banker. The following financial information has been presented to you as

a prospective investment opportunity:

Extracts from the Trial Balance of Financial Meltdown Ltd at 28 February 2018:

Revenue

Gross profit

Profit for the year

Credit purchases

Total assets

Total liabilities

Current assets

Inventories

Current liabilities

Average trade accounts

payable

NS 000

50 000

10 000

4 000

20 000

5 000

5 500

1625

500

1 800

2 700

The bank uses the following basis to make investment decisions for the sector this company

operates in:

a) Net profit percentage of at least 5%

b) Solvency ratio of at least 1:1

c) Acid test ratio of at least 1:1

d) Supplier payment period of less than 60 days

You are required to:

Calculate the following ratios and comment on whether or not you would support an

investment in Financial Meltdown Ltd based on each of the ratios individually.

Net profit percentage

(3)

Solvency ratio

(4)

Acid test ratio

(4)

Supplier payment period

(4)

END OF QUESTION PAPER