|

FMS721S - FINANCIAL MANAGEMENT IN HEALHT SERVICES - 2ND OPP - JULY 2022 |

|

1 Page 1 |

▲back to top |

' (·

nAm I BI A u n IVE RS ITV

OF SCIEnCE

TECHnOLOGY

FACULTY OF HEALTH, APPLIED SCIENCES AND NATURAL RESOURCES

DEPARTMENT OF HEALTH SCIENCES

QUALIFICATION: BACHELOROF SCIENCEIN HEALTHINFORMATION SYSTEMSMANAGEMENT

QUALIFICATION CODE: 07BHIS

COURSE: FINANCIAL MANAGEMENT IN

HEALTHSERVICES

SESSION: JULY2022

LEVEL: 7

COURSE CODE: FMS721S

PAPER: THEORY

DURATION: 3 HOURS

MARKS: 100

SUPLEMENTAY/SECOND OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINER

DR MOIPI NGAUJAKE

MODERATOR

MR NELSONPRADA

INSTRUCTIONS

1. Read the questions and instructions carefully

2. Answer All the questions

3. Write neatly and clearly

4. Begin each question on a separate sheet of paper and number the answers clearly

PERMISSIBLE MATERIALS

1. SCIENTIFICCALCULATOR

THIS QUESTION PAPER CONSISTS OF 5 PAGES

(Including this front page}

1

|

2 Page 2 |

▲back to top |

QUESTION 1

[SECTION A]

{35 Marks)

1.1 Discuss the direct measures (Proactive Strategy) as a form of quality improvement

(12)

of a healthcare organization?

1.2 Discuss the objectives of healthcare finance management?

(6)

1.3 Explain the concept of Depreciation?

(1)

1.4 Explain the concept of Accrual Accounting?

(4)

1.5 Differentiate between the different types of expenses?

(8)

1.6 Differentiate between Gross Patient Revenue and Net Patient Revenue?

(4)

QUESTION 2

[SECTION BJ

(30 MARKS)

Tuhafeni Shikongo's family owns a Pharmacy. His family started the business 3 years ago. He plans

to buy further equipment to modernize the Pharmacy. Hafeni is interested to see how and when his

cash in-flows and out-flows will occur.

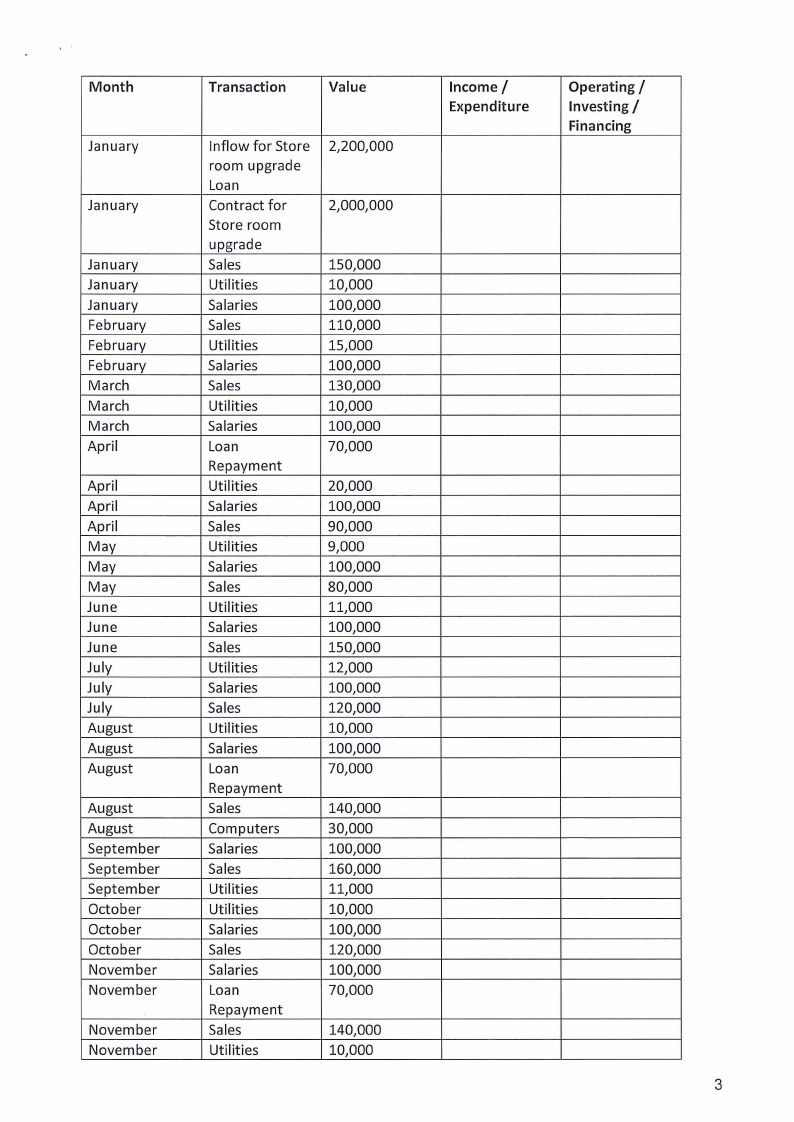

Directions: From the following information, calculate Tuhafeni's cash flow position. Complete the

statement of cash flow and the cash flow statement. Hafeni's beginning cash balance was

N$100,000. The following steps are hints for completing the exercise.

1. Arrange each transaction as income or expense.

2. Categorize each transaction as an operating, investing or financing activity.

3. Summarize the information on the statement of cash flows form below.

4. Classify each transaction into like categories.

5. Summarize the transaction into quarterly values.

6. Prepare the summary values and totals on the cash flow statement.

2

|

3 Page 3 |

▲back to top |

Month

January

January

January

January

January

February

February

February

March

March

March

April

April

April

April

May

May

May

June

June

June

July

July

July

August

August

August

August

August

September

September

September

October

October

October

November

November

November

November

Transaction

Value

Inflow for Store

room upgrade

Loan

Contract for

Store room

upgrade

Sales

Utilities

Salaries

Sales

Utilities

Salaries

Sales

Utilities

Salaries

Loan

Repayment

Utilities

Salaries

Sales

Utilities

Salaries

Sales

Utilities

Salaries

Sales

Utilities

Salaries

Sales

Utilities

Salaries

Loan

Repayment

Sales

Computers

Salaries

Sales

Utilities

Utilities

Salaries

Sales

Salaries

Loan

Repayment

Sales

Utilities

2,200,000

2,000,000

150,000

10,000

100,000

110,000

15,000

100,000

130,000

10,000

100,000

70,000

20,000

100,000

90,000

9,000

100,000

80,000

11,000

100,000

150,000

12,000

100,000

120,000

10,000

100,000

70,000

140,000

30,000

100,000

160,000

11,000

10,000

100,000

120,000

100,000

70,000

140,000

10,000

Income/

Expenditure

Operating/

Investing/

Financing

3

|

4 Page 4 |

▲back to top |

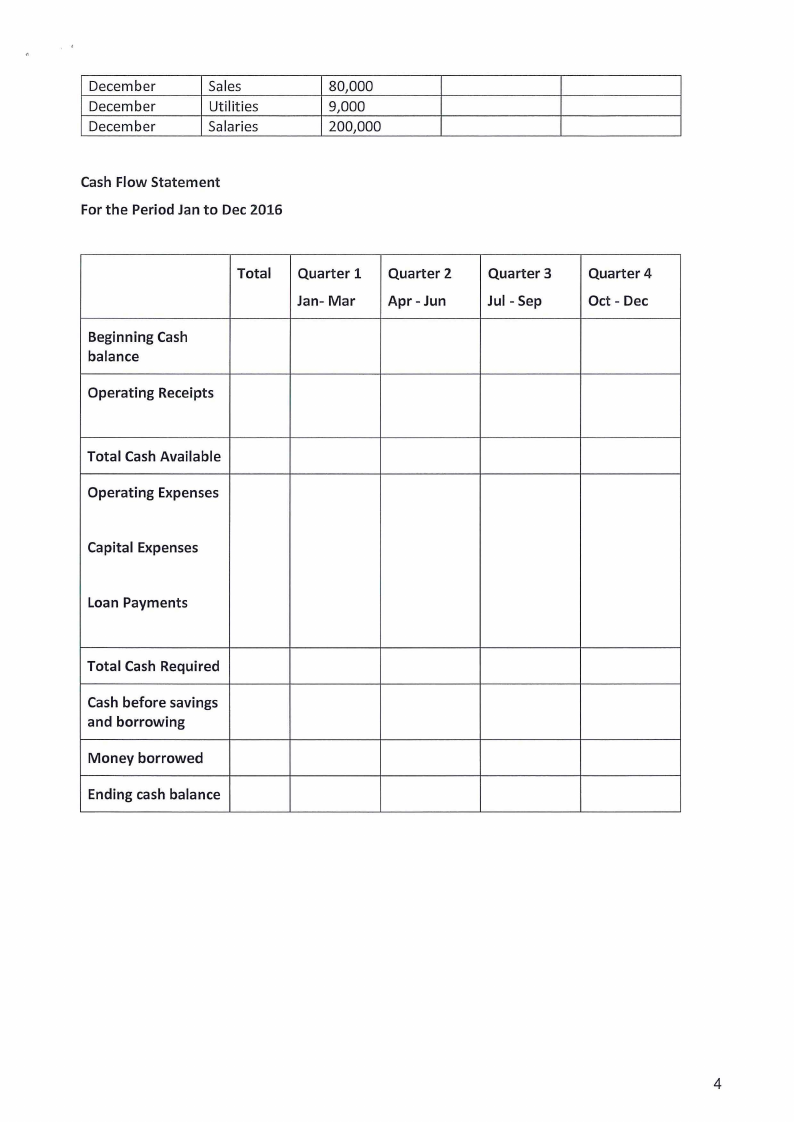

December

December

December

Sales

Utilities

Salaries

Cash Flow Statement

For the Period Jan to Dec 2016

80,000

9,000

200,000

Total

Beginning Cash

balance

Operating Receipts

Quarter 1

Jan- Mar

Quarter 2

Apr - Jun

Quarter 3

Jul - Sep

Quarter 4

Oct - Dec

Total Cash Available

Operating Expenses

Capital Expenses

Loan Payments

Total Cash Required

Cash before savings

and borrowing

Money borrowed

Ending cash balance

4

|

5 Page 5 |

▲back to top |

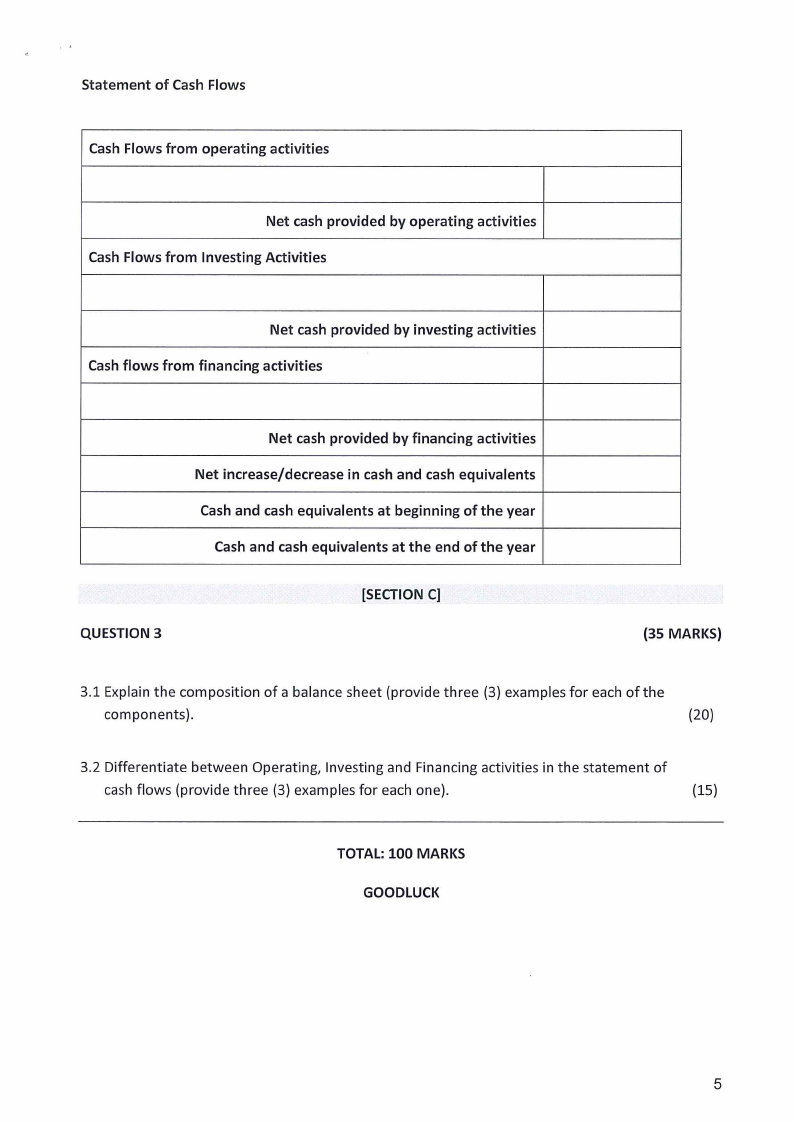

Statement of Cash Flows

Cash Flows from operating activities

Net cash provided by operating activities

Cash Flows from Investing Activities

Net cash provided by investing activities

Cash flows from financing activities

Net cash provided by financing activities

Net increase/decrease in cash and cash equivalents

Cash and cash equivalents at beginning of the year

Cash and cash equivalents at the end of the year

QUESTION 3

[SECTION C]

(35 MARKS)

3.1 Explain the composition of a balance sheet (provide three (3) examples for each of the

components).

(20)

3.2 Differentiate between Operating, Investing and Financing activities in the statement of

cash flows (provide three (3) examples for each one).

(15)

TOTAL: 100 MARKS

GOODLUCK

5