CAH610S - COST AND MANAGEMENT ACCOUNTING FOR HOSPITALITY AND TOURISM - 1ST OPP - NOVEMBER 2022

|

CAH610S - COST AND MANAGEMENT ACCOUNTING FOR HOSPITALITY AND TOURISM - 1ST OPP - NOVEMBER 2022 |

|

1 Page 1 |

▲back to top |

nAmlBIA UnlVERSITY

OF SCIEn CE Ano TECHn OLOGY

FACULTYOFCOMMERCEH, UMANSCIENCEAS ND EDUCATION

ECONOMICS,ACCOUNTINGAND FINANCE

QUALIFICATIONCODE:07BHOM & 07BOTM

COURSECODE:CAH610S

DATE: NOVEMBER 2022

LEVEL:6

COURSENAME: COST& MANAGEMENT

ACCOUNTING FOR HOSPITALITY& TOURISM

MODE: FT

DURATION: 3 HOURS

MARKS: 100

EXAMINER(S)

MODERATOR:

FIRSTOPPORTUNITYEXAMINATION PAPER

Sheehama, K.G.H.

Odada, L.

INSTRUCTIONS

1. Answer ALL the questions.

2. Write clearly and neatly.

3. Number the answers clearly.

NON - PROGRAMMABLECALCUTOR

1. Examination paper

2. Examination script

THIS QUESTION PAPERCONSISTSOF 7 PAGES(INCLUDING THIS FRONT PAGE)

|

2 Page 2 |

▲back to top |

QUESTION 1

(26 MARKS)

Each of the following questions (1. -10) has only ONE correct answer. Please answer this

question ON the answer sheet provided. E.g. 1. D

Use the following information to answer 1- 3:

An organisation has the following total costs at two activity levels:

Activity level (units)

15 000

24 000

Total costs

N$380 000

N$452 000

Variable cost per unit is constant in this range.

1. Variable cost per unit in this activity range is:

A

N$23.33

B

N$18.83

C

N$9.00

D

N$8.00

2. The amount of total fixed costs in this range is:

A

N$380 000

B

N$452 000

C

N$260 000

D

N$360 000

3. What are the total costs at an activity level of 18 000 units?

A

N$380 000

B

N$452 000

C

N$440 000

D

N$404000

Use the following information to answer 4 and 5:

Kandongo Wood Joinery, a friend of yours, has recently set up a small business making chairs. He has

supplied you with the following figures, and has asked for your advice on a few issues:

Costs per month

N$

Wood

40 000

Carpenter

54 000

Manufacturing overheads

20 000

The above total production costs are based on producing 600 chairs per month.

4. The cost per chair is:

A

N$118

B

N$190

C

N$138

D

N$130

5. What would be the selling price per curtain, if Kandongo Wood Joinery wanted a mark-up of 20%?

A

N$240

B

N$210

C

N$228

D

N$230

2

|

3 Page 3 |

▲back to top |

Use the following information to answer 6 - 9:

Namwandi company Ltd makes concrete bricks made up of cement and sand. Additional

information is as follows:

N$

Building materials (bricks, cements, zincs, etc.)

100 000

Indirect labour cost

50 000

Wages of builders, electricians, and plumbers

200 000

Indirect material used

20000

Depreciation of office equipment

100 000

Other factory overhead costs

50000

6. The amount of prime cost for the period is:

A

N$300 000

B

N$350 000

C

N$400 000

D

N$450 000

7. The amount of manufacturing overheads cost for the period is:

A

N$230 000

B

N$220 000

C

N$110 000

D

N$120 000

8. Costs that are unaffected by a choice between alternatives and have been included in

the past is:

A

sunk cost

B

period cost

C

product cost

D

direct cost

9. In the code of ethics followed by management accountants, confidentiality is:

A

being honest, standing for what is right

B being courteous and decent

C not revealing or disclosing privileged or private information

D accepting the consequences of actions and decisions

10. In the code of ethics followed by management accountants, accountability is:

A

being just and unbiased

B being courteous and decent

C not revealing or disclosing privileged or private information

D accepting the consequences of actions and decisions

11. The type or branch of accounting that generates reports for the use of external

parties such as creditors, investors and government agencies is known as:

A

Financial accounting

8

Managerial accounting

C Tax accounting

D Forensic accounting

12. The branch of accounting that generates reports and information for the use of

internal management is known as:

A Tax accounting

B Management accounting

C Auditing

D International accounting

3

|

4 Page 4 |

▲back to top |

13. Wellington Ltd used a predetermined overhead rate during 2022 of N$3 per direct

labour hour, based on an estimate of 24 000 direct labour hours to be worked during

the year. Actual costs and activity during 2022 were: Actual manufacturing overhead

cost incurred, N$84 000; Actual direct labour hours worked, 27 000. The under- or

over-applied overhead for 2022 would be:

A

N$3 000 under-applied

B

N$3 000 over-applied

C

N$120 000

D

N$9 000

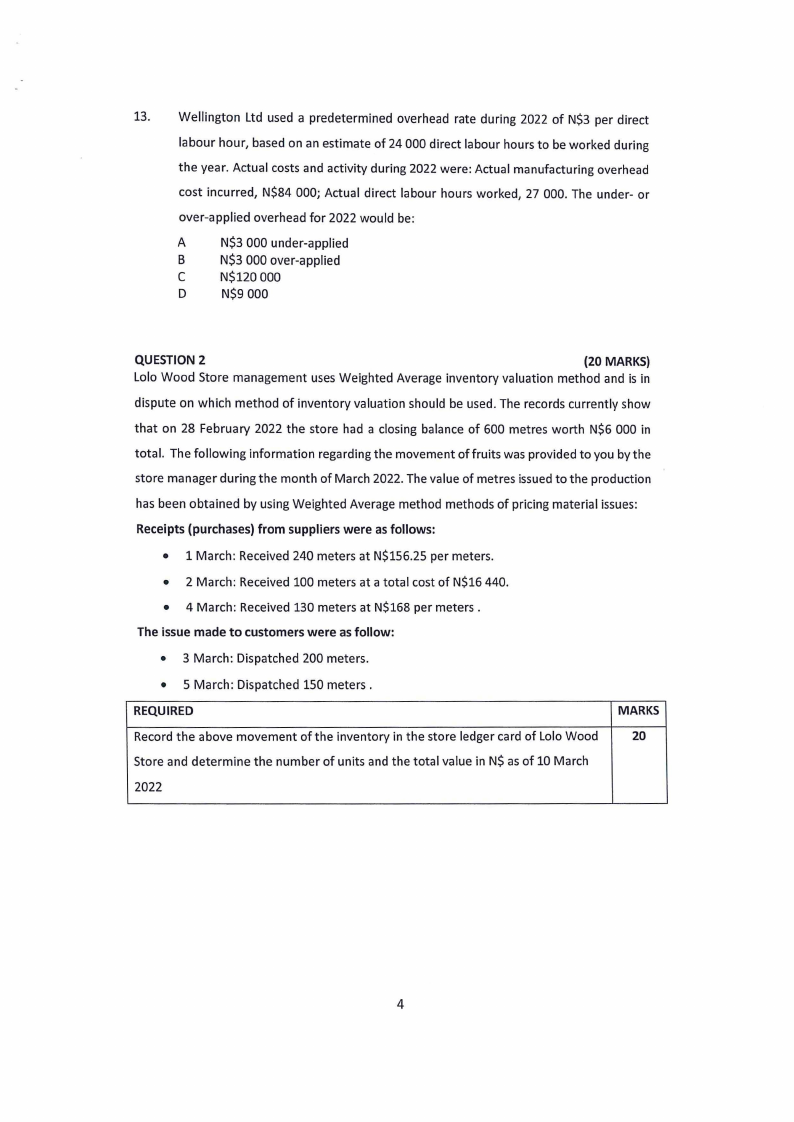

QUESTION 2

(20 MARKS)

Lolo Wood Store management uses Weighted Average inventory valuation method and is in

dispute on which method of inventory valuation should be used. The records currently show

that on 28 February 2022 the store had a closing balance of 600 metres worth N$6 000 in

total. The following information regarding the movement of fruits was provided to you by the

store manager during the month of March 2022. The value of metres issued to the production

has been obtained by using Weighted Average method methods of pricing material issues:

Receipts(purchases)from supplierswere asfollows:

• 1 March: Received 240 meters at N$156.25 per meters.

• 2 March: Received 100 meters at a total cost of N$16 440.

• 4 March: Received 130 meters at N$168 per meters.

The issuemade to customerswere asfollow:

• 3 March: Dispatched 200 meters.

• 5 March: Dispatched 150 meters.

REQUIRED

MARKS

Record the above movement of the inventory in the store ledger card of Lolo Wood

20

Store and determine the number of units and the total value in N$ as of 10 March

2022

4

|

5 Page 5 |

▲back to top |

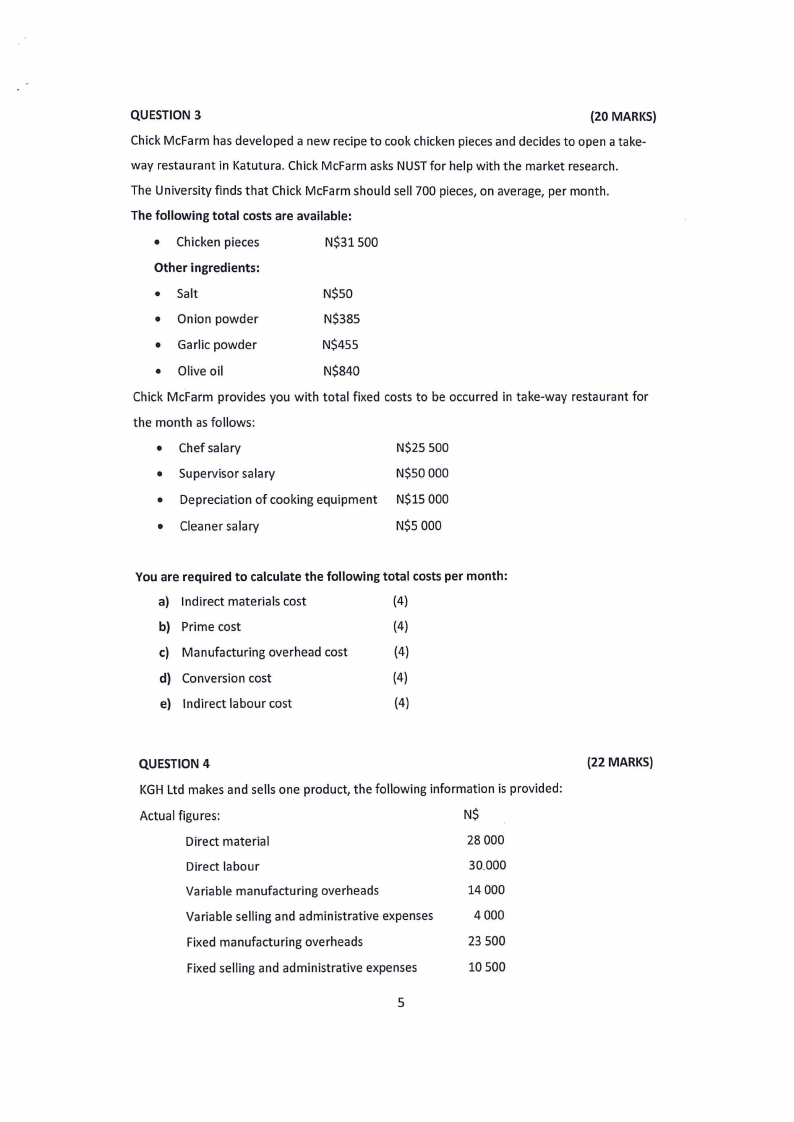

QUESTION3

(20 MARKS)

Chick McFarm has developed a new recipe to cook chicken pieces and decides to open a take-

way restaurant in Katutura. Chick McFarm asks NUSTfor help with the market research.

The University finds that Chick McFarm should sell 700 pieces, on average, per month.

The following total costsare available:

• Chicken pieces

N$31500

Other ingredients:

• Salt

• Onion powder

• Garlic powder

• Olive oil

N$50

N$385

N$455

N$840

Chick McFarm provides you with total fixed costs to be occurred in take-way restaurant for

the month as follows:

• Chef salary

N$25 500

• Supervisor salary

N$SO000

• Depreciation of cooking equipment N$15 000

• Cleaner salary

N$5 000

You are required to calculatethe following total costsper month:

a) Indirect materials cost

(4)

b) Prime cost

(4)

c) Manufacturing overhead cost

(4)

d) Conversion cost

(4)

e) Indirect labour cost

(4)

QUESTION4

KGH Ltd makes and sells one product, the following information is provided:

Actual figures:

N$

Direct material

28 000

Direct labour

30,000

Variable manufacturing overheads

14000

Variable selling and administrative expenses

4000

Fixed manufacturing overheads

23 500

Fixed selling and administrative expenses

10 500

5

(22 MARKS)

|

6 Page 6 |

▲back to top |

Production

Units sold

Selling price

900 units

800 units

N$200

KGH Ltd use machine hours to allocate fixed manufacturing overheads.

The absorption rate is N$16 per machine hour. It normally takes 1.5 machine hours to produce

one product.

REQUIRED:

Prepare the statements of profit or loss for the period for management using:

a) Direct costing

{8)

b) Absorption costing

{12)

QUESTIONS

{12 MARKS)

The management of Penguin CC presently considers investing in a new machine which it

believes will increase productivity in its factory. The initial cash outlay will be N$334 000 and

a return of at least 12% per annum is required on all new capital projects. It is estimated that

the following cash flows will be derived from operations with this new machine:

Year

Cashflow

1

N$155 000

2

N$144000

3

N$75 000

4

N$ 61000

5

N$12161

Additional information:

The factory supervisor is of the opinion that this machine will have an economic useful life of

5 years after which it will most probably have no resale value.

REQUIRED:

Make a recommendation to the management of the corporation asto the viability of investing

in this machine. Make use of the net present value method. {12)

END OF EXAMINATION PAPER

6

|

7 Page 7 |

▲back to top |

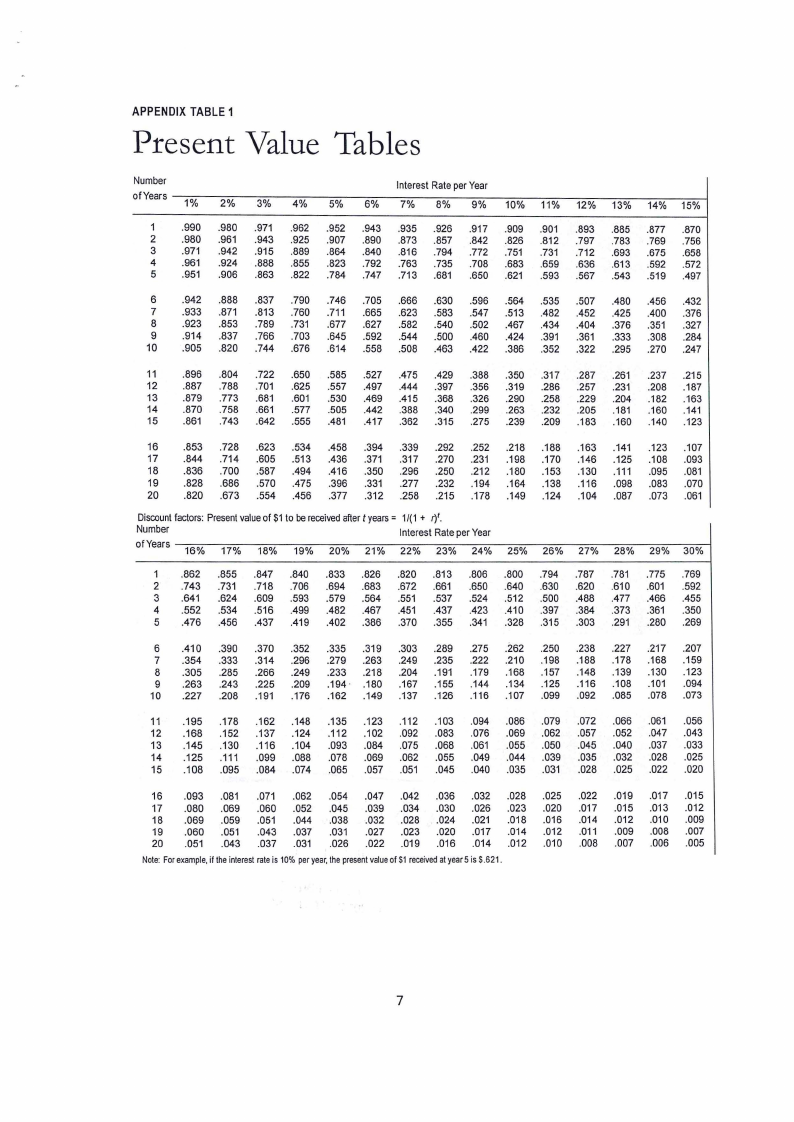

APPENDIXTABLE1

Present Value Tables

Number

Interest Rate per Year

of Years

1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15%

1 .990 .980 .971 .962 .952 .943 .935 .926 .917 .909 .901 .893 .885 .877 .870

2

.980 .961 .943 .925 .907 .890 .873 .857 .842 .826 .812 .797 .783 .769 .756

3

.971 .942 .915 .889 .864 .840 .816 .794 .772 .751 .731 .712 .693 .675 .658

4

.961 .924 .888 .855 .823 .792 .763 .735 .708 .683 .659 .636 .613 .592 .572

5 .951 .906 .863 .822 .784 .747 .713 .681 .650 .621 .593 .567 .543 .519 .497

6 .942 .888 .837 .790 .746 .705 .666 .630 .596 .564 .535 .507 .480 .456 .432

7 .933 .871 .813 .760 .711 .665 .623 .583 .547 .513 .482 .452 .425 .400 .376

8

.923 .853 .789 .731 .677 .627 .582 .540 .502 .467 .434 .404 .376 .351 .327

9 .914 .837 .766 .703 .645 .592 .544 .500 .460 .424 .391 .361 .333 .308 .284

10 .905 .820 .744 .676 .614 .558 .508 .463 .422 .386 .352 .322 .295 .270 .247

11 .896 .804 .722 .650 .585 .527 .475 .429 .388 .350 .317 .287 .261 .237 .215

12 .887 .788 .701 .625 .557 .497 .444 .397 .356 .319 .286 .257 .231 .208 .187

13 .879 .773 .681 .601 .530 .469 .415 .368 .326 .290 .258 .229 .204 .182 .163

14 .870 .758 .661 .577 .505 .442 .388 .340 .299 .263 .232 .205 .181 .160 .141

15 .861 .743 .642 .555 .481 .417 .362 .315 .275 .239 .209 .183 .160 .140 .123

16 .853 .728 .623 .534 .458 .394 .339 .292 .252 .218 .188 .163 .141 .123 .107

17 .844 .714 .605 .513 .436 .371 .317 .270 .231 .198 .170 .146 .125 .108 .093

18 .836 .700 .587 .494 .416 .350 .296 .250 .212 .180 .153 .130 .111 .095 .081

19 .828 .686 .570 .475 .396 .331 .277 .232 .194 .164 .138 .116 .098 .083 .070

20 .820 .673 .554 .456 .377 .312 .258 .215 .178 .149 .124 .104 .087 .073 .061

Discountfactors: Present valueof $1 to be receivedaftert years= 1/(1+ 1')'.

Number

Interest Rate per Year

of Years 16% 17% 18% 19% 20% 21% 22% 23% 24% 25% 26% 27% 28% 29% 30%

1 .862 .855 .847 .840 .833 .826 .820 .813 .806 .800 .794 .787 .781 .775 .769

2 .743 .731 .718 .706 .694 .683 .672 .661 .650 .640 .630 .620 .610 .601 .592

3 .641 .624 .609 .593 .579 .564 .551 .537 .524 .512 .500 .488 .477 .466 .455

4 .552 .534 .516 .499 .482 .467 .451 .437 .423 .410 .397 .384 .373 .361 .350

5 .476 .456 .437 .419 .402 .386 .370 .355 .341 .328 .315 .303 .291 .280 .269

6 .410 .390 .370 .352 .335 .319 .303 .289 .275 .262 .250 .238 .227 .217 .207

7 .354 .333 .314 .296 .279 .263 .249 .235 .222 .210 .198 .188 .178 .168 .159

8 .305 .285 .266 .249 .233 .218 .204 .191 .179 .168 .157 .148 .139 .130 .123

9 .263 .243 .225 .209 .194 · .180 .167 .155 .144 .134 .125 .116 .108 .101 .094

10 .227 .208 .191 .176 .162 .149 .137 .126 .116 .107 .099 .092 .085 .078 .073

11 .195 .178 .162 .148 .135 .123 .112 .103 .094 .086 .079 .072 .066 .061 .056

12 .168 .152 .137 .124 .112 .102 .092 .083 .076 .069 .062 .057 .052 .047 .043

13 .145 .130 .116 .104 .093 .084 .075 .068 .061 .055 .050 .045 .040 .037 .033

14 .125 .111 .099 .088 .078 .069 .062 .055 .049 .044 .039 .035 .032 .028 .025

15 .108 .095 .084 .074 .065 .057 .051 .045 .040 .035 .031 .028 .025 .022 .020

16 .093 .081 .071 .062 .054 .047 .042 .036 .032 .028 .025 .022 .019 .017 .015

17 .080 .069 .060 .052 .045 .039 .034 .030 .026 .023 .020 .017 .015 .013 .012

18 .069 .059 .051 .044 .038 .032 .028 .024 .021 .018 .016 .014 .012 .010 .009

19 .060 .051 .043 .037 .031 .027 .023 .020 .017 .014 .012 .011 .009 .008 .007

20 .051 .043 .037 .031 .026 .022 .019 .016 .014 .012 .010 .008 .007 .006 .005

Note:Forexamplei,f the interestrateis 10%peryear,the presentvalueof $1receivedat year5 is S.621.

7