|

MFN710S- MANAGERIAL FINANCE 320- 1ST OPP- NOV 2023 |

|

1 Page 1 |

▲back to top |

nAmlBIA UnlVERSITY

OF SCIEnCE Ano TECHnOLOGY

FA CUL TY OF COMMERCE, HUMAN SCIENCES, AND EDUCATION

DEPARTMENT OF ECONOMICS, ACCOUNTING, AND FINANCE

QUALIFICATION: BACHELOR OF ACCOUNTING

QUALIFICATION CODE: 07BOAC LEVEL:?

COURSE CODE: MFN710S

COURSE NAME: MANAGERIAL FINANCE 320

SESSION: NOVEMBER 2023

PAPER: THEORY AND CALCULATIONS

DURATION: 3 HOURS

MARKS: 100

EXAMINERS

MODERATOR:

FIRST OPPORTUNITY EXAMINATION QUESTION PAPER

Alina Gustav and Lameck Odada

Alfred Makosa

INSTRUCTIONS

1. This examination question paper consists of FOUR (4) questions

2. Answer ALL the questions in blue or black ink only. NO PENCIL.

3. Start each question on a new page, number the answers correctly and clearly.

4. Write clearly, and neatly showing all your workings/assumptions.

5. Work with at least four (4) decimal places in all your calculations and round off only final

answers to two (2) decimal places.

6. Questions relating to this examination may be raised in the initial 30 minutes after the start

of the examination. Thereafter, candidates must use their initiative to deal with any

perceived errors or ambiguities and any assumptions made by the candidate should be

clearly stated.

PERMISSIBLE MATERIALS

1. Silent, non-programmable calculators

THIS QUESTION PAPER CONSISTS OF _6_ PAGES (excluding this front page)

|

2 Page 2 |

▲back to top |

QUESTION 1

[30 MARKS]

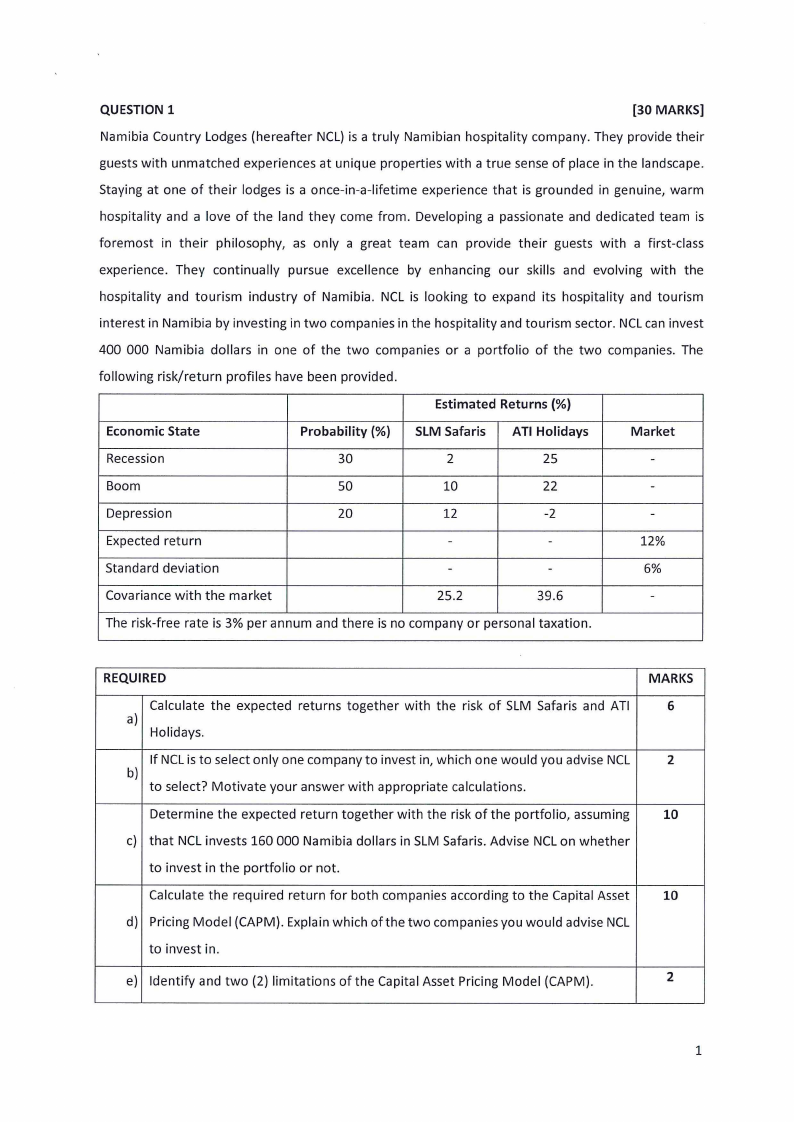

Namibia Country Lodges (hereafter NCL) is a truly Namibian hospitality company. They provide their

guests with unmatched experiences at unique properties with a true sense of place in the landscape.

Staying at one of their lodges is a once-in-a-lifetime experience that is grounded in genuine, warm

hospitality and a love of the land they come from. Developing a passionate and dedicated team is

foremost in their philosophy, as only a great team can provide their guests with a first-class

experience. They continually pursue excellence by enhancing our skills and evolving with the

hospitality and tourism industry of Namibia. NCL is looking to expand its hospitality and tourism

interest in Namibia by investing in two companies in the hospitality and tourism sector. NCLcan invest

400 000 Namibia dollars in one of the two companies or a portfolio of the two companies. The

following risk/return profiles have been provided.

Estimated Returns{%)

Economic State

Probability {%) SLM Safaris ATI Holidays

Market

Recession

30

2

25

-

Boom

50

10

22

-

Depression

20

12

-2

-

Expected return

-

-

12%

Standard deviation

-

-

6%

Covariance with the market

25.2

39.6

-

The risk-free rate is 3% per annum and there is no company or personal taxation.

REQUIRED

MARKS

Calculate the expected returns together with the risk of SLM Safaris and ATI

6

a)

Holidays.

If NCL is to select only one company to invest in, which one would you advise NCL

2

b)

to select? Motivate your answer with appropriate calculations.

Determine the expected return together with the risk of the portfolio, assuming

10

c) that NCL invests 160 000 Namibia dollars in SLM Safaris. Advise NCL on whether

to invest in the portfolio or not.

Calculate the required return for both companies according to the Capital Asset

10

d) Pricing Model (CAPM). Explain which of the two companies you would advise NCL

to invest in.

e) Identify and two (2) limitations of the Capital Asset Pricing Model (CAPM).

2

1

|

3 Page 3 |

▲back to top |

QUESTION 2

[25 MARKS]

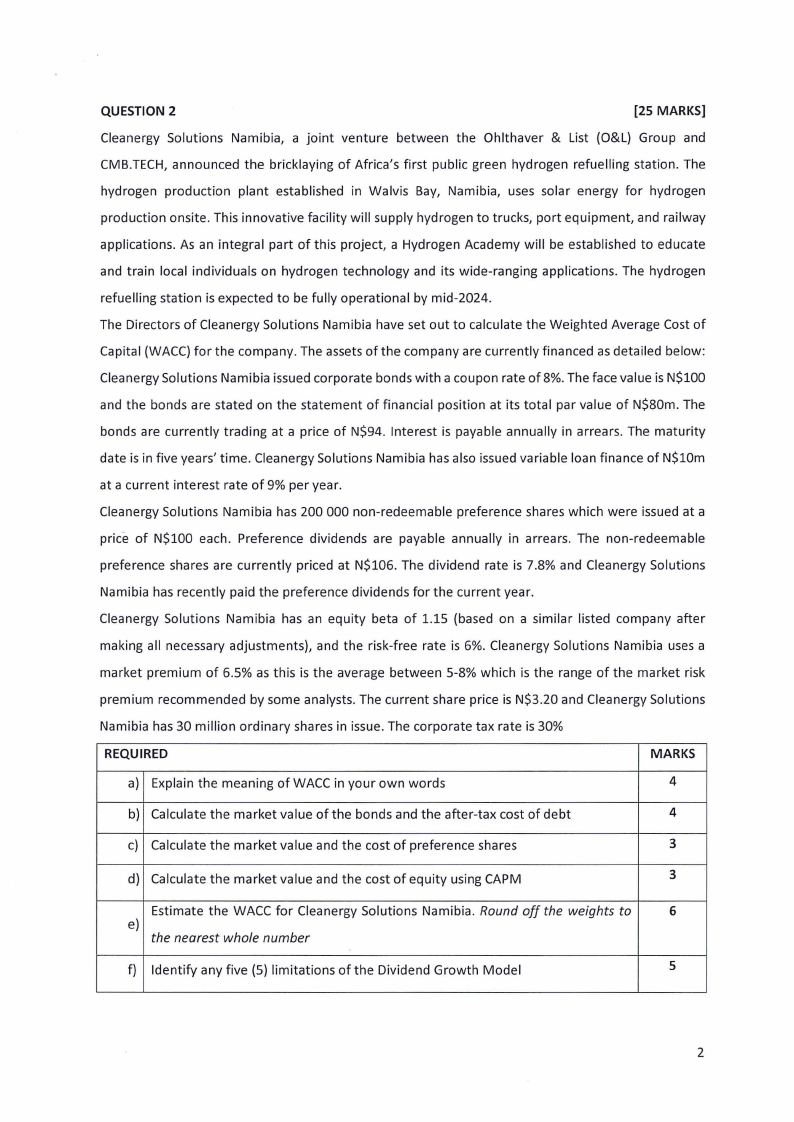

Cleanergy Solutions Namibia, a joint venture between the Ohlthaver & List (O&L) Group and

CMB.TECH, announced the bricklaying of Africa's first public green hydrogen refuelling station. The

hydrogen production plant established in Walvis Bay, Namibia, uses solar energy for hydrogen

production onsite. This innovative facility will supply hydrogen to trucks, port equipment, and railway

applications. As an integral part of this project, a Hydrogen Academy will be established to educate

and train local individuals on hydrogen technology and its wide-ranging applications. The hydrogen

refuelling station is expected to be fully operational by mid-2024.

The Directors of Cleanergy Solutions Namibia have set out to calculate the Weighted Average Cost of

Capital (WACC) for the company. The assets of the company are currently financed as detailed below:

Cleanergy Solutions Namibia issued corporate bonds with a coupon rate of 8%. The face value is N$100

and the bonds are stated on the statement of financial position at its total par value of N$80m. The

bonds are currently trading at a price of N$94. Interest is payable annually in arrears. The maturity

date is in five years' time. Cleanergy Solutions Namibia has also issued variable loan finance of N$10m

at a current interest rate of 9% per year.

Cleanergy Solutions Namibia has 200 000 non-redeemable preference shares which were issued at a

price of N$100 each. Preference dividends are payable annually in arrears. The non-redeemable

preference shares are currently priced at N$106. The dividend rate is 7.8% and Cleanergy Solutions

Namibia has recently paid the preference dividends for the current year.

Cleanergy Solutions Namibia has an equity beta of 1.15 (based on a similar listed company after

making all necessary adjustments), and the risk-free rate is 6%. Cleanergy Solutions Namibia uses a

market premium of 6.5% as this is the average between 5-8% which is the range of the market risk

premium recommended by some analysts. The current share price is N$3.20 and Cleanergy Solutions

Namibia has 30 million ordinary shares in issue. The corporate tax rate is 30%

REQUIRED

MARKS

a) Explain the meaning of WACC in your own words

4

b) Calculate the market value of the bonds and the after-tax cost of debt

4

c) Calculate the market value and the cost of preference shares

3

d) Calculate the market value and the cost of equity using CAPM

3

Estimate the WACC for Cleanergy Solutions Namibia. Round off the weights to

6

e)

the nearest whole number

f) Identify any five (5) limitations of the Dividend Growth Model

5

2

|

4 Page 4 |

▲back to top |

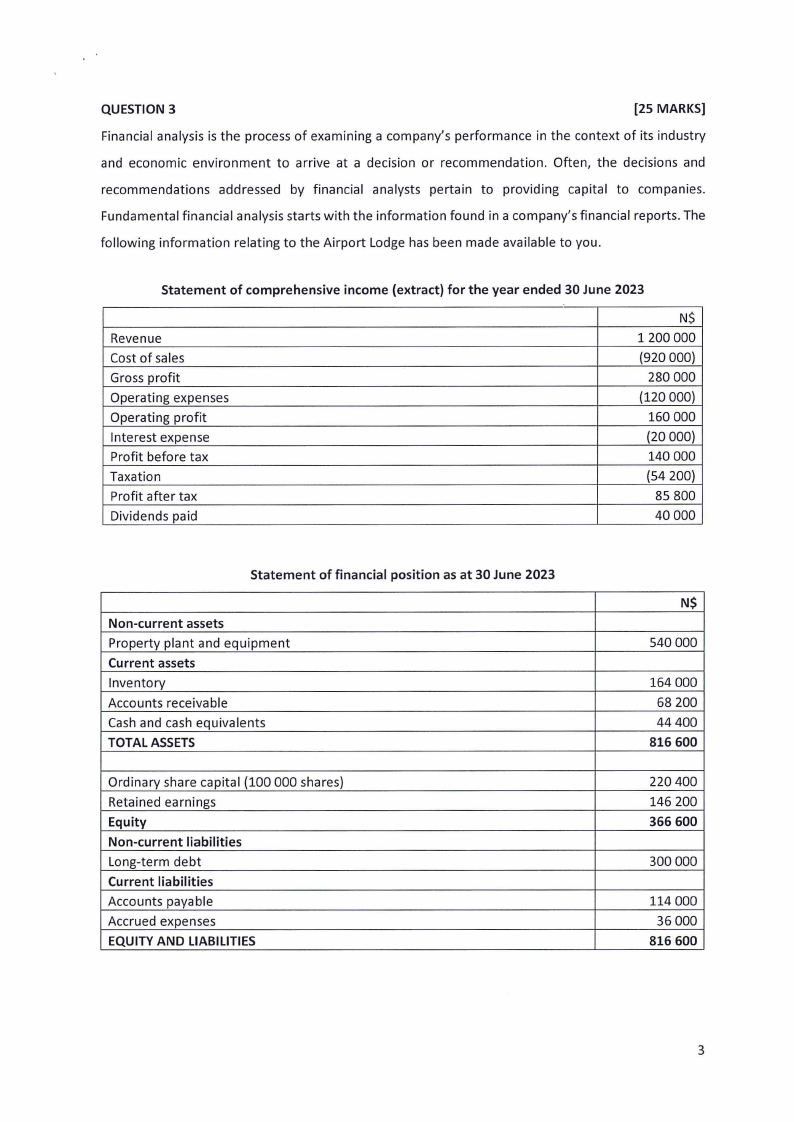

QUESTION 3

[25 MARKS]

Financial analysis is the process of examining a company's performance in the context of its industry

and economic environment to arrive at a decision or recommendation. Often, the decisions and

recommendations addressed by financial analysts pertain to providing capital to companies.

Fundamental financial analysis starts with the information found in a company's financial reports. The

following information relating to the Airport Lodge has been made available to you.

Statement of comprehensive income (extract) for the year ended 30 June 2023

Revenue

Cost of sales

Gross profit

Operating expenses

Operating profit

Interest expense

Profit before tax

Taxation

Profit after tax

Dividends paid

N$

1200 000

(920 000)

280 000

(120 000)

160 000

(20 000)

140 000

(54 200)

85 800

40000

Statement of financial position as at 30 June 2023

Non-current assets

Property plant and equipment

Current assets

Inventory

Accounts receivable

Cash and cash equivalents

TOTAL ASSETS

Ordinary share capital (100 000 shares)

Retained earnings

Equity

Non-current liabilities

Long-term debt

Current liabilities

Accounts payable

Accrued expenses

EQUITY AND LIABILITIES

N$

540 000

164 000

68 200

44400

816 600

220 400

146 200

366 600

300 000

114 000

36 000

816 600

3

|

5 Page 5 |

▲back to top |

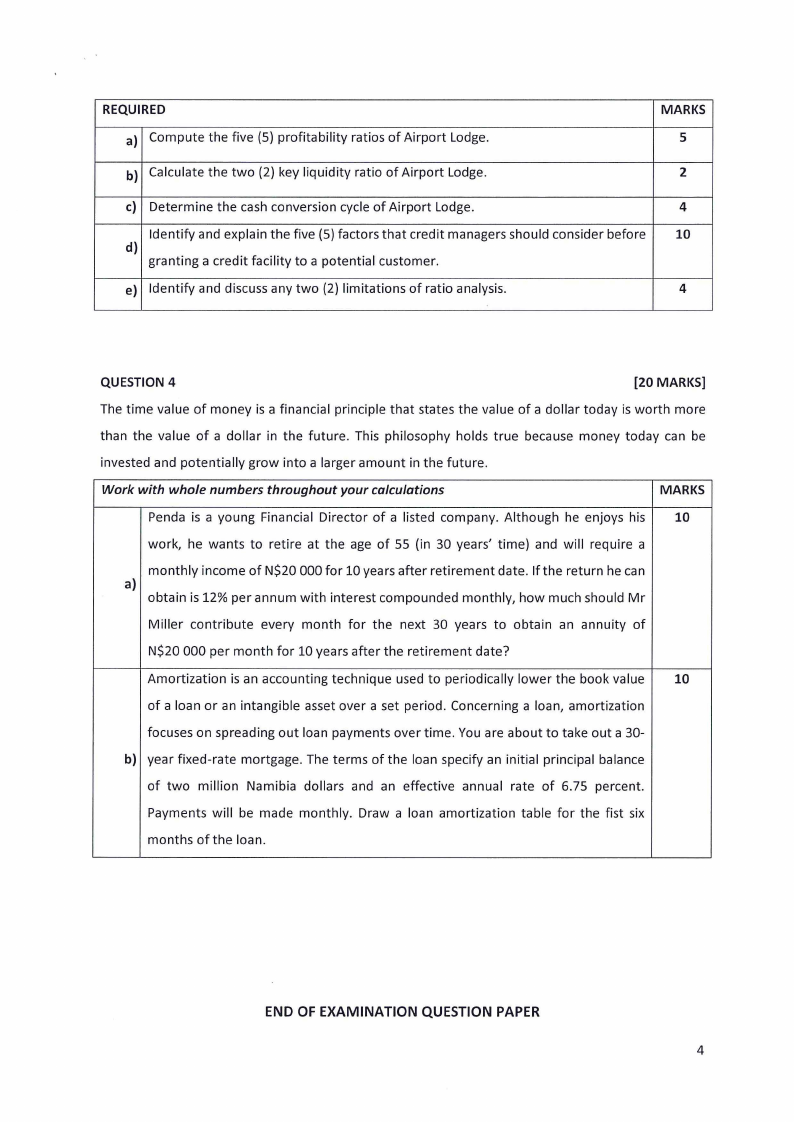

REQUIRED

a) Compute the five (5) profitability ratios of Airport Lodge.

MARKS

5

b) Calculate the two (2) key liquidity ratio of Airport Lodge.

2

c) Determine the cash conversion cycle of Airport Lodge.

4

Identify and explain the five (5) factors that credit managers should consider before

10

d)

granting a credit facility to a potential customer.

e) Identify and discuss any two (2) limitations of ratio analysis.

4

QUESTION 4

[20 MARKS]

The time value of money is a financial principle that states the value of a dollar today is worth more

than the value of a dollar in the future. This philosophy holds true because money today can be

invested and potentially grow into a larger amount in the future.

Work with whole numbers throughout your calculations

MARKS

Penda is a young Financial Director of a listed company. Although he enjoys his 10

work, he wants to retire at the age of 55 (in 30 years' time) and will require a

monthly income of N$20 000 for 10 years after retirement date. If the return he can

a)

obtain is 12% per annum with interest compounded monthly, how much should Mr

Miller contribute every month for the next 30 years to obtain an annuity of

N$20 000 per month for 10 years after the retirement date?

Amortization is an accounting technique used to periodically lower the book value

10

of a loan or an intangible asset over a set period. Concerning a loan, amortization

focuses on spreading out loan payments over time. You are about to take out a 30-

b) year fixed-rate mortgage. The terms of the loan specify an initial principal balance

of two million Namibia dollars and an effective annual rate of 6.75 percent.

Payments will be made monthly. Draw a loan amortization table for the fist six

months of the loan.

END OF EXAMINATION QUESTION PAPER

4