|

MFN710S- MANAGERIAL FINANCE 320- 2ND OPP- NOV 2023 |

|

1 Page 1 |

▲back to top |

nr-lffilBIA un!VERSiTY

OF SCI:En CE An D TECHn OLOGY

FA CUL TY OF COMMERCE, HUMAN SCIENCES, AND EDUCATION

DEPARTl\\flEI\\JT OF ECONOMICS, ACCOUNTING AND FINANCE

QUALIFICATION: BACHELOR OF ACCOUNTING

QUALIFICATION CODE: 07BOAC LEVEL: 7

COURSE CODE: MFN71 OS

COURSE NAME: MANAGERIAL FINANCE 320

SESSION: JANUARY 2024

PAPER: THEORY AND CALCULATIONS

DURATION: 3 HOURS

MAm<S: ·100

SECOND OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINERS

Alina Gustav and Lameck Odada

MODERATOR: Alfred Makosa

INSTRUCTIONS

1. This examination question paper consists of FOUR (4) questions

2. Answer ALL the questions in blue or black inl<only. NO PENCIL.

3. Start each question on a new page, number the answers correctly and clearly.

4. Write clearly, and neatly showing all your workings/assumptions.

5. Work with at least four (4) decimal places in all your calculations and round off only final

answers to two (2) decimal places.

6. Questions relating to this examination may be raised in the initial 30 minutes after the start

of the examination. Thereafter, candidates must use their initiative to deal with any

perceived errors or ambiguities and any assumptions made by the candidate should be

clearly stated.

PERMISSIBLE MATERIALS

" Silent, non-programmable calculators

THIS QUESTION PAPER CONSISTS OF _6_ PAGES (excluding this front page)

|

2 Page 2 |

▲back to top |

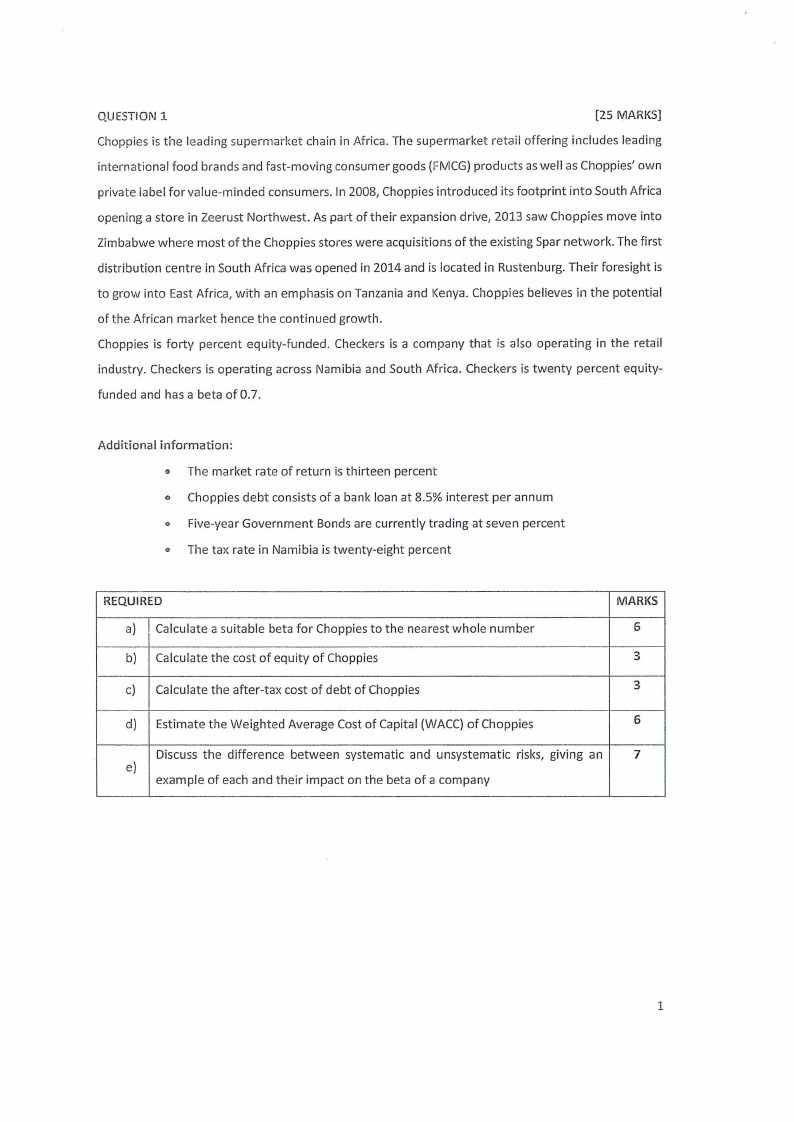

QUESTION 1

[25 MARKS]

Choppies is the leading supermarket chain in Africa. The supermarket retail offering includes leading

international food brands and fast-moving consumer goods (FIVICG)products as well as Choppies' own

private label for value-minded consumers. In 2008, Choppies introduced its footprint into South Africa

opening a store in Zeerust Northwest. As part of their expansion drive, 2013 saw Choppies move into

Zimbabwe where most of the Choppies stores were acquisitions of the existing Spar network. The first

distribution centre in South Africa was opened in 2014 and is located in Rusten burg. Their foresight is

to grow into East Africa, with an emphasis on Tanzania and Kenya. Choppies believes in the potential

of the African market hence the continued growth.

Choppies is forty percent equity-funded. Checkers is a company that is also operating in the retail

industry. Checkers is operating across Namibia and South Africa. Checkers is twenty percent equity-

funded and has a beta of 0.7.

Additional information:

o The market rate of return is thirteen percent

o Choppies debt consists of a bank loan at 8.5% interest per annum

o Five-year Government Bonds are currently trading at seven percent

o The tax rate in Namibia is twenty-eight percent

REQUIRED

a) Calculate a suitable beta for Choppies to the nearest whole number

b) Calculate the cost of equity of Choppies

c) Calculate the after-tax cost of debt of Choppies

MARKS

6

3

3

d) Estimate the Weighted Average Cost of Capital (WACC) of Choppies

6

Discuss the difference between systematic and unsystematic risks, giving an

7

e)

example of each and their impact on the beta of a company

1

|

3 Page 3 |

▲back to top |

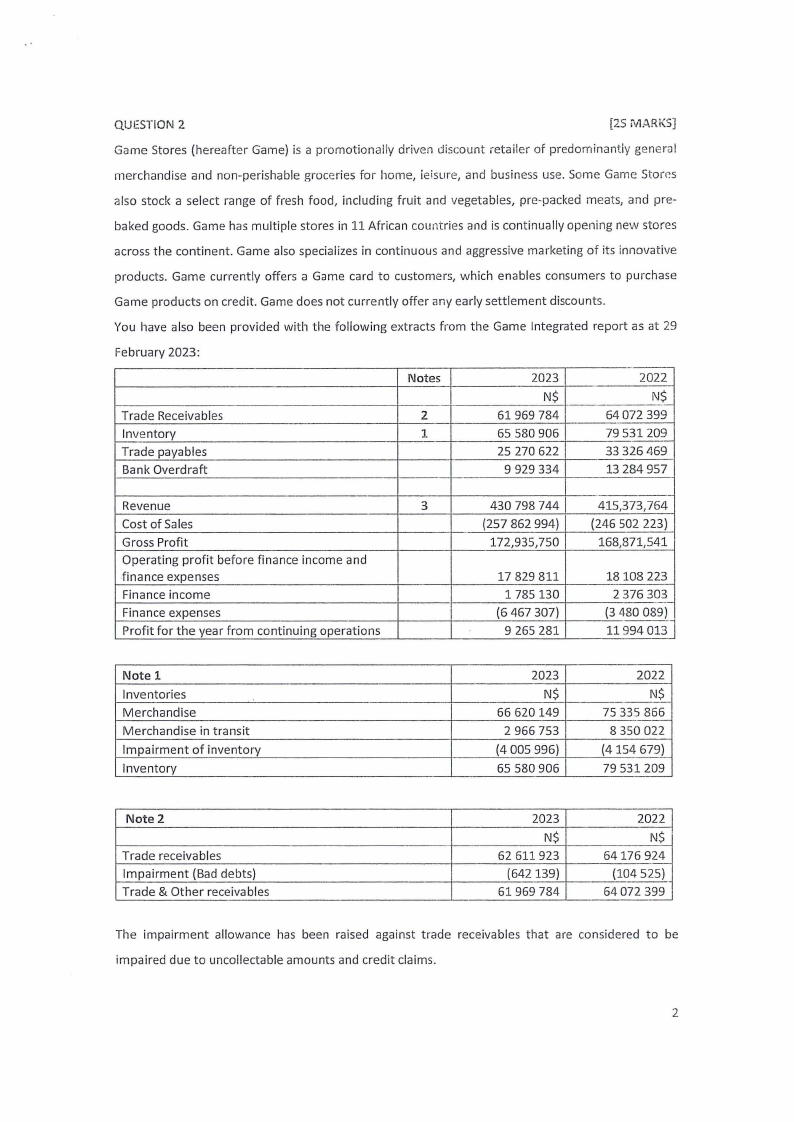

QUESTION 2

[25 M/:\\RKS]

Game Stores (hereafter Game) is a promotionally driven discount retailer of predominantly general

merchandise and non-perishable groceries for home, ieisure, and business use. Some Game Ston~s

also stock a select range of fresh food, including fruit and vegetables, pre-packed meats, and pre-

baked goods. Game has multiple stores in 11 African countries and is continually opening new stores

across the continent. Game also specializes in continuous and aggressive marketing of its innovative

products. Game currently offers a Game card to customers, which enables consumers to purchase

Game products on credit. Game does not currently offer any early settlement discounts.

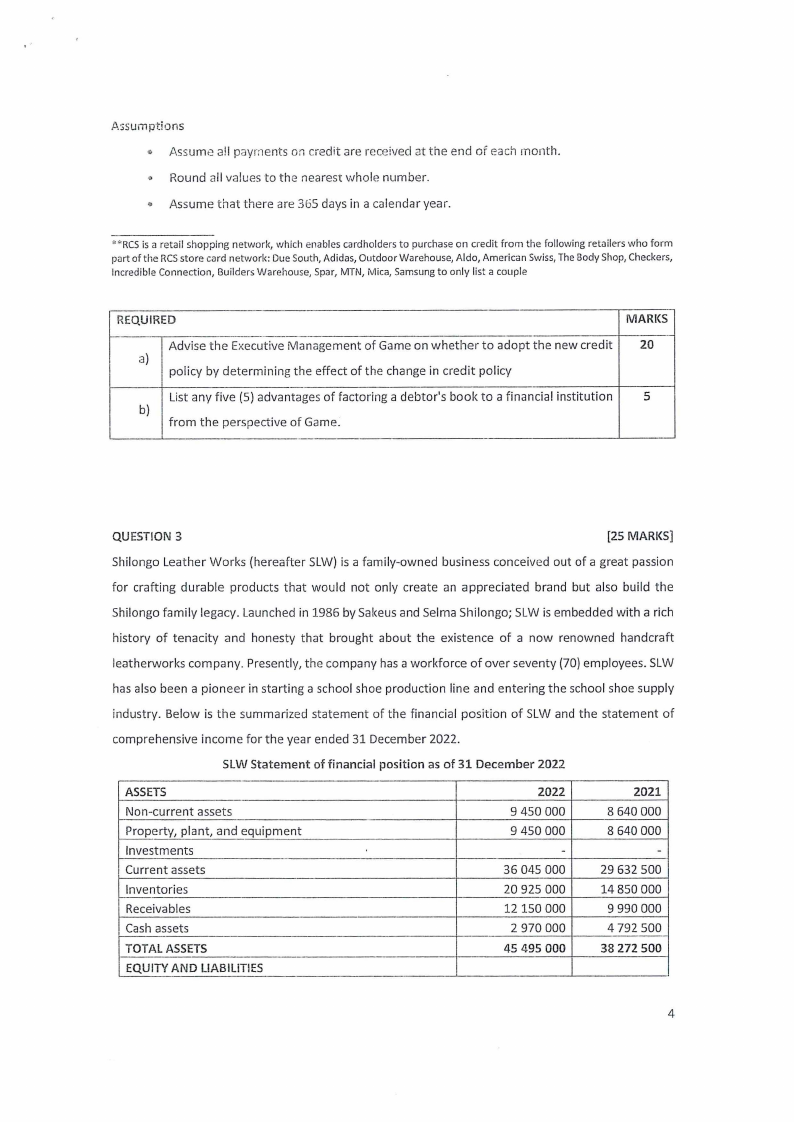

You have also been provided with the following extracts from the Game Integrated report as at 29

February 2023:

Trade Receivables

Inventory

Trade payables

Bank Overdraft

Notes

2

1

2023

N$

61969 784

65 580 906

25 270 622

9 929 334

2022

N$

64072 399

79 531209

33 326 469

13 284 957

Revenue

3

Cost of Sales

Gross Profit

Operating profit before finance income and

.finance expenses

Finance income

Finance expenses

Profit for the year from continuing operations

430 798 744

(257 862 994)

172,935,750

17 829 811

1785130

(6 467 307)

9 265 281

415,373,764

(246 502 223)

168,871,541

18108 223

2 376 303

(3 480 089)

11994 013

Note 1

Inventories

Merchandise

Merchandise in transit

Impairment of inventory

Inventory

2023

N$

66620149

2 966 753

(4 005 996)

65 580 906

2022

N$

75 335 866

8 350 022

(4154 679)

79 531 209

Note 2

Trade receivables

Impairment (Bad debts)

Trade & Other receivables

2023

N$

62 611923

(642 139)

61969 784

2022

N$

64176 924

(104 525)

64072 399

The impairment allowance has been raised against trade receivables that are considered to be

impaired due to uncollectable amounts and credit claims.

2

|

4 Page 4 |

▲back to top |

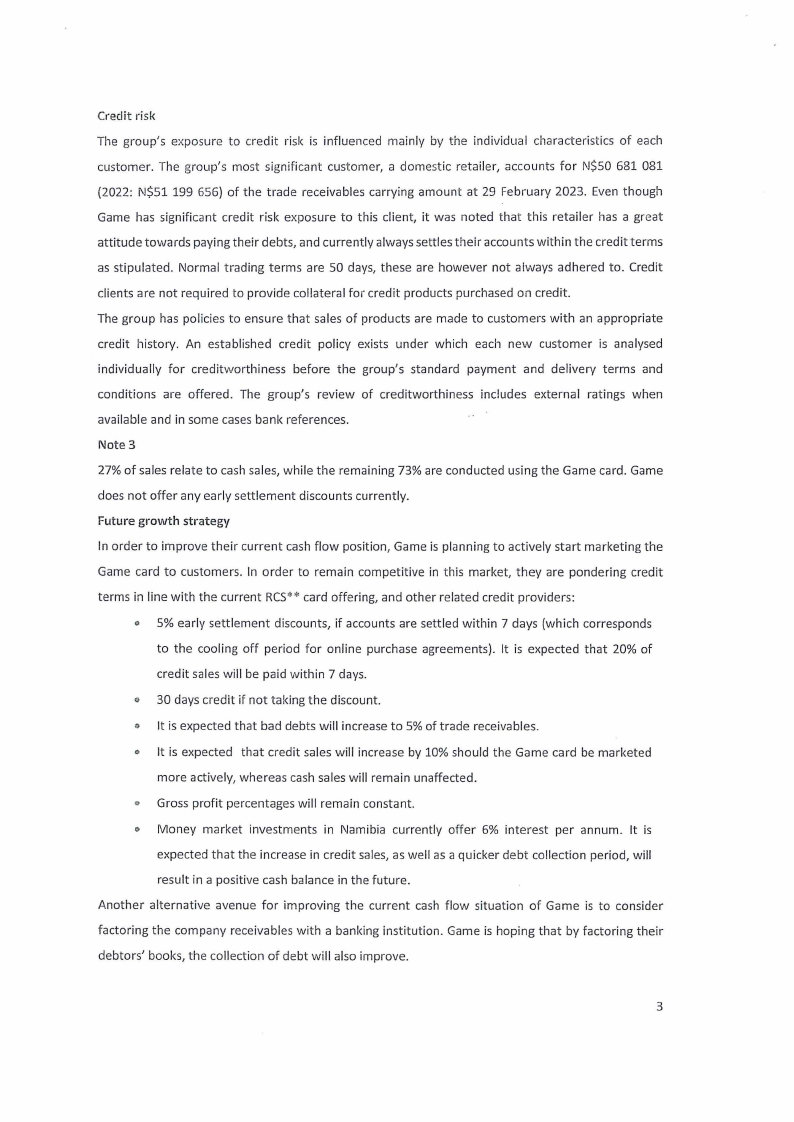

Credit risk

The group's exposure to credit risk is influenced mainly by the individual characteristics of each

customer. The group's most significant customer, a domestic retailer, accounts for N$50 681 081

(2022: i'l$51 199 656) of the trade receivables carrying amount at 29 February 2023. Even though

Game has significant credit risk exposure to this client, it was noted that this retailer has a great

attitude towards paying their debts, and currently always settles their accounts within the credit terms

as stipulated. Normal trading terms are 50 days, these are however not always adhered to. Credit

clients are not required to provide collateral for credit products purchased on credit.

The group has policies to ensure that sales of products are made to customers with an appropriate

credit history. An established credit policy exists under which each new customer is analysed

individually for creditworthiness before the group's standard payment and delivery terms and

conditions are offered. The group's review of creditworthiness includes external ratings when

available and in some cases bank references.

Note 3

27% of sales relate to cash sales, while the remaining 73% are conducted using the Game card. Game

does not offer any early settlement discounts currently.

Future growth strategy

In order to improve their current cash flow position, Game is planning to actively start marketing the

Game card to customers. In order to remain competitive in this market, they are pondering credit

terms in line with the current RCS** card offering, and other related credit providers:

0 5% early settlement discounts, if accounts are settled within 7 days (which corresponds

to the cooling off period for online purchase agreements). It is expected that 20% of

credit sales will be paid Vvithin 7 days.

" 30 days credit if not taking the discount.

0 It is expected that bad debts will increase to 5% of trade receivables.

c It is expected that credit sales will increase by 10% should the Game card be marketed

more actively, whereas cash sales will remain unaffected.

0 Gross profit percentages will remain constant.

0 Money market investments in Namibia currently offer 6% interest per annum. It is

expected that the increase in credit sales, as well as a quicker debt collection period, will

result in a positive cash balance in the future.

Another alternative avenue for improving the current cash flow situation of Game is to consider

factoring the company receivables with a banking institution. Game is hoping that by factoring their

debtors' books, the collection of debt will also improve.

3

|

5 Page 5 |

▲back to top |

Assumptions

., Assume all payrnents on credit are received at the end of each month.

,. Round all values to the nearest whole number.

" Assume that there are 365 days in a calendar year.

uRCS is a retail shopping network, which enables cardholders to purchase on credit from the following retailers who form

part of the RCSstore card network: Due South, Adidas, Outdoor Warehouse, Aldo, American Swiss,The Body Shop, Checkers,

Incredible Connection, Builders Warehouse, Spar, MTN, Mica, Samsung to only list a couple

REQUIRED

MARKS

Advise the Executive Management of Game on whether to adopt the new credit

20

a)

policy by determining the effect of the change in credit policy

List any five (5) advantages of factoring a debtor's book to a financial institution

5

b)

from the perspective of Game.

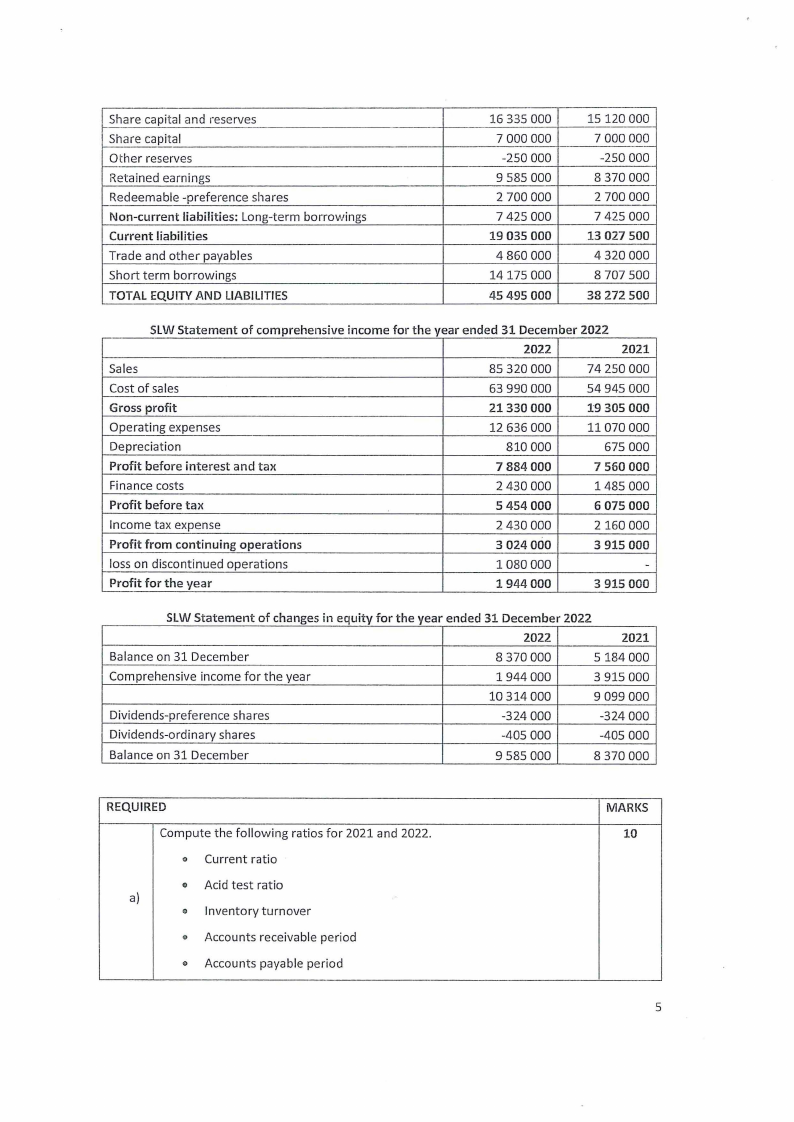

QUESTION 3

[25 MARKS]

Shilongo Leather Works (hereafter SLW) is a family-owned business conceived out of a great passion

for crafting durable products that would not only create an appreciated brand but also build the

Shilongo family legacy. Launched in 1986 by Sakeus and Selma Shilongo; SLW is embedded with a rich

history of tenacity and honesty that brought about the existence of a now renowned handcraft

leatherworks company. Presently, the company has a workforce of over seventy (70) employees. SLW

has also been a pioneer in starting a school shoe production line and entering the school shoe supply

industry. Below is the summarized statement of the financial position of SLW and the statement of

comprehensive income for the year ended 31 December 2022.

SLW Statement of financial position as of 31 December 2022

ASSETS

Non-current assets

Property, plant, and equipment

Investments

Current assets

Inventories

Receivables

Cash assets

TOTAL ASSETS

EQUITY AND LIABILITIES

2022

9 450 000

9 450 000

-

36 045 000

20 925 000

12150 000

2 970 000

45 495 000

2021

8 640 000

8 640 000

-

29 632 500

14 850 000

9 990 000

4 792 500

38 272 500

4

|

6 Page 6 |

▲back to top |

Share capital and reserves

Share capital

Other reserves

Retained earnings

Redeemable -preference shares

Non-current liabilities: Long-term borrowings

Current liabilities

Trade and other payables

Short term borrowings

TOTAL EQUITYAND LIABILITIES

16 335 000

7 000 000

-250 000

9 585 000

2 700 000

7 425 000

19 035 000

4 860 000

14175 000

45 495 000

15 120 000

7 000 000

-250 000

8 370 000

2 700 000

7 425 000

13 027 500

4 320 000

8 707 500

38 272 500

SLW Statement of comprehensive income for the year ended 31 December 2022

2022

2021

Sales

85 320 000

74 250 000

Cost of sales

63 990 000

54 945 000

Gross profit

21330 000

19 305 000

Operating expenses

12 636 000

11070 000

Depreciation

810 000

675 000

Profit before interest and tax

7 884000

7 560 000

Finance costs

2 430 000

1485 000

Profit before tax

S 454000

6 075 000

Income tax expense

2 430 000

2 160 000

Profit from continuing operations

3 024 000

3 915 000

loss on discontinued operations

1080 000

-

Profit for the year

1944 000

3 915 000

SLW Statement of changes in equity for the year ended 31 December 2022

2022

2021

Balance on 31 December

8 370 000

5 184 000

Comprehensive income for the year

1944 000

3 915 000

10 314 000

9 099 000

Dividends-preference shares

-324 000

-324 000

Dividends-ordinary shares

-405 000

-405 000

Balance on 31 December

9 585 000

8 370 000

REQUIRED

Compute the following ratios for 2021 and 2022.

0 Current ratio

0 Acid test ratio

a)

0 Inventory turnover

., Accounts receivable period

" Accounts payable period

MARl<S

10

5

|

7 Page 7 |

▲back to top |

--

Cornpute the relevant ratios for 202.1 and 2022 required for an analysis of

b)

SLW's use of debt to finance its operations

--··

Compute three profitability ratios for 2021 and 2022, two of which will provide

c) information regarding operating effectiveness, and one which will assist in

establishing the effectiveness of the use of the assets.

d) Compute the return on the shareholders' equity in 2021 and 2022

e) Identify any three (3) limitations of ratio analysis

·-

4

6

2

3

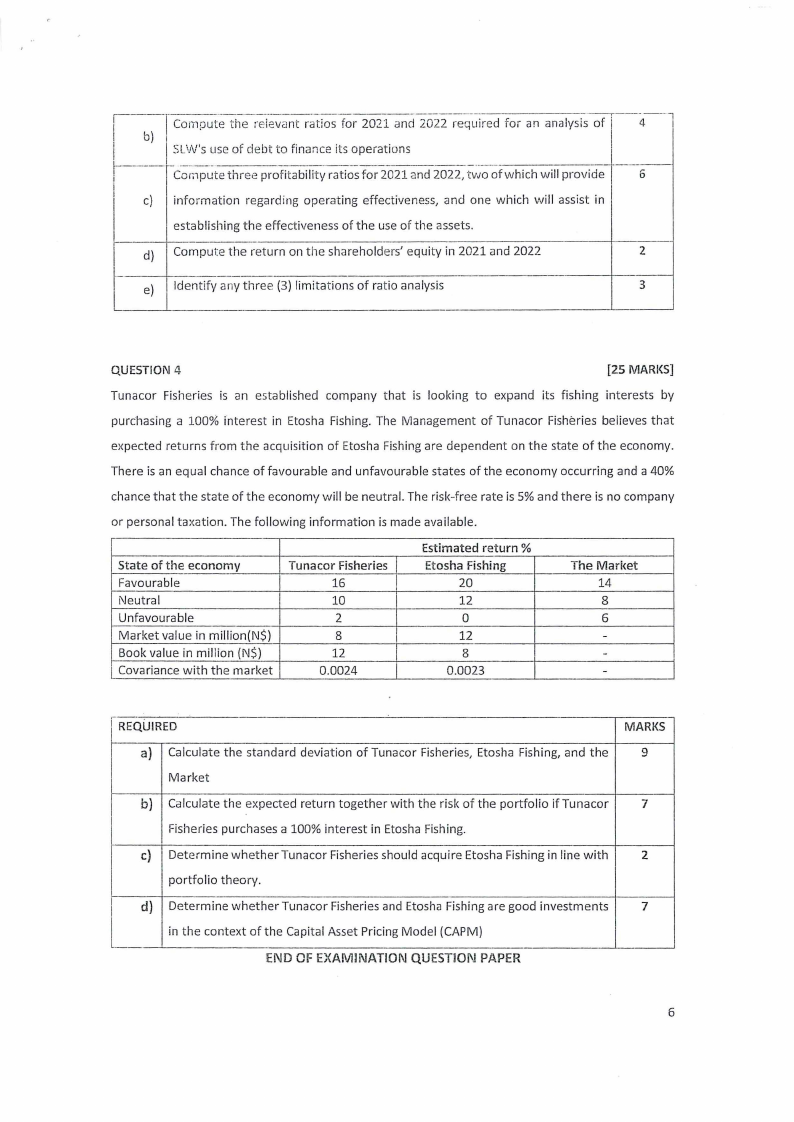

QUESTION 4

[25 iVlARl<S]

Tunacor Fisheries is an established company that is looking to expand its fishing interests by

purchasing a 100% interest in Etosha Fishing. The Management of Tunacor Fisheries believes that

expected returns from the acquisition of Etosha Fishing are dependent on the state of the economy.

There is an equal chance of favourable and unfavourable states of the economy occurring and a 40%

chance that the state of the economy will be neutral. The risk-free rate is 5% and there is no company

or personal taxation. The following information is made available.

State of the economy

Favourable

Neutral

Unfavourable

Market value in million(N$)

Book value in million (N$)

Covariance with the market

Tunacor Fisheries

16

10

2

8

12

0.0024

Estimated return%

Etosha Fishing

20

12

0

12

8

0.0023

The Market

14

8

6

-

-

-

REQUIRED

MARKS

a) Calculate the standard deviation of Tunacor Fisheries, Etosha Fishing, and the

9

Market

b) Calculate the expected return together with the risk of the portfolio if Tunacor

7

Fisheries purchases a 100% interest in Etosha Fishing.

c) Determine whether Tunacor Fisheries should acquire Etosha Fishing in line with

2

portfolio theory.

d) Determine whether Tunacor Fisheries and Etosha Fishing are good investments

7

in the context of the Capital Asset Pricing Model (CAPM)

END OF EXAMINATION QUESTION PAPER

6

|

8 Page 8 |

▲back to top |