|

BAC1200 - BUSINESS ACCOUNTING 1B - 2ND OPP - JAN 2020 |

|

1 Page 1 |

▲back to top |

p

NAMIBIA UNIVERSITY

OF SCIENCE AND TECHNOLOGY

FACULTY OF MANAGEMENT SCIENCES

DEPARTMENT OF ACCOUNTING, ECONOMICS AND FINANCE

QUALIFICATION: VARIOUS PROGRAMES

QUALIFICATION CODE: VARIOUS

COURSE CODE: BAC1200

SESSION: JANUARY/FEBRUARY 2020

DURATION: 3 HOURS

LEVEL: 5

COURSE NAME: BUSINESS ACCOUNTING 1B

PAPER: THEORY AND PRACTICAL

MARKS: 100

EXAMINER(S)

MODERATOR:

SECOND OPPORTUNITY EXAMINATION QUESTION PAPER

Nkala, D., Jatamunua, R., Mushonga, E., Sheehama, K.G.H., Muleka, T., Paulus, Sh.

and Hainghumbi, H.

Odada, L.

INSTRUCTIONS

This exam paper is made up of four (4) questions

2. Answer ALL the questions and in blue or black ink

Start each question on a new page in your answer booklet and show all

your workings

4. Questions relating to this examination may be raised in the initial 30

minutes after the start of the paper. Thereafter, candidates must use

their initiative to deal with any perceived error or ambiguities and any

assumption made by the candidate should be clearly stated.

PERMISSIBLE MATERIALS

1.

2.

3.

Examination paper.

Examination script.

Calculator

THIS QUESTION PAPER CONSISTS OF 5 PAGES (including this front page)

|

2 Page 2 |

▲back to top |

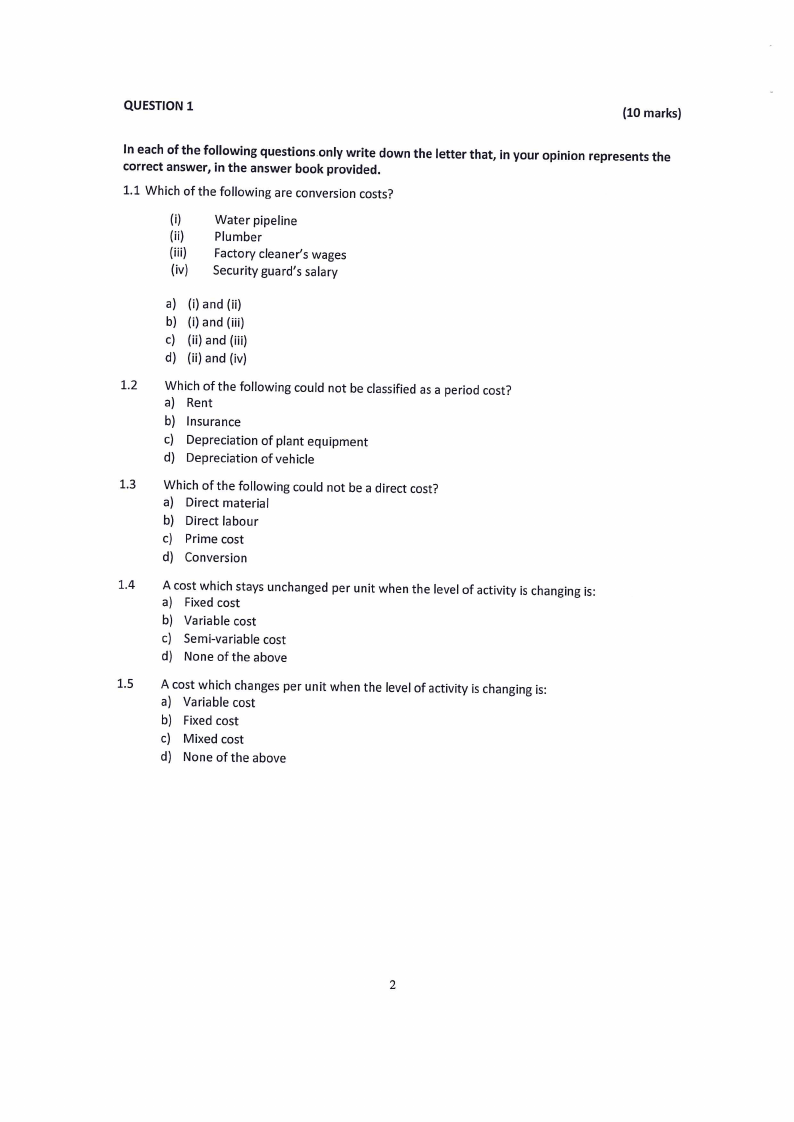

QUESTION 1

(10 marks)

In each of the following questions only write down the letter that, in your opinion represents the

correct answer, in the answer book provided.

1.1 Which of the following are conversion costs?

(i)

Water pipeline

(ii)

Plumber

(iii)

Factory cleaner’s wages

(iv) Security guard’s salary

a) (i) and (ii)

b) (i) and (iii)

c) (ii) and (iii)

d) (ii) and (iv)

1.2

Which of the following could not be classified as a period cost?

a) Rent

b) Insurance

c) Depreciation of plant equipment

d) Depreciation of vehicle

1.3

Which of the following could not be a direct cost?

a) Direct material

b) Direct labour

c) Prime cost

d) Conversion

1.4

A cost which stays unchanged per unit when the level of activity is changing is:

a) Fixed cost

b) Variable cost

c) Semi-variable cost

d) None of the above

1.5

A cost which changes per unit when the level of activity is changing is:

a) Variable cost

b) Fixed cost

c) Mixed cost

d) None of the above

|

3 Page 3 |

▲back to top |

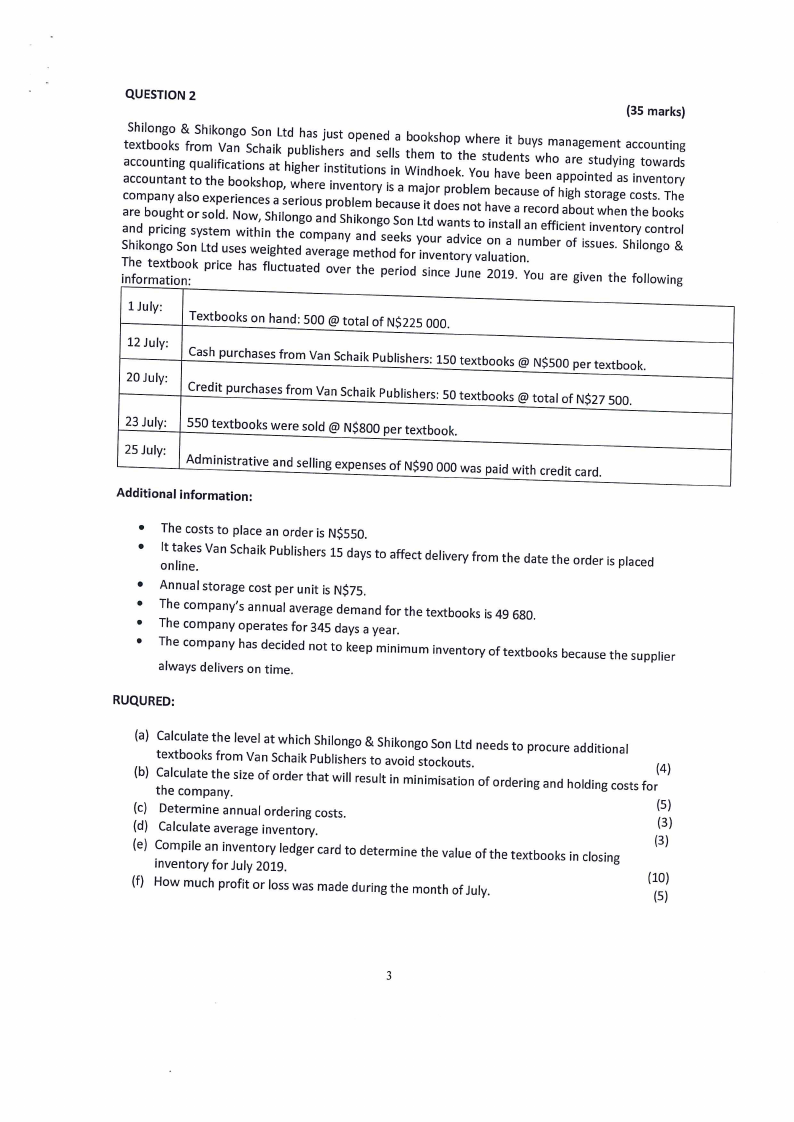

QUESTION 2

(35 marks)

caatScecohxccmitooplbuuaoonnnnottgykiaosnngta&lfsqtorouSoahmeltixihkpefoVienacrbngaitooeionokScncSseshohsnaoipakta,Ltshdepiwrughibhhoelaeurisrssehjeipurnisrsstnotvbietolanupenttmedoinronyebssdeeliclsisanaua sWtbmeihoaneojdmiokthrsdohoetoeopkpsr.otbhnweloYhteoemuSrhteauhbvdaeeevictneataubssurbyeeescweonhorofmd aahnpaiagbparhooeguietnsmSttteoewurdnhdatyegineansgactciohcnsetotvosue.wbnnaottroioTkdhnrsseyg

information:

1 July:

Textbooks on hand: 500 @ total of N$225 000.

12 July:

20 July:

Cash purchases from Van Schaik Publishers: 150 textbooks @ N$500 per textbook.

Credit purchases from Van Schaik Publishers: 50 textbooks @ total of NS27 500.

23 July: | 550 textbooks were sold @ NS800 per textbook.

25 July:

Administrative and selling expenses of N$90 000 was paid with credit card.

Additional information:

¢ The costs to place an order is NS550.

e

It takes

online.

Van

Schaik

Publishers

15

days

to

affect

delivery

from

the

date

the

order

is placed

° Annual storage cost per unit is N$75.

¢

¢

The

The

company’s annual average

company operates for 345

demand for the

days a year.

textbooks

is 49

680.

¢ The company has decided not to keep minimum inventory of textbooks because the supplier

always delivers on time.

RUQURED:

(a)

(b)

Calculate the level at which Shilongo & Shikongo Son Ltd

textbooks from Van Schaik Publishers to avoid stockouts.

needs

to

procure

additional

Calculate the size

the company.

of order

that

will

result

in minimisation

of ordering

and

holding

costs

(4)

for

(c) Determine annual ordering costs.

(5)

(d) Calculate average inventory.

(3)

(e)

Compile an inventory ledger card to determine

inventory for July 2019.

the value of the textbooks

in closing

(3)

(f) How much profit or loss was made during the month of July.

(10)

(5)

|

4 Page 4 |

▲back to top |

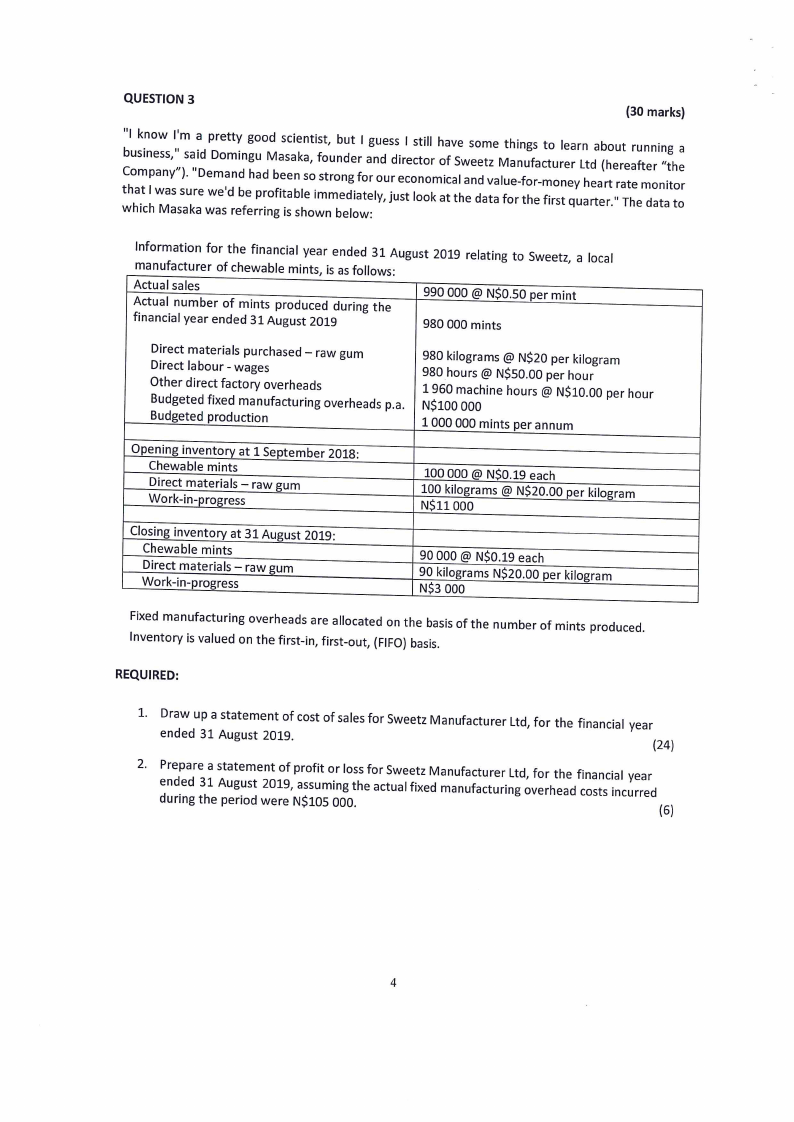

QUESTION 3

(30 marks)

twCb"|hhuoaismtkciphnnae|onswwysMa,”as")sI.a'smksuaar"ieadDwewpaDmerso'eatdmntirdyenbfgeeguhroarpodirdnoMgfabisetseaiacsnkbieslaneh,stooiswitfnsm,otmureonbdbndeuigetlarotwfe|o:lragynu,odeusrsjduisertc|eoclsnttoioolorlmkichoaatfavletShweaensedodtamztevaalMuftaoehnriu-ntffghsaoecrt-ftmuiororsnetlereyqauranLrhtdetaearrb(t.oh"uetrraeTtahefertumendornanitina“tgtohtreoa

Information for the financial year ended 31 August

manufacturer of chewable mints, is as follows:

2019

relating

to

Sweetz,

a local

Actual sales

Actual number of mints produced during the

financial year ended 31 August 2019

990 000 @ NSO.50 per mint

980 000 mints

Direct materials purchased — raw gum

Direct labour - wages

Other direct factory overheads

Budgeted fixed manufacturing overheads p.a.

Budgeted production

980 kilograms @ N$20 per kilogram

980 hours @ NS50.00 per hour

1960 machine hours @ N$10.00 per hour

NS100 000

1000 000 mints per annum

Opening inventory at 1 September 2018:

Chewable mints

Direct materials — raw gum

Work-in-progress

100 000 @ NS0.19 each

100 kilograms @ NS$20.00 per kilogram

N$11 000

Closing inventory at 31 August 2019:

Chewable mints

Direct materials — raw gum

Work-in-progress

90 000 @ NSO.19 each

90 kilograms NS20.00 per kilogram

NS3 000

Fixed manufacturing overheads are allocated on the basis of the number of mints produced.

Inventory is valued on the first-in, first-out, (FIFO) basis.

REQUIRED:

1.

Draw up a statement of cost

ended 31 August 2019.

of sales

for

Sweetz

Manufacturer

Ltd,

for

the

financial

year

(24)

2.

Prepare a statement of

ended 31 August 2019,

during the period were

profit or loss for Sweetz Manufacturer Ltd, for the

assuming the actual fixed manufacturing overhead

N$105 000.

financial year

costs incurred

(6)

|

5 Page 5 |

▲back to top |

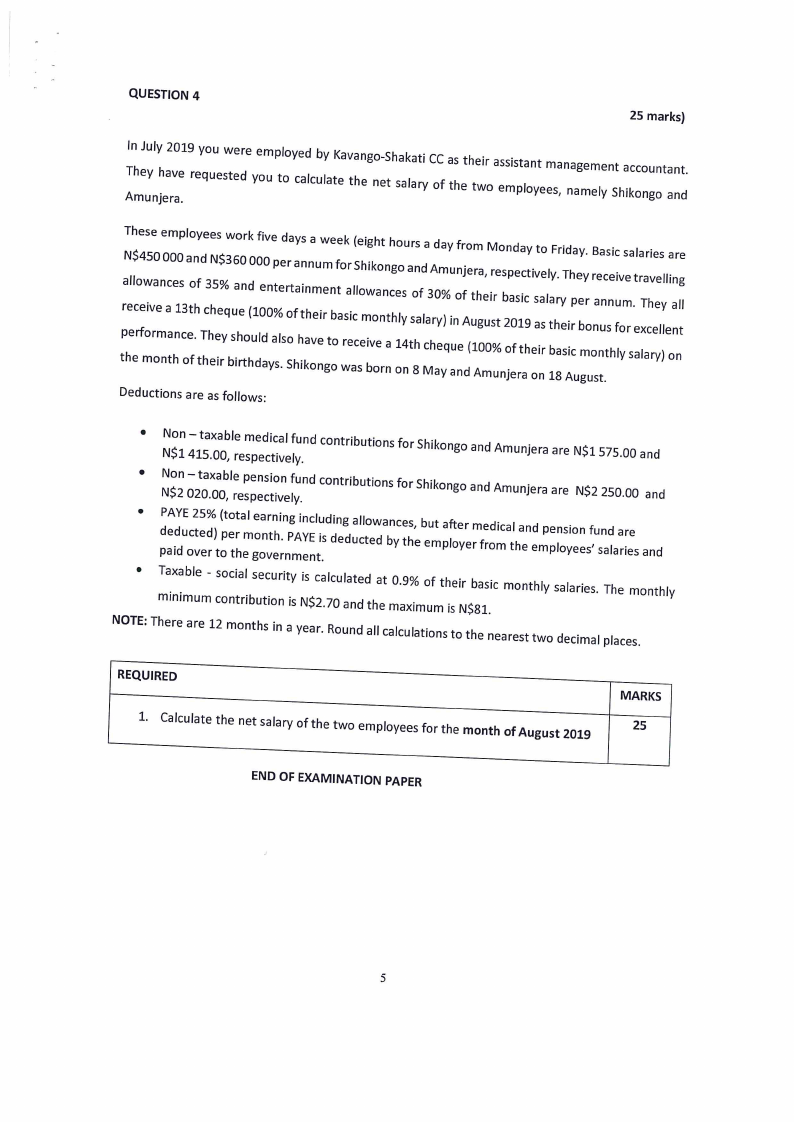

QUESTION 4

25 marks)

In July 2019 you were employed by Kavango-Shakati CC as their assistant Management accountant.

tpraheelecrlefoimowvoraenmntcaahensc1e3o.tfohftThc3hehie5rey%qbuiserahtnodhu(dl1ade0y0ns%.talesroSotfhaihitakhnvoemeinergnottobaswriaaecslclemiobvowoenartnnhca elsoy1n4thso8aflMac3rahy0ye)%quaiennofdAu(tg1Ahu0emis0urt%njbe2oaf0rs1ait9cheoiSanrsalat1brh8ayesiiArcupgebmruosontnau.tnshnluyfmor.SaelxTachreyel)ylenoantll

Deductions are as follows:

¢

Non

N$1

—taxable medical fund

415.00, respectively.

contributions

for Shikongo

and

Amunjera

are

N$1

575.00

and

¢

Non

N$2

-taxable pension fund

020.00, respectively.

contributions

for

Shikongo

and

Amunjera

are

N$2

250.00

and

°

PAYE 25%

deducted)

Paid over

(total earning including allowances,

per month. PAYE is deducted by the

to the government.

but after medical and pension fund are

employer from the employees’ salaries

and

e

Taxable - social security is calculated at 0.9% of their basic

minimum contribution is NS2.70 and the maximum is NS81,

monthly

salaries.

The

monthly

NOTE: There are 12 months in a year. Round all calculations to the nearest two decimal places.

REQUIRED

1. Calculate the net salary of the two employees for the month of August 2019

END OF EXAMINATION PAPER

|

6 Page 6 |

▲back to top |