|

IFN712S-INTERNATIONAL FINANCE-1ST OPP- NOV 2024 |

|

1 Page 1 |

▲back to top |

nAmlBIA unlVERSITY

OF SCIEn CE TECHn OLOGY

FACULTY OF COMMERCE, HUMAN SCIENCESAND EDUCATION

DEPARTMENT OF ECONOMICS, ACCOUNTING AND FINANCE

QUALIFICATION: BACHELOR OF ECONOMICS

QUALIFICATION CODE: O7BEC0

LEVEL: 7

COURSE CODE: IFN712S

COURSE NAME: INTERNATIONAL FINANCE

SESSION: NOVEMBER 2024

DURATION: 3 HOURS

PAPER: THEORY

MARKS: 100

FIRST OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINER(S) Ms K. Kavezeri

MODERATOR: Mr I. Nashivela

INSTRUCTIONS

1. Answer ALL the questions.

2. Write clearly and neatly.

3. Number the answers clearly.

PERMISSIBLE MATERIALS

1. Pens/pencils/erasers

2. Calculator

3. Ruler

THIS QUESTION PAPER CONSISTS OF 8 PAGES {Including this front page)

|

2 Page 2 |

▲back to top |

QUESTION 1

(25 Marks]

Select the letter that best represents your choice.

1. GDP is supposed to measure

A) the volume of production within a country's borders.

B) the volume of services generated within a country's borders.

C) the volume of production of a country's output.

D) GNP plus depreciation.

E) net unilateral transfers from foreigners.

2. In open economies

A) saving and investment are necessarily equal.

B) as in a closed economy, saving and investment are not necessarily equal.

C) saving and investment are not necessarily equal as they are in a closed economy.

D) saving and investment are necessarily equal contrary to the case of a closed economy.

E) investment always refers to the domestic stock market.

3. Government purchases are defined as

A) only goods purchased by federal, state, or local governments.

B) all goods and services purchased by the federal government.

C) all goods and services purchased by the federal or state government.

D) all goods and services purchased by the federal, state, or local government.

E) goods and services purchased from the government.

4. The CA is equal to

A) Y- (C- I+ G).

B) Y + (C + I + G).

C) Y - (C+ I + G).

D) Y - (C + I - G).

E) Y + (C - I - G).

5. For open economies,

A) S = I.

B) S =I+ CA.

C) S = I - CA.

D) S >I+ CA.

E) S <I+ CA.

6. How many British pounds would it cost to buy a pair of American designer jeans

costing $45 if the exchange rate is 1.50 dollars per British pound?

A) 10 British pounds

B) 20 British pounds

C) 30 British pounds

D) 35 British pounds

E) 25 British pounds

2

|

3 Page 3 |

▲back to top |

7. An appreciation of a country's currency

A) decreases the relative price of its exports and lowers the relative price of its imports.

B) raises the relative price of its exports and raises the relative price of its imports.

C) lowers the relative price of its exports and raises the relative price of its imports.

D) raises the relative price of its exports and lowers the relative price of its imports.

E) raises the relative price of its exports and does not affect the relative price of its imports.

8. A foreign exchange swap

A) is a spot sale of a currency.

B) is a forward repurchase of the currency.

C) is a spot sale of a currency combined with a forward repurchase of the currency.

D) is a spot sale of a currency combined with a forward sale of the currency.

E) make up a negligible proportion of all foreign exchange trading.

9. Which of the following is NOT an example of a financial derivative?

A) forwards

B) bonds

C) swaps

D) futures

E) options

10. Which of the following is NOT a major actor in the foreign exchange market?

A) corporations

B) central banks

C) commercial banks

D) non-bank financial institutions

E) tourists

11. The action of arbitrage is

A) the process of buying a currency cheap and selling it dear.

B) the process of buying a currency dear and selling it cheap.

C) the process of buying and selling currency at the same price.

D) the process of selling currency at different prices in different markets.

E)the process of buying a currency and holding onto it to take it off the market.

12. The exchange rate between currencies depends on

A) the interest rate that can be earned on deposits of those currencies.

B) the interest rate that can be earned on deposits of those currencies and the expected future

exchange rate.

C) the expected future exchange rate.

D) national output.

E)the interest rate that can be earned on deposits of those countries and the national output.

3

|

4 Page 4 |

▲back to top |

13. The aggregate money demand depends on

A) the interest rate.

B) the price level.

C) real national income.

D) the interest rate, price level, and real national income.

E)the price level and the liquidity of the asset.

14. Which one of the following statements is the MOST accurate?

A) A decrease in the money supply lowers the interest rate while an increase in the money supply

raises the interest rate, given the price level and output.

B) An increase in the money supply lowers the interest rate while a fall in the money supply

raises the interest rate, given the price level.

C) An increase in the money supply lowers the interest rate while a fall in the money supply

raises the interest rate, given the output level.

D) An increase in the money supply lowers the interest rate while a fall in the money supply

raises the interest rate, given the price level and output.

E)An increase in the money supply does not usually affect the interest rate.

15. The money supply schedule is

A) horizontal because MS is set by the central bank while P is taken as given.

B) horizontal because M_Sis set by the central bank.

C)vertical because M_Sis set by the households and firms while Pis taken as given.

D) vertical because MS and P are set by the central bank.

E) vertical because MS is set by the central bank while P is taken as given.

16. A reduction in a country's money supply causes

A) its currency to depreciate in the foreign exchange market.

B) its currency to appreciate in the foreign exchange market.

C) does not affect its currency in the foreign market.

D) does affect its currency in the foreign market in an ambiguous manor.

E) affects other countries currency in the foreign market.

17. Under Purchasing Power Parity

A) E$/E = PUS/PE.

B) E$/E = PE/PES.

C) E$/E =PUS+ PE.

D) E$/E = PUS - PE.

E) E$/P = PUS/PE.

4

|

5 Page 5 |

▲back to top |

18. Under the monetary approach to the exchange rate

A) a reduction in the money supply will cause immediate currency depreciation.

B) a rise in the money supply will cause currency depreciation.

C) a rise in the money supply will cause immediate currency appreciation.

D) a rise in the money supply will cause depreciation.

E) a rise in the money supply will cause immediate currency depreciation.

19. When all variables start out at their long-run equilibrium levels, the most important

determinant of long-run swings in nominal exchange rates is

A) a shift in relative money supply levels.

B) a shift in relative money supply growth rates.

C) a change in relative output demand.

D) a change in relative output supply.

E) a change in relative inflation rates.

20. How does an increase in the real exchange rate affect exports and imports?

A) Exports increase; imports decrease.

B) Exports decrease; imports increase.

C) Exports increase; imports change ambiguously.

D) Exports change ambiguously; imports decrease.

E) Exports increase; imports are constant.

21. The current account balance is

A) the supply of a country's exports less the country's own demand for imports.

B) the demand for a country's exports plus the country's own demand for imports.

C) the country's own demand for imports less the demand for a country's exports.

D) the demand for a country's exports less the country's own demand for imports.

E)the country's federal reserves minus the national debt.

22. The domestic currency price of a representative domestic expenditure basket is

A) P, the domestic price level.

B) E, the nominal exchange rate.

C) P times E, the domestic price level times the domestic price level.

D) P"",the foreign price level.

E) p* times E, the foreign price level times the nominal exchange rate.

23. The real exchange rate, q, is defined as

A) the price of the foreign basket in terms of the domestic one.

B) the price of the domestic basket in terms of the foreign one.

C) the price of the foreign basket.

D) the price of the domestic basket.

E)the nominal exchange rate in terms of the domestic basket.

5

|

6 Page 6 |

▲back to top |

24. What is the best way to describe aggregate demand?

A) quantity required to satisfy equilibrium

B) exports decrease; imports increase

C)amount of a country's goods and services demanded by household and firms throughout the

world

D) individual's demand

E) domestic demand of foreign imports.

25. Central banks often intervene in currency markets. This activity is called

A) managed floating.

B) fixing exchange rates.

C) currency warfare.

D) super-pegging.

E)flexible floating.

6

|

7 Page 7 |

▲back to top |

QUESTION 2

[25 Marks]

1. Suppose that today's exchange rate is $2.10 per euro, next year's expected exchange

rate is $2.226 per euro, the dollar interest rate is 10%, and the euro interest rate is 5%?

(a)

What is the expected dollar rate of return on euro deposits.

(3)

(b) Does interest parity hold in this case? Motivate your answer.

(2)

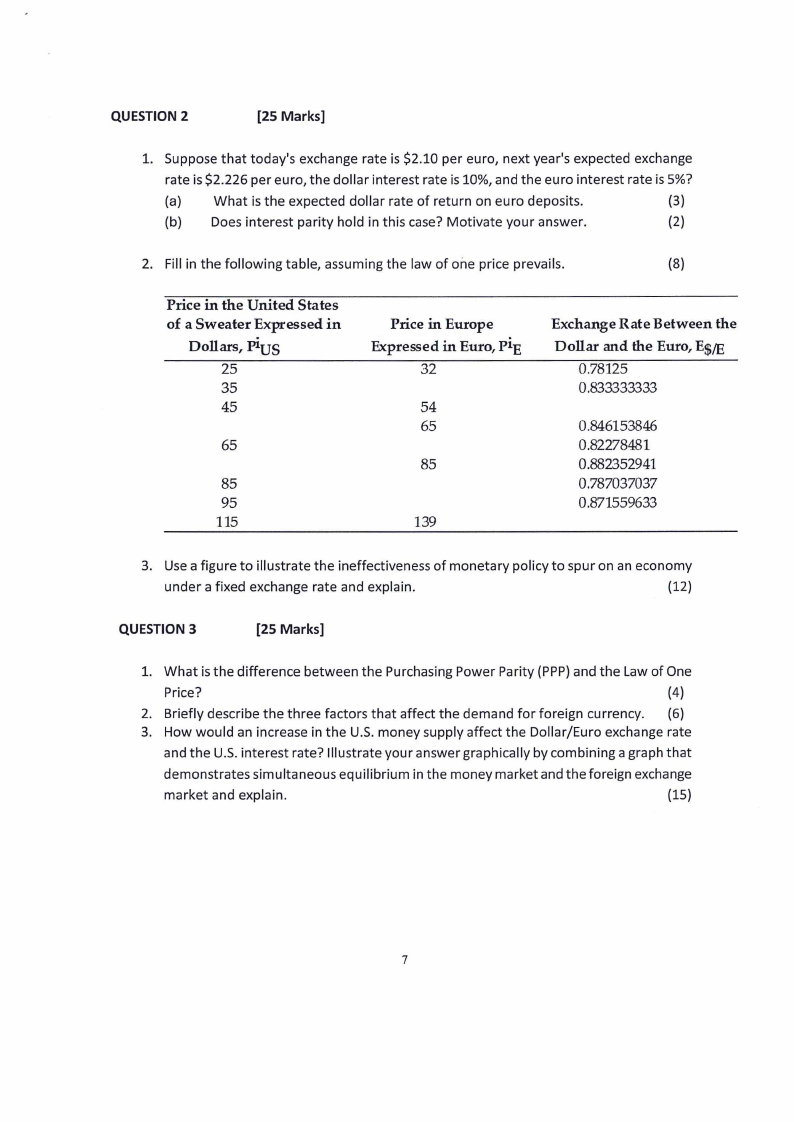

2. Fill in the following table, assuming the law of one price prevails.

(8)

Price in the United States

of a Sweater Expressed in

Dollars, piUS

25

35

45

65

85

95

115

Price in Europe

Expressed in Euro, piE

32

54

65

85

139

Exchange Rate Between the

Dollar and the Euro, E$fE

0.78125

0 .833333333

0.846153846

0.82278481

0.882352941

0.787037037

0.871559633

3. Use a figure to illustrate the ineffectiveness of monetary policy to spur on an economy

under a fixed exchange rate and explain.

(12)

QUESTION 3

[25 Marks]

1. What is the difference between the Purchasing Power Parity (PPP) and the Law of One

Price?

(4)

2. Briefly describe the three factors that affect the demand for foreign currency. (6)

3. How would an increase in the U.S. money supply affect the Dollar/Euro exchange rate

and the U.S. interest rate? Illustrate your answer graphically by combining a graph that

demonstrates simultaneous equilibrium in the money market and the foreign exchange

market and explain.

(15)

7

|

8 Page 8 |

▲back to top |

QUESTION 4

[25 Marks]

1. Using 4 different figures, plot the time paths showing the effects of a permanent

increase in the United States money supply on the following economic variables:

The U.S. Money supply

The dollar interest rate.

The U.S. price level

The dollar/euro exchange rate)

(10)

2. Discussthe shortcomings of the PPP and the law of one price in explaining actual data on

exchange rates and national price levels.

(15)

TOTAL = 100 MARKS

8