|

BAI620S - BUSINESS ACCOUNTING FOR INFORMATICS - 2ND OPP SUPL |

|

1 Page 1 |

▲back to top |

n Am IBIA u n IVERsITY

OFSCIEnCEAno TECHnOLOGY

FACULTY OF COMMERCE, HUMAN SCIENCES AND EDUCATION

DEPARTMENT OF ACCOUNTING, ECONOMICS AND FINANCE

QUALIFICATION : Bachelor of Informatics

QUALIFICATION CODE: 07 BAIF

COURSE CODE: BAl620S

LEVEL: 5

COURSE NAME: BUSINESS ACCOUNTING FOR

INFORMATICS

SESSION: January 2023

PAPER: THEORY AND CALCULATIONS

DURATION: 3 HOURS

MARKS: 100 marks

SECOND OPPORTUNITY EXAMINATION - QUESTION PAPER

EXAMINER(S) Ms M E Cloete

MODERATOR Ms Y Andrew

INSTRUCTIONS

1. This paper consists of FIE pages. If your paper does not contain all the pages, please

put up your hand so that a replacement paper can be handed to you.

2. Answer ALL questions in blue or black ink only.

3. Write clearly and neatly.

4. Number each answer clearly.

5. No programmable calculators are allowed.

6. Show all workings clearly.

7. Round numbers to the nearest whole number.

8. Questions relating to the paper may be raised in the initial 30 minutes after the start of

the paper. Thereafter, candidates must use their initiative to deal with any perceived

error or ambiguities & any assumption made by the candidate should be clearly stated.

9. Delete all open spaces on your answer sheets with pen. Pages on your answer sheet

that contain pencil or tippex will be marked as such and will not be eligible for a remark.

10. Read questions carefully, if you need to provide explanations, you should always use

full sentences, refrain from simply naming facts.

11. Any resemblance to any people, places, organisations or anything are purely

coincidental.

|

2 Page 2 |

▲back to top |

QUESTION 1

(22 MARKS)

a) Explain the difference between external auditors and internal auditors.

(4 marks)

b) List and explain the differences between Management Accounting and Financial

Accounting. Provide your answer in a comparative format.

(12 Marks)

c) Explain the following accounting concepts:

• Periodicity concept

• Materiality concept

• Going concern concept

(3 marks)

d) Define the various source documents below:

• Quotation

• Purchase order

• Credit note

(3 marks)

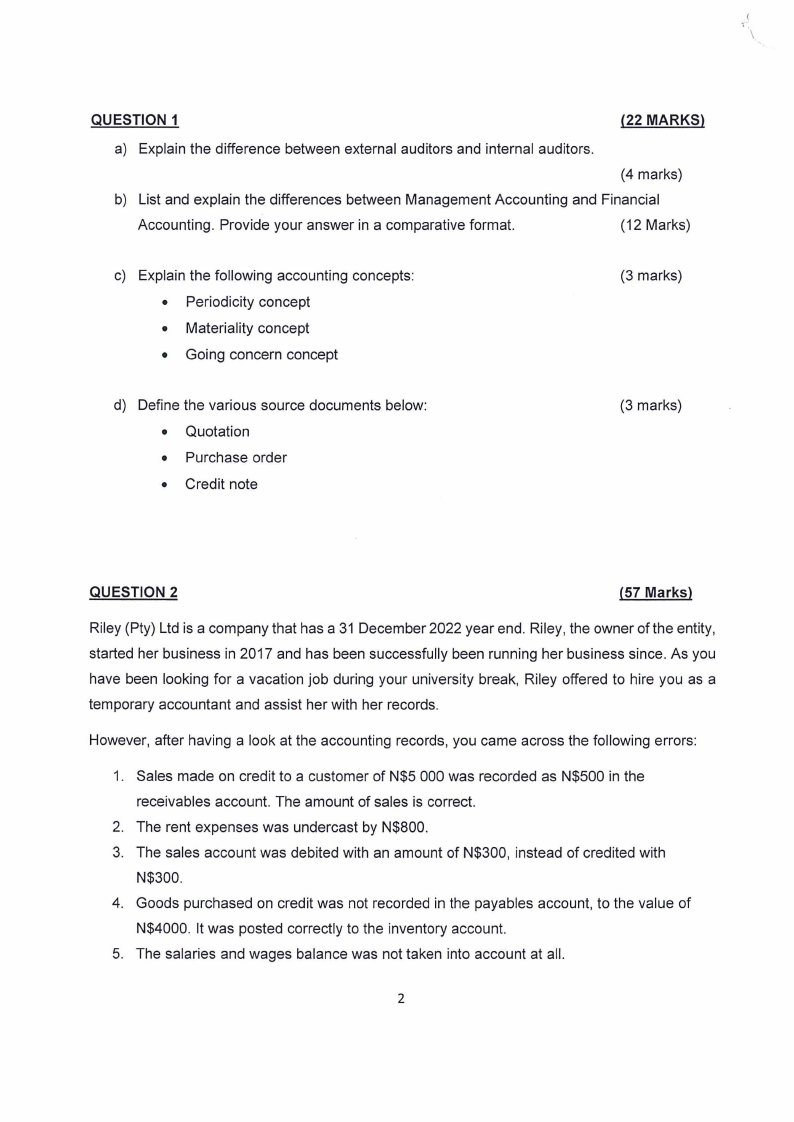

QUESTION 2

(57 Marks)

Riley (Pty) Ltd is a company that has a 31 December 2022 year end. Riley, the owner of the entity,

started her business in 2017 and has been successfully been running her business since. As you

have been looking for a vacation job during your university break, Riley offered to hire you as a

temporary accountant and assist her with her records.

However, after having a look at the accounting records, you came across the following errors:

1. Sales made on credit to a customer of N$5 000 was recorded as N$500 in the

receivables account. The amount of sales is correct.

2. The rent expenses was undercast by N$800.

3. The sales account was debited with an amount of N$300, instead of credited with

N$300.

4. Goods purchased on credit was not recorded in the payables account, to the value of

N$4000. It was posted correctly to the inventory account.

5. The salaries and wages balance was not taken into account at all.

2

|

3 Page 3 |

▲back to top |

6. There are 365 days in the year for the company.

7. All sales and purchases made are on credit.

8. Ignore VAT for the entire question.

Land and Buildings

Inventory

Rent

Interest received

Trade payables

Trade receivables

Sales

Cost of sales

Electricity

Capital

Loan

Vehicles

Drawings

Bank

Ni

100 000

17 600

3 500

200

11 000

9 000

53 000

22 000

15 500

24 500

95 000

28 000

13 000

25 000

a) Prepare the trial balance for the entity as at 31 December 2022, after factoring in the

various adjustments.

(20 marks)

b) Prepare the statement of profit and loss for the entity for the period ended 31 December

2022.

(9 marks)

c) Prepare the statement of financial position for the entity as at 31 December 2022.

(18 marks)

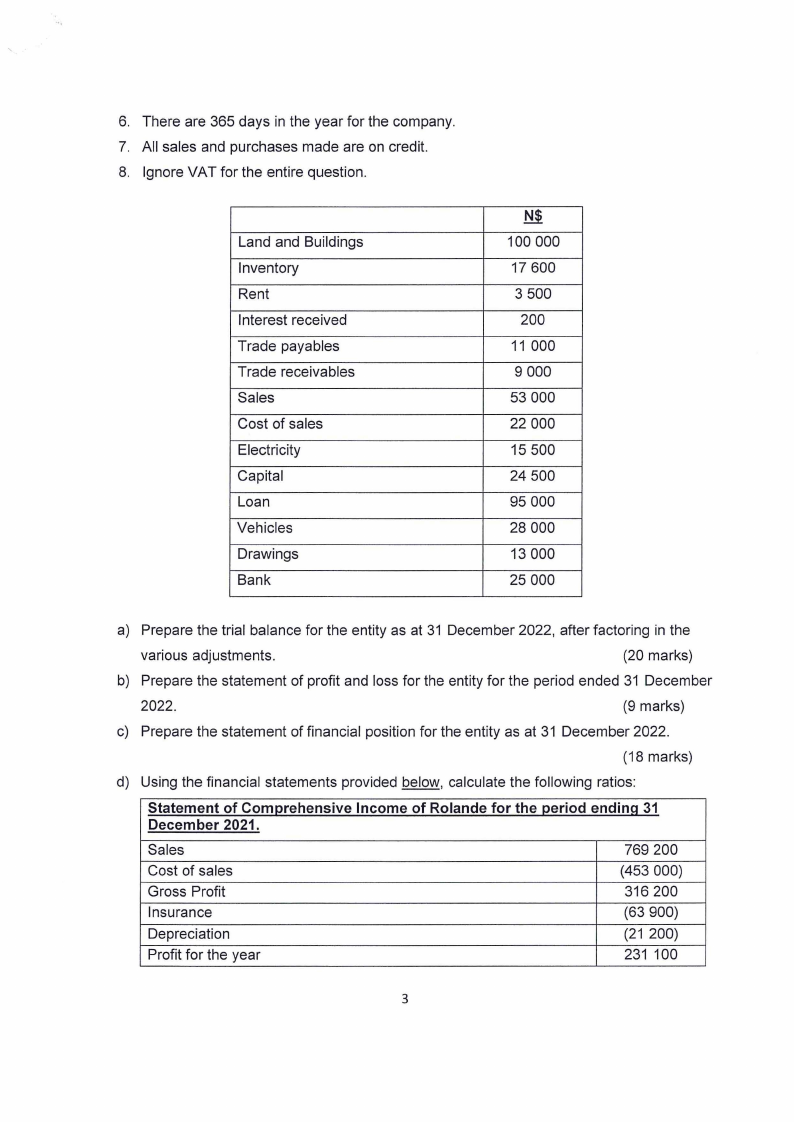

d) Using the financial statements provided below, calculate the following ratios:

Statement of Com~rehensive Income of Rolande for the ~eriod ending 31

December 2021.

Sales

Cost of sales

Gross Profit

Insurance

Depreciation

Profit for the year

769 200

(453 000)

316 200

(63 900)

(21 200)

231 100

3

|

4 Page 4 |

▲back to top |

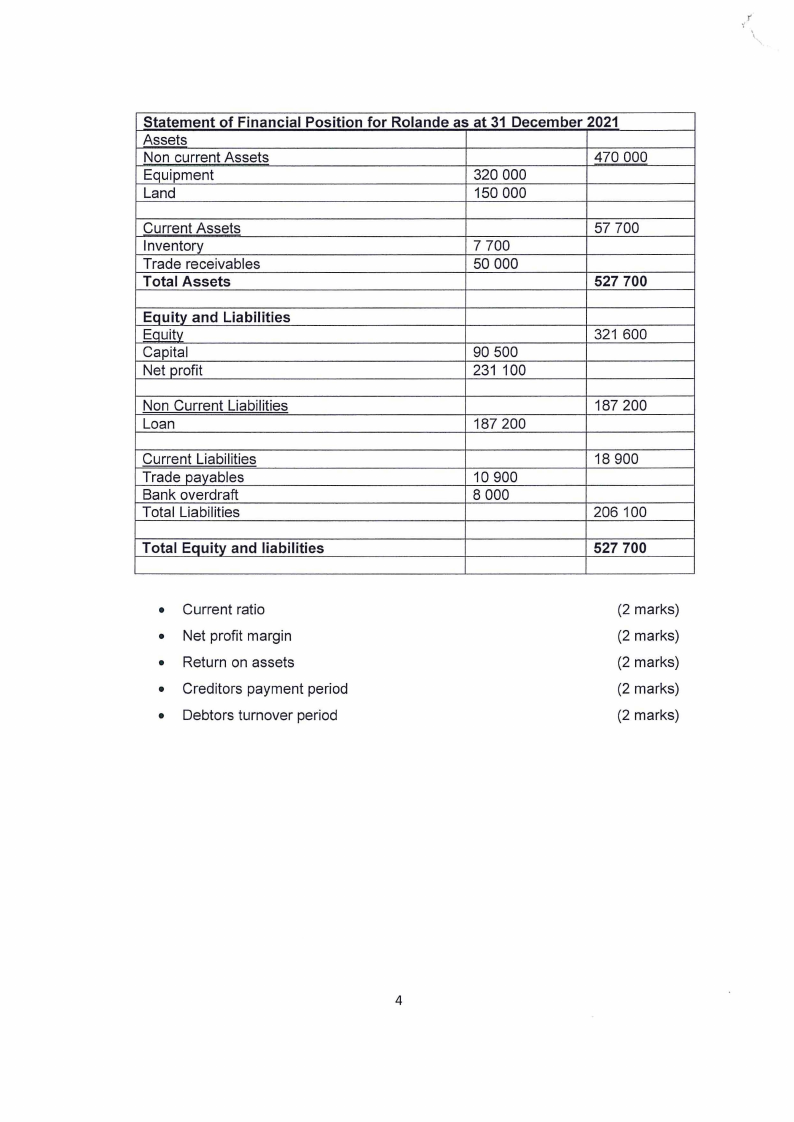

Statement of Financial Position for Rolande as at 31 December 2021

Assets

Non current Assets

470 000

Equipment

320 000

Land

150 000

Current Assets

Inventory

Trade receivables

Total Assets

7 700

50 000

57 700

527 700

EQuity and Liabilities

Eouitv

Capital

Net profit

90 500

231 100

321 600

Non Current Liabilities

Loan

187 200

187 200

Current Liabilities

Trade payables

Bank overdraft

Total Liabilities

10 900

8 000

18 900

206 100

Total Equity and liabilities

527 700

• Current ratio

• Net profit margin

• Return on assets

• Creditors payment period

• Debtors turnover period

(2 marks)

(2 marks)

(2 marks)

(2 marks)

(2 marks)

4

|

5 Page 5 |

▲back to top |

Question 3

a) Provide 4 examples of items that are zero rated for VAT purposes.

(21 Marks)

(4 Marks)

b) Rolande Trading, is a sole trader, that specializes in the supply and provision of gardening

equipment and services for households and corporates. Rolande Trading is a registered

VAT vendor, and you have been provided with the following transactions for the month of

November 2022:

1. The entity performed gardening services for a customer (who is not a registered

VAT vendor) for the amount of N$5300 (excluding VAT). The customer paid cash.

2. The owner decided to have a party for the staff as they had been working really

hard. The total value of the supplies is N$3400 including VAT, purchased from

Party World (a VAT vendor).

3. The entity purchased gardening equipment from MegaBuild Pupkewitz, for

N$6700 (including VAT). Megabuild is a registered VAT vendor.

4. Paid salaries and wages to employees for N$18 000.

Required:

i. Prepare the journal entries for all the above transactions.

(10 marks)

ii. Prepare the VAT control account in the general ledger for the above

transactions, including the closing off of the account and carrying over.

(6 marks)

iii. State whether VAT is a receivable or payable and what the amount is.

(1 mark)

END OF QUESTION PAPER!

5

|

6 Page 6 |

▲back to top |

·-------- ---

nAmlBIA

Unl\\/ERSITY

OF SCIEnce A-TIO

TECHnOLOGY

2022-10-19

HOOA: CCOUNTING,

ECONOMIACNSDANAI\\ICE