|

CAH610S- COST AND MANAGEMENT ACCOUNTING FOR HOSP AND TOURISM- 1ST OPP- NOV 2023 |

|

1 Page 1 |

▲back to top |

nAm I BI A un IVERSITY

OF SCIEn CE Ano TECHn OLOGY

FACULTYOF COMMERCEH, UMANSCIENCESAND EDUCATION

DEPARTMENT OF ECONOMICS, ACCOUNTING AND FINANCE

QUALIFICATION CODE: 07BHOM & 07BOTM

COURSE CODE: CAH610S

DATE: NOVEMBER 2023

LEVEL: 6

COURSE NAME: COST& MANAGEMENT

ACCOUNTING FORHOSPITALITY& TOURISM

PAPER: THEORYAND CALCULATIONS

DURATION: 3 HOURS

MARKS: 100

EXAMINER

MODERATOR

FIRST OPPORTUNITY EXAMINATION PAPER

Sheehama, K.G.H.

Odada, L.

INSTRUCTIONS

1. This question paper is made up of four (4) questions.

2. Answer All the questions in blue or black ink only. NO pencil

3. Start each question on a new page in your answer booklet and show all workings.

4. Work with four (4) decimal places in all your calculations and only round off only final

answers to two (2) decimal places unless otherwise stated.

5. Questions relating to this examination may be raised in the initial 30 minutes after the

start of the paper. Thereafter, candidates must use their initiative to deal with any

perceived error or ambiguities & any assumption made by the candidate should be

clearly stated.

NON - PROGRAMMABLE CALCUTOR

1. Examination paper

2. Examination script

THIS QUESTION PAPER CONSISTS OF 7 PAGES (INCLUDINGTHIS FRONTPAGE)

|

2 Page 2 |

▲back to top |

QUESTION 1

(30 MARKS)

Each of the following questions (1.1 - 1.15) has only ONE correct answer. Please answer

this question ON the answer sheet provided. E.g., 1. D

1.1 A company has fixed costs of N$60 000 per annum. It manufactures a single product

which it sells for N$20 per unit. Its contribution to sales ratio is 40%. The company's

break-even point in N$ is:

A. N$240 000

B. N$260 000

C. N$160 000

D. N$150 000

1.2 A company manufactures a single product which it sells for N$160 per unit. Fixed

costs are N$76 800 per month and the product has a contribution to sales ratio of

40%. In a period when actual sales were N$224 000, the company's margin of safety

was:

A. N$192 000

B. N$32 000

C. N$96 000

D. N$128 000

1.3 Fast-Food Ltd supplied the following details regarding its product:

Selling price per unit

Variable production cost per unit

Variable selling cost per unit

Fixed production cost per year

Fixed selling costs per year

N$60.00

N$12.00

N$4.00

N$35 800

N$6 000

Contribution margin per unit is:

A. N$16

B. N$56

C. N$44

D. N$48

2

|

3 Page 3 |

▲back to top |

The following details refer to questions 1.4 and 1.5:

Jairus Ltd currently sells 2 500 pairs of shoes per year. Other details for the past year are as

follows:

Selling price per pair of shoes N$400

Purchase cost per pair of shoes N$250

Annual fixed costs:

Salaries

Advertising

Miscellaneous

N$130 000

N$40 000

N$70 000

1.4 The company's break-even in number of shoes is:

A. 1200

B. 1400

C. 1600

D. 960

1.5 Assume that for the next year an additional fixed advertising campaign costing

N$17 400 is proposed, whilst at the same time selling price is increased by 12%. In

this case the new contribution margin per pairs of shoes will be:

A. N$150

B. N$198

C. N$155

D. N$195

1.6 A company that manufactures a single product supplied the following budgeted details:

Selling price per unit

Variable costs per unit:

Direct material

Direct labour

Variable overheads

Fixed overheads per month

150

30

40

20

40 000

During the past month, 3 000 units were manufactured while only 2 400 units were sold.

The net income for the month was:

A. N$360 000

B. N$144 000

C. N$140 000

D. N$104 000

3

|

4 Page 4 |

▲back to top |

1.7 A company that manufactures a single product supplied the following budgeted details:

Selling price per unit

Variable costs per unit:

Direct material

Direct labour

Variable overheads

Fixed overheads per month

150

30

40

20

40000

During the past month, 3 000 units were manufactured while only 2 400 units were sold.

Total contribution margin for the month was:

A. N$360 000

B. N$144 000

C. N$140 000

D. N$104000

1.8 A company that manufactures a single product supplied the following budgeted detai

Selling price per unit

Variable costs per unit

Direct material

Direct labour

Variable overheads

Fixed overheads per month

150

30

40

20

40000

During the past month, 3 000 units were manufactured while only 2 400 units were sold.

Total variable cost per unit for the month was:

A. N$95

B. N$70

C. N$90

D. N$20

1.9 Neumeister Ltd has a maximum capacity of 20 000 units of a certain product per year.

Other details regarding this product are as follows:

Selling price

N$250 per unit

Variable manufacturing cost

N$50 per unit

Variable marketing and administrative costs

N$120 per unit

Total fixed costs

N$105 000 per year

4

|

5 Page 5 |

▲back to top |

Because of a mater,ial shortage, only 2 000 units are expected to be sold this year.

Management has also estimated that total fixed costs will increase by N$20 000 per

annum. Sales price will remain at N$250 per unit. In order to earn a net income of

N$35 000.

The new total contribution margin must be:

A. N$105 000

8. N$140 000

C. N$160 000

D. N$150 000

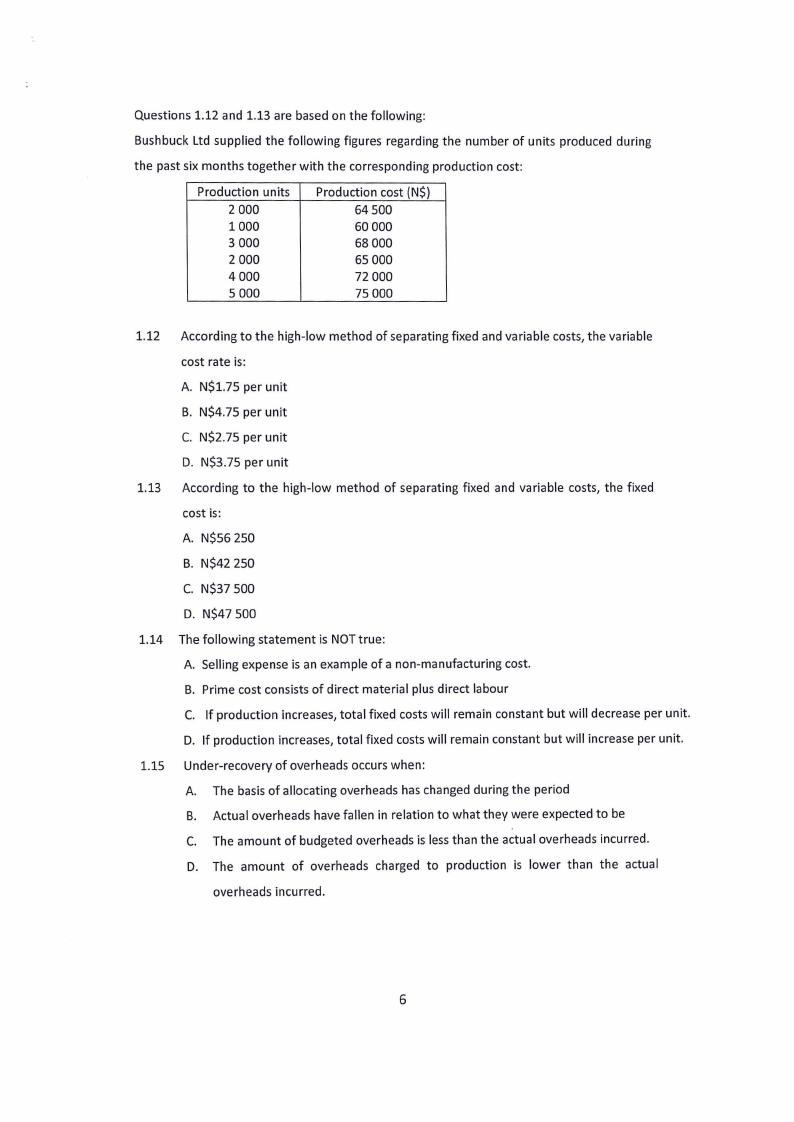

1.10 Neumeister Ltd has a maximum capacity of 20 000 units of a certain product per year.

Other details regarding this product are as follows:

Selling price

Variable cost

Variable marketing and administrative costs

Fixed factory overheads

Fixed marketing and administrative costs

N$250 per unit

N$170 per unit

N$120 per unit

N$60 000 per year

$45 000 per year

Because of a material shortage, only 2 000 units are expected to be sold this year.

Management has also estimated that total fixed costs will increase by N$20 000 per

annum. Variable cost per unit will remain at N$250 per unit. In order to earn a net

income of N$35 000.

The new selling price per unit must be:

A. N$250 per unit

B. N$340 per unit

C. N$240 per unit

D. N$255 per unit

1.11 A firm's telephone account would normally be classified into the following category:

A. Fixed cost

B. Variable cost

C. Stepped fixed cost

D. Semi-variable/mixed cost

5

|

6 Page 6 |

▲back to top |

Questions 1.12 and 1.13 are based on the following:

8ushbuck Ltd supplied the following figures regarding the number of units produced during

the past six months together with the corresponding production cost:

Production units

2 000

1000

3 000

2 000

4000

5 000

Production cost (N$)

64500

60 000

68000

65 000

72 000

75 000

1.12 According to the high-low method of separating fixed and variable costs, the variable

cost rate is:

A. N$1.75 per unit

8. N$4.75 per unit

C. N$2.75 per unit

D. N$3.75 per unit

1.13 According to the high-low method of separating fixed and variable costs, the fixed

cost is:

A. N$56 250

8. N$42 250

C. N$37 500

D. N$47 500

1.14 The following statement is NOTtrue:

A. Selling expense is an example of a non-manufacturing cost.

8. Prime cost consists of direct material plus direct labour

C. If production increases, total fixed costs will remain constant but will decrease per unit.

D. If production increases, total fixed costs will remain constant but will increase per unit.

1.15 Under-recovery of overheads occurs when:

A. The basis of allocating overheads has changed during the period

8. Actual overheads have fallen in relation to what they were expected to be

C. The amount of budgeted overheads is less than the actual overheads incurred.

D. The amount of overheads charged to production is lower than the actual

overheads incurred.

6

|

7 Page 7 |

▲back to top |

QUESTION 2

(20 MARKS)

The Patio is a manufacturer of garden furniture that has consistently used weighted average

costing (AVCO) in valuing inventory. The management of the Patio are now interested in

knowing the effect of using FIFO in valuing inventory instead of using AVCO. The following

transactions for the Patio were recorded for the period:

2 August Opening inventory

100 units @N$S0 per unit

5 August Received

120 units @N$57.S0 per unit

6 August lssued/sa les

200 units

7 August Received

180 units @N$60 per unit

8 August Issued/sales

150 units

9 August Return to supplier units purchased on 7 August 20 units

REQUIRED:

Prepare an inventory ledger card of the Patio for the month of August using

a) four columns showing the date, receiving, issuing, and balancing columns.

Each column contains quantity, unit price and the total amount

Calculate the gross profit of the Patio. Assume that the selling price is N$300

b)

per unit.

MARKS

14

6

QUESTION 3

(24 MARKS)

Chick McFarm has developed a new recipe to cook whole chickens and decides to open a take-

way restaurant in Katutura. Chick McFarm asks NUSTfor help with the market research.

The University finds that Chick McFarm should sell 700 chickens per month, on average

selling price of N$190.

The following total monthly costsare available:

Cost per chicken

N$45

Other ingredients on average per chicken used in cooking process.

Salt

N$0.50

Onion powder

N$1.00

Garlic powder

N$1.S0

Olive oil

N$2.00

7

|

8 Page 8 |

▲back to top |

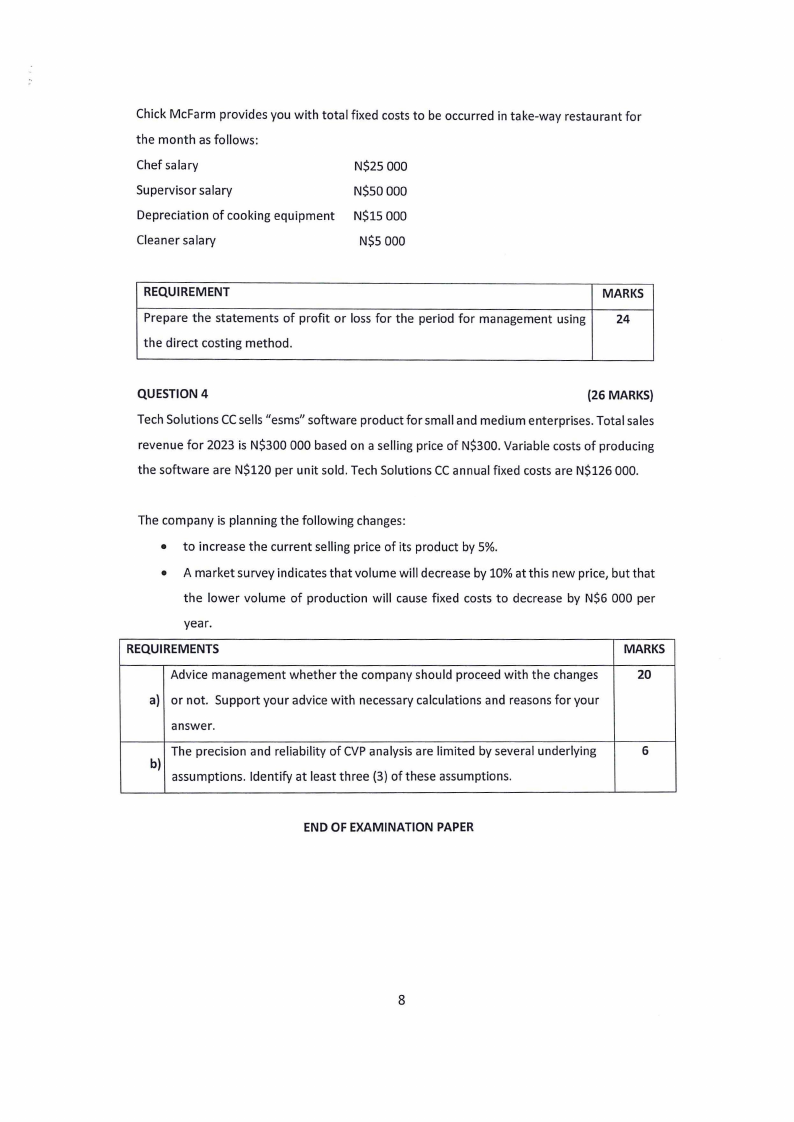

Chick McFarm provides you with total fixed costs to be occurred in take-way restaurant for

the month as follows:

Chef salary

N$25 000

Supervisor salary

N$50 000

Depreciation of cooking equipment N$15 000

Cleaner salary

N$5 000

REQUIREMENT

MARKS

Prepare the statements of profit or loss for the period for management using 24

the direct costing method.

QUESTION 4

(26 MARKS)

Tech Solutions CCsells "esms" software product for small and medium enterprises. Total sales

revenue for 2023 is N$300 000 based on a selling price of N$300. Variable costs of producing

the software are N$120 per unit sold. Tech Solutions CCannual fixed costs are N$126 000.

The company is planning the following changes:

• to increase the current selling price of its product by 5%.

• A market survey indicates that volume will decrease by 10% at this new price, but that

the lower volume of production will cause fixed costs to decrease by N$6 000 per

year.

REQUIREMENTS

MARKS

Advice management whether the company should proceed with the changes

20

a) or not. Support your advice with necessary calculations and reasons for your

answer.

The precision and reliability of CVPanalysis are limited by several underlying

6

b)

assumptions. Identify at least three {3) of these assumptions.

END OF EXAMINATION PAPER

8