|

CAH610S- COST AND MANAGEMENT ACCOUNTING FOR HOSP AND TOURISM- 2ND OPP- NOV 2023 |

|

1 Page 1 |

▲back to top |

nAmlBIA UnlVERSITY

OF SCIEnCE

TECHnOLOGY

FACULTY OF COMMERCE, HUMAN SCIENCESAND EDUCATION

DEPARTMENT OF ECONOMICS, ACCOUNTING AND FINANCE

QUALIFICATION CODE: 07BHOM & 07BOTM

COURSE CODE: CAH610S

DATE: JANUARY 2024

LEVEL: 6

COURSE NAME: COST& MANAGEMENT

ACCOUNTINGFORHOSPITALITY& TOURISM

PAPER: THEORYAND CLACULATIONS

DURATION: 3 HOURS

MARKS: 100

SECOND OPPORTUNITY EXAMINATION PAPER

EXAMINER

MODERATOR

Sheehama, K.G.H.

Odada, L.

INSTRUCTIONS

1. This question paper is made up of four (4) questions.

2. Answer ALL the questions in blue or black ink only. NO pencil

3. Start each question on a new page in your answer booklet and show all workings.

4. Work with four (4) decimal places in all your calculations and only round off only final

answers to two (2) decimal places unless otherwise stated.

5. Questions relating to this examination may be raised in the initial 30 minutes after the

start of the paper. Thereafter, candidates must use their initiative to deal with any

perceived error or ambiguities & any assumption made by the candidate should be

clearly stated.

NON - PROGRAMMABLE CALCUTOR

1. Examination paper

2. Examination script

THIS QUESTION PAPER CONSISTS OF 8 PAGES (INCLUDINGTHIS FRONTPAGE)

|

2 Page 2 |

▲back to top |

QUESTION 1

(30 MARKS)

Each of the following questions (1.1-1.15) has only ONE correct answer. Please answer

this question ON the answer sheet provided. E.g. 1.1-A

1.1 Management accounting is used by:

a) Shareholders

b) Internal managers

c) Employees

d) External users

e) None of the above

1.2 Management accounting has the following functions:

a) Providing information to external parties

b) Estimating costs of products and services

c) Providing information for internal use

d) a and c

e) band c

1.3 In the code of ethics followed by management accountants, integrity is:

a) Being honest, standing for what is right

b) Being just and unbiased

c) Being courteous and decent

d) Not revealing or disclosing privileged or private information

e) Accepting the consequences of actions and decisions

1.4 In the code of ethics followed by management accountants, confidentiality is:

a) Being honest, standing for what is right

b) Being just and unbiased

c) Being courteous and decent

d) Not revealing or disclosing privileged or private information

e) Accepting the consequences of actions and decisions

1.5 In the code of ethics followed by management accountants, accountability is:

a) Being honest, standing for what is right

b) Being just and unbiased

c) Being courteous and decent

d) Not revealing or disclosing privileged or private information

e) Accepting the consequences of actions and decisions

2

|

3 Page 3 |

▲back to top |

1.6 Fixed cost per unit:

a) Increases as activity volume decreases

b) Remains constant with volume of activity

c) Increases as activity volume increases

d) Dcreases as activity volume increases

e) band c

1.7 A cost that will change in the future due to a decision being made is known as:

a) An opportunity cost

b) A sunk cost

c) A changing cost

d) An incremental cost

e) A relevant cost

1.8 Conversion costs include:

a) Direct labour

b) Direct material

c) Direct material and manufacturing overheads

d) Direct labour and direct materials

e) Direct labour and manufacturing overheads

1.9 Costs unaffected by a choice between alternatives and have been included in the past is:

a) A sunk cost

b) A period cost

c) A product cost

d) A direct cost

e) An indirect cost

1.10 Variable cost per unit:

a) Increases as activity volume decreases

b) Remains constant with volume of activity

c) Decreases as activity volume increases

d) a and b

e) band c

3

|

4 Page 4 |

▲back to top |

1.11 A company has fixed costs of N$60 000 per annum. It manufactures a single product

which it sells for N$20 per unit. Its variable cost to sales ratio is 60%. The company's

break-even point in N$ is:

a) N$240 000

b) N$260 000

c) N$160 000

d) N$150 000

e) None of the above

1.12 Luxury Hotel Ltd supplied the following details regarding its product:

Selling price per unit

Variable production cost per unit

Variable selling cost per unit

Fixed production cost per year

Fixed selling costs per year

The contribution margin per unit is:

N$600.00

N$120.00

N$40.00

N$358 000

N$60 000

a) N$160

b) N$560

c) N$440

d) N$480

e) None of the above

The following details refer to questions 1.13 and 1.14:

Nam-Shoes Ltd currently sells 2 500 pairs of shoes per year. Other details for the past year

are as follows:

Selling price per pair of shoes N$200

Purchase cost per pair of shoes N$125

Annual fixed costs:

Salaries

N$65 000

Advertising

N$20 000

Miscellaneous

N$35 000

1.13 The company's break-even in number of shoes is:

a) 1200

b) 1400

c) 1600

d) 1500

e) None of the above

4

|

5 Page 5 |

▲back to top |

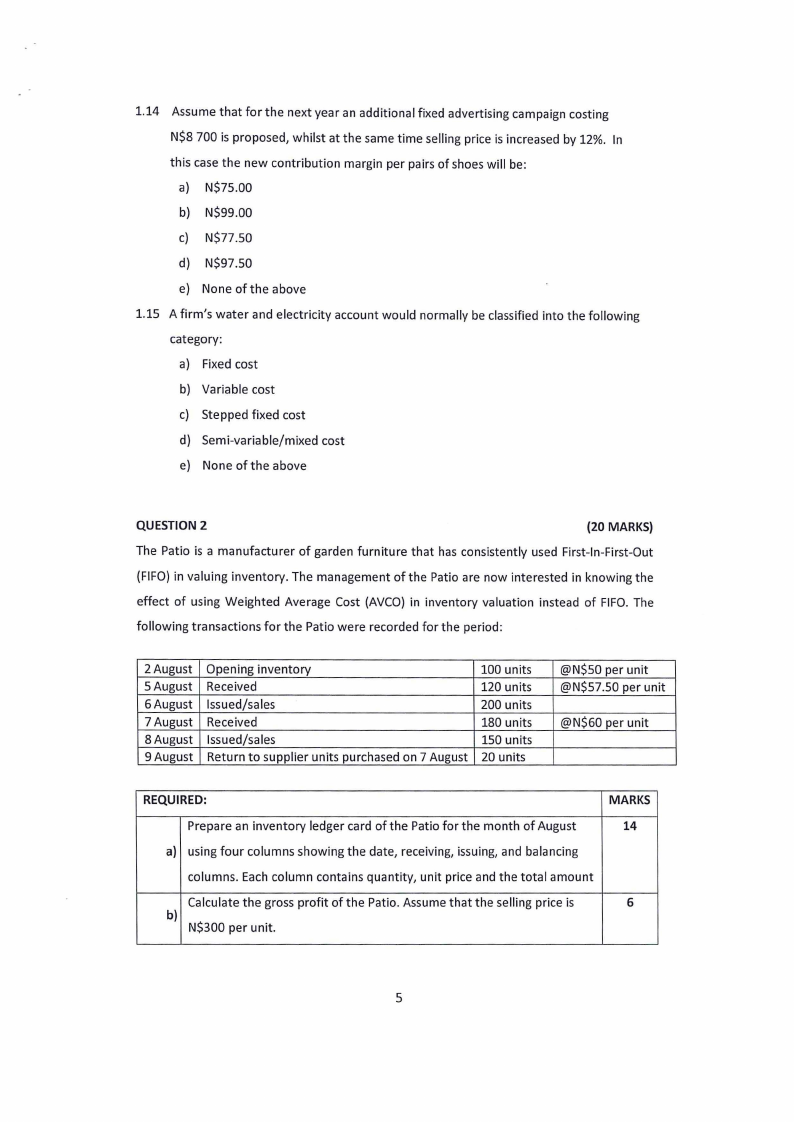

1.14 Assume that for the next year an additional fixed advertising campaign costing

N$8 700 is proposed, whilst at the same time selling price is increased by 12%. In

this case the new contribution margin per pairs of shoes will be:

a) N$75.00

b) N$99.00

c) N$77.50

d) N$97.50

e) None of the above

1.15 A firm's water and electricity account would normally be classified into the following

category:

a) Fixed cost

b) Variable cost

c) Stepped fixed cost

d) Semi-variable/mixed cost

e) None of the above

QUESTION 2

(20 MARKS)

The Patio is a manufacturer of garden furniture that has consistently used First-In-First-Out

(FIFO) in valuing inventory. The management of the Patio are now interested in knowing the

effect of using Weighted Average Cost (AVCO) in inventory valuation instead of FIFO. The

following transactions for the Patio were recorded for the period:

2August

SAugust

6August

7 August

8 August

9 August

Opening inventory

Received

Issued/sales

Received

Issued/sales

Return to supplier units purchased on 7 August

100 units

120 units

200 units

180 units

150 units

20 units

@N$50 per unit

@N$57.50 per unit

@N$60 per unit

REQUIRED:

Prepare an inventory ledger card of the Patio for the month of August

a) using four columns showing the date, receiving, issuing, and balancing

columns. Each column contains quantity, unit price and the total amount

Calculate the gross profit of the Patio. Assume that the selling price is

b)

N$300 per unit.

MARKS

14

6

5

|

6 Page 6 |

▲back to top |

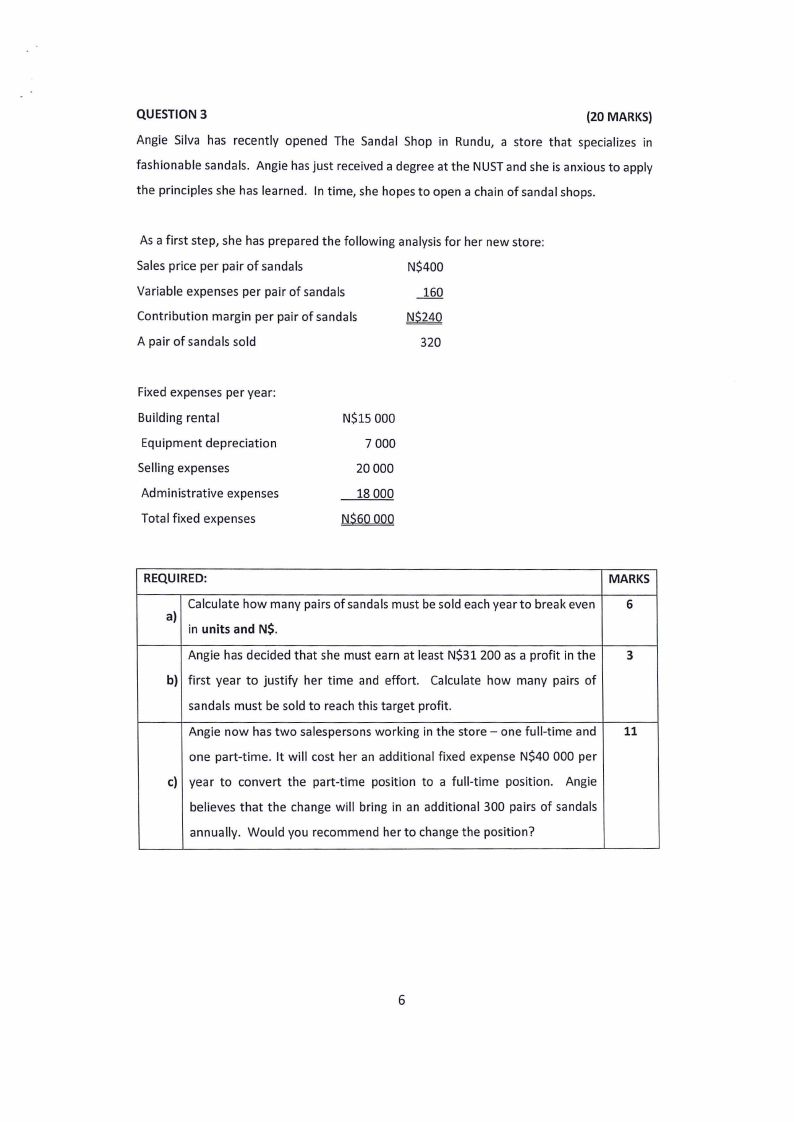

QUESTION 3

(20 MARKS)

Angie Silva has recently opened The Sandal Shop in Rundu, a store that specializes in

fashionable sandals. Angie has just received a degree at the NUSTand she is anxious to apply

the principles she has learned. In time, she hopes to open a chain of sandal shops.

As a first step, she has prepared the following analysis for her new store:

Sales price per pair of sandals

N$400

Variable expenses per pair of sandals

160

Contribution margin per pair of sandals

N$240

A pair of sandals sold

320

Fixed expenses per year:

Building rental

Equipment depreciation

Selling expenses

Administrative expenses

Total fixed expenses

N$15 000

7 000

20000

18 000

N$60000

REQUIRED:

MARKS

Calculate how many pairs of sandals must be sold each year to break even

6

a)

in units and N$.

Angie has decided that she must earn at least N$31 200 as a profit in the

3

b) first year to justify her time and effort. Calculate how many pairs of

sandals must be sold to reach this target profit.

Angie now has two salespersons working in the store - one full-time and 11

one part-time. It will cost her an additional fixed expense N$40 000 per

c) year to convert the part-time position to a full-time position. Angie

believes that the change will bring in an additional 300 pairs of sandals

annually. Would you recommend her to change the position?

6

|

7 Page 7 |

▲back to top |

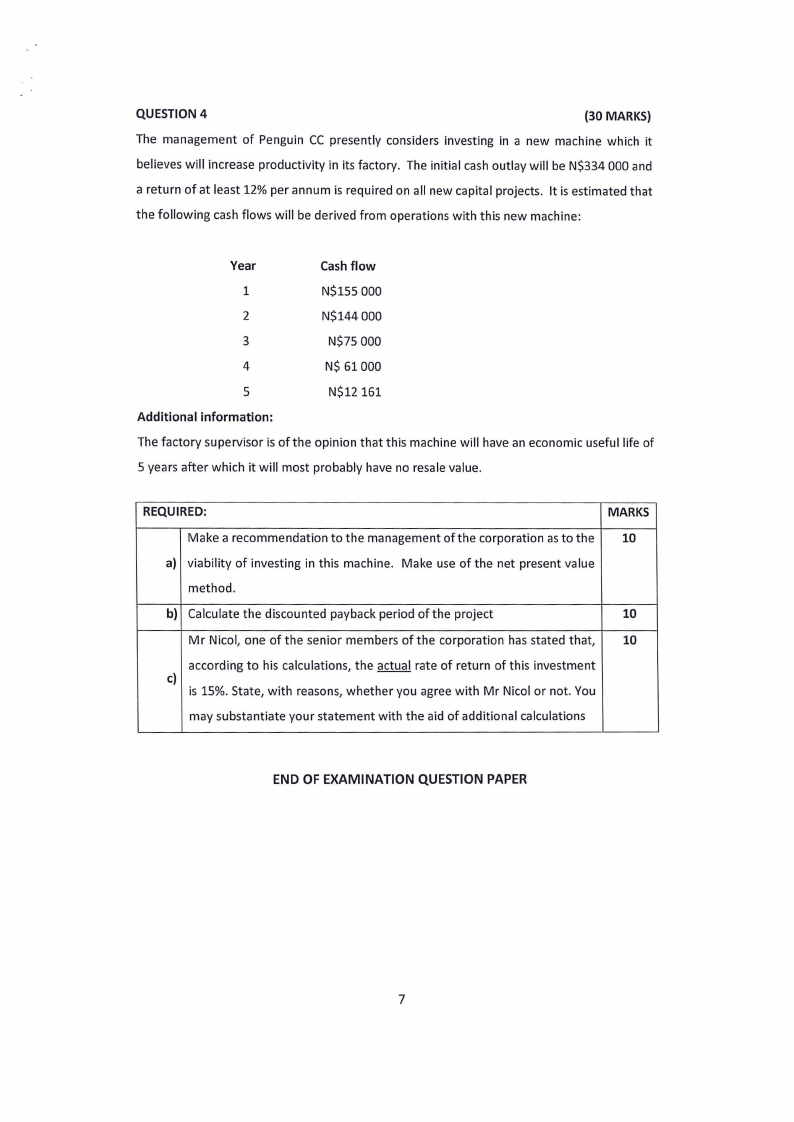

QUESTION 4

{30 MARKS)

The management of Penguin CC presently considers investing in a new machine which it

believes will increase productivity in its factory. The initial cash outlay will be N$334 000 and

a return of at least 12% per annum is required on all new capital projects. It is estimated that

the following cash flows will be derived from operations with this new machine:

Year

Cash flow

1

N$155 000

2

N$144000

3

N$75 000

4

N$ 61000

5

N$12 161

Additional information:

The factory supervisor is of the opinion that this machine will have an economic useful life of

5 years after which it will most probably have no resale value.

REQUIRED:

MARKS

Make a recommendation to the management of the corporation as to the 10

a) viability of investing in this machine. Make use of the net present value

method.

b) Calculate the discounted payback period of the project

10

Mr Nicol, one of the senior members of the corporation has stated that,

10

according to his calculations, the actual rate of return of this investment

c)

is 15%. State, with reasons, whether you agree with Mr Nicol or not. You

may substantiate your statement with the aid of additional calculations

END OF EXAMINATION QUESTION PAPER

7

|

8 Page 8 |

▲back to top |

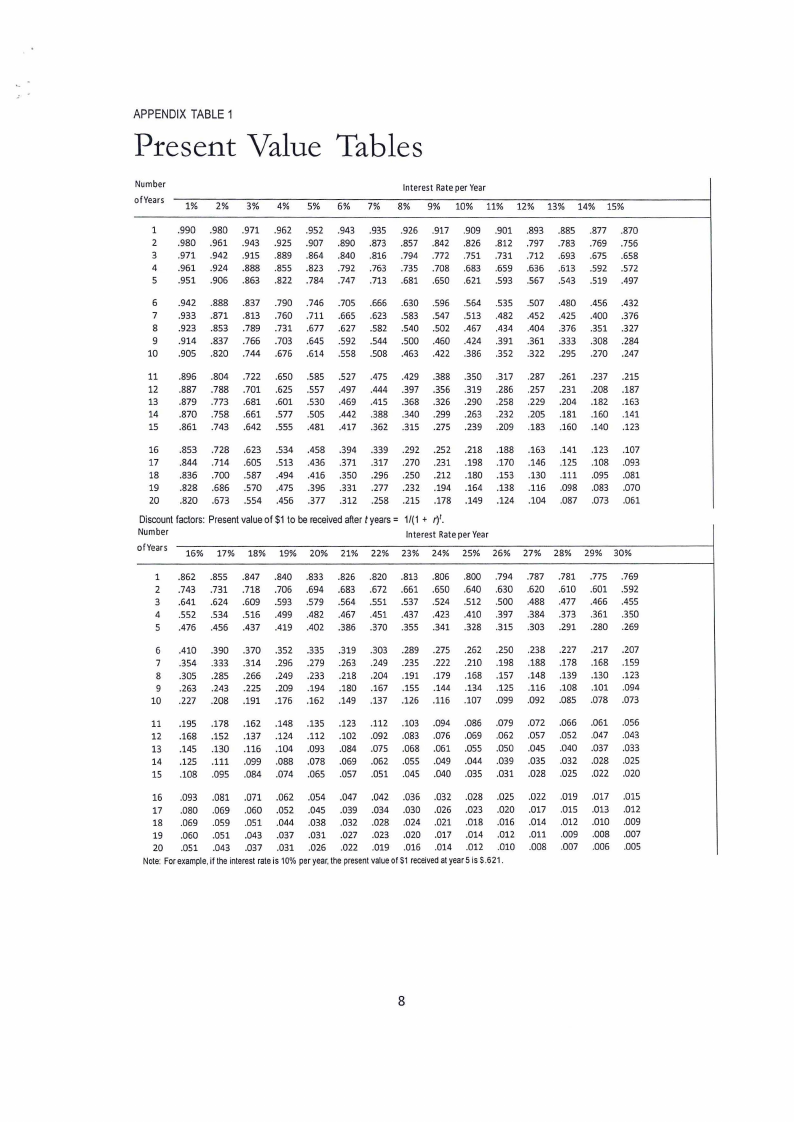

APPENDIXTABLE1

Present Value Tables

Number

Interest Rateper Year

of Years 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15%

1 .990 .980 .971 .962 .952 .943 .935 .926 .917 .909 .901 .893 .885 .877 .870

2 .980 .961 .943 .925 .907 .890 .873 .857 .842 .826 .812 .797 .783 .769 .756

3 .971 .942 .915 .889 .864 .840 .816 .794 .772 .751 .731 .712 .693 .675 .658

4 .961 .924 .888 .855 .823 .792 .763 .735 .708 .683 .659 .636 .613 .592 .572

5 .951 .906 .863 .822 .784 .747 .713 .681 .650 .621 .593 .567 .543 .519 .497

6 .942 .888 .837 .790 .746 .705 .666 .630 .596 .564 .535 .507 .480 .456 .432

7 .933 .871 .813 .760 .711 .665 .623 .583 .547 .513 .482 .452 .425 .400 .376

8 .923 .853 .789 .731 .677 .627 .582 .540 .502 .467 .434 .404 .376 .351 .327

9 .914 .837 .766 .703 .645 .592 .544 .500 .460 .424 .391 .361 .333 .308 .284

10 .905 .820 .744 .676 .614 .558 .508 .463 .422 .386 .352 .322 .295 .270 .247

11 .896 .804 .722 .650 .585 .527 .475 .429 .388 .350 .317 .287 .261 .237 .215

12 .887 .788 .701 .625 .557 .497 .444 .397 .356 .319 .286 .257 .231 .208 .187

13 .879 .773 .681 .601 .530 .469 .415 .368 .326 .290 .258 .229 .204 .182 .163

14 .870 .758 .661 .577 .sos .442 .388 .340 .299 .263 .232 .205 .181 .160 .141

15 .861 .743 .642 .555 .481 .417 .362 .315 .275 .239 .209 .183 .160 .140 .123

16 .853 .728 .623 .534 .458 .394 .339 .292 .252 .218 .188 .163 .141 .123 .107

17 .844 .714 .605 .513 .436 .371 .317 .270 .231 .198 .170 .146 .125 .108 .093

18 .836 .700 .587 .494 .416 .350 .296 .250 .212 .180 .153 .130 .111 .095 .081

19 .828 .686 .570 .475 .396 .331 .277 .232 .194 .164 .138 .116 .098 .083 .070

20 .820 .673 .554 .456 .377 .312 .258 .215 .178 .149 .124 .104 .087 .073 .061

Discounftactors:Presenvt alueof $1to be receivedafterI years= 1/(1+ r')1.

Number

Interest Rateper Year

of Years 16% 17% 18% 19% 20% 21% 22% 23% 24% 25% 26% 27% 28% 29% 30%

1 .862 .855 .847 .840 .833 .826 .820 .813 .806 .800 .794 .787 .781 .775 .769

2 .743 .731 .718 .706 .694 .683 .672 .661 .650 .640 .630 .620 .610 .601 .592

3 .641 .624 .609 .593 .579 .564 .551 .537 .524 .512 .500 .488 .477 .466 .455

4 .552 .534 .516 .499 .482 .467 .451 .437 .423 .410 .397 .384 .373 .361 .350

5 .476 .456 .437 .419 .402 .386 .370 .355 .341 .328 .315 .303 .291 .280 .269

6 .410 .390 .370 .352 .335 .319 .303 .289 .275 .262 .250 .238 .227 .217 .207

7 .354 .333 .314 .296 .279 .263 .249 .235 .222 .210 .198 .188 .178 .168 .159

8 .305 .285 .266 .249 .233 .218 .204 .191 .179 .168 .157 .148 .139 .130 .123

9 .263 .243 .225 .209 .194 .180 .167 .155 .144 .134 .125 .116 .108 .101 .094

10 .227 .208 .191 .176 .162 .149 .137 .126 .116 .107 .099 .092 .085 .078 .073

11 .195 .178 .162 .148 .135 .123 .112 .103 .094 .086 .079 .072 .066 .061 .056

12 .168 .152 .137 .124 .112 .102 .092 .083 .076 .069 .062 .057 .052 .047 .043

13 .145 .130 .116 .104 .093 .084 .075 .068 .061 .055 .050 .045 .040 .037 .033

14 .125 .111 .099 .088 .078 .069 .062 .055 .049 .044 .039 .035 .032 .028 .025

15 .108 .095 .084 .074 .065 .057 .051 .045 .040 .035 .031 .028 .025 .022 .020

16 .093 .081 .071 .062 .054 .047 .042 .036 .032 .028 .025 .022 .019 .017 .015

17 .080 .069 .060 .052 .045 .039 .034 .030 .026 .023 .020 .017 .015 .013 .012

18 .069 .059 .051 .044 .038 .032 .028 .024 .021 .018 .016 .014 .012 .010 .009

19 .060 .051 .043 .037 .031 .027 .023 .020 .017 .014 .012 .011 .009 .008 .007

20 .051 .043 .037 .031 .026 .022 .019 .016 .014 .012 .010 .008 .007 .006 .005

Note:Forexamplei,f theinterestrateis 10%peryear,thepresentvalueof S1receivedat year5 is S.621.

8