|

AUT621S- AUDITING 202- 1ST OPP- NOV 2023 |

|

1 Page 1 |

▲back to top |

nAmlBIA UnlVERSITY

OF SCIEn CE Ano TECHn OLOGY

FACULTY OF COMMERCE, HUMAN SCIENCESAND EDUCATION

DEPARTMENT OF ECONOMICS, ACCOUNTING & FINANCE

QUALIFICATION : BACHELOR OF ACCOUNTING

QUALIFICATION CODE: 07 BOAC

COURSE: AUDITING 202

DATE: NOVEMBER 2023

DURATION: 3 HRS

LEVEL: 6

COURSE CODE: AUT 621S

SESSION: NOVEMBER 2023

MARKS: 100

EXAMINER{S)

FIRST OPPORTUNITY

EXAMINATION QUESTION PAPER

Kamotho, D.W., Hainghumbi, H.T. P

MODERATOR: Ms W Gertze

THIS QUESTION PAPER CONSISTS OF _6_ PAGES (including this front page)

INSTRUCTIONS

1. Answer all the questions in blue or black ink

2. Start each question on a new page in your answer booklet & show all your workings

3. Questions relating to this examination may be raised in the initial 30 minutes after the start

of the paper. Thereafter, candidates must use their initiative to deal with any perceived error or

ambiguities & any assumption made by the candidate should be clearly stated.

PERMISSIBLE MATERIALS

1. Nonprogrammable scientific or financial calculator

|

2 Page 2 |

▲back to top |

Question 1

(25 Marks)

Miggy {Pty) Ltd {hereafter "Miggy"), a local distributor of confectionaries, has asked your

accounting firm to evaluate their system of internal controls. The CEOof Miggy explained

the current system of internal controls to your colleague. Your colleague has since been

promoted to a senior position; therefore, she has passed on the information below to

you. You are expected to generate recommendations for the partner at your accounting

firm to share with the CEOof Miggy.

Since Miggy is a relatively medium-sized organization, they have a lot of faith in their long-

term employees. They have one accountant who takes care of all accounting and

administration matters which streamlines many of their processes. For example, in this

dual role, he purchases all of the supplies and pays for these purchases. He also receives

the cheques from customers and completes the monthly bank reconciliation.

The accountant is so busy that the company handles various functions a bit

differently. Petty cash is one such function. All employees have access to the petty cash

in a desk drawer and are asked to only place a note if they use any of the cash.

Wages/salaries payouts is another such function. On payday, the salary cheques are

picked up by the accountant and left in his office for employees to collect. Due to the

accountant's busy schedule, employees are welcome to help themselves by collecting

their cheques. However, before he leaves for the weekend, he will move the cheques into

a safe in his office.

The CEOis still quite embarrassed because he had to fire one of his employees for visiting

illegal websites on a company computer. He later found out this individual was a

convicted offender who served prison time for molesting children. The company had a

hard time getting the employee to admit it was him because the company does not assign

individual passwords to access the computer.

The CEO expressed his frustration because both he and the accountant interviewed and

approved all of the new hires in the company.

2

|

3 Page 3 |

▲back to top |

REQUIRED:

Based on the above information:

a) Define Internal control.

(3 marks)

b) Based on the description of the system of internal controls provided, identify any

six (6) control weaknesses in Miggy's internal control system.

(6 marks)

c) For each control weakness identified, recommend to the CEOwhat the company

can do to improve those controls.

(6 marks)

d) The CEOwants to understand the components of internal control. List and briefly

discuss the five (5) components that make a good internal control system.

(10 marks)

[Total: 25 Marks]

Question 2

{25 marks)

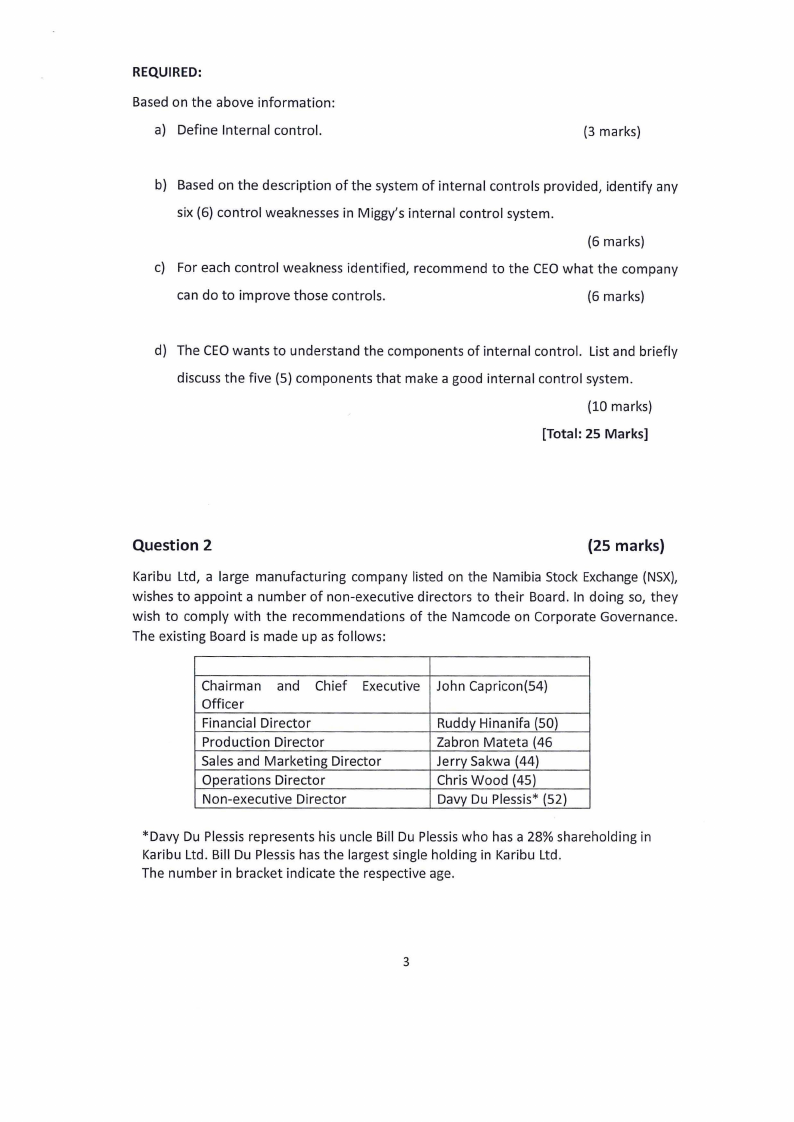

Karibu Ltd, a large manufacturing company listed on the Namibia Stock Exchange (NSX),

wishes to appoint a number of non-executive directors to their Board. In doing so, they

wish to comply with the recommendations of the Namcode on Corporate Governance.

The existing Board is made up as follows:

Chairman and Chief Executive

Officer

Financial Director

Production Director

Sales and Marketing Director

Operations Director

Non-executive Director

John Capricon(54)

Ruddy Hinanifa (50)

Zabron Mateta (46

Jerry Sakwa (44)

Chris Wood (45)

Davy Du Plessis* (52)

*Davy Du Plessis represents his uncle Bill Du Plessiswho has a 28% shareholding in

Karibu Ltd. Bill Du Plessis has the largest single holding in Karibu Ltd.

The number in bracket indicate the respective age.

3

|

4 Page 4 |

▲back to top |

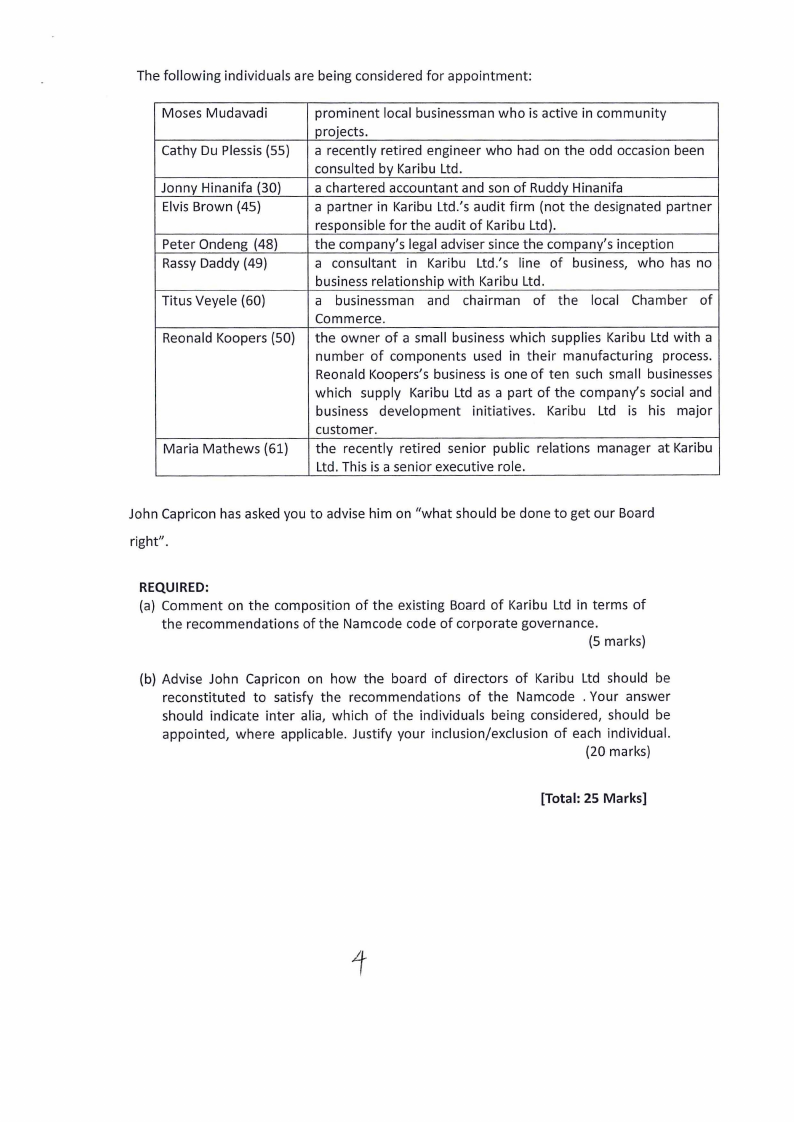

The following individuals are being considered for appointment:

Moses Mudavadi

Cathy Du Plessis (55}

Jonny Hinanifa (30)

Elvis Brown (45)

Peter Ondeng (48)

RassyDaddy (49}

Titus Veyele {60)

Reonald Koopers (50)

Maria Mathews (61)

prominent local businessman who is active in community

projects.

a recently retired engineer who had on the odd occasion been

consulted by Karibu Ltd.

a chartered accountant and son of Ruddy Hinanifa

a partner in Karibu Ltd.'s audit firm (not the designated partner

responsible for the audit of Karibu Ltd).

the company's legal adviser since the company's inception

a consultant in Karibu Ltd.'s line of business, who has no

business relationship with Karibu Ltd.

a businessman and chairman of the local Chamber of

Commerce.

the owner of a small business which supplies Karibu Ltd with a

number of components used in their manufacturing process.

Reonald Koopers's business is one of ten such small businesses

which supply Karibu Ltd as a part of the company's social and

business development initiatives. Karibu Ltd is his major

customer.

the recently retired senior public relations manager at Karibu

Ltd. This is a senior executive role.

John Capricon has asked you to advise him on "what should be done to get our Board

right".

REQUIRED:

(a) Comment on the composition of the existing Board of Karibu Ltd in terms of

the recommendations of the Namcode code of corporate governance.

(5 marks)

(b) Advise John Capricon on how the board of directors of Karibu Ltd should be

reconstituted to satisfy the recommendations of the Namcode . Your answer

should indicate inter alia, which of the individuals being considered, should be

appointed, where applicable. Justify your inclusion/exclusion of each individual.

{20 marks)

[Total: 25 Marks]

|

5 Page 5 |

▲back to top |

Question 3

25 Marks

You are about to begin the audit of one of your larger clients, Mama Kambo Ltd (hereafter

"MK"). MK is a long-established wholesale distributor of dairy produce and operates out

of three countries: South Africa, Botswana and Namibia. In each country, the company

has a distribution refrigeration warehouse, and it also operates a centralised office in

South Africa for purchasing and accounting functions. As part of the audit, you must carry

out a detailed examination of the transactions of MK, including its internal controls

components.

MK's internal controls consist of the following components:

• Control environment

• Risk assessment process

• Information system, including processes relevant to financial reporting and

communication

• Control activities

• Monitoring of controls.

REQUIRED:

a) Discusswhat is meant by the term 'control environment'.

(2 marks)

b) Why is it important for the auditor to obtain an understanding of a client

company and its environment, including the company's internal controls?

(7 marks)

c) Outline THREEkey factors that an auditor would expect to see (find) in operation in

MK's control environment.

(3 marks)

d) Outline FOURdifferent control activities that should be found in MK and provide

one specific example of each.

(8 marks)

e) Discussfive inherent limitations of an internal control system

(5 marks)

[Total: 25 Marks]

5

|

6 Page 6 |

▲back to top |

Question 4

(25 Marks)

You have recently been appointed the audit senior for Hamilton Computers Ltd, a

technology company involved in the development of computer software and the

manufacture of information technology (IT) hardware. The audit will commence shortly.

The Company relies heavily on its IT systems to manage and operate the business. The

company has just implemented a new accounting IT system to support and record all of

its financial transactions.

At a recent meeting with the company's chief financial officer (CFO),the audit partner

informed the CFOthat an audit of the new accounting IT system will be conducted this

year, focusing largely on the general and application controls in the new system.

REQUIRED:

(a) The audit partner has asked you to brief him on the key aims and objectives of

the audit of the new accounting IT system for the CFO.

(5 marks)

(b) As part of the discussions at the meeting, the audit partner mentioned that there are

three main areas upon which the audit of general controls will focus, namely:

(i) IT Information security

(ii) IT systems change control

(iii) IT operations.

The audit partner has requested that you to assess the key risks and controls in each

area.

(14 marks)

(c) The audit partner has also noted that the team will use computer assisted audit

techniques (CAATs)as part of this year's audit and would like you to briefly explain the

benefits of using CAATs.

(6 marks)

[Total: 25 Marks]

END OF QUESTION PAPER

6