|

FAR811S-ADVANCED FINANCIAL ACCOUNTING AND REPORTING-2ND OPP-JULY 2022 |

|

1 Page 1 |

▲back to top |

nAmlBIA UnlVERSITY

0 F SCIEn CE An D TECHn OLOGY

FACULTY OF COMMERCE, HUMAN SCIENCESAND EDUCATION

DEPARTMENT OF ACCOUNTING, ECONOMICS AND FINANCE

QUALIFICATION : BACHELOR OF ACCOUNTING HONOURS

QUALIFICATION CODE: 08 BOAH

COURSE CODE: FAR811S

LEVEL: 8

COURSE NAME: ADVANCEDFINANCIALACCOUNTING

AND REPORTING

SESSION: July/August 2022

PAPER: THEORYAND CALCULATIONS

DURATION: 3 hours

MARKS: 100

EXAMINER(S}

FINAL ASSESSMENT- 2nd Opportunity

D W Kamotho

MODERATOR: Dr E Mashiri

INSTRUCTIONS

1. Answer ALL questions in blue or black ink only.

2. Write clearly and neatly.

3. Start each question on a new page and number the answers clearly.

4. No programmable calculators are allowed.

5. Questions relating to the paper may be raised in the initial 30

minutes after the start of the paper. Thereafter, candidates must use

their initiative to deal with any perceived error or ambiguities & any

assumption made by the candidate should be clearly stated.

6. Any resemblance to any people, places, organisations or anything is

purely coincidental.

THIS QUESTION PAPER CONSISTS OF 6 PAGES (Including the front page)

1

|

2 Page 2 |

▲back to top |

QUESTION 1

(15 marks}

Softa Ltd developed a unique soft drink. It is very healthy and yet tastes like the top-selling

unhealthy brands. Unfortunately, the product does not sell very well. Softa Ltd has identified

the following reasons for this:

• The product is not being correctly marked.

• The marketing problem is attributed to the fact that the product does not have a

trademark.

Softa Ltd therefore set about developing a trademark for this product. All indications are that

it will be called Softa Cola.

In developing the trademark, Softa Ltd incurred the following expenses up to 30 June 2021:

Design of logo

Legal fees for registration

Advertising campaign to promote the trademark

N$

950 000

400 000

800 000

Total

2 150 000

From budgets prepared and experiences so far it seems that Softa Ltd will enjoy benefits from

the trademark for the next 10 years. Softa Ltd is already experiencing an upswing in the

demand for its product.

REQUIRED:

Explain with reasons, how Softa Ltd should treat the cost of developing the trademark in the

financial statements for the year ended 30 June 2021 in terms of the requirements of the

conceptual framework for financial reporting 2018. Discussall the possible alternatives.

2

|

3 Page 3 |

▲back to top |

QUESTION 2

(30 marks)

This question has two parts

Part A

The difference between debt and equity in an entity's statement of financial position is not

easily distinguishable for preparers of financial statements. Some financial instruments may

have both features, which can lead to inconsistency of reporting. The International

Accounting Standards Board (IASB) has agreed that greater clarity may be required in its

definitions of assets and liabilities for debt instruments. It is thought that defining the nature

of liabilities would help the IASB'sthinking on the difference between financial instruments

classified as equity and liabilities.

REQUIRED:

(i) Discussthe key classification differences between debt and equity under International

Financial Reporting Standards.

Note. Examples should be given to illustrate your answer. (12 marks)

(ii) Explain why it is important for entities to understand the impact of the classification of a

financial instrument as debt or equity in the financial statements. (6 marks)

Part B

The directors of Avis, a public limited company, are reviewing the financial statements of two

entities which are acquisition targets, Olynpia and Rocky.They have asked for clarification on

the treatment of the following financial instruments within the financial statements of the

entities.

Olynpia has two classes of shares: A and B shares. A shares are Olynpia's ordinary shares and

are correctly classed as equity. B shares are not mandatorily redeemable shares but contain

a call option allowing Olynpia to repurchase them. Dividends are payable on the B shares if,

and only if, dividends have been paid on the A ordinary shares. The terms of the B shares are

such that dividends are payable at a rate equal to that of the A ordinary shares. Additionally,

Olynpia has also issued share options which give the counterparty rights to buy a fixed

number of its B shares for a fixed amount of $10 million. The contract can be settled only by

the issuance of shares for cash by Olynpia.

Rockyhas in issuetwo classesof shares: A shares and Bshares. A shares are correctly classified

as equity. Two million B shares of nominal value of $1 each are in issue. The B shares are

redeemable in two years' time. Rocky has a choice as to the method of redemption of the B

shares. It may either redeem the B shares for cash at their nominal value or it may issue one

million A shares in settlement. A shares are currently valued at $10 per share. The lowest

price for Rocky's A shares since its formation has been $5 per share.

3

|

4 Page 4 |

▲back to top |

REQUIRED:

Discusswhether the above arrangements regarding the B shares of each of Olynpia and Rocky

should be treated as liabilities or equity in the financial statements of the respective issuing

companies.

(12 marks)

(Total= 30 marks)

QUESTION 3

This question has two separate parts

(30 Marks)

Part 1

Sugar Co leased a machine from Spice Co. The terms of the lease are as follows:

Inception of lease

Lease term

Present value of future lease payments

Useful life of asset

1 January 2021

4 years at $78,864 per annum payable in

arrears

$250,000

4 years

REQUIRED:

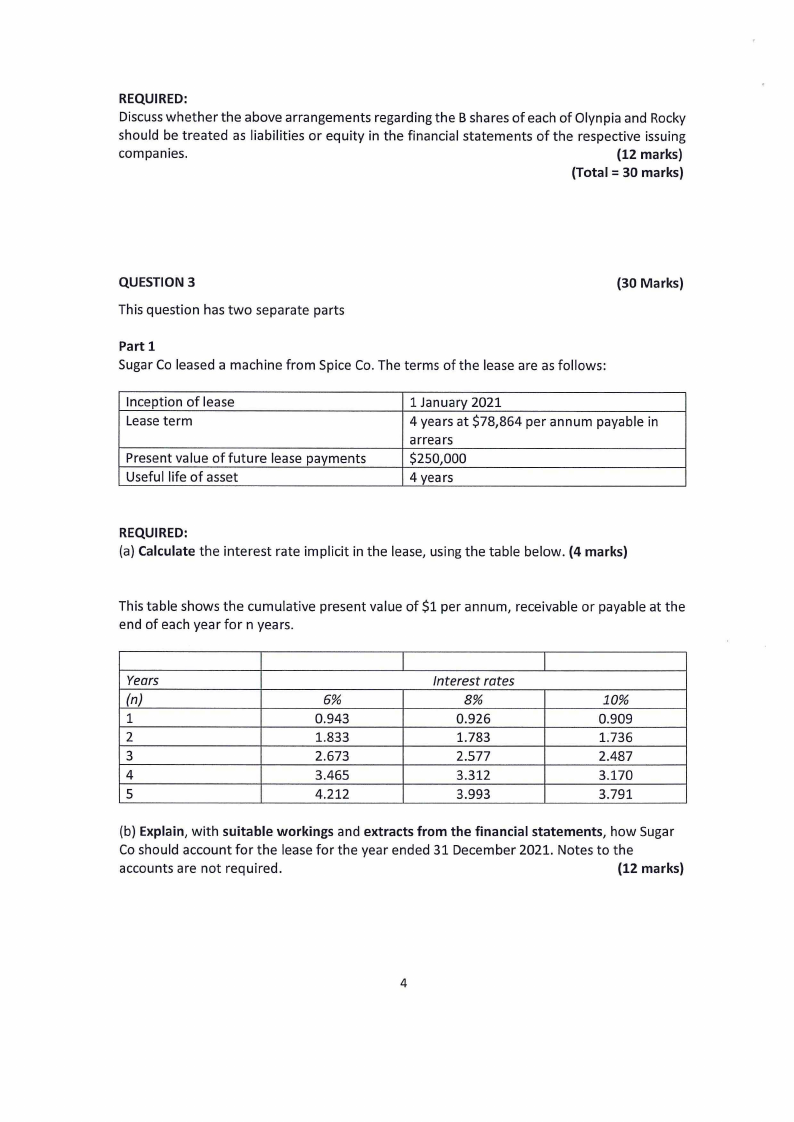

(a) Calculate the interest rate implicit in the lease, using the table below. (4 marks)

This table shows the cumulative present value of $1 per annum, receivable or payable at the

end of each year for n years.

Years

(n)

1

2

3

4

5

6%

0.943

1.833

2.673

3.465

4.212

Interest rates

8%

0.926

1.783

2.577

3.312

3.993

10%

0.909

1.736

2.487

3.170

3.791

(b) Explain, with suitable workings and extracts from the financial statements, how Sugar

Co should account for the lease for the year ended 31 December 2021. Notes to the

accounts are not required.

(12 marks)

4

|

5 Page 5 |

▲back to top |

Part 2

Khomasad is a public limited company and would like advice in relation to the following

transactions.

(a) Khomasad owned a building on which it raised finance. Khomasad sold the building for

N$6 million, its fair value, to a finance company on 1 June 2021 when the carrying amount

was N$3.6 million. The same building was leased back from the finance company for a period

of 20 years. The remaining useful life of the building is 25 years. The lease rentals for the

period are N$441,000 payable annually in arrears. The interest rate implicit in the lease is 7%.

The present value of the lease payments is N$5 million. The transaction constitutes a sale in

accordance with IFRS15 Revenuefrom Contracts with Customers.

REQUIRED:

Advise Khomasad how to account for the above transaction for the year ended 31 May 2022.

(14 marks)

Question 4

(25 Marks)

International Financial Reporting Standards (IFRS) support the use of fair values when

reporting the values of assets wherever practical. This involves periodic remeasurements of

assets and the consequent recognition of gains and losses in the financial statements. There

are several methods of recognising gains and losses on remeasurement of assets required by

IFRS.

Willy adopts the revaluation model of IAS 16 Property, Plant & Equipment, and the fair value

model of IAS40 Investment Property. Willy chooses to recognise any fair value gains or losses

arising on its equity investments in 'other comprehensive income' as permitted by IFRS9

Financial Instruments. The following two matters have arisen

(i) Willy owns a piece of property it purchased on 1 April 2018 for N$3.5 million. The land

component of the property was estimated to be N$1 million at the date of purchase.

The useful economic life of the building on this land was estimated to be 25 years on

1 April 2018. The property was used as the corporate headquarters for two years from

that date. On 1 April 2020, the company moved its headquarters to another building

and leased the entire property for five years to an unrelated tenant on an arm's length

5

|

6 Page 6 |

▲back to top |

basis in order to benefit from the rental income and future capital appreciation. The

fair value of the property on 1 April 2020 was N$4.1 million (land component N$1.9

million), and on 31 March 2021, N$4.8 million (land component N$2.1 million). The

estimate of useful economic life remained unchanged throughout the period. Land

and buildings are considered to be two separate assets by the directors of Willy.

(ii) Willy holds a portfolio of equity investments the value of which was correctly

recorded at N$12 million on 1 April 2020. During the year ended 31 March 2021, the

company received dividends of N$0.75 million. Further equity investments were

purchased at a cost of N$1.6 million. Shares were disposed of during the year for

proceeds of N$1.1 million. These shares had cost N$0.4 million a number of years

earlier but had been valued at N$0.9 million on 1 April 2020. The fair value of the

financial assets held on 31 March 2021 was N$14 million.

REQUIRED:

(a) Advise how IFRSrequire gains or losseson remeasurement to be dealt with in the financial

statements in the case of each of the following assets. The calculation of such gains or losses

is not necessary, merely their accounting treatment. Your answer should indicate clearly

where in the performance statement each component of gain or loss should appear.

(i) Property, plant & equipment held under the revaluation model of IAS 16.

(4 marks)

(ii) Investment property held under the fair value model of IAS40.

(2 marks)

(iii) Financial assets held at fair value under IFRS9.

(4 marks)

(b) In each of the matters (i) and (ii) above, briefly outline the appropriate accounting

treatment and show the journal entries in the financial statements of Willy Ltd (Willy) for year

ended 31 March 2021, resulting from recording the events described. Any entry affecting the

performance statement must be clearly classified as either 'profit or loss' or 'other

comprehensive income'.

(15 marks)

END OF QUESTION PAPER

6