|

PDM611S - PROPERTY DEVELOPMENT AND MARKETING - 2ND OPP - JULY 2023 |

|

1 Page 1 |

▲back to top |

n Am I BI A u n IVER s I TY

OF SCIEnCE

TECHnOLOGY

FACULTY OF ENGINEERING AND THE BUILT ENVIRONMENT

DEPARTMENT OF LAND AND SPATIAL SCIENCES

QUALIFICATION{S): BACHELOR OF PROPERTYSTUDIES

DIPLOMA IN PROPERTYSTUDIES

QUALIFICATION{S) CODE: 08BPRS

06DPRS

NQF LEVEL: 6

COURSE CODE: PDM611S

COURSE NAME: PROPERTYDEVELOPMENT AND

MARKETING

EXAMS SESSION: JULY 2023

PAPER:

THEORY

DURATION:

3 HOURS

MARKS:

100

SECOND OPPORTUNITY/SUPPLEMENTARY EXAMINATION QUESTION PAPER

EXAMINER{S)

SAMUEL ATO K. HAYFORD

MODERATOR:

UAURIKA KAHIREKE

INSTRUCTIONS

1. Read the entire question paper before answering the Questions.

2. Please write clearly and legibly!

3. The question paper contains a total of 4 questions.

4. You must answer ALL QUESTIONS.

5. Make sure your Student Number is on the EXAMINATION BOOK(S).

PERMISSIBLE MATERIALS

1. Non-programmable Scientific Calculator

THIS QUESTION PAPER CONSISTS OF 6 PAGES (Including this front page)

|

2 Page 2 |

▲back to top |

Property Development and Marketing

PDM611S

Question 1

For each of the following statements indicate whether it is 'TRUE' or 'FALSE'. Each correct answer carries 1

mark.

(20)

a) A Listing Contract indicates among other things a broker's fee as a specified amount or as a

percentage of the selling price if the broker finds a buyer from a particular class of people who is

"ready, willing and able" to purchase the property.

(1)

b) For a specific property development project, market research is important in getting to know the

relevant clientele in a specific real estate sub-markets and respond to their needs with a suitable

product offering.

(1)

c) Real estate market analysis has the potential to identify some features lacking in the existing supply

of properties, which if included in the proposed project, will offer a competitive advantage.

(1)

d) If the actual vacancy rate is below the natural vacancy rate, landlords feel they can afford to wait for

better tenants and those who can pay higher rents; this will exert upward pressure on rents.

(1)

e) When real estate demand keeps up with the supply of housing and the local economy is declining,

increase in rentals generally reflect in continued appreciation in real estate prices.

(1)

f) Vacancy levels for commercial and retail spaces are measured in terms of rental units as those for

apartments are measured in square footage.

(1)

g) Rental rates or levels provide a good indicator of the supply and demand situation for income

producing properties.

(1)

h) Market occupancy rate is important because it tells the potential of a property. Low vacancy rates

and a lower number of permits generally show that real estate prices will appreciate.

(1)

i) High vacancy rates indicate an oversupply of real estate which ultimately pressures rental rates

downward because there is so much competition among landlords for tenants.

(1)

Second Opportunity Examination Paper

Page 2 of 6

July 2023

|

3 Page 3 |

▲back to top |

Property Development and Marketing

PDM611S

j) When low occupancy rates occur, it is a landlord's market. The low rates create higher demand for

existing units which, in turn, keeps market prices higher.

(1)

k) Increase in number of property listing is a reflection of a situation in which the cost of renting a home

is low as compared to the cost of buying a home.

(1)

I) Increase in listings of real estate with agents is an indication that the market is becoming saturated.

This provides an incentive for real estate investor to embark on increased property developments.

m) Market areas that boast of better highway network capacity usually tend to have competitive

advantage that enhances their ability to command rent.

(1)

n) Rental revenues can be estimated by looking at comparable properties in the market and

benchmarking existing rental rates. Leasing brokers are the best sources for this type of information.

(1)

o) A more general market study may require demand and pricing analysis of a given site for a proposed

development.

(1)

p) Too many listings give buyers the opportunity to be more picky making investment opportunities

even much more attractive for real estate investors.

(1)

q) Decrease in property listings indicates demand is greater than supply. Price will trend downwards and

so will the opportunity for appreciation will diminish.

(1)

r) Concessions items like upgrades, special deals are normally associated with landlord's market. (1)

s) Natural vacancy rate is that rate where rent increases are zero. Rent growth is negative or falling

when_prevailing vacancy rate is above the natural vacancy rate.

(1)

t) In order to establish the Highest and best use for a given real estate development, the development

concept will normally involve analysis of the real estate space market, physical analysis, legal and

political analysis and financial analysis.

(1)

[20)

Second Opportunity Examination Paper

Page 3 of 6

July 2023

|

4 Page 4 |

▲back to top |

Property Development and Marketing

PDM611S

Question 2

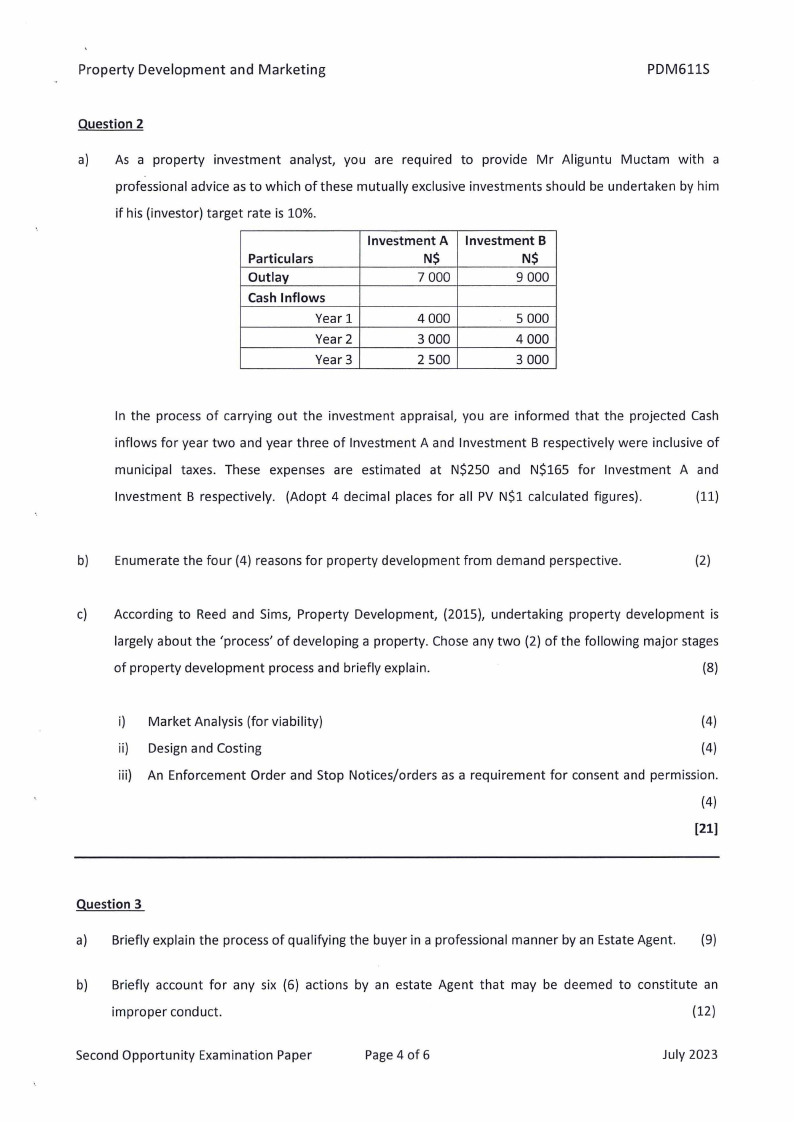

a) As a property investment analyst, you are required to provide Mr Aliguntu Muctam with a

professional advice as to which of these mutually exclusive investments should be undertaken by him

if his (investor) target rate is 10%.

Particulars

Outlay

Cash Inflows

Year 1

Year2

Year3

Investment A

N$

7 000

4 000

3 000

2 500

Investment B

N$

9 000

5 000

4000

3 000

In the process of carrying out the investment appraisal, you are informed that the projected Cash

inflows for year two and year three of Investment A and Investment B respectively were inclusive of

municipal taxes. These expenses are estimated at N$250 and N$165 for Investment A and

Investment B respectively. (Adopt 4 decimal places for all PV N$1 calculated figures).

(11)

b) Enumerate the four (4) reasons for property development from demand perspective.

(2)

c) According to Reed and Sims, Property Development, (2015), undertaking property development is

largely about the 'process' of developing a property. Chose any two (2) of the following major stages

of property development process and briefly explain.

(8)

i) Market Analysis (for viability)

(4)

ii) Design and Costing

(4)

iii) An Enforcement Order and Stop Notices/orders as a requirement for consent and permission.

(4)

[21)

Question 3

a) Briefly explain the process of qualifying the buyer in a professional manner by an Estate Agent. (9)

b) Briefly account for any six (6) actions by an estate Agent that may be deemed to constitute an

improper conduct.

(12)

Second Opportunity Examination Paper

Page 4 of 6

July 2023

|

5 Page 5 |

▲back to top |

Property Development and Marketing

c) Elaborate on the process of selling real estates under estate agency business.

PDM611S

(13)

[34)

Question 4

a) Outline any three (3) Demand factors or indications of apartments (residential facilities as a major

type of property.

(3)

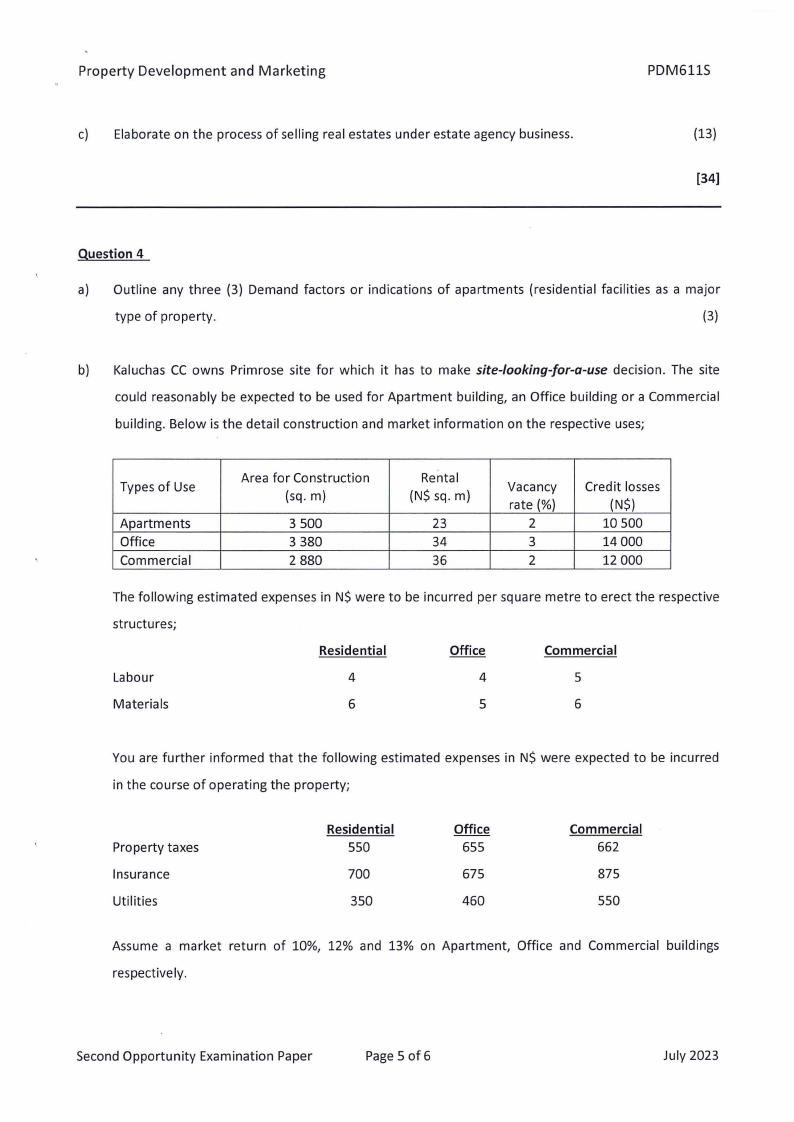

b) Kaluchas CC owns Primrose site for which it has to make site-looking-for-a-use decision. The site

could reasonably be expected to be used for Apartment building, an Office building or a Commercial

building. Below is the detail construction and market information on the respective uses;

Types of Use

Apartments

Office

Commercial

Area for Construction

(sq. m)

3 500

3 380

2 880

Rental

(N$ sq. m)

23

34

36

Vacancy

rate(%)

2

3

2

Credit losses

(N$)

10 500

14 000

12 000

The following estimated expenses in N$ were to be incurred per square metre to erect the respective

structures;

Residential

Office

Commercial

Labour

4

4

5

Materials

6

5

6

You are further informed that the following estimated expenses in N$ were expected to be incurred

in the course of operating the property;

Property taxes

Insurance

Utilities

Residential

550

700

350

Office

655

675

460

Commercial

662

875

550

Assume a market return of 10%, 12% and 13% on Apartment, Office and Commercial buildings

respectively.

Second Opportunity Examination Paper

Page 5 of 6

July 2023

|

6 Page 6 |

▲back to top |

Property Development and Marketing

PDM611S

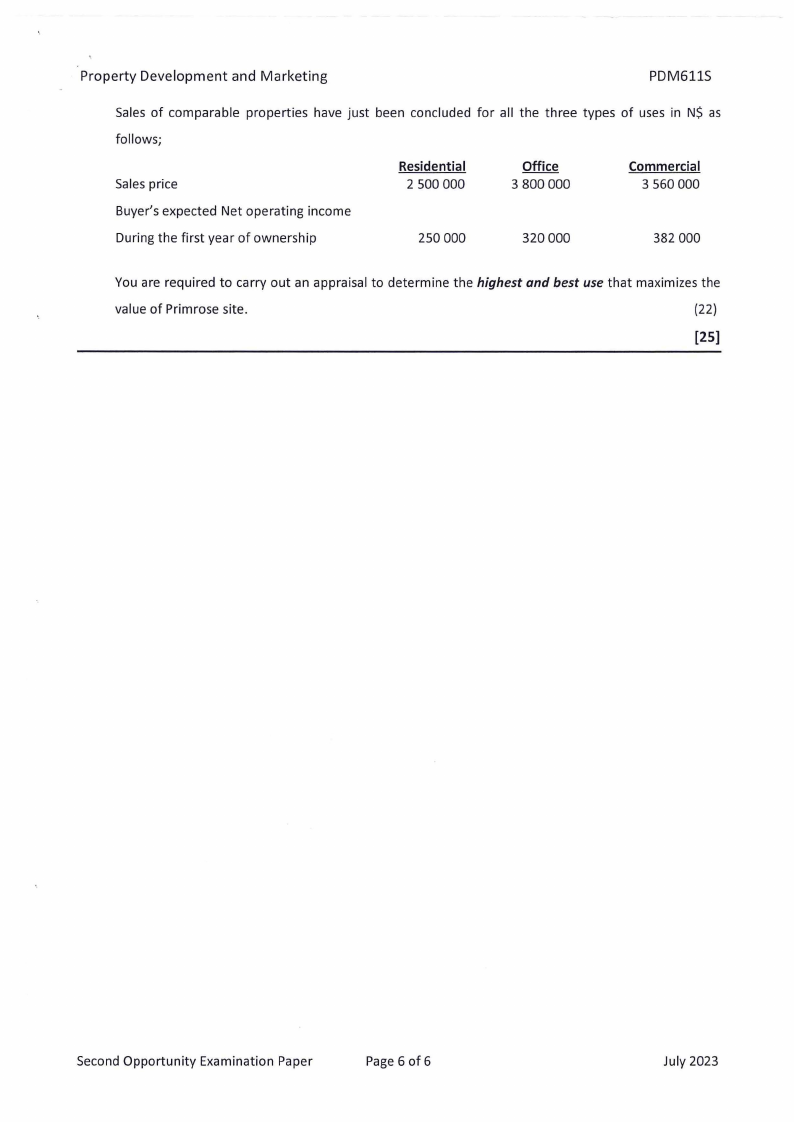

Sales of comparable properties have just been concluded for all the three types of uses in N$ as

follows;

Sales price

Residential

2 500 000

Office

3 800 000

Commercial

3 560 000

Buyer's expected Net operating income

During the first year of ownership

250 000

320 000

382 000

You are required to carry out an appraisal to determine the highest and best use that maximizes the

value of Primrose site.

(22)

[25]

Second Opportunity Examination Paper

Page 6 of 6

July 2023