|

FAC511S - FINANCIAL ACCOUNTING 101 - 2ND OPP - JAN 2020 |

|

1 Page 1 |

▲back to top |

a

Z. e

i

a4

on be

{

toe!

taefe

SSYeia

As Shay

NAMIBIA UNIVERSITY

OF SCIENCE AND TECHNOLOGY

FACULTY OF MANAGEMENT SCIENCES

DEPARTMENT OF ACCOUNTING, ECONOMICS AND FINANCE

QUALIFICATION: BACHELOR OF MARKETING, BACHELOR OF ACCOUNTING, BACHELOR OF

TRANSPORT MANAGEMENT, BACHELOR OF LOGISTICS AND SUPPLY CHAIN MANAGEMENT

QUALIFICATION CODE: 07BMAR/

O07MARB/ 07BOAC/ 07BLSC/

LEVEL: 5

07BTMM

COURSE CODE: FAC511S

COURSE NAME: FINANCIAL ACCOUNTING 101

SESSION: JANUARY 2020

PAPER: THEORY AND CALCULATIONS

DURATION: 3 HOURS

MARKS: 100

SECOND OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINER(S) | C. MAHINDI, V. MAHINDI AND D. NKALA

MODERATOR: | J. van WYK

INSTRUCTIONS

1. Answer ALL questions in blue or black ink only

2. Write clearly and neatly.

3. Start each question on a new page and number the answers

clearly.

4. No programmable calculators are allowed.

Questions relating to the paper may be raised in the initial 30

minutes after the start of the paper. Thereafter, candidates must

use their initiative to deal with any perceived error or ambiguities

& any assumption made by the candidate should be clearly

stated.

. The names of people and businesses used throughout this exam

paper do not reflect reality and are purely coincidental.

. Show all workings!

THIS QUESTION PAPER CONSISTS OF 4 PAGES (Excluding the front page)

|

2 Page 2 |

▲back to top |

QUESTION 1

(15 MARKS)

Your friend started studying accounting this year. He is new to the subject and asked for your

assistance by answering the following questions:

1. The framework for the Preparation and Presentation of Financial Statements includes an

underlying assumption. Name this underlying assumption and briefly explain it.

(3)

2. Briefly explain the term “recognition” in relation to the elements of financial statements. (2)

3. Briefly explain the term “measurement” in relation to the elements of financial statements.

(2)

4. State and briefly explain the fundamental qualitative characteristics as identified in the

Conceptual Framework.

(6)

5. What is the purpose of the Statement of financial position

(2)

QUESTION 2

(15 MARKS)

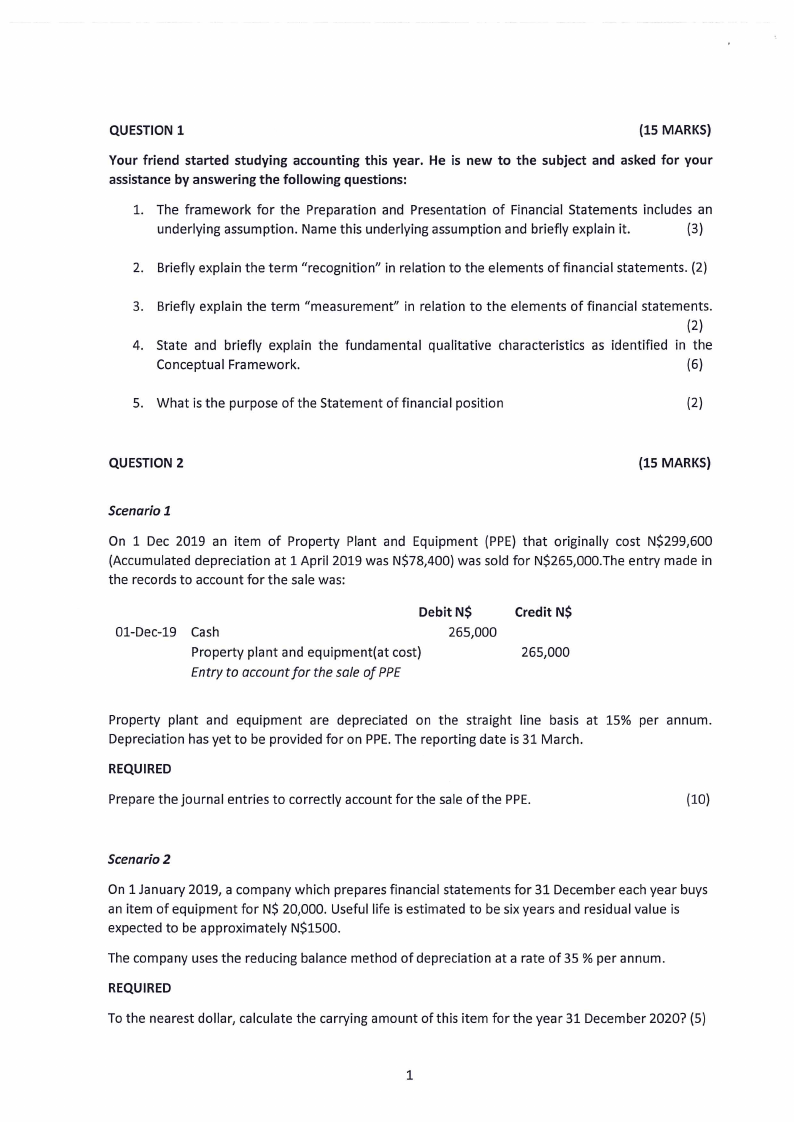

Scenario 1

On 1 Dec 2019 an item of Property Plant and Equipment (PPE) that originally cost NS299,600

(Accumulated depreciation at 1 April 2019 was NS78,400) was sold for NS265,000.The entry made in

the records to account for the sale was:

01-Dec-19

Debit NS

Cash

265,000

Property plant and equipment(at cost)

Entry to account for the sale of PPE

Credit NS

265,000

Property plant and equipment are depreciated on the straight line basis at 15% per annum.

Depreciation has yet to be provided for on PPE. The reporting date is 31 March.

REQUIRED

Prepare the journal entries to correctly account for the sale of the PPE.

(10)

Scenario 2

On 1 January 2019, a company which prepares financial statements for 31 December each year buys

an item of equipment for NS 20,000. Useful life is estimated to be six years and residual value is

expected to be approximately NS1500.

The company uses the reducing balance method of depreciation at a rate of 35 % per annum.

REQUIRED

To the nearest dollar, calculate the carrying amount of this item for the year 31 December 2020? (5)

|

3 Page 3 |

▲back to top |

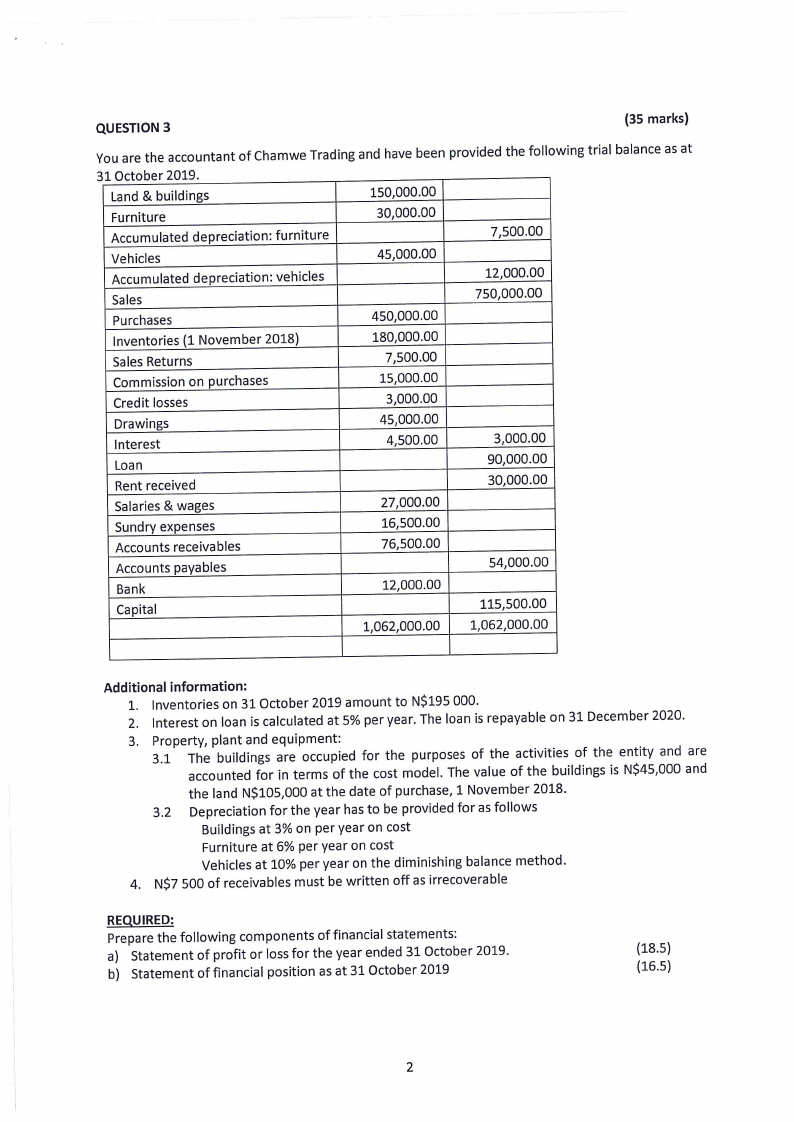

QUESTION 3

(35 marks)

You are the accountant of Chamwe Trading and have been provided the following trial balance as at

31 October 2019.

Land & buildings

150,000.00

Furniture

Accumulated depreciation: furniture

30,000.00

7,500.00

Vehicles

Accumulated depreciation: vehicles

Sales

45,000.00

12,000.00

750,000.00

Purchases

Inventories (1 November 2018)

Sales Returns

Commission on purchases

Credit losses

450,000.00

180,000.00

7,500.00

15,000.00

3,000.00

Drawings

Interest

Loan

Rent received

Salaries & wages

Sundry expenses

45,000.00

4,500.00

27,000.00

16,500.00

3,000.00

90,000.00

30,000.00

Accounts receivables

Accounts payables

Bank

Capital

76,500.00

12,000.00

1,062,000.00

54,000.00

115,500.00

1,062,000.00

Additional information:

1.

2.

Inventories on 31 October 2019 amount to N$195 000.

Interest on loan is calculated at 5% per year. The loan is repayable on 31 December 2020.

3.

Property, plant and equipment:

3.1 The buildings are occupied

for the

purposes

of the

activities

of the

entity

and

are

accounted for in terms of the cost model. The value of the buildings is NS45,000 and

the land NS105,000 at the date of purchase, 1 November 2018.

3.2 Depreciation for the year has to be provided for as follows

Buildings at 3% on per year on cost

Furniture at 6% per year on cost

Vehicles at 10% per year on the diminishing balance method.

4. NS7 500 of receivables must be written off as irrecoverable

REQUIRED:

Prepare the following components of financial statements:

a) Statement of profit or loss for the year ended 31 October 2019.

b) Statement of financial position as at 31 October 2019

(18.5)

(16.5)

|

4 Page 4 |

▲back to top |

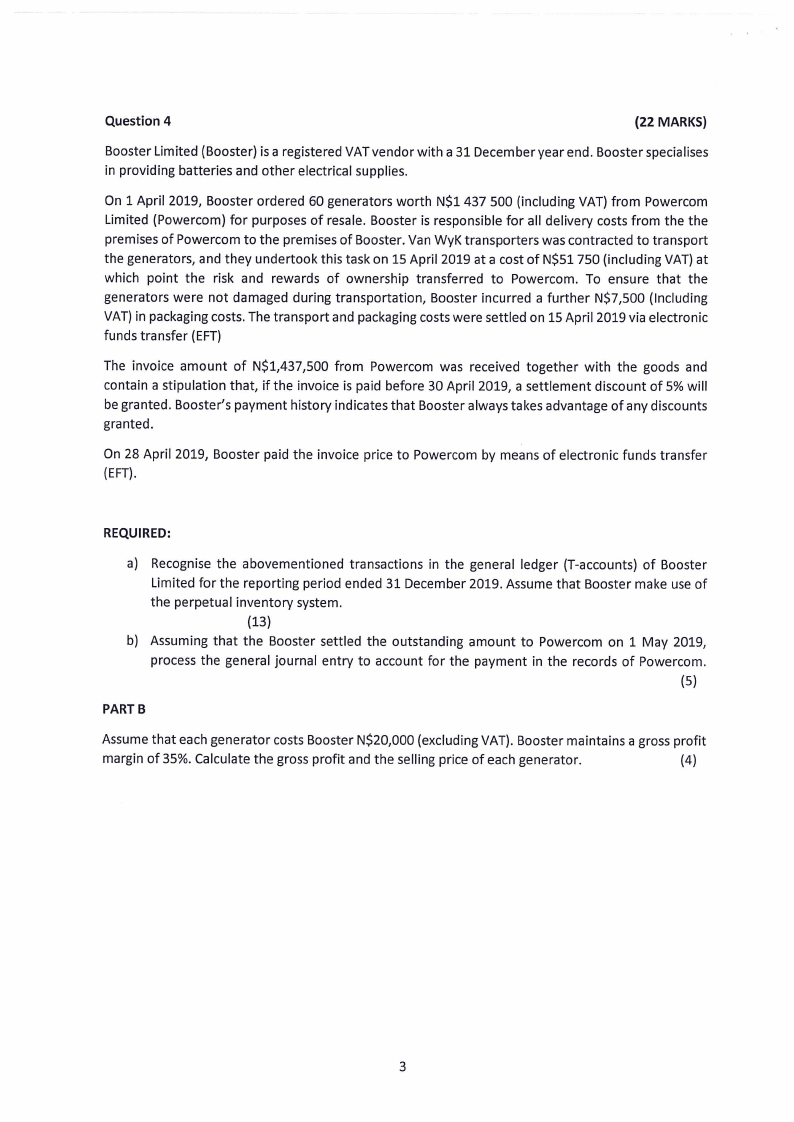

Question 4

(22 MARKS)

Booster Limited (Booster) is a registered VAT vendor with a 31 December year end. Booster specialises

in providing batteries and other electrical supplies.

On 1 April 2019, Booster ordered 60 generators worth N$1 437 500 (including VAT) from Powercom

Limited (Powercom) for purposes of resale. Booster is responsible for all delivery costs from the the

premises of Powercom to the premises of Booster. Van WyK transporters was contracted to transport

the generators, and they undertook this task on 15 April 2019 at a cost of NS$51 750 (including VAT) at

which point the risk and rewards of ownership transferred to Powercom. To ensure that the

generators were not damaged during transportation, Booster incurred a further NS7,500 (Including

VAT) in packaging costs. The transport and packaging costs were settled on 15 April 2019 via electronic

funds transfer (EFT)

The invoice amount of N$1,437,500 from Powercom was received together with the goods and

contain a stipulation that, if the invoice is paid before 30 April 2019, a settlement discount of 5% will

be granted. Booster’s payment history indicates that Booster always takes advantage of any discounts

granted.

On 28 April 2019, Booster paid the invoice price to Powercom by means of electronic funds transfer

(EFT).

REQUIRED:

a) Recognise the abovementioned transactions in the general ledger (T-accounts) of Booster

Limited for the reporting period ended 31 December 2019. Assume that Booster make use of

the perpetual inventory system.

(13)

b) Assuming that the Booster settled the outstanding amount to Powercom on 1 May 2019,

process the general journal entry to account for the payment in the records of Powercom.

(5)

PART B

Assume that each generator costs Booster N$20,000 (excluding VAT). Booster maintains a gross profit

margin of 35%. Calculate the gross profit and the selling price of each generator.

(4)

|

5 Page 5 |

▲back to top |

QUESTION 5

(13 MARKS)

Samsung (Pty) Ltd’s current reporting period ends on 30 June 2019 and they use the periodic inventory

system.

On 10 June 2019 , Samsung (Pty) Ltd entered into a written agreement with a customer, CellShop (Pty)

Ltd. The contract was signed by both parties and stipulates, inter alia, the following:

e 300Samsung S4 cellphones will be delivered to CellShop (Pty) Ltd’s premises on the following

dates:

o 175 cellphones will be delivered on 20 June 2019; and

o 125cellphones will be delivered on 6 July 2019.

e The sales price of the 300 cellphones is NS862 500 (including VAT) and it is payable on 31 July

2019.

The sales price per cellphone is not influenced by the sales volume and the Samsung S4 cellphone is a

distinct product.

CellShop (Pty) Ltd has an excellent payment record and the expectation is that the outstanding amount

will be paid before the due date.

Both companies are registered as VAT vendors in accordance with the VAT Act. A VAT rate of 15% is

applicable.

YOU ARE REQUIRED TO:

Recognise the revenue (sales) by applying the 5-step model of IFRS 15. Assume that the requirements

of step 1 have been met. Show workings where applicable.

(13 marks)

END OF PAPER!

|

6 Page 6 |

▲back to top |