|

BAI620S - BUSINESS ACCOUNTING FOR INFORMATICS - 1ST OPP - NOV 2022 |

|

1 Page 1 |

▲back to top |

n Am IBIA u n IVERs ITY

OFSCIEnCEAno TECHnOLOGY

FACULTY OF COMMERCE, HUMAN SCIENCES AND EDUCATION

DEPARTMENT OF ACCOUNTING, ECONOMICS AND FINANCE

QUALIFICATION : Bachelor of Informatics

QUALIFICATION CODE: 07 BAIF

COURSE CODE: BAl620S

SESSION: November 2022

LEVEL: 5

COURSE NAME: BUSINESS ACCOUNTING FOR

INFORMATICS

PAPER: THEORY AND CALCULATIONS

DURATION: 3 HOURS

MARKS: 100 marks

FIRST OPPORTUNITY FINAL EXAMINATION - QUESTION PAPER

EXAMINER(S) Ms M E Cloete

MODERATOR Ms Y Andrew

INSTRUCTIONS

1. This paper consists of FIVE pages. If your paper does not contain all the pages,

please put up your hand so that a replacement paper can be handed to you.

2. Answer ALL questions in blue or black ink only.

3. Write clearly and neatly.

4. Number each answer clearly.

5. No programmable calculators are allowed.

6. Show all workings clearly.

7. Round all numbers to the nearest whole number.

8. Questions relating to the paper may be raised in the initial 30 minutes after the start

of the paper. Thereafter, candidates must use their initiative to deal with any perceived

error or ambiguities & any assumption made by the candidate should be clearly

stated.

9. Delete all open spaces on your answer sheets with pen. Pages on your answer sheet

that contain pencil or tippex will be marked as such and will not be eligible for a

remark.

10. Read questions carefully, if you need to provide explanations, you should always use

full sentences, refrain from simply naming facts.

11. Any resemblance to any people, places, organisations or anything are purely

coincidental.

|

2 Page 2 |

▲back to top |

'

l

QUESTION 1

(22 MARKS)

a) List the 4 branches of Accounting?

(4 marks)

b) Explain the following accounting concepts:

(3 marks)

• Entity concept

• Money measurement concept

• Going concern concept

c) Provide the different types of business forms in Namibia and name one advantage and

one disadvantage of each business form. Provide your answer in a tabular format as

below:

{12 Marks)

Business Type

Advantage

Disadvantage

(4 marks)

(4 marks)

(4 marks)

d) Define the various source documents:

• Goods received note

• Invoice

• Petty cash voucher

(3 marks)

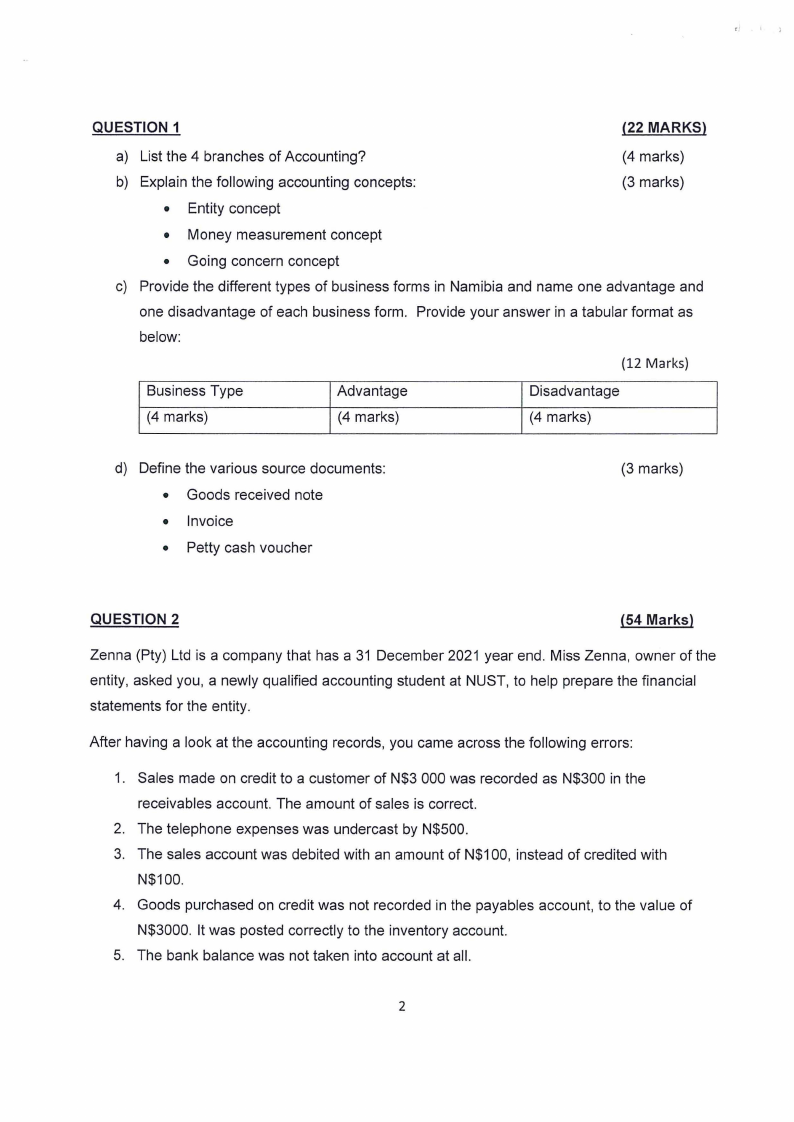

QUESTION 2

(54 Marks)

Zenna (Pty) Ltd is a company that has a 31 December 2021 year end. Miss Zenna, owner of the

entity, asked you, a newly qualified accounting student at NUST, to help prepare the financial

statements for the entity.

After having a look at the accounting records, you came across the following errors:

1. Sales made on credit to a customer of N$3 000 was recorded as N$300 in the

receivables account. The amount of sales is correct.

2. The telephone expenses was undercast by N$500.

3. The sales account was debited with an amount of N$100, instead of credited with

N$100.

4. Goods purchased on credit was not recorded in the payables account, to the value of

N$3000. It was posted correctly to the inventory account.

5. The bank balance was not taken into account at all.

2

|

3 Page 3 |

▲back to top |

6. There are 365 days in the year for the company.

7. All sales and purchases made are on credit.

8. Ignore VAT for the entire question.

Land and Buildings

Inventory

Telephone

Discount received

Trade payables

Trade receivables

Sales

Cost of sales

Salaries and wages

Capital

Loan

Vehicles

Drawings

90 000

15 500

2 000

500

9 000

7 000

48 000

16 000

13 500

22 500

100 000

22 000

10 000

a) Prepare the trial balance for the entity as at 31 December 2021, after factoring in the

various adjustments.

(18 marks)

b) Prepare the statement of profit and loss for the entity for the period ended 31 December

2021.

(8 marks)

c) Prepare the statement of financial position for the entity as at 31 December 2021.

(18 marks)

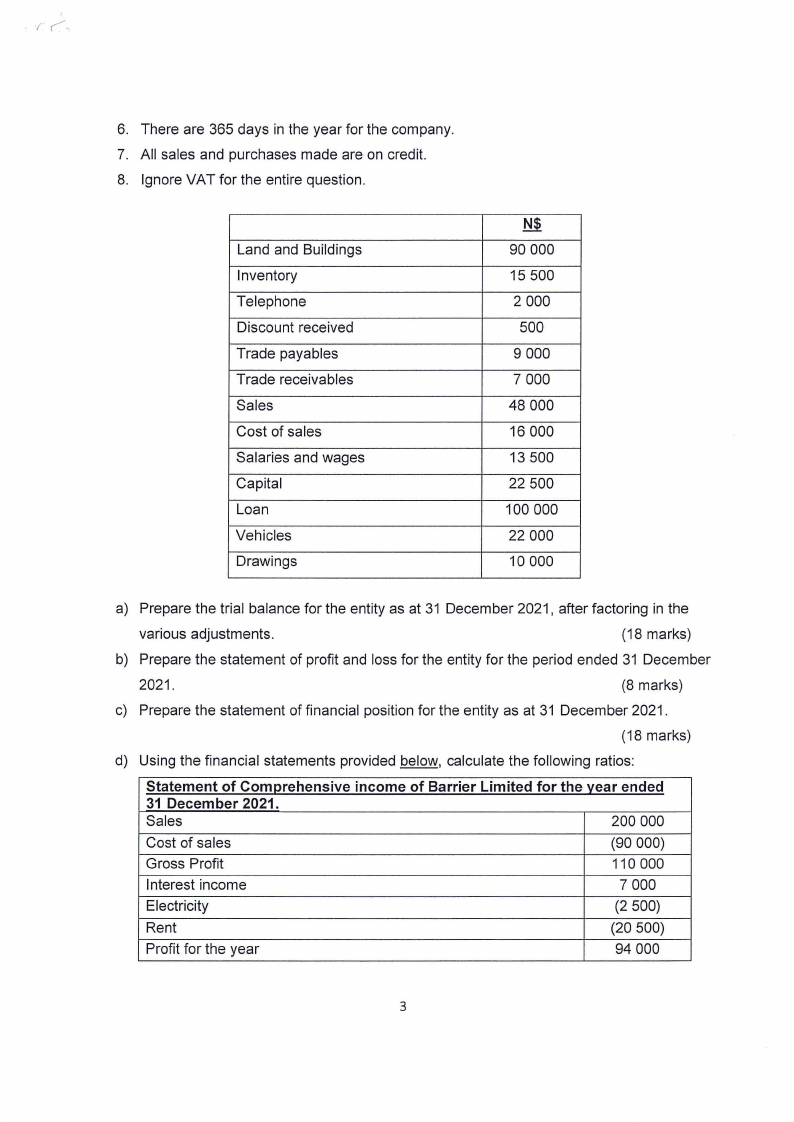

d) Using the financial statements provided below, calculate the following ratios:

Statement of Com~rehensive income of Barrier Limited for the ~ear ended

31 December 2021.

Sales

200 000

Cost of sales

(90 000)

Gross Profit

110 000

Interest income

7 000

Electricity

(2 500)

Rent

(20 500)

Profit for the year

94 000

3

|

4 Page 4 |

▲back to top |

r'

Statement of Financial Position of Barrier Limited as at 31 December 2021.

Assets

Non current Assets

170 000

Land and BuildinQs

120 000

Vehicles

50 000

Current Assets

Inventory

Trade receivables

Bank

Total Assets

25 700

16 300

9 000

51 000

221 000

Equity and Liabilities

Eauitv

Capital

Net profit

90 000

94 000

184 000

Non Current Liabilities

Loan

25 600

25 600

Current Liabilities

Trade payables

Total Liabilities

11 400

11 400

37 000

Total Equity and liabilities

221 000

• Current ratio

• Gross profit margin

• Net profit margin

• Debtors' collection period

• Days stock on hand

(2 marks)

(2 marks)

(2 marks)

(2 marks)

(2 marks)

Question 3

(24 Marks)

a) Explain what the difference between input VAT (Value Added Tax) and output VAT is.

(2 Marks)

b) Provide 2 examples of items that are exempt for VAT purposes.

(2 Marks)

c) Nanna Trading, is a sole trader, that specializes in the supply and provision of building

equipment and services for construction purposes. Nanna Trading is a registered VAT

4

|

5 Page 5 |

▲back to top |

vendor, and you have been provided with the following transactions for the month of

October 2021:

1. The entity performed repair services for a customer (who is not a registered VAT

vendor) for the amount of N$2700 (excluding VAT). The customer paid cash.

2. The owner bought milk, coffee and sugar for the employees of the entity, to

consume during office hours. The total value of the supplies is N$180 including

VAT, purchased from Checkers (a VAT vendor).

3. The entity purchased spare parts for repairs from Build It, for N$3500 (including

VAT). Build It is a registered VAT vendor.

4. Paid salaries and wages to employees for N$15 000.

5. The entity performed repairs on a window for a customer on credit. The total

amount owing by the customer is N$1 700 (including VAT).

Required:

i. Prepare the journal entries for all the above transactions.

(13 marks)

ii. Prepare the VAT control account in the general ledger for the above

transactions, including the closing off of the account and carrying over.

(7 marks)

END OF QUESTION PAPER!

5

|

6 Page 6 |

▲back to top |

/

o>JBqmaal

Wlndho9lc

e.!AMIBIA

2022-10-19

ECONOMAICNSDF!l\\!ANCE