|

AEM810S-APPLIED ECONOMETRICS-1ST OPP-JUNE 2022 |

|

1 Page 1 |

▲back to top |

n Am I BI A u n IVE Rs ITY

OF SCIEnCE Ano TECHn OLOGY

FACULTY OF COMMERCE, HUMAN SCIENCES AND EDUCATION

DEPARTMENT OF ACCOUNTING, ECONOMICS AND FINANCE

QUALIFICATION:

BACHELOR OF ECONOMICS HONOURS DEGREE

QUALIFICATION CODE:

08HECO

COURSE CODE:

AEM810S

LEVEL:

8

COURSE NAME: APPLIED ECONOMETRICS

SESSION:

PAPER:

THEORY

DURATION:

3 HOURS MARKS:

100

FIRST OPPORTUNITY QUESTION PAPER

EXAMINER(S) Prof. Tafirenyika Sunde

MODERATOR: Dr. Reinhold Karna ti

INSTRUCTIONS

1. Answer ALL the questions.

2. Write clearly and neatly.

3. Number the answers clearly.

PERMISSIBLE MATERIALS

1. Ruler

2. Calculator

THIS QUESTION PAPER CONSISTS OF 4 PAGES

1

|

2 Page 2 |

▲back to top |

QUESTION 1 (25 MARKS)

a) What is the difference between time-series and cross-sectional data?

[5]

b) Explain the purpose of the following diagnostic tests, and also state their hypotheses

and decision rules

1. Normality

[3]

ll. Autocorrelation

[3]

lll. Heteroscedasticity

[3]

IV. Ramsey RESET

[3]

V. CUSUM

[3]

c) Given the following unrestricted OLS regression equation

Yt = B0 + B1Xu + B2Xu + B3X3t + B4X4t + B5Xst + et

1. State the hypothesis and decision rule used to test whether X2, X3 and X4 are

redundant variables.

[4]

11. If the variables in question c) i. are redundant, how would the adjusted

coefficient of determination be affected?

[1]

QUESTION 2 (25 MARKS)

a) What properties of time series data would make Ordinary Least Squares (OLS) results

spurious?

[2]

b) State the four characteristics of the spurious OLS regression equation. [4]

c) Why should one conduct the unit-roots tests?

[4]

d) State the Augmented Dickey-Fuller (ADF) and Phillips Peron equations used to test for

unit roots.

[10]

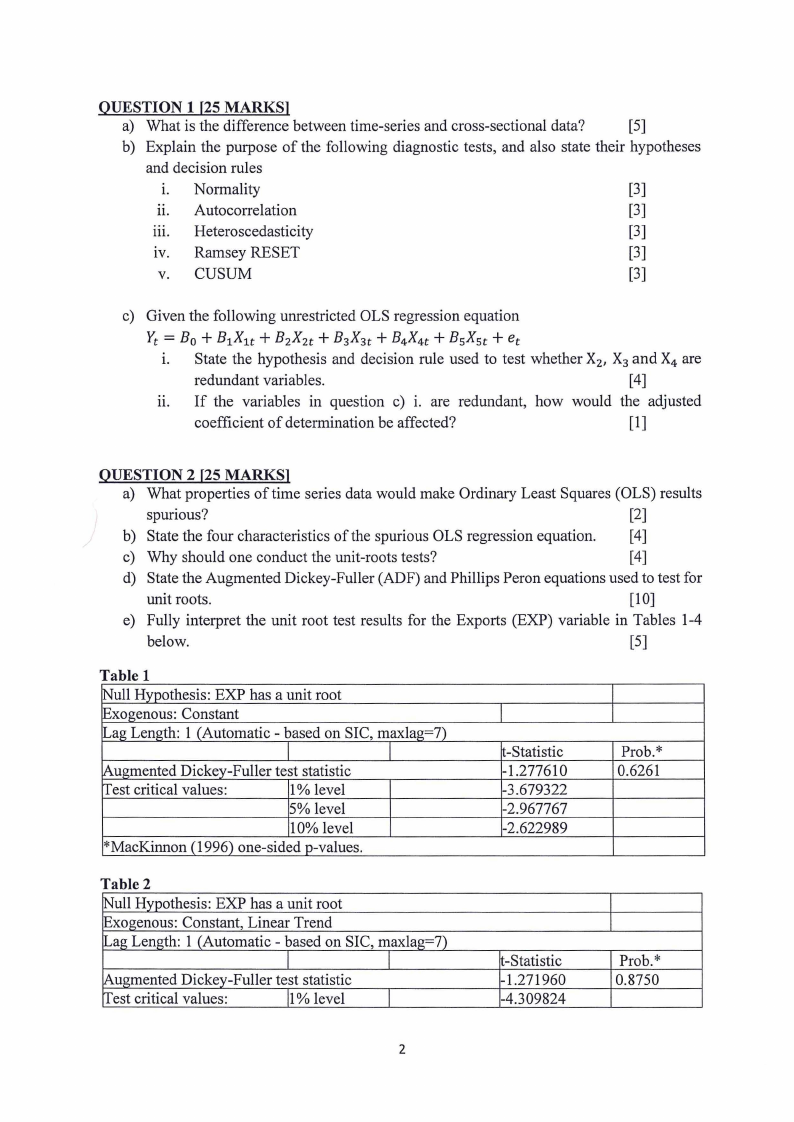

e) Fully interpret the unit root test results for the Exports (EXP) variable in Tables 1-4

below.

[5]

Table 1

Null Hypothesis: EXP has a unit root

Exogenous: Constant

Lag Length: 1 (Automatic - based on SIC, maxlag=7)

Augmented Dickey-Fuller test statistic

Test critical values:

1% level

5% level

10% level

*MacKinnon (1996) one-sided p-values.

~-Statistic

-1.277610

-3.679322

-2.967767

-2.622989

Prob.*

0.6261

Table 2

Null Hypothesis: EXP has a unit root

Exogenous: Constant, Linear Trend

lag Length: 1 (Automatic - based on SIC, maxlag=7)

I

I

!Augmented Dickey-Fuller test statistic

[est critical values:

11% level

I

~-Statistic

-1.271960

-4.309824

Prob.*

0.8750

2

|

3 Page 3 |

▲back to top |

15%level

I

110%level I

*MacKinnon (1996) one-sided p-values.

Table 3

Null Hypothesis: D(EXP) has a unit root

!Exogenous: Constant

I.,agLength: 2 (Automatic - based on SIC, maxlag=7)

!Augmented Dickey-Fuller test statistic

[est critical values:

1% level

5% level

I 0% level

*MacKinnon (1996) one-sided p-values.

Table 4

Null Hypothesis: D(EXP) has a unit root

!Exogenous: Constant, Linear Trend

Lag Length: 2 (Automatic - based on SIC, maxlag=7)

[Augmented Dickey-Fuller test statistic

[est critical values:

1% level

5% level

10% level

*MacKinnon (1996) one-sided p-values.

l-3.574244

l-3.221128

t-Statistic

-3.903703

-3.699871

-2.976263

-2.627420

t-Statistic

-4.340872

-4.339330

-3.587527

-3.229230

Prob.*

0.0062

Prob.*

0.0100

QUESTION 3 [25 MARKS)

a) Under what circumstances do you use the ARDL econometrics method?

b) Given Gross Domestic Product (GDP), Capital (K) and Labour (L) variables, where

GDP is the dependent variable, and K and L are independent variables, answer the

following questions:

1. Write the ARDL equation for the three variables.

[3]

11. How do you test for cointegration using the equation in b) i. above? State the

hypothesis and decision rule.

[2]

111. If cointegration is confirmed state, the ARDL-ECM for these three variables.

[8]

1v. Write down the short-run and long-run parameters in the ARDL-ECM equation.

[2]

v. Interpret the ARDL-ECM results in Table 5 below.

[5]

3

|

4 Page 4 |

▲back to top |

Table S

ARDL Error Correction Regression

Dependent Variable: D(LNGDP)

Selected Model: ARDL(3, 2, 1)

Case 2: Restricted Constant and No Trend

Variable

Coefficient

D(LNGDP(-1))

0.272387

D(LNGDP(-2))

0.111162

D(LNPCE)

0.418140

D(LNPCE(-1))

0.455314

D(LNPDI)

0.136933

ECT(-1)

-0.868385

R-squared

0.992970

Adjusted R-squared

0.991297

S.E. of regression

0.001965

Sum squared residual

8. l lE-05

Log likelihood

133.3458

Durbin-Watson stat

1.712794

Std. Error

t-Statistic

0.041986

6.487582

0.019216

5.784960

0.026011

16.07579

0.061821

7.364981

0.005837

23.45855

0.060270

-14.40829

Mean dependent var

S.D. dependent var

Akaike info criterion

Schwarz criterion

Hannan-Quinn criterion.

Prob.

0.0000

0.0000

0.0000

0.0000

0.0000

0.0000

0.029535

0.021068

-9.433025

-9.145061

-9.347398

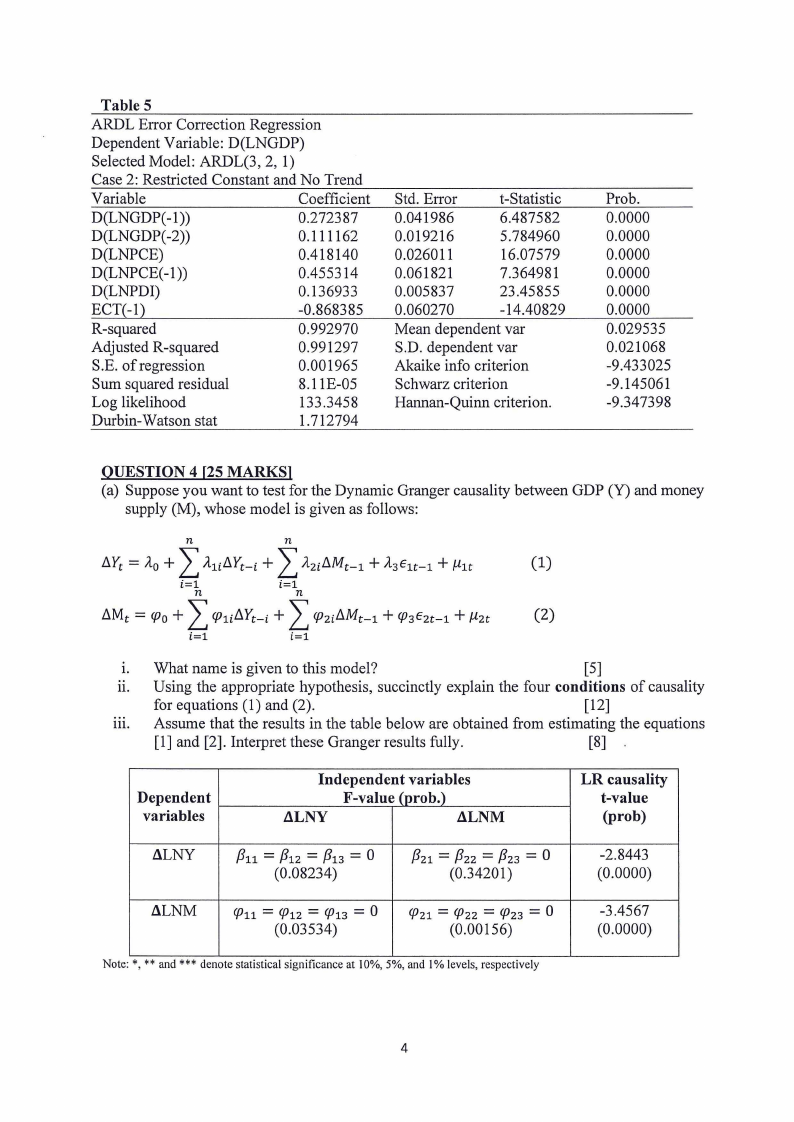

QUESTION 4 [25 MARKS)

(a) Suppose you want to test for the Dynamic Granger causality between GDP (Y) and money

supply (M), whose model is given as follows:

L L n

n

LiYt=Ao+ A1iLiYt-i + A2iLiMt-l + A3Eu_ 1 + µ1t

(1)

L L i=ln

i=l n

= LiMt

(/Jo+

(/JHLiYt-i+

+ + (/J2iLiMt-1

(fJ3E2t-1 µ2t

(2)

i=l

i=l

1. What name is given to this model?

[5]

11. Using the appropriate hypothesis, succinctly explain the four conditions of causality

for equations (1) and (2).

[12]

m. Assume that the results in the table below are obtained from estimating the equations

[1] and [2]. Interpret these Granger results fully.

[8]

Dependent

variables

Independent variables

F-value (prob.)

LlLNY

LlLNM

LR causality

t-value

(prob)

LlLNY

/311 = /312 = /313 = 0

(0.08234)

/321 = /322 = /323 = 0

(0.34201)

-2.8443

(0.0000)

LlLNM

(/J11 = (/J12 = (fJ13 = 0

(0.03534)

(/J21 = (/J22 = (/J23 = 0

(0.00156)

-3.4567

(0.0000)

Note:*,** and*** denote statistical significance at 10%, 5%, and 1% levels, respectively

4