|

BAC621C- BUSINESS ACCOUNTING 2B CATS- 2ND OPP- JUNE 2023 |

|

1 Page 1 |

▲back to top |

nAmlBIA

UnlVERSITY

0 F SCIEnCEAno

TECHnOLOGY

HP-65B

HAROLDPUPKEWITZ

GraduateSchoolof Business

FACULTY OF COMMERCE, HUMAN SCIENCESAND EDUCATION

HAROLDPUPKEWITZGRADUATESCHOOLOF BUSINESS(HP-GSB)

HAROLD PUPKEWITZ GRADUATE SCHOOL OF BUSINESS

QUALIFICATION: DIPLOMA IN BUSINESS PROCESS MANAGEMENT

QUALIFICATION CODE: 06DBPM LEVEL: 6

COURSE CODE: BAC621 C

COURSE NAME: INTRODUCTION TO

BUSINESS MANAGEMENT

SESSION: JULY 2023

DURATION: 3 HOURS

PAPER: PAPER 2

MARKS: 100

SECOND OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINER

Sheehama, K.G.H.

MODERATOR Odada, L

INSTRUCTIONS

1. Answer ALL the questions.

2. Write clearly and neatly, showing all your workings

3. Number the answers clearly.

4. Round off your final answers to 2 decimal places

PERMISSIBLE MATERIALS

1. Examination paper

2. Examination script

3. Non-programmable calculator

THIS QUESTION PAPER CONSISTS OF 7 PAGES (including this front page)

|

2 Page 2 |

▲back to top |

What amount should be budgeted for direct labour in February?

(2)

A.

N$160 000

B.

N$140 000

C.

N$146 000

D.

136 500

1.3 Explain any three (3) of functions of budgets.

(6)

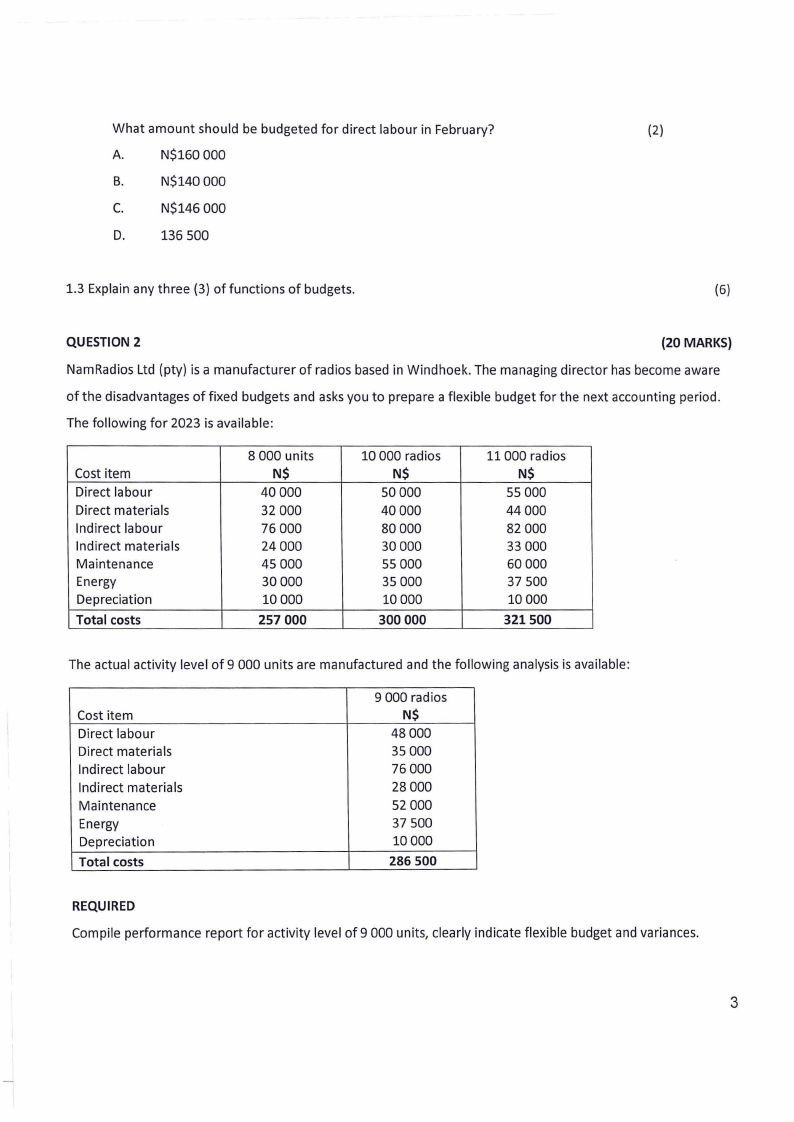

QUESTION 2

(20 MARKS)

NamRadios Ltd (pty) is a manufacturer of radios based in Windhoek. The managing director has become aware

of the disadvantages of fixed budgets and asks you to prepare a flexible budget for the next accounting period.

The following for 2023 is available:

Cost item

Direct labour

Direct materials

Indirect labour

Indirect materials

Maintenance

Energy

Depreciation

Total costs

8 000 units

N$

40000

32 000

76 000

24 000

45 000

30000

10000

257 000

10 000 radios

N$

so000

40000

80 000

30 000

55 000

35 000

10000

300 000

11 000 radios

N$

55 000

44000

82 000

33 000

60000

37 500

10000

321500

The actual activity level of 9 000 units are manufactured and the following analysis is available:

Cost item

Direct labour

Direct materials

Indirect labour

Indirect materials

Maintenance

Energy

Depreciation

Total costs

9 000 radios

N$

48000

35 000

76 000

28 000

52 000

37 500

10000

286 500

REQUIRED

Compile performance report for activity level of 9 000 units, clearly indicate flexible budget and variances.

3

|

3 Page 3 |

▲back to top |

REQUIRED:

Prepare the following budgets in (N$) for the year ended 30 April 2023:

3.1 Sales budget

(3)

3.2 Production budget

(4)

3.3 Direct materials purchased budget

(6)

3.4 Direct labour budget

(3)

3.5 Manufacturing overheads budget

(3)

3.6 Total fixed costs budget

(1)

QUESTION 4

(20 Marks)

Angie Silva has recently opened The Sandal Shop in Rundu, a store that specializes in fashionable sandals. Angie

has just received a degree at the NUSTand she is anxious to apply the principles she has learned. In time, she

hopes to open a chain of sandal shops. As a first step, she has prepared the following analysis for her new store:

Sales price per pair of sandals

N$400

Variable

expenses per pair of sandals

_.1§Q

Contribution margin per pair of sandals

N$240

Pair of sandals sold

320

Fixed expenses per year:

Building rental

N$15 000

Equipment depreciation

7 000

Selling expenses

20000

Administrative expenses

18 000

Total fixed expenses

N$60 000

REQUIRED:

4.1 Calculate how many pairs of sandals must be sold each year to break even in units and N$.

(6)

4.2 Angie has decided that she must earn at least N$31 200 as profit in the first year to justify her time and

effort. Calculate how many pairs of sandals must be sold to reach this target profit.

(3)

4.3 Angie now has two salespersons working in the store - one full time and one part time. It will cost her an

additional fixed expense N$40 000 per year to convert the part-time position to a full-time position. Angie

believes that the change will bring in additional 300 pair of sandals annually. Would you recommend her

to change the position? Justify.

(11)

5

|

4 Page 4 |

▲back to top |

APPENDIXTABLE1

Present Value Tables

Number

Interest Rate per Year

of Years 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15%

1 .990 .980 .971 .962 .952 .943 .935 .926 .917 .909 .901 .893 .885 .877 .870

2 .980 .961 .943 .925 .907 .890 .873 .857 .842 .826 .812 .797 .783 .769 .756

3 .971 .942 .915 .889 .864 .840 .816 .794 .772 .751 .731 .712 .693 .675 .658

4 .961 .924 .888 .855 .823 .792 .763 .735 .708 .683 .659 .636 .613 .592 .572

5 .951 .906 .863 .822 .784 .747 .713 .681 .650 .621 .593 .567 .543 .519 .497

6 .942 .888 .837 .790 .746 .705 .666 .630 .596 .564 .535 .507 .480 .456 .432

7 .933 .871 .813 .760 .711 .665 .623 .583 .547 .513 .482 .452 .425 .400 .376

8 .923 .853 .789 .731 .677 .627 .582 .540 .502 .467 .434 .404 .376 .351 .327

9 .914 .837 .766 .703 .645 .592 .544 .500 .460 .424 .391 .361 .333 .308 .284

10 .905 .820 .744 .676 .614 .558 .508 .463 .422 .386 .352 .322 .295 .270 .247

11 .896 .804 .722 .650 .585 .527 .475 .429 .388 .350 .317 .287 .261 .237 .215

12 .887 .788 .701 .625 .557 .497 .444 .397 .356 .319 .286 .257 .231 .208 .187

13 .879 .773 .681 .601 .530 .469 .415 .368 .326 .290 .258 .229 .204 .182 .163

14 .870 .758 .661 .577 .505 .442 .388 .340 .299 .263 .232 .205 .181 .160 .141

15 .861 .743 .642 .555 .481 .417 .362 .315 .275 .239 .209 .183 .160 .140 .123

16 .853 .728 .623 .534 .458 .394 .339 .292 .252 .218 .188 .163 .141 .123 .107

17 .844 .714 .605 .513 .436 .371 .317 .270 .231 .198 .170 .146 .125 .108 .093

18 .836 .700 .587 .494 .416 .350 .296 .250 .212 .180 .153 .130 .111 .095 .081

19 .828 .686 .570 .475 .396 .331 .277 .232 .194 .164 .138 .116 .098 .083 .070

20 .820 .673 .554 .456 .377 .312 .258 .215 .178 .149 .124 .104 .087 .073 .061

= Discountfactors:Presentvalueof $1 to be receivedafter t years 1/(1 + r)1.

Number

Interest Rate per Year

of Years 16% 17% 18% 19% 20% 21% 22% 23% 24% 25% 26% 27% 28% 29% 30%

1 .862 .855 .847 .840 .833 .826 .820 .813 .806 .800 .794 .787 .781 .775 .769

2 .743 .731 .718 .706 .694 .683 .672 .661 .650 .640 .630 .620 .610 .601 .592

3 .641 .624 .609 .593 .579 .564 .551 .537 .524 .512 .500 .488 .477 .466 .455

4 .552 .534 .516 .499 .482 .467 .451 .437 .423 .410 .397 .384 .373 .361 .350

5 .476 .456 .437 .419 .402 .386 .370 .355 .341 .328 .315 .303 .291 .280 .269

6 .410 .390 .370 .352 .335 .319 .303 .289 .275 .262 .250 .238 .227 .217 .207

7 .354 .333 .314 .296 .279 .263 .249 .235 .222 .210 .198 .188 .178 .168 .159

8 .305 .285 .266 .249 .233 .218 .204 .191 .179 .168 .157 .148 .139 .130 .123

9 .263 .243 .225 .209 .194 .180 .167 .155 .144 .134 .125 .116 .108 .101 .094

10 .227 .208 .191 .176 .162 .149 .137 .126 .116 .107 .099 .092 .085 .078 .073

11 .195 .178 .162 .148 .135 .123 .112 .103 .094 .086 .079 .072 .066 .061 .056

12 .168 .152 .137 .124 .112 .102 .092 .083 .076 .069 .062 .057 .052 .047 .043

13 .145 .130 .116 .104 .093 .084 .075 .068 .061 .055 .050 .045 .040 .037 .033

14 .125 .111 .099 .088 .078 .069 .062 .055 .049 .044 .039 .035 .032 .028 .025

15 .108 .095 .084 .074 .065 .057 .051 .045 .040 .035 .031 .028 .025 .022 .020

16 .093 .081 .071 .062 .054 .047 .042 .036 .032 .028 .025 .022 .019 .017 .015

17 .080 .069 .060 .052 .045 .039 .034 .030 .026 .023 .020 .017 .015 .013 .012

18 .069 .059 .051 .044 .038 .032 .028 .024 .021 .018 .016 .014 .012 .010 .009

19 .060 .051 .043 .037 .031 .027 .023 .020 .017 .014 .012 .011 .009 .008 .007

20 .051 .043 .037 .031 .026 .022 .019 .016 .014 .012 .010 .008 .007 .006 .005

Note:Forexamplei,f theinterestrateis 10%peryear,thepresentvalueof $1receivedatyear5 is $.621.

7