|

BBF612S - BUSINESS FINANCE - 1ST OPP - NOV 2024 |

|

1 Page 1 |

▲back to top |

nAmlBIA UnlVERSITY

OF SCIEn CE Ano TECHn OLOGY

FACULTY OF COMMERCE, HUMAN SCIENCES AND EDUCATION

DEPARTMENT OF GOVERNANCE AND MANAGEMENT SCIENCES

QUALIFICATION: BACHELOR OF BUSINESS MANAGEMENT

QUALIFICATION CODE: 07BBMN

LEVEL: 7

COURSE CODE: BBF612S

COURSE NAME: BUSINESSFINANCE

SESSION: NOVEMBER 2024

DURATION: 2 HOURS

PAPER: PAPER1/1

MARKS: 100

EXAMINER(S)

FIRST OPPORTUNITY EXAMINATION QUESTION PAPER

MSC KAUAMI

MS B NDUNGAUA

MODERATOR: MR ERNEST MBANGA

INSTRUCTIONS

1. Answer ALL the questions, except question 4 where you may choose

EITHER a. orb.

2. Show all formulae and calculations as marks will be awarded for them.

3. Write clearly and neatly.

4. Number the answers clearly.

PERMISSIBLE MATERIALS

1. Calculator.

THIS QUESTION PAPER CONSISTS OF 6 PAGES (Including this front page)

1

|

2 Page 2 |

▲back to top |

SECTION A: MULTIPLE CHOICE QUESTIONS

[10 Marks]

Question 1: Multiple Choice Questions- Choosethe correct Answer

Please note that all questions carry 1 mark each.

1. The following are important considerations in financing assets, except:

a. Inflation

b. Suitability

c. Control

d. Timing

2. A good source of finance for a business that has difficulty in collecting debts is

a. Factoring

b. Debentures

c. Trade credit

d. Invoice discounting

3. Which of the following long-term financing methods is interest free?

a. Debentures

b. Bonds

c. Equity

d. Mortgage.

4. Bonds

a. require monthly instalments, comprising an interest component and partial

down payment of the principal.

b. are forms of equity financing which may be used for an indefinite period.

c. may be converted into overdraft accounts.

d. require interest payments every six months and repayment of the principal at

maturity.

5. A firm can finance its long-term financing by means of the following:

a. Equity, bank overdraft, debentures, bonds

b. Mortgage loan, equity, trade credit, bonds

c. Bonds, debentures, equity, mortgage loan

d. Trade credit, equity, overdraft, mortgage loan

6. Financial plans do not involve predictions of the economic outlook

a. True

b. False

2

|

3 Page 3 |

▲back to top |

7. Retailers have heavy reliance on short-term debt because of having higher

proportion of temporary current assets.

a. True

b. False

8. Is it correct for you to advise a business to finance its short-term obligations using

long-term debt, in order to secure its cash flow position?

a. Yes

b. No

9. If firms obtain funds from creditors or by means of preference shares, they ....

a. Sacrifice little or no share of control of management

b. Sacrifice all share of control of management

c. Gain no share of control of management

d. None of the above

10. Financial leverage uses debt financing to:

a. Decrease liabilities and therefore increase the firm's value

a. Increase the EPS(earnings per share) and the value of the firm

b. Increase the firm's cost of capital

c. All of these

d. None of these

3

|

4 Page 4 |

▲back to top |

SECTION B: SHORT QUESTIONS

[57 Marks]

Question 2: Introduction to Financial Management

(12 marks)

(1 marks per principle;3 marks for relevant explanations)

Explain the three fundamental principles of financial management.

Question 3: Users of Financial Statements

(14 marks)

(1 mark per user and 1 mark for relevant explanation)

Name the main users of financial statements and indicate what information they are

normally interested in.

Question 4: Profit planning and control

(14 marks)

(1 mark per advantage/principle and 1 mark for relevant explanation)

Answer only one question, either a) OR b).

a) Briefly summarise the advantages of budgeting.

OR

b) Briefly summarise the principles of budgeting.

Question 5: The Time Value of Money

(9 marks)

The purpose of financial management is to increase the value of the firm. In this

regard, the effect of time on the value of money is significant.

1. Briefly explain the concept of time value of money (TVM).

(3)

2. Contrast the concepts of Future Values (FV) and Present Values (PV) as concepts of

the time value of money.

(6)

Question 6: The Management of Working Capital

Briefly explain a firm's motives for holding cash

(8 marks)

(2 marks per correct answer)

(8)

4

|

5 Page 5 |

▲back to top |

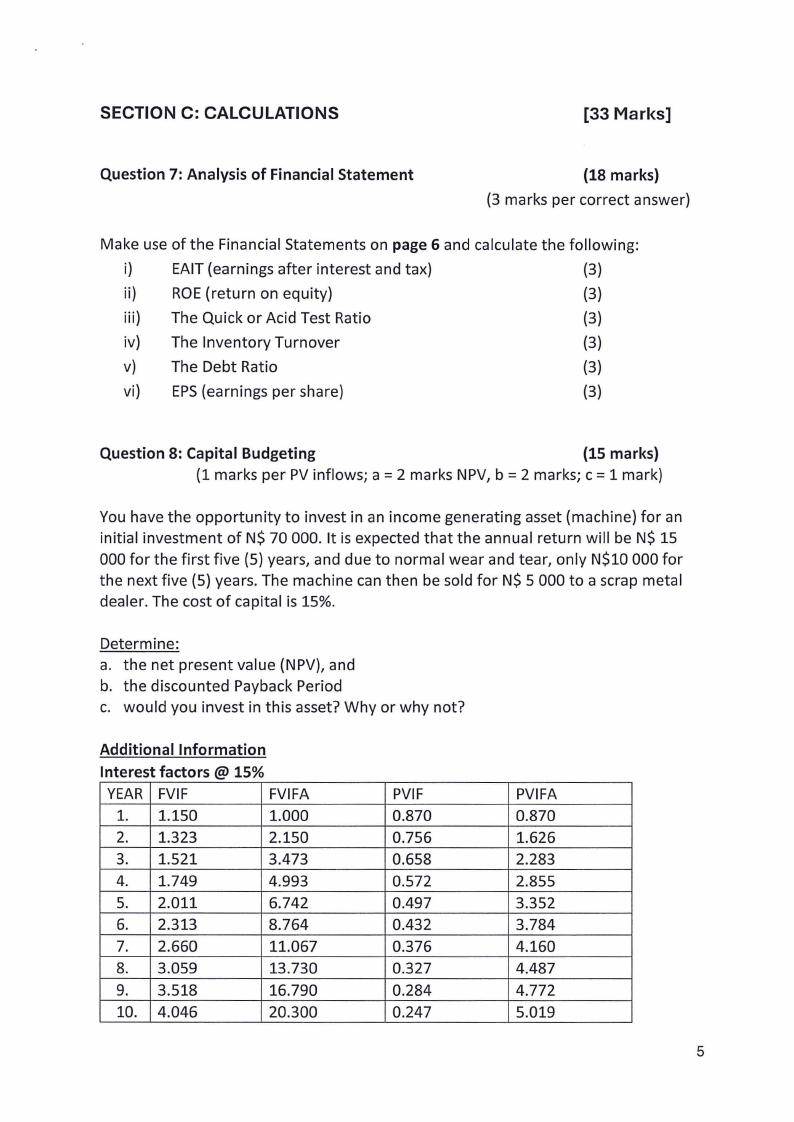

SECTION C: CALCULATIONS

[33 Marks]

Question 7: Analysis of Financial Statement

(18 marks)

(3 marks per correct answer)

Make use of the Financial Statements on page 6 and calculate the following:

i)

EAIT (earnings after interest and tax)

(3)

ii) ROE(return on equity)

(3)

iii) The Quick or Acid Test Ratio

(3)

iv) The Inventory Turnover

(3)

v) The Debt Ratio

(3)

vi) EPS(earnings per share)

(3)

Question 8: Capital Budgeting

(15 marks)

(1 marks per PV inflows; a= 2 marks NPV, b = 2 marks; c = 1 mark)

You have the opportunity to invest in an income generating asset (machine) for an

initial investment of N$ 70 000. It is expected that the annual return will be N$ 15

000 for the first five (5) years, and due to normal wear and tear, only N$10 000 for

the next five (5) years. The machine can then be sold for N$ 5 000 to a scrap metal

dealer. The cost of capital is 15%.

Determine:

a. the net present value (NPV), and

b. the discounted Payback Period

c. would you invest in this asset? Why or why not?

Additional Information

Interest factors @ 15%

YEAR FVIF

FVIFA

1. 1.150

1.000

2. 1.323

2.150

3. 1.521

3.473

4. 1.749

4.993

5. 2.011

6.742

6. 2.313

8.764

7. 2.660

11.067

8. 3.059

13.730

9. 3.518

16.790

10. 4.046

20.300

PVIF

0.870

0.756

0.658

0.572

0.497

0.432

0.376

0.327

0.284

0.247

PVIFA

0.870

1.626

2.283

2.855

3.352

3.784

4.160

4.487

4.772

5.019

5

|

6 Page 6 |

▲back to top |

•, I

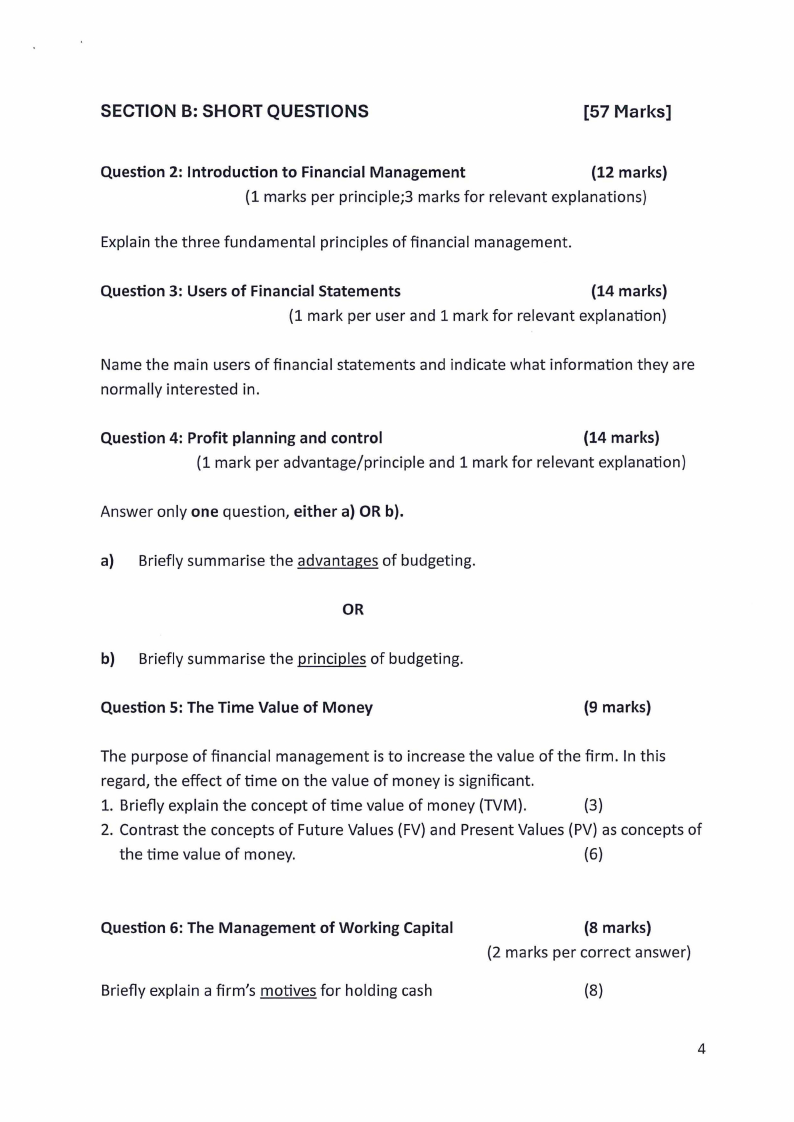

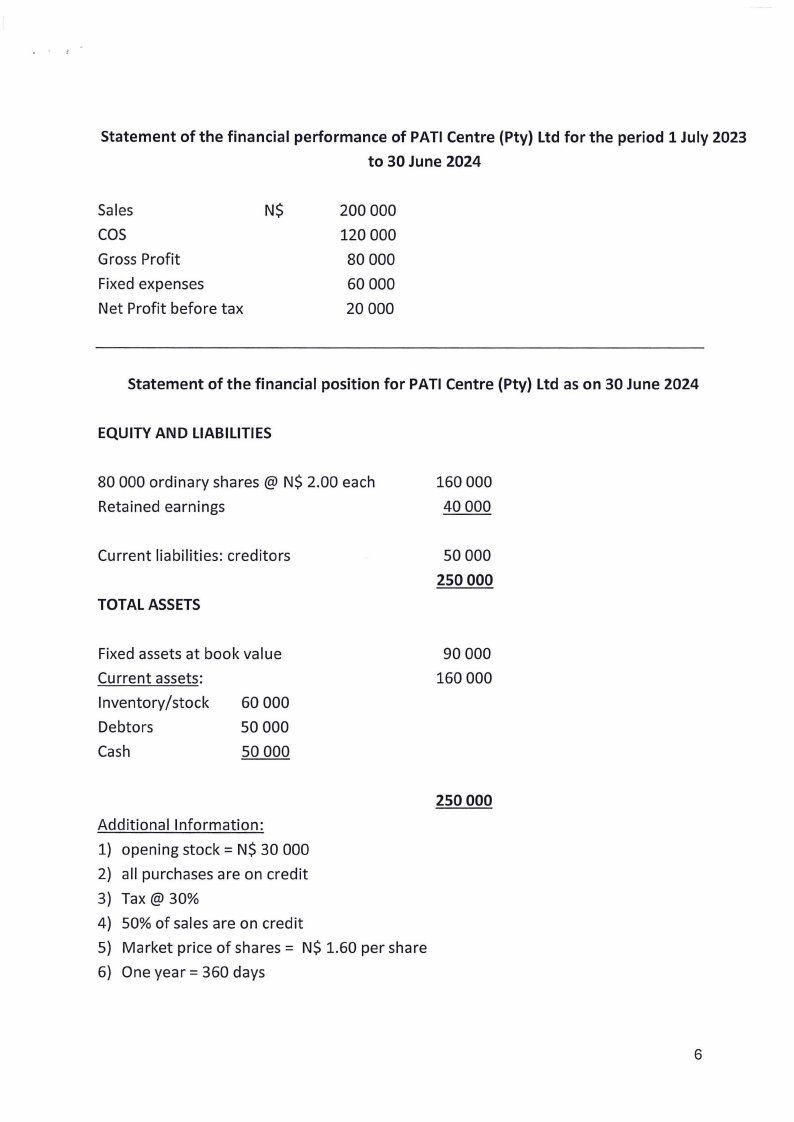

Statement of the financial performance of PATI Centre (Pty) Ltd for the period 1 July 2023

to 30 June 2024

Sales

N$

cos

Gross Profit

Fixed expenses

Net Profit before tax

200 000

120 000

80 000

60 000

20 000

Statement of the financial position for PATI Centre (Pty) Ltd as on 30 June 2024

EQUITY AND LIABILITIES

80 000 ordinary shares@ N$ 2.00 each

Retained earnings

Current liabilities: creditors

TOTAL ASSETS

160 000

40 000

so000

250 000

Fixed assets at book value

Current assets:

Inventory/stock

Debtors

Cash

60 000

so 000

so 000

90 000

160 000

250 000

Additional Information:

1) opening stock= N$ 30 000

2) all purchases are on credit

3) Tax@ 30%

4) 50% of sales are on credit

5) Market price of shares= N$ 1.60 per share

6) One year= 360 days

6