|

BBF612S - BUSINESS FINANCE - 2ND OPP - NOV 2024 |

|

1 Page 1 |

▲back to top |

nAm I BI A un IVERS ITY

OF SCIEnCE Ano TECHnOLOGY

FACULTY OF COMMERCE, HUMAN SCIENCES AND EDUCATION

DEPARTMENT OF GOVERNANCE AND MANAGEMENT SCIENCES

QUALIFICATION: BACHELOR OF BUSINESS MANAGEMENT

QUALIFICATION CODE: 07BBMN

LEVEL: 7

COURSE CODE: BBF612S

COURSE NAME: BUSINESSFINANCE

SESSION: JANUARY 2025

DURATION: 2 HOURS

PAPER: PAPER1/1

MARKS: 100

SECOND OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINER(S)

MSCKAUAMI

MS B NDUNGAUA

MODERATOR: MR ERNEST MBANGA

INSTRUCTIONS

1. Answer ALL the questions.!

2. Show all formulae and calculations as marks will be awarded for them.

3. Write clearly and neatly.

4. Number the answers clearly.

PERMISSIBLE MATERIALS

1. Calculator.

THIS QUESTION PAPER CONSISTS OF 4 PAGES (Including this front page)

1

|

2 Page 2 |

▲back to top |

SECTIONA: SHORT QUESTIONS

[67 Marks]

Question 1: The Agency Problem

(10 marks)

Discuss management and/or other issues that can lead to the agency problem.

Question 2: Financial Statements

{12 marks)

(1 mark per principle and 1 mark for relevant explanation)

Name and briefly explain any 6 generally accepted accounting principles that have to

be adhered to when compiling financial statements.

Question 3: Analysis of Financial Statement

(15 marks)

(1 mark per ratio type and 2 marks for relevant explanation)

Identify the basic types/groups of financial ratios that can be used in financial

statement analysis, explain what they measure and give an example of each

type/group.

Question 4: Capital Budgeting

{14 marks)

Among key decisions that a financial manager makes are decisions pertaining to

capital budgeting.

1. Briefly explain capital budgeting

(4)

2. Discuss the two approaches to making capital budgeting decisions (10}

Question 5: Financing

{16 marks)

(2 marks per correct answer)

Briefly outline the characteristics that distinguish debt from equity as a source of

finance.

2

|

3 Page 3 |

▲back to top |

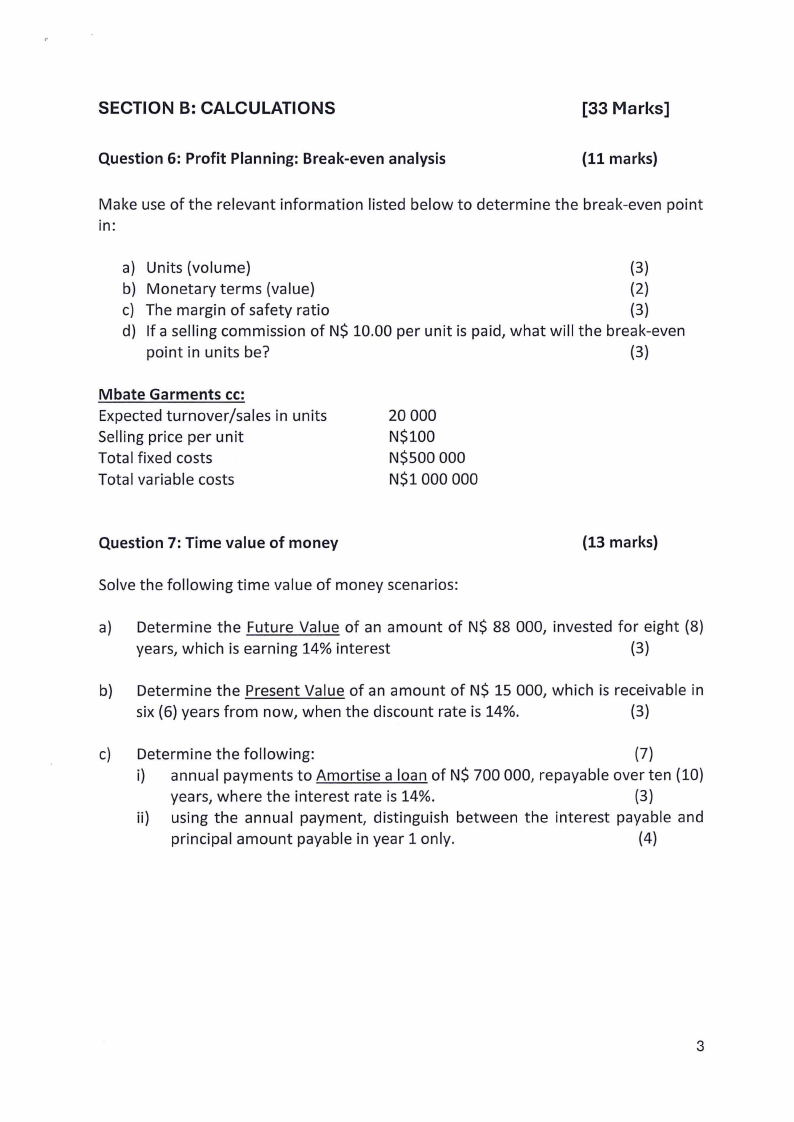

SECTION B: CALCULATIONS

[33 Marks]

Question 6: Profit Planning: Break-even analysis

(11 marks)

Make use of the relevant information listed below to determine the break-even point

in:

a) Units (volume)

(3)

b) Monetary terms (value)

(2)

c) The margin of safety ratio

(3)

d) If a selling commission of N$ 10.00 per unit is paid, what will the break-even

point in units be?

(3)

Mbate Garments cc:

Expected turnover/sales

Selling price per unit

Tota I fixed costs

Total variable costs

in units

20 000

N$100

N$500 000

N$1000 000

Question 7: Time value of money

(13 marks)

Solve the following time value of money scenarios:

a) Determine the Future Value of an amount of N$ 88 000, invested for eight (8)

years, which is earning 14% interest

(3)

b) Determine the Present Value of an amount of N$ 15 000, which is receivable in

six (6) years from now, when the discount rate is 14%.

(3)

c) Determine the following:

(7)

i) annual payments to Amortise a loan of N$ 700 000, repayable over ten (10)

years, where the interest rate is 14%.

(3)

ii) using the annual payment, distinguish between the interest payable and

principal amount payable in year 1 only.

(4)

3

|

4 Page 4 |

▲back to top |

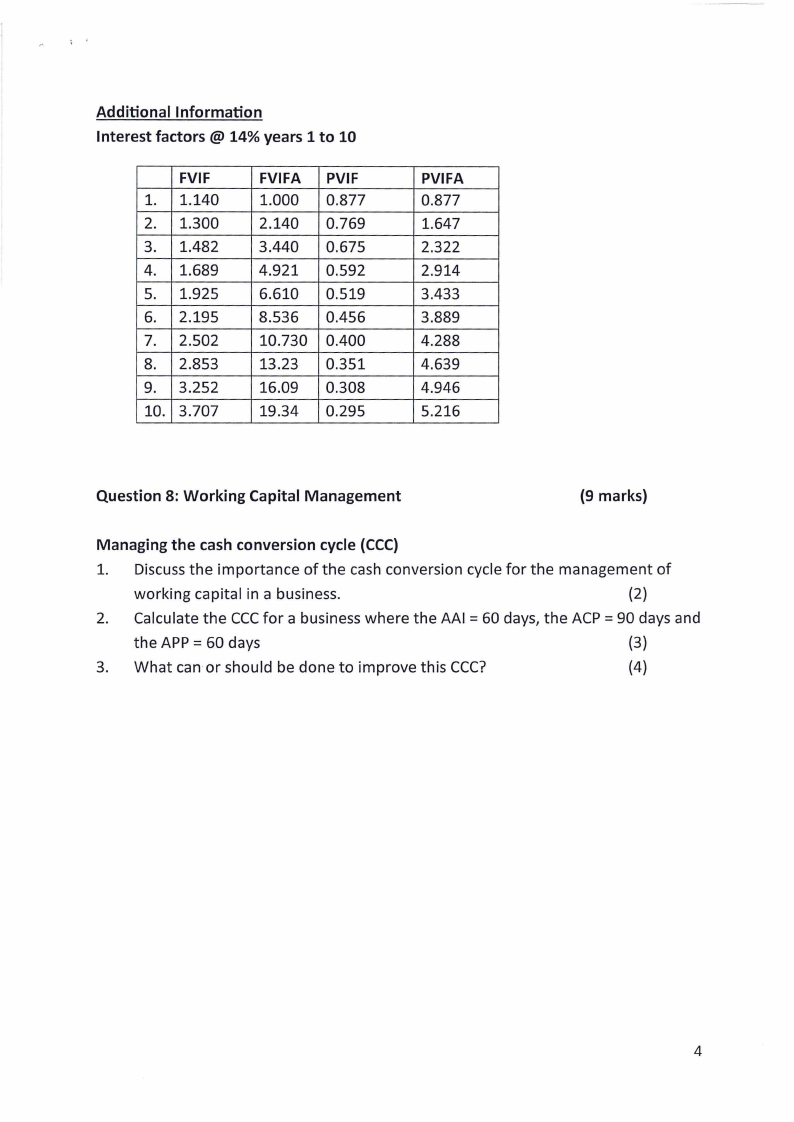

Additional Information

Interest factors @ 14% years 1 to 10

FVIF

1. 1.140

2. 1.300

3. 1.482

4. 1.689

5. 1.925

6. 2.195

7. 2.502

8. 2.853

9. 3.252

10. 3.707

FVIFA

1.000

2.140

3.440

4.921

6.610

8.536

10.730

13.23

16.09

19.34

PVIF

0.877

0.769

0.675

0.592

0.519

0.456

0.400

0.351

0.308

0.295

PVIFA

0.877

1.647

2.322

2.914

3.433

3.889

4.288

4.639

4.946

5.216

Question 8: Working Capital Management

(9 marks)

Managing the cash conversion cycle (CCC)

1. Discuss the importance of the cash conversion cycle for the management of

working capital in a business.

(2)

2. Calculate the CCCfor a business where the AAI = 60 days, the ACP = 90 days and

the APP= 60 days

(3)

3. What can or should be done to improve this CCC?

(4)

4