|

FOB412S - FUNDAMENTALS OF AGRIBUSINESS MANAGEMENT - 1ST OPP - NOV 2024 |

|

1 Page 1 |

▲back to top |

nAmlBIA UnlVERSITY

OF SCIEnCE TECHnOLOGY

FACULTY OF COMMERCE, HUMAN SCIENCESAND EDUCATION

DEPARTMENT OF TECHNICAL AND VOCATIONAL EDUCATION AND TRAINING (TVET)

QUALIFICATION: NUST BRIDGING PROGRAMME -TVET AGRICULTURE STREAM

QUALIFICATION CODE: 04NBTA

LEVEL: 4

COURSE CODE: FOB412S

COURSE NAME: FUNDAMENTALS

OF AGRIBUSINESS MANAGEMENT

SESSION: NOVEMBER 2024

DURATION: 3 HOURS

PAPER: 1

MARKS: 100

EXAMINER(S)

FIRST OPPORTUNITY EXAMINATION QUESTION PAPER

Ms. E MATALI

MODERATOR: Mr. A MERORO

INSTRUCTIONS

1. The paper has 3 SECTIONS (A, Band C).

2. Write clearly and neatly using a black or blue ink pen.

3. Show all your work clearly and neatly.

4. Each section must start on a new page.

5. All written work MUST be done in blue or black ink.

PERMISSIBLE MATERIALS: 1. Non-Programmable Calculator without the cover

THIS QUESTION PAPER CONSISTS OF_ 4_ PAGES (Including this front page)

|

2 Page 2 |

▲back to top |

SECTION A

QUESTION 1

[10 marks]

Write down the letter corresponding to your choice next to the question number.

1.1. What is agribusiness?

a) The process of growing crops.

b) The management of agricultural products and services as a business.

c) The marketing of agricultural machinery.

d) Farming for subsistence.

(2 Marks)

1.2. Which of the following is NOT a function of management in agribusiness?

a) Planning

b) Organizing

c) Forecasting

d) Production

(2 Marks)

1.3. An agribusiness that controls all stages of production from growing crops to selling

to consumers is practicing:

a) Horizontal integration

b) Vertical integration

c) Cooperative management

d) Diversification

(2 Marks)

1.4. Which financial statement shows the assets, liabilities, and equity of an

agribusiness at a specific point in time?

a) Income Statement

b) Cash Flow Statement

c) Balance Sheet

d) Profit and LossStatement

(2 Marks)

1

|

3 Page 3 |

▲back to top |

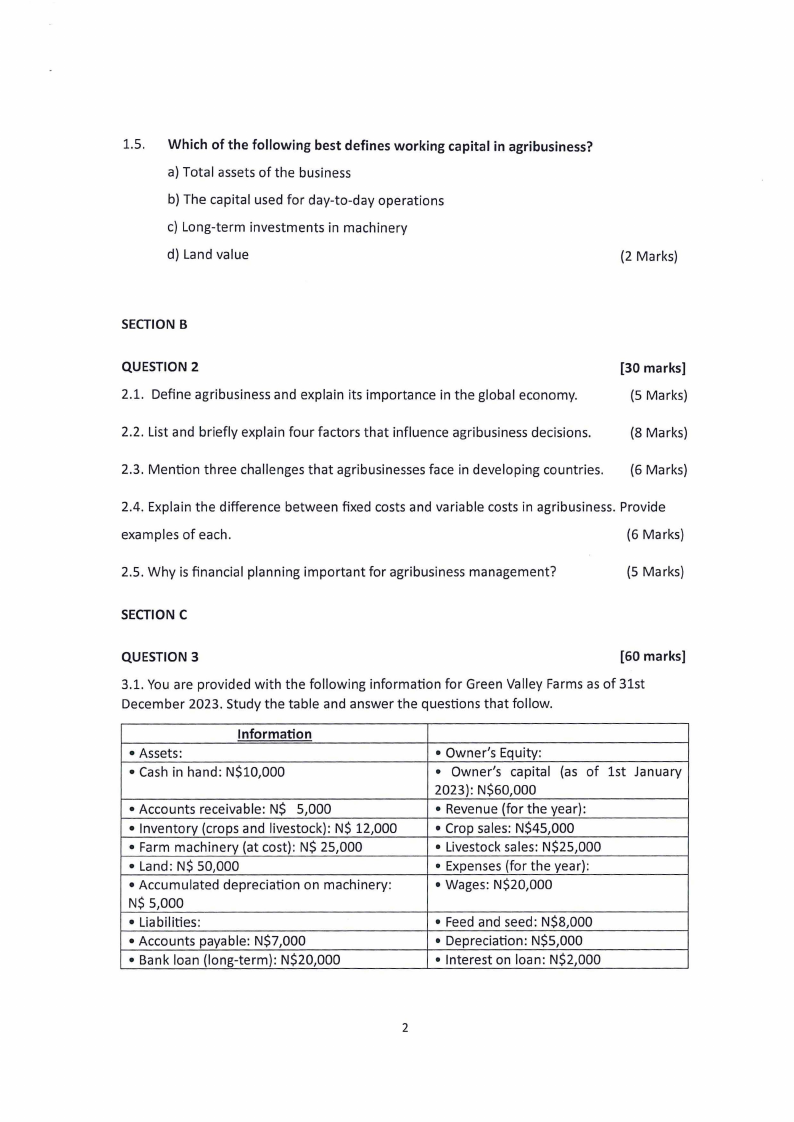

1.5. Which of the following best defines working capital in agribusiness?

a) Total assets of the business

b) The capital used for day-to-day operations

c) Long-term investments in machinery

d) Land value

(2 Marks)

SECTION B

QUESTION 2

2.1. Define agribusiness and explain its importance in the global economy.

[30 marks]

(5 Marks)

2.2. List and briefly explain four factors that influence agribusiness decisions.

(8 Marks)

2.3. Mention three challenges that agribusinesses face in developing countries. (6 Marks)

2.4. Explain the difference between fixed costs and variable costs in agribusiness. Provide

examples of each.

(6 Marks)

2.5. Why is financial planning important for agribusiness management?

(5 Marks)

SECTION C

QUESTION 3

[GOmarks]

3.1. You are provided with the following information for Green Valley Farms as of 31st

December 2023. Study the table and answer the questions that follow.

Information

• Assets:

•Cashin hand: N$10,000

• Accounts receivable: N$ 5,000

• Inventory (crops and livestock): N$ 12,000

• Farm machinery (at cost): N$ 25,000

• Land: N$ 50,000

• Accumulated depreciation on machinery:

N$ 5,000

• Liabilities:

• Accounts payable: N$7,000

• Bank loan (long-term): N$20,000

• Owner's Equity:

• Owner's capital (as of 1st January

2023): N$60,000

• Revenue (for the year):

• Crop sales: N$45,000

• Livestock sales: N$25,000

• Expenses (for the year):

• Wages: N$20,000

• Feed and seed: N$8,000

• Depreciation: N$5,000

• Interest on loan: N$2,000

2

|

4 Page 4 |

▲back to top |

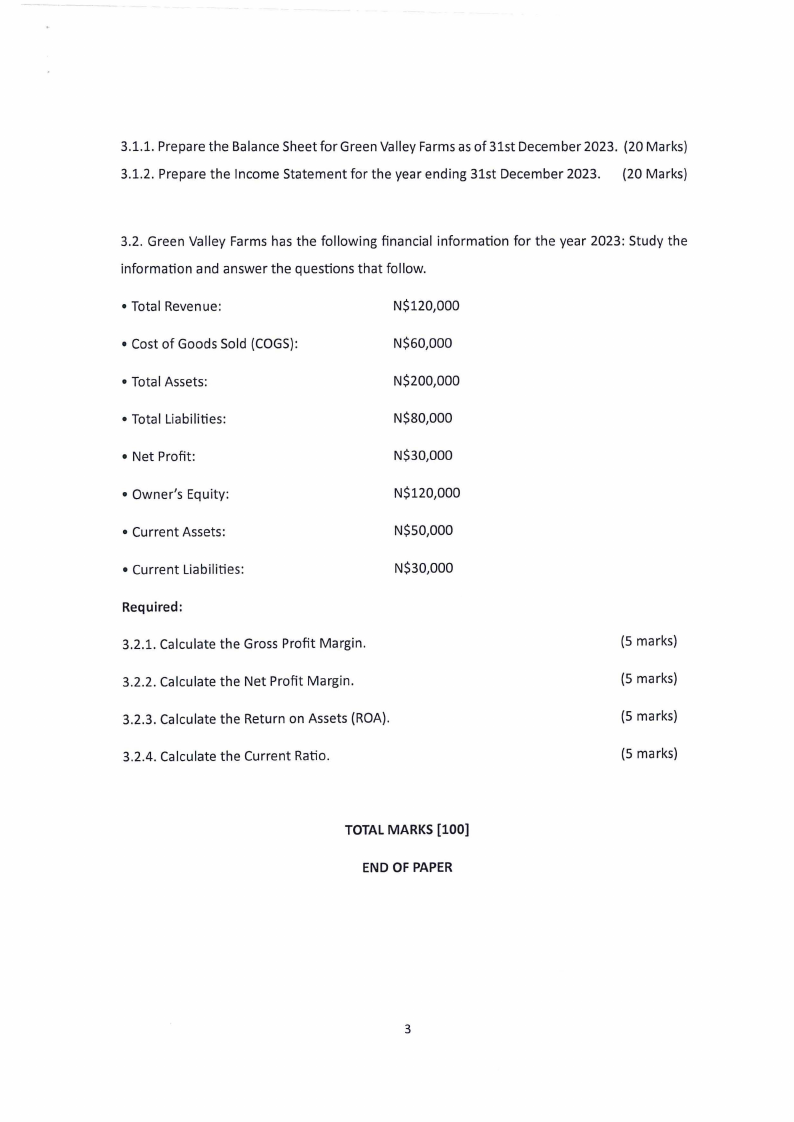

3.1.1. Prepare the Balance Sheet for Green Valley Farms as of 31st December 2023. {20 Marks)

3.1.2. Prepare the Income Statement for the year ending 31st December 2023. {20 Marks)

3.2. Green Valley Farms has the following financial information for the year 2023: Study the

information and answer the questions that follow.

• Total Revenue:

N$120,000

• Cost of Goods Sold {COGS):

N$60,000

• Total Assets:

N$200,000

• Total Liabilities:

N$80,000

• Net Profit:

N$30,000

• Owner's Equity:

N$120,000

• Current Assets:

N$50,000

• Current Liabilities:

N$30,000

Required:

3.2.1. Calculate the Gross Profit Margin.

3.2.2. Calculate the Net Profit Margin.

{5 marks)

{5 marks)

3.2.3. Calculate the Return on Assets {ROA).

3.2.4. Calculate the Current Ratio.

(5 marks)

(5 marks)

TOTAL MARKS [100)

END OF PAPER

3