|

AME820S-ADVANCED MACROECONOMICS -1ST OPP-NOV 2024 |

|

1 Page 1 |

▲back to top |

nAm I BI A un IVE RSITY

OF SCIEnCE Ano TECHnOLOGY

FACULTY OF COMMERCE, HUMAN SCIENCES AND EDUCATION

DEPARTMENT OF ECONOMICS ACCOUNTING AND FINANCE

QUALIFICATION:

BACHELOR OF ECONOMICS HONOURS DEGREE

QUALIFICATION CODE:

08HECO LEVEL:

8

COURSE CODE:

AME820S COURSE NAME: ADV AN CED MACROECONOMICS

SESSION: Nnv ;;)h _<j:_/,_-:-_ PAPER:

DURATION:

3 HOURS MARKS:

THEORY

100

FIRST OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINER (S)

Prof. T. Sunde

MODERATOR:

Dr Reinhold Kamati

INSTRUCTIONS

1. Answer FOUR (4) questions.

2. Write clearly and neatly.

3. Number all the answers.

PERMISSIBLE MATERIALS

I.Ruler

2. Calculator

THIS QUESTION PAPER CONSISTS OF 4 PAGES, INCLUDING THE COVER PAGE

1

|

2 Page 2 |

▲back to top |

QUESTION 1 [25 marks]

Explain how economists use models to understand the economy and discuss the limitations of

market-clearing models in the context of macroeconomic analysis. In your answer, address the

following:

a) Define and differentiate between microeconomics and macroeconomics.

(5 marks)

b) Describe the process of building an economic model and explain its usefulness in

summarising the relationships among economic variables. Provide an example of such a

model.

(10 marks)

c) Define a market-clearing model and explain why the assumption of price flexibility may

not always be realistic in the short run. Use real-world examples to support your argument.

(10 marks)

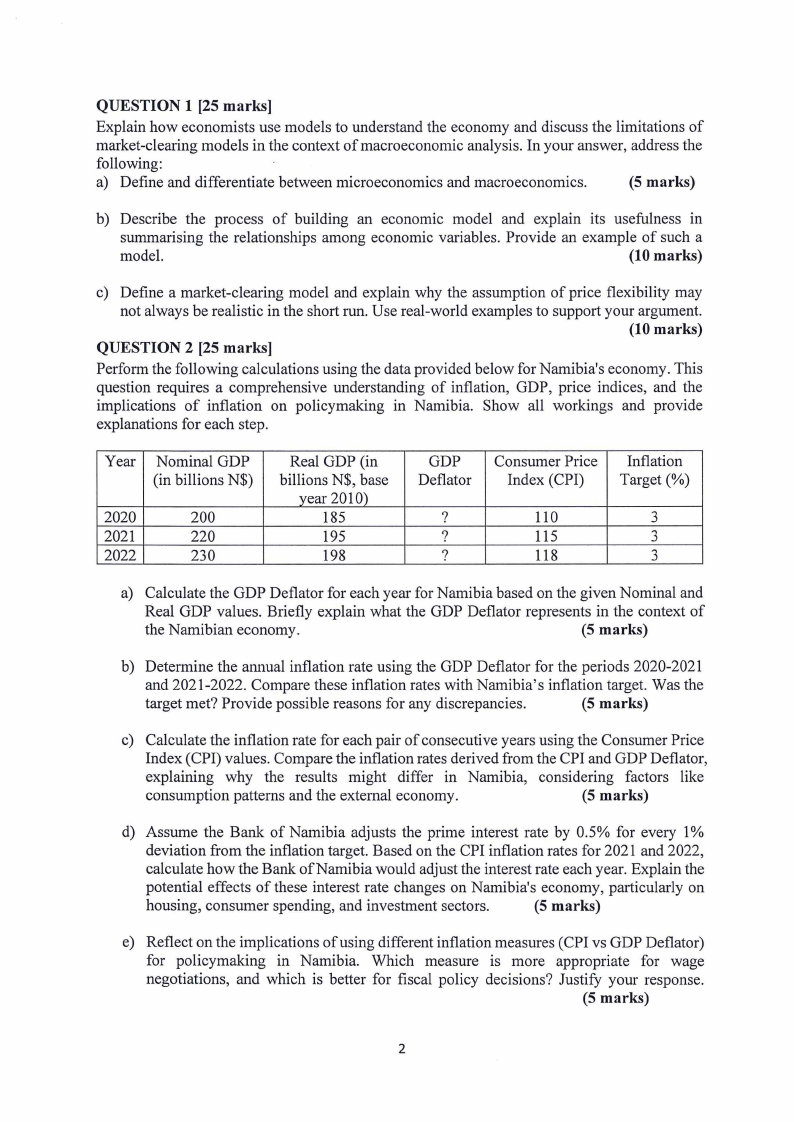

QUESTION 2 [25 marks]

Perform the following calculations using the data provided below for Namibia's economy. This

question requires a comprehensive understanding of inflation, GDP, price indices, and the

implications of inflation on policymaking in Namibia. Show all workings and provide

explanations for each step.

Year Nominal GDP

(in billions N$)

2020

200

2021

220

2022

230

Real GDP (in

billions N$, base

year 2010)

185

195

198

GDP Consumer Price Inflation

Deflater Index (CPI) Target(%)

?

110

3

?

115

3

?

118

3

a) Calculate the GDP Deflater for each year for Namibia based on the given Nominal and

Real GDP values. Briefly explain what the GDP Deflater represents in the context of

the Namibian economy.

(5 marks)

b) Determine the annual inflation rate using the GDP Deflater for the periods 2020-2021

and 2021-2022. Compare these inflation rates with Namibia's inflation target. Was the

target met? Provide possible reasons for any discrepancies.

(5 marks)

c) Calculate the inflation rate for each pair of consecutive years using the Consumer Price

Index (CPI) values. Compare the inflation rates derived from the CPI and GDP Deflater,

explaining why the results might differ in Namibia, considering factors like

consumption patterns and the external economy.

(5 marks)

d) Assume the Bank of Namibia adjusts the prime interest rate by 0.5% for every 1%

deviation from the inflation target. Based on the CPI inflation rates for 2021 and 2022,

calculate how the Bank of Namibia would adjust the interest rate each year. Explain the

potential effects of these interest rate changes on Namibia's economy, particularly on

housing, consumer spending, and investment sectors.

(5 marks)

e) Reflect on the implications of using different inflation measures (CPI vs GDP Deflater)

for policymaking in Namibia. Which measure is more appropriate for wage

negotiations, and which is better for fiscal policy decisions? Justify your response.

(5 marks)

2

|

3 Page 3 |

▲back to top |

QUESTION 3 (25 marks]

As a small open economy, Namibia interacts significantly with the rest of the world through

trade and capital flows. Using the open economy framework, answer the following questions:

1. National Income Identity for an Open Economy: Namibia's national income identity can

be expressed as Y = C + I + G + NX, where Y is the GDP, C is consumption, I is

investment, G is government spending, and NX is net exports. Given the following data for

Namibia in 2023:

o GDP (Y) = N$ 500 billion

o Consumption (C) = N$ 300 billion

= o Government spending (G) N$ 100 billion

o Net Exports (NX) = N$ - 20 billion

a) Calculate Namibia's investment (I) for 2023.

(5 marks)

b) Namibia has been running a trade deficit (NX < 0). Discuss how a trade deficit is

related to net capital outflow (NCO) and explain what the sign of net exports (-20

billion) implies for Namibia's net capital outflow.

(5 marks)

c) Suppose Namibia's real exchange rate depreciates by 10% due to market forces.

Explain how this depreciation might affect Namibia's trade balance (NX) in the short

and long run. What would be the likely impact on exports, imports, and net exports?

(5 marks)

d) The Namibian government plans to increase its spending by N$ 50 billion without

increasing taxes. Use the open economy model to predict how this fiscal policy could

affect Namibia's trade deficit and exchange rate. Provide a step-by-step explanation.

(5 marks)

e) As an economic advisor to the Namibian government, recommend two policies to

reduce the trade deficit. Justify how each policy would influence net exports, exchange

rates, and overall economic stability.

(5 marks)

3

|

4 Page 4 |

▲back to top |

QUESTION 4 [25 marks]

Namibia is working to boost its economic growth through policies that affect capital

accumulation and population growth. Using the Solow Growth Model, answer the following

questions and provide well-labelled diagrams to support your explanations:

a) Explain how the Solow growth model determines the steady-state levels of capital per

worker and output per worker. Draw a figure showing the steady-state capital per worker

and output per worker, labelling the savings curve and depreciation line and indicating the

steady-state level of capital.

(10 marks)

b) Analyse the impact of an increase in the savings rate on the steady-state level of capital per

worker and output per worker. Draw a new figure showing how the increase in the savings

rate shifts the savings curve and indicates the new steady state.

(5 marks)

c) Discuss the concept of the Golden Rule level of capital in the Solow model. Explain the

conditions that must be met to achieve the Golden Rule level of capital and draw a diagram

showing how the Golden Rule level of capital compares to the current steady state.

(5 marks)

d) Describe the effect of an increase in the population growth rate on the steady-state level of

capital per worker. Draw a figure that illustrates how the increase in population growth

shifts the steady state, labelling the new steady-state levels of capital per worker and output

per worker.

(5 marks)

QUESTION 5 [25 marks]

Economic fluctuations, often referred to as business cycles, are a key feature of macroeconomic

analysis. Using the Aggregate Demand (AD) and Aggregate Supply (AS) model, answer the

following questions and provide well-labelled diagrams where necessary.

a) Explain how short-run economic fluctuations are measured using GDP and unemployment

data. Provide a diagram to illustrate the business cycle, showing expansions and recessions.

(5 marks)

b) Discuss how the Aggregate Demand curve is derived and explain why it slopes downward.

Illustrate how a decrease in consumer confidence might shift the Aggregate Demand curve

with a diagram.

(5 marks)

c) Analyse the difference between the short-run and long-run Aggregate Supply curves.

Explain how price flexibility, in the long run, affects the economy's output and

employment. Provide a diagram to support your answer.

(5 marks)

d) Suppose Namibia experiences a negative supply shock due to a disruption in oil supply.

Using the AD-AS model, explain how this shock would affect the economy in the short

run. Provide a diagram to show how the Aggregate Supply curve shifts and the resulting

changes in output and prices.

(5 marks)

e) Discuss the role of stabilisation policies in managing short-run economic fluctuations.

Explain how monetary or fiscal policy can mitigate the effects of a recession. Use a diagram

to illustrate how these policies can shift the Aggregate Demand curve.

(5 marks)

4