|

GAU711S- AUDITING 301- 1ST OPP- JUNE 2023 |

|

1 Page 1 |

▲back to top |

nAmlBIA unlVERSITY

OF SCIEnCE Ano TECHnOLOGY

FACULTY OF COMMERCE, HUMAN SCIENCESAND EDUCATION

DEPARTMENT OF ECONOMICS, ACCOUNTING AND FINANCE

QUALIFICATION: BACHELOR OF_ACCOUNTING

QUALIFICATION CODE: 07BOAC

LEVEL: 7

COURSE CODE: GAU 711S

COURSE NAME: AUDITING 310

DATE: JUNE 2023

DURATION: 3 hours

PAPER: THEORY

MARKS: 100

FIRST OPPORTUNITY EXAMINATION PAPER

EXAMINER(S) Dr. A. Simasiku

MODERATOR: Mr. T Pandulo

INSTRUCTIONS

1. Capture your full name, student number and assessment number on the first page.

2. Answer ALL the questions and manage your time properly.

3. Number each page correctly

4. Write clearly and neatly.

5. Do not write in pencil and do not use tip-ex, as this will not be marked.

6. The names of people and businesses used throughout this assessment do not reflect the

reality and may be purely coincidental.

THIS QUESTION PAPER CONSISTS OF 3 PAGES (excluding this front page)

0

|

2 Page 2 |

▲back to top |

QUESTION 1

(30 marks)

You are newly appointed auditor of Moore Limited. Moore Limited operates as a

retailer in food, consumables and other delicatessen. Their year-end is 31 August

2022.

Moore Limited is listed on the Namibian Stock exchange and has a reporting deadline

of 05 September 2022. Moore Limited operates as a retailer in South Africa and

Namibia and has more than 500 branches across the two countries. Majority of its

stock is imported and the main suppliers are Switzerland, China and Canada.

As part of our preliminary engagement activities we have already identified the

following:

Due to the number of branches identified, it is evident that there are a large number of

volumes of transactions per month

Moore Limited applies IFRS where under IAS 2 (applied for inventories) require that

provision should be raised for obsolete stock, and it should be carried at the lower of

cost or net realisable value.

The directors of Moore Limited are identified to be aggressive in their leadership style

and have been known to dismiss the auditors where there is a disagreement

During the year the company has provided financial assistance to one of its

subsidiaries to acquire shares in Moore Limited. None of the provisions of section 44

of the companies act were met( Also note, none of the exceptions to the provisions

apply. Upon further investigations it was noted that when management were notified

of the non-compliance that their attitude towards such non-compliance was rather

nonchalant.

Required:

Based on the information given above, present the following requirements.

(a) Identify the audit risk factors that will increase or decrease the audit risk of the

audit of Moore Limited (10)

(b) Shortly comment why the above identified risks should be risks (10)

(c) Briefly state whether the responses to the above risks would be included in the

audit strategy or the audit plan. (10)

N/B: Use the following guide to answer this question.

Indicator

Why is it a risk

Audit plan or Audit

strategy

1

|

3 Page 3 |

▲back to top |

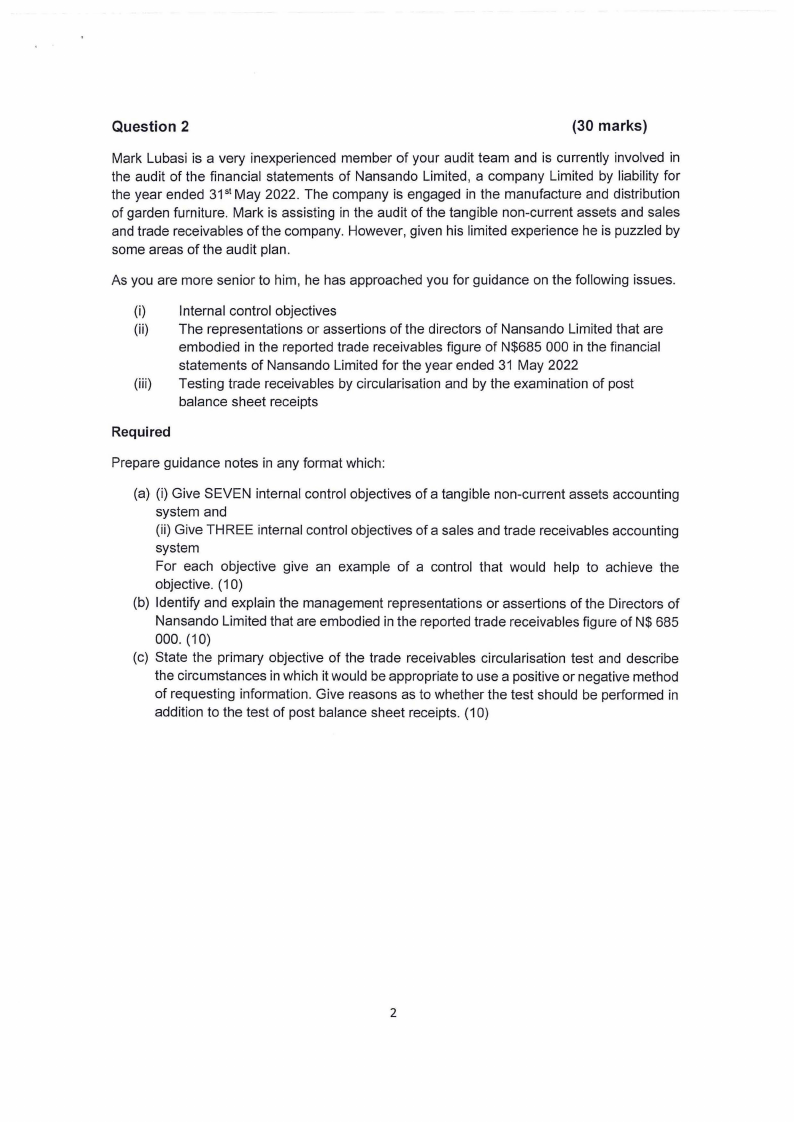

Question 2

(30 marks)

Mark Lubasi is a very inexperienced member of your audit team and is currently involved in

the audit of the financial statements of Nansando Limited, a company Limited by liability for

the year ended 31st May 2022. The company is engaged in the manufacture and distribution

of garden furniture. Mark is assisting in the audit of the tangible non-current assets and sales

and trade receivables of the company. However, given his limited experience he is puzzled by

some areas of the audit plan.

As you are more senior to him, he has approached you for guidance on the following issues.

(i) Internal control objectives

(ii) The representations or assertions of the directors of Nansando Limited that are

embodied in the reported trade receivables figure of N$685 000 in the financial

statements of Nansando Limited for the year ended 31 May 2022

(iii) Testing trade receivables by circularisation and by the examination of post

balance sheet receipts

Required

Prepare guidance notes in any format which:

(a) (i) Give SEVEN internal control objectives of a tangible non-current assets accounting

system and

(ii) Give THREE internal control objectives of a sales and trade receivables accounting

system

For each objective give an example of a control that would help to achieve the

objective. (10)

(b) Identify and explain the management representations or assertions of the Directors of

Nansando Limited that are embodied in the reported trade receivables figure of N$ 685

000. (10)

(c) State the primary objective of the trade receivables circularisation test and describe

the circumstances in which it would be appropriate to use a positive or negative method

of requesting information. Give reasons as to whether the test should be performed in

addition to the test of post balance sheet receipts. (10)

2

|

4 Page 4 |

▲back to top |

•

I

Question 3

(20 marks)

Under the going concern assumption, an entity is ordinarily viewed as continuing in

business for the foreseeable future with neither the intention nor the necessity of

liquidation, ceasing trading or seeking protection from creditors pursuant to laws or

regulations. According to ISA 570, the auditor shall evaluate whether sufficient

appropriate audit evidence has been obtained and shall conclude on the

appropriateness of management's use of the going concern basis of accounting in the

preparation of the financial statements.

Required

Describe investigations you would carry out to decide whether a company is a going

concern and whether it has a reasonable chance of recovering from its going

concern problems.

Your answer should include details of checks you would carry out in verifying the

company's profit and cash flow forecasts. (20 )

Question 4

(20 marks)

The directors of Compton and Eden have appointed your firm to act as auditors for

the year ended 31 December 2022. They are going to ask their current auditors to

resign since they are unhappy with the service they have been given.

Required:

(a) Describe the matters you would consider and the investigations you would

carry out before accepting appointment as auditors. (8)

(b) Describe the statutory and ethical procedures that should follow before and

after accepting appointment

(12)

END OF QUESTION PAPER

3