|

GAU711S- AUDITING 301- 2ND OPP- JUNE 2023 |

|

1 Page 1 |

▲back to top |

n Am I 8 I A Un IVERS ITY

OF SCIEnCE Ano TECHnOLOGY

FACULTY OF COMMERCE, HUMAN SCIENCESAND EDUCATION

DEPARTMENT OF ECONOMICS, ACCOUNTING AND FINANCE

QUALIFICATION: BACHELOR OF ACCOUNTING

QUALIFICATION CODE: 07BOAC

LEVEL: 7

COURSE CODE: GAU 7115

COURSE NAME: AUDITING 310

DATE: JUNE 2023

DURATION: 3 HOURS

PAPER: THEORY

MARKS: 100

SECOND OPPORTUNITY EXAMINATION PAPER

EXAMINER{S) Dr. A. Simasiku

MODERATOR: Mr T. Pandulo

INSTRUCTIONS

1. Capture your full name, student number and assessment number on the first page.

2. Answer ALL the questions and manage your time properly.

3. Number each page correctly

4. Write clearly and neatly.

5. Do not write in pencil and do not use tip-ex, as this will not be marked.

6. The names of people and businesses used throughout this assessment do not reflect the

reality and may be purely coincidental.

THIS QUESTION PAPER CONSISTS OF 5 PAGES {excluding this front page)

1

|

2 Page 2 |

▲back to top |

Question 1

(20 marks)

The auditor obtains evidence sufficient to be able to draw conclusions which in turn support.

the audit opinion. Audit evidence is obtained by applying auditing procedures, and these

may be applied to an entire set of data, usually referred to as the population, or to part of the

population by selecting a sample from that population.

Required

Answer the following questions regarding audit sampling.

1. What is audit sampling?

(2)

2. Where an auditor applies procedures to less than 100% of a population, what are the

items to which the auditing procedures are applied collectively known as?

(1)

3. Why is it important that the sample be representative of the population?

(2)

4. What is sampling risk?

(2)

5. Reduce all steps in an audit sampling exercise to 4 broad stages.

(2)

6. What are the 5 factors to consider when planning an audit sample?

(2)

7. At the outset of a sampling exercise, what should the auditor determine regarding the

population?

(2)

8. What are sampling units? Give three examples of sampling units in relation to accounts.

receivable.

(2)

9. List four parameters which must be determined when setting the sample size for a

statistical sample?

2)

10. What is stratification? Give two examples of how accounts payable may be stratified. (3)

Question 2

(20 marks)

Required:

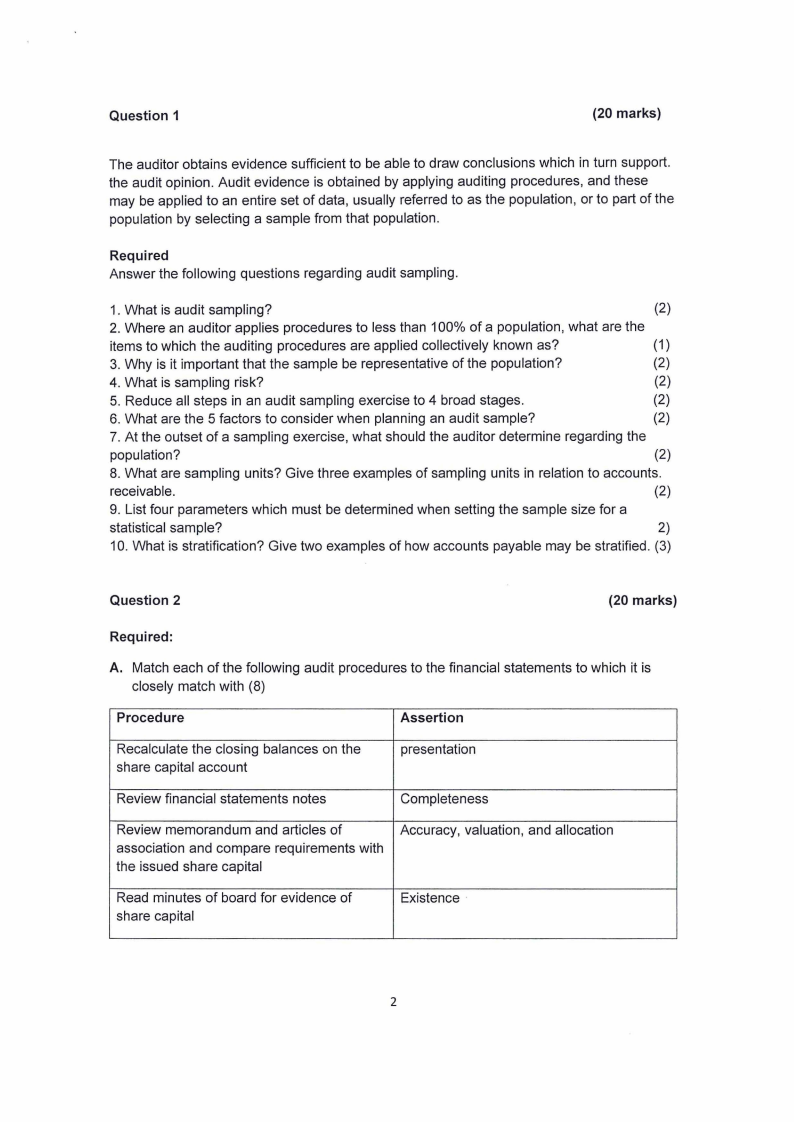

A. Match each of the following audit procedures to the financial statements to which it is

closely match with (8)

Procedure

Assertion

Recalculate the closing balances on the

share capital account

presentation

Review financial statements notes

Completeness

Review memorandum and articles of

association and compare requirements with

the issued share capital

Accuracy, valuation, and allocation

Read minutes of board for evidence of

share capital

Existence ·

2

|

3 Page 3 |

▲back to top |

B. You are drafting an engagement letter in respect of Severn company Limited and are

aware that ISA 210 Terms of the audit engagement requires certain issues to be in the

engagement letter (5)

Required

Indicate which ones should be included and those to be excluded in the engagement letter.

Please Just indicate, INCLUDED or EXCLUDED

1. Scope of the audit

2. Complaint procedures

3. Responsibility of management of Severn Company Limited

4. Fees and billing arrangement

5. Timetable for the provision of accounting information by Severn Company Limited

C. NAB and Company have decided that it would like to accept the nomination as MICKEY

limited s auditors and Mickeys existing auditors have agreed to resign rather than be

removed from office. The audit manager in charge of the tender has set out a list of

procedures that the firm must undertake before Mickey can be approved as an audit client.

1. Ensure that the existing auditor's resignation has been properly conducted.

2. Communicate with Mickeys existing auditors.

3. Submit an engagement letter.

4. Perform client screening including an assessment of Mickeys risk profile.

Required

Show the correct order in which the above procedures should be undertaken.

D. Required

Indicate whether the following procedures below will be conducted during the interim or

the final audit. Please just indicate INTERIM AUDIT or FINAL AUDIT (3)

1. Perform preliminary analytical procedures to identify any major changes in the

business.

2. Obtain third party confirmations relating to receivables, payables, and cash.

3. Update documents relating to the clients accounting systems which has been

prepared in prior year audits.

Question 3

(30 marks)

(i) Stratification is a technique commonly used by auditors when carrying out a sampling

exercise. You are on the audit team for the year end audit of Nam Golf Ltd, a large

wholesaler of golf equipment to the public. Equipment is imported and purchased

locally and sold to golf clubs, sports shops, and specialist golf retail outlets. The

majority of the company's customers purchase on credit, but there are a significant

number of cash sales made as higher discounts are given for cash sales than for credit

sales.

3

|

4 Page 4 |

▲back to top |

Required:

a) Give the reason auditors stratify populations when sampling.

(1)

b) Discuss whether stratification can be used when conducting:

Haphazard sampling

Monetary unit sampling

(4 )

c) Give 2 examples of stratification which may be appropriate on the audit of Nam Golf

Ltd based on the information given above. One to illustrate stratification when

conducting tests of detail and one to illustrate its use when performing tests of

controls.

(4)

d) If a population is stratified by value, it is not necessary to select any items from the

lowest stratum if the value of the highest stratum is greater than 50% of the value of

the population. True or false? Justify.

(2)

e) The most suitable sample selection method for testing completeness of current

liabilities is monetary unit sampling. True or false? Justify.

(3)

f) Haphazard selection is not appropriate when using statistical sampling. True or

false? Justify.

(2)

(ii) Answer the following questions relating to audit opinions.

a) In terms of ISA 700, what are the objectives of the auditor when forming an opinion

and reporting on financial statements?

(2)

b) Which of the following is correct? Explain why you regard the others as incorrect:

i. The auditor certifies that the financial statements are materially correct.

ii. The auditor's report conveys an opinion on whether sufficient appropriate

evidence has been gathered on the audit.

iii. The auditor forms an opinion on whether the financial statements are

prepared in all material respects, in accordance with the International

Financial Reporting Standards.

(4)

c) Which of the following is not a modification of the auditor's opinion? Justify.

i. An adverse qualification

ii. A disclaimer

iii. An emphasis of matter

(2)

4

|

5 Page 5 |

▲back to top |

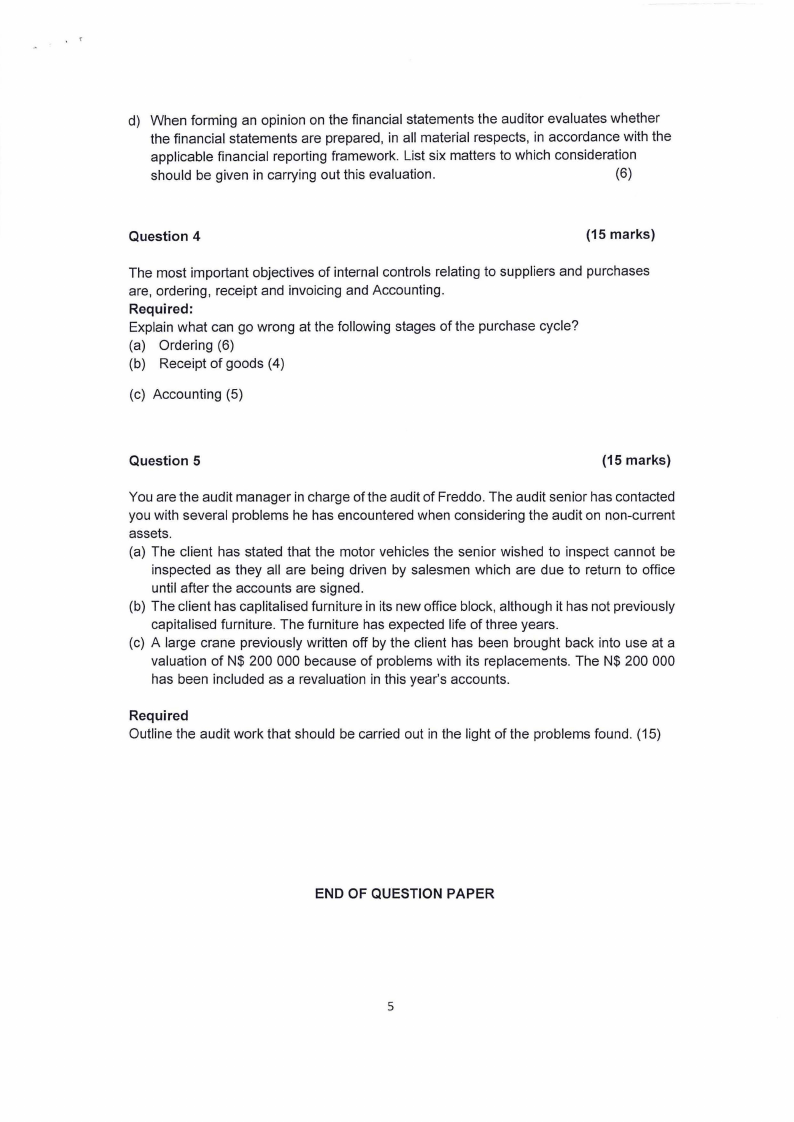

,r

d) When forming an opinion on the financial statements the auditor evaluates whether

the financial statements are prepared, in all material respects, in accordance with the

applicable financial reporting framework. List six matters to which consideration

should be given in carrying out this evaluation.

(6)

Question 4

(15 marks)

The most important objectives of internal controls relating to suppliers and purchases

are, ordering, receipt and invoicing and Accounting.

Required:

Explain what can go wrong at the following stages of the purchase cycle?

(a) Ordering (6)

(b) Receipt of goods (4)

(c) Accounting (5)

Question 5

(15 marks)

You are the audit manager in charge of the audit of Fredda. The audit senior has contacted

you with several problems he has encountered when considering the audit on non-current

assets.

(a) The client has stated that the motor vehicles the senior wished to inspect cannot be

inspected as they all are being driven by salesmen which are due to return to office

until after the accounts are signed.

(b) The client has caplitalised furniture in its new office block, although it has not previously

capitalised furniture. The furniture has expected life of three years.

(c) A large crane previously written off by the client has been brought back into use at a

valuation of N$ 200 000 because of problems with its replacements. The N$ 200 000

has been included as a revaluation in this year's accounts.

Required

Outline the audit work that should be carried out in the light of the problems found. (15)

END OF QUESTION PAPER

5