|

GTA711S- TAXATION 310- 2ND OPP- JUNE 2023 |

|

1 Page 1 |

▲back to top |

n Am I BI A u n IVER s ITY

OF SCIEnCE Ano TECHnOLOGY

FACULTY OF COMMERCE, HUMAN SCIENCES& EDUCATION

DEPARTMENT OF ECONOMICS, ACCOUNTING AND FINANCE

QUALIFICATION: BACHELOROF ACCOUNTING

QUALIFICATION CODE: 07BAOC

LEVEL: 7

COURSECODE: GTA711S

COURSE NAME: TAXATION 310

SESSION: JULY2023

PAPER: THEORY& APPLICATION

DURATION: 3 HOURS

MARKS: 100

SECOND OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINER(S) Mr. G Jansen, Mrs. Y van Wyk & Mr. T Elago

MODERATOR: Ms. F Haimbala

INSTRUCTIONS

1. This question paper is made up of four (4) questions.

2. Answer ALL the questions and in blue or black ink.

3. Start each question on a new page in your answer booklet.

4. Please remove the last page of this paper and insert it in your answer booklet.

5. The names of people and businesses used throughout this examination paper do not

Reflect reality and may be purely coincidental.

6. Questions relating to this examination may be raised in the initial 30 minutes after the

start of the paper. Thereafter, candidates must use their initiative to deal with any

perceived error or ambiguities & any assumption made by the candidate should be

clearly stated.

THIS QUESTION PAPER CONSISTS OF 13 PAGES {Including this front page)

1

|

2 Page 2 |

▲back to top |

QUESTION 1

(40 MARKS)

Natasha Joubert, a resident of Namibia who completed her master's degree in creative arts,

started a dance academy business called DanceNAM Entity, in Windhoek. She signed a 15-year

lease agreement for a dance hall in Klein Windhoek on pt August 2022. A monthly rental of

N$10,000 is payable from the commencement of the lease. In addition, she is obliged to

improve the dance hall at a cost of N$1500 000. A lease premium of N$80,000 was also payable

on 1st August 2022. The improvements were completed on 1st January 2023 at a cost of

N$1300 000.

The statement of profit or loss for the year of assessment 2023 revealed a net profit of

N$2 350,000 before the following receipts and accruals were taken into account:

Receipts and Accruals:

Local dividends were received from Allan Grey Namibia, N$50,000

Interest from a loan granted to her lazy brother, N$11,000

Expenses:

Employee benefits expenses totalling N$400,000 were paid to employees. This amount consists

of:

Permanent employees

N$ 300,000

Non-permanent employees

N$ 17,000

Pension fund contribution for permanent staff

N$ 33,000

Medical aid contributions (employer only)

N$ 50 000

Administrative expenses:

Rent expenses (Dance Hall Klein Windhoek)

N$70,000

Municipality costs

N$ 28,000

Telephone expenses

N$ 24,000

Repairs and Maintenance

N$18,000

2

|

3 Page 3 |

▲back to top |

Annuities paid to employees:

On 1 September 2022 one of the employees, Uncle G, was killed during the repairs done to the

dance hall. Due to the poor financial status of his widow, the business decided to pay her an

annuity of N$2,000 per month for the next 2 years.

On the same day Neelsie who is currently employed by DanceNam Entity was injured in the

same accident. Due to the severity of his injuries, he will not be able to take up employment.

An annuity of N$5,000 per month. is payable to him.

Credit losses:

An interest free loan was granted to Uncle G on 1 March 2022 to enable him to do repairs on

his private vehicle.

Natasha Joubert decided not to recover the sum from uncle G's widow. The amount of the loan

was N$50,000.

Provision for credit losses:

DanceNAM considers 5% of the outstanding accounts receivable to be doubtful.

The outstanding accounts receivables (excluding the loan interest relating to uncle G above) for

the 2022 year of assessment amounted to N$75,000 and N$130,000 for the 2023 year of

assessment.

Other

DanceNAM incurred other deductible expenses of N$20,000.

She also purchased a foot arch stretcher at a cash price of N$200,000. Delivery and transport

charges were N$5,000 and a total amount of N$ 15 000 has been paid as import duties

(customs and exercise) on the foot arch stretcher. The foot arch stretcher is just one of the

modern-day equipment used in dancing.

3

|

4 Page 4 |

▲back to top |

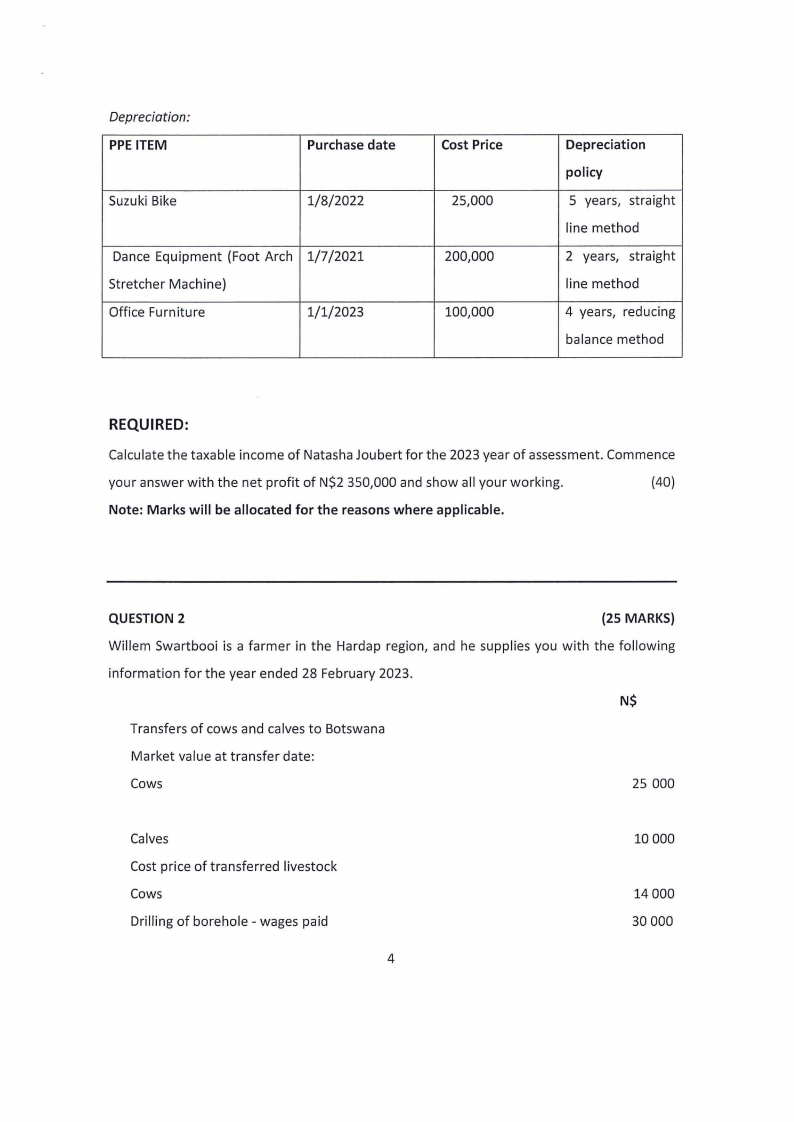

Depreciation:

PPE ITEM

Purchase date

Suzuki Bike

1/8/2022

Dance Equipment (Foot Arch 1/7/2021

Stretcher Machine)

Office Furniture

1/1/2023

Cost Price

25,000

200,000

100,000

Depreciation

policy

5 years, straight

line method

2 years, straight

line method

4 years, reducing

balance method

REQUIRED:

Calculate the taxable income of Natasha Joubert for the 2023 year of assessment. Commence

your answer with the net profit of N$2 350,000 and show all your working.

(40)

Note: Marks will be allocated for the reasons where applicable.

QUESTION 2

(25 MARKS)

Willem Swartbooi is a farmer in the Hardap region, and he supplies you with the following

information for the year ended 28 February 2023.

N$

Transfers of cows and calves to Botswana

Market value at transfer date:

Cows

25 000

Calves

Cost price of transferred livestock

Cows

Drilling of borehole - wages paid

4

10 000

14 000

30 000

|

5 Page 5 |

▲back to top |

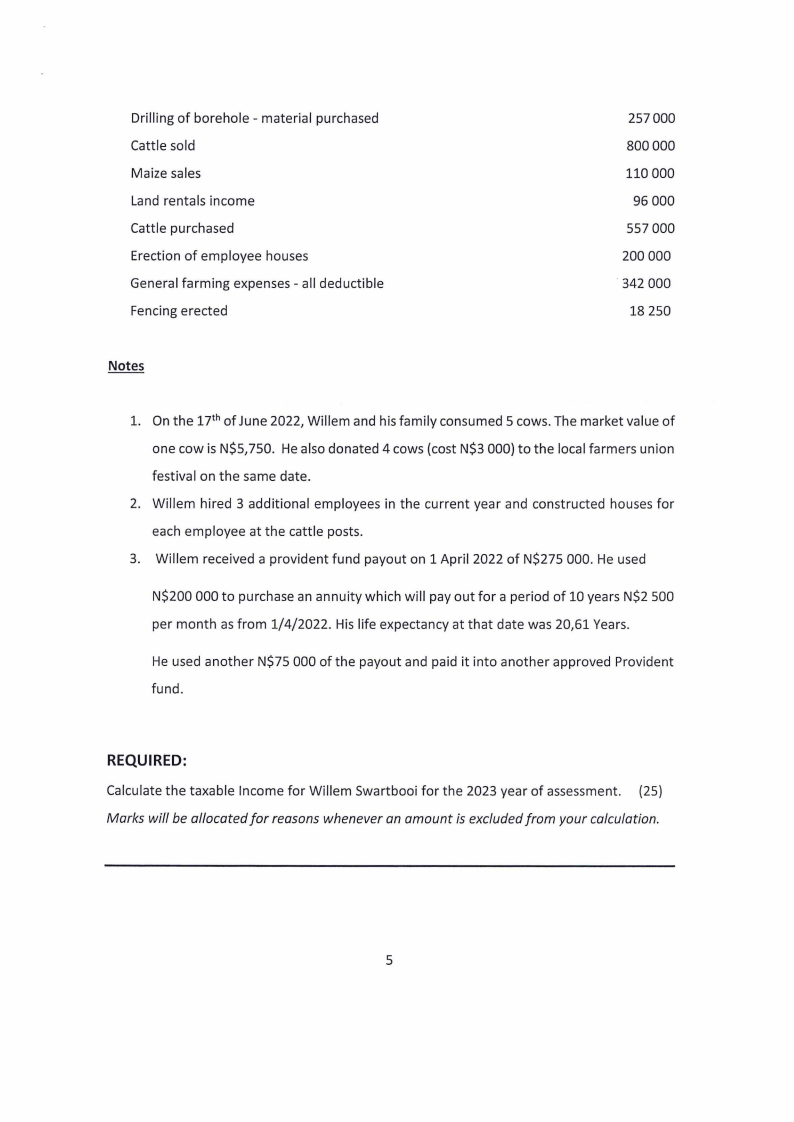

Drilling of borehole - material purchased

Cattle sold

Maize sales

Land rentals income

Cattle purchased

Erection of employee houses

General farming expenses - all deductible

Fencing erected

257000

800 000

110 000

96 000

557 000

200 000

342 000

18 250

Notes

1. On the 17th of June 2022, Willem and his family consumed 5 cows. The market value of

one cow is N$5,750. He also donated 4 cows (cost N$3 000) to the local farmers union

festival on the same date.

2. Willem hired 3 additional employees in the current year and constructed houses for

each employee at the cattle posts.

3. Willem received a provident fund payout on 1 April 2022 of N$275 000. He used

N$200 000 to purchase an annuity which will pay out for a period of 10 years N$2 500

per month as from 1/4/2022. His life expectancy at that date was 20,61 Years.

He used another N$75 000 of the payout and paid it into another approved Provident

fund.

REQUIRED:

Calculate the taxable Income for Willem Swartbooi for the 2023 year of assessment. (25)

Marks will be allocated for reasons whenever an amount is excluded from your calculation.

5

|

6 Page 6 |

▲back to top |

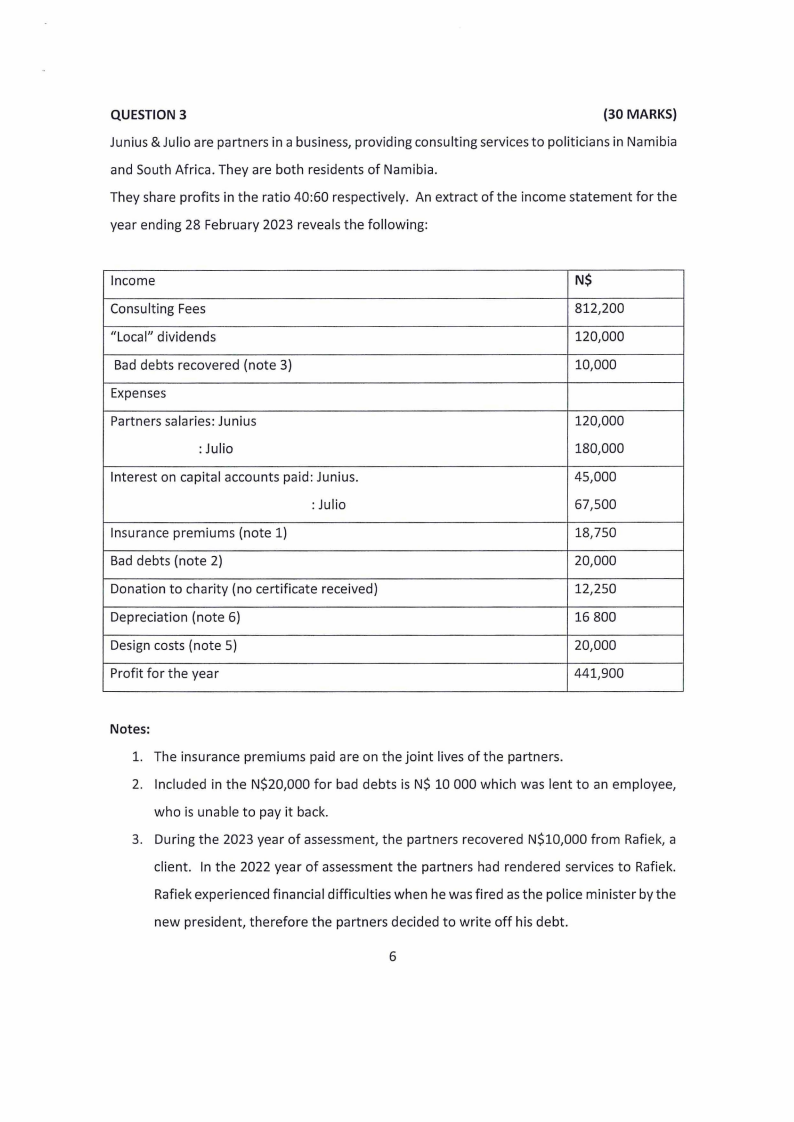

QUESTION 3

(30 MARKS)

Junius & Julio are partners in a business, providing consulting services to politicians in Namibia

and South Africa. They are both residents of Namibia.

They share profits in the ratio 40:60 respectively. An extract of the income statement for the

year ending 28 February 2023 reveals the following:

Income

Consulting Fees

"Local" dividends

Bad debts recovered (note 3)

Expenses

Partners salaries: Junius

: Julio

Interest on capital accounts paid: Junius.

: Julio

Insurance premiums (note 1)

Bad debts (note 2)

Donation to charity (no certificate received)

Depreciation (note 6)

Design costs (note 5)

Profit for the year

N$

812,200

120,000

10,000

120,000

180,000

45,000

67,500

18,750

20,000

12,250

16 800

20,000

441,900

Notes:

1. The insurance premiums paid are on the joint lives of the partners.

2. Included in the N$20,000 for bad debts is N$ 10 000 which was lent to an employee,

who is unable to pay it back.

3. During the 2023 year of assessment, the partners recovered N$10,000 from Rafiek, a

client. In the 2022 year of assessment the partners had rendered services to Rafiek.

Rafiek experienced financial difficulties when he was fired as the police minister by the

new president, therefore the partners decided to write off his debt.

6

|

7 Page 7 |

▲back to top |

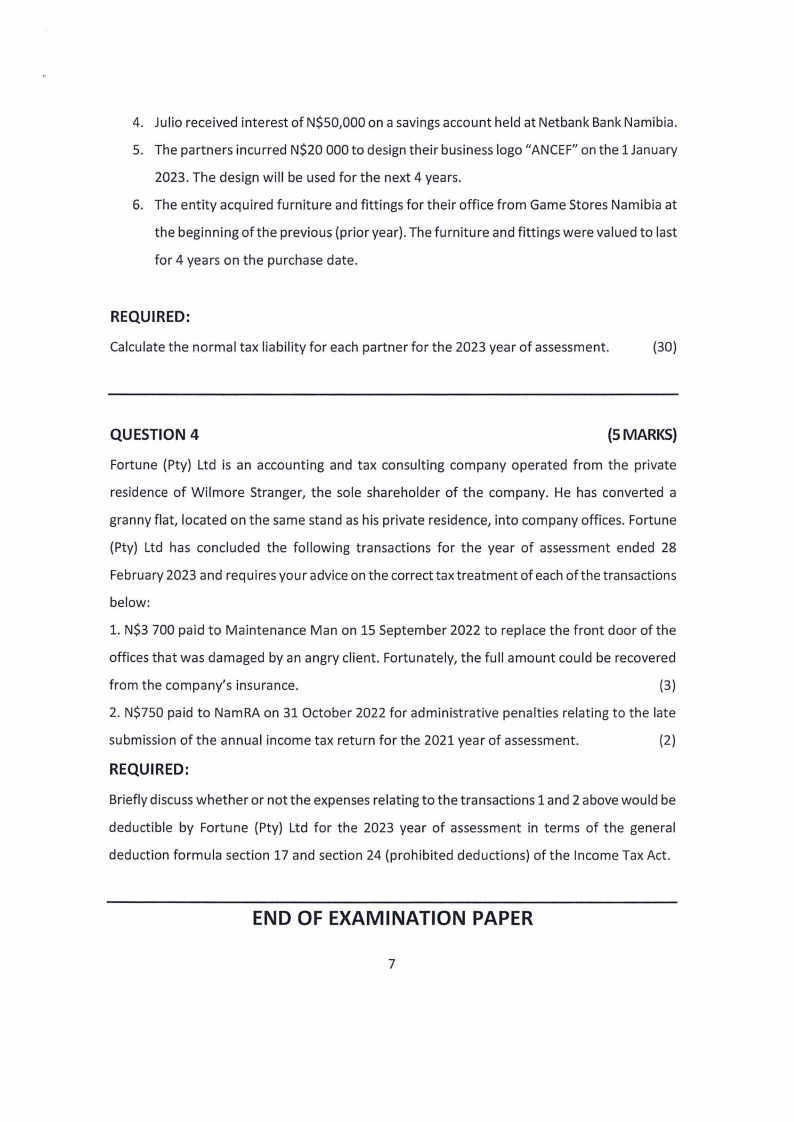

4. Julio received interest of N$50,000 on a savings account held at Netbank Bank Namibia.

5. The partners incurred N$20 000 to design their business logo "ANCEF" on the 1 January

2023. The design will be used for the next 4 years.

6. The entity acquired furniture and fittings for their office from Game Stores Namibia at

the beginning of the previous (prior year). The furniture and fittings were valued to last

for 4 years on the purchase date.

REQUIRED:

Calculate the normal tax liability for each partner for the 2023 year of assessment.

(30)

QUESTION 4

(SMARKS)

Fortune (Pty) Ltd is an accounting and tax consulting company operated from the private

residence of Wilmore Stranger, the sole shareholder of the company. He has converted a

granny flat, located on the same stand as his private residence, into company offices. Fortune

(Pty) Ltd has concluded the following transactions for the year of assessment ended 28

February 2023 and requires your advice on the correct tax treatment of each of the transactions

below:

1. N$3 700 paid to Maintenance Man on 15 September 2022 to replace the front door of the

offices that was damaged by an angry client. Fortunately, the full amount could be recovered

from the company's insurance.

(3)

2. N$750 paid to Nam RA on 31 October 2022 for administrative penalties relating to the late

submission of the annual income tax return for the 2021 year of assessment.

(2)

REQUIRED:

Briefly discuss whether or not the expenses relating to the transactions 1 and 2 above would be

deductible by Fortune (Pty) Ltd for the 2023 year of assessment in terms of the general

deduction formula section 17 and section 24 (prohibited deductions) of the Income Tax Act.

END OF EXAMINATION PAPER

7

|

8 Page 8 |

▲back to top |

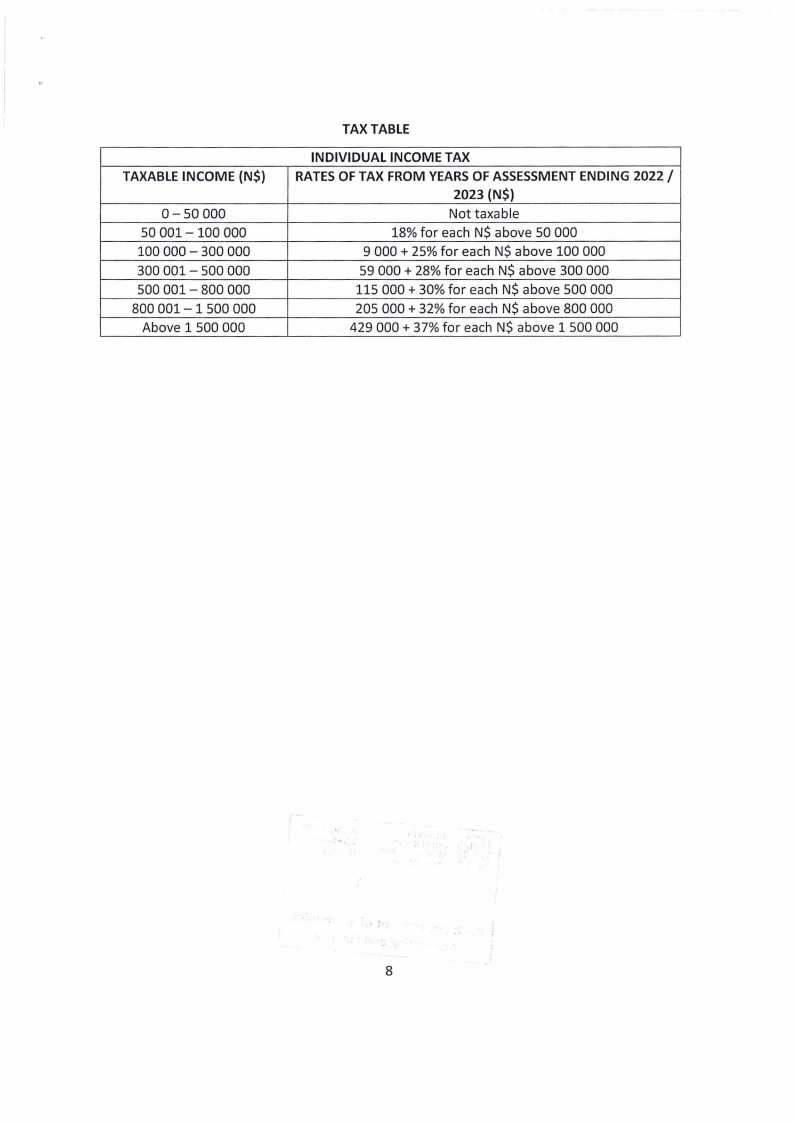

TAXABLE INCOME {N$}

0-50 000

50 001-100 000

100 000 - 300 000

300 001 - 500 000

500 001- 800 000

800 001 - 1 500 000

Above 1 500 000

TAX TABLE

INDIVIDUAL INCOME TAX

RATES OF TAX FROM YEARS OF ASSESSMENT ENDING 2022 /

2023 {N$)

Not taxable

18% for each N$ above 50 000

9 000 + 25% for each N$ above 100 000

59 000 + 28% for each N$ above 300 000

115 000 + 30% for each N$ above 500 000

205 000 + 32% for each N$ above 800 000

429 000 + 37% for each N$ above 1 500 000

8