|

FEO810S-FINANCIAL ECONOMICS-1ST OPP-JUNE 2022 |

|

1 Page 1 |

▲back to top |

nAmlBIA un1VERSITY

OFSCIEnCEAno TECHnOLOGY

FACULTY OF MANAGEMENT SCIENCES

DEPARTMENT OF ACCOUNTING, ECONOMICS AND FINANCE

BACHELOR OF ECONOMICS HONOURS

(0SBECH)

FINANCIAL ECONOMICS (FEO810S)

DATE:

DURATION:

MARKS:

Time:

June 2022

3 Hours

100

08:00- 11:00am

EXAMINER

MODERATOR

FIRST OPPORTUNITY EXAMINATION QUESTION PAPER (2022)

Prof. T. KAULIHOWA

Dr. R. KAMATI

INSTRUCTIONS

1. This paper is made up two sections (A & B)

2. Section A is compulsory, answer any two questions in Section B

3. Show all your workings & round off only final answers to 4 decimal places

4. Financial/Scientific calculators are allowed

REQUIREMENTS: Scientific or Financial calculator

This paper consists of 5 pages excluding this cover page and the formulas sheet

|

2 Page 2 |

▲back to top |

SECTIONA: Answer all questions

[20 MARKS)

1.Markets in which funds are transferred from those who have excess funds available to those who

have a shortage of available funds are called?

[2]

A) commodity markets.

B) fund-available markets.

C) derivative exchange markets.

D) financial markets.

2. Poorly performing financial markets can be the cause of

[2]

A) wealth.

B) poverty.

C)financial stability.

D) financial expansion

3. Banks and other financial institutions engage in financial intermediation, which

[2]

A) can hurt the performance of the economy.

B) can benefit economic performance.

C) has no effect on economic performance.

D) involves borrowing from investors and lending to savers

4. Stockholders are residual claimants, meaning that they

[2]

A) have the priority claim on all a company's assets.

B) are liable for all a company's debts.

C) will never share in a company's profits.

D) receive the remaining cash flow after all other claims are paid.

5. Information plays an important role in asset pricing because it allows the buyer to more accurately

judge

[2]

A) liquidity.

B) risk.

C) capital.

D) policy.

6. The coronavirus pandemic led to a decline in stock prices because

A) of a lowered expected dividend growth rate.

B) of a lowered required return on investment in equity.

C) higher expected future stock prices.

D) higher current dividends.

[2]

1

|

3 Page 3 |

▲back to top |

7. According to the efficient market hypothesis, the current price of a financial security

[2]

A) is the discounted net present value of future interest payments.

B) is determined by the lowest successful bidder.

C) fully reflects all available relevant information.

D) is a result of none of the above.

8. Stock market crashes lead us to believe that

[2]

A) factors other than market fundamentals influence asset prices.

B) unexploited profit opportunities never exist.

C) crashes are always predictable when market participants behave rationally.

D) bubbles are a natural outcome of an efficient market.

9. Suppose you are currently in the long position of a long-term bond. In this case, to hedge against a

capital loss, you would enter a ____

contract to ____

a long-term bond in the future. [2]

A) interest-rate forward; sell

B) interest-rate forward; buy

C) exchange-rate forward; buy

D) exchange-rate forward; sell

10. The seller of an option has the ____

to buy or sell the underlying asset while the purchaser of

an option has the ____

to buy or sell the asset.

[2]

A) obligation; right

B) right; obligation

C) obligation; obligation

D) right; right

2

|

4 Page 4 |

▲back to top |

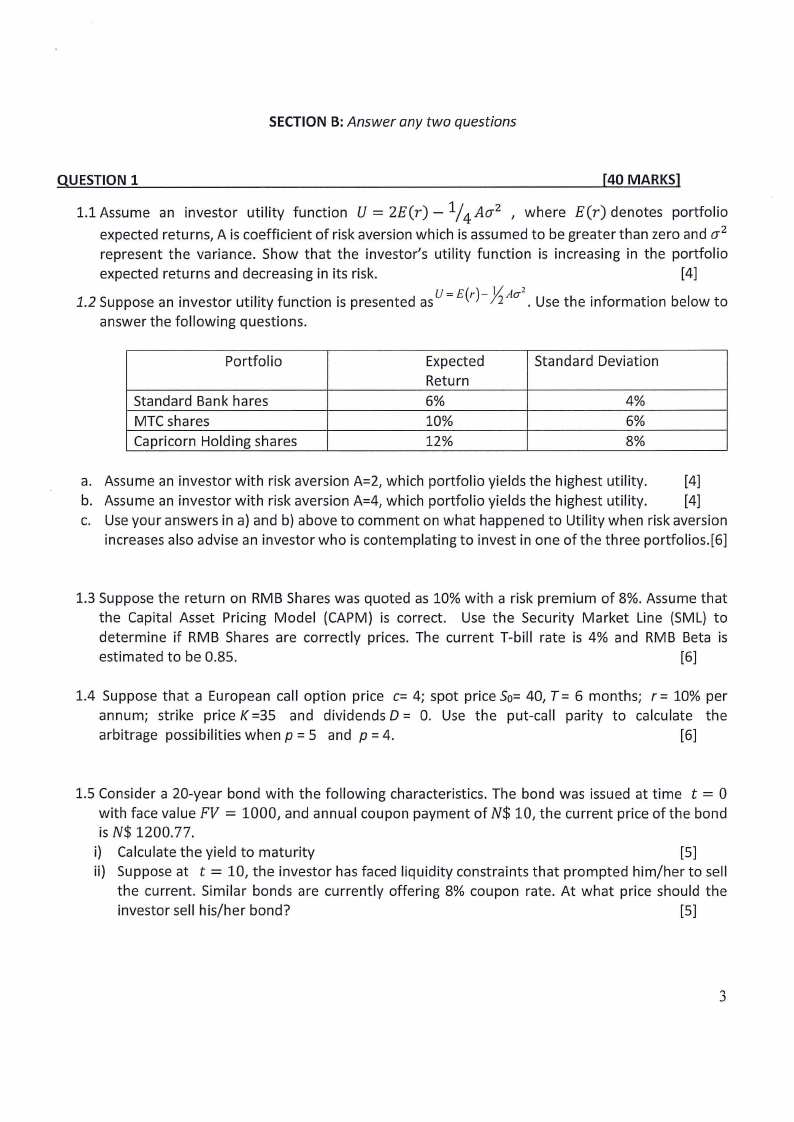

SECTION B: Answer any two questions

QUESTION 1

[40 MARKS]

= 1.1 Assume an investor utility function U 2E(r) - ¼Aa 2 , where E(r) denotes portfolio

expected returns, A is coefficient of risk aversion which is assumed to be greater than zero and a 2

represent the variance. Show that the investor's utility function is increasing in the portfolio

expected returns and decreasing in its risk.

[4]

½2

1.2 Suppose an investor utility function is presented asu =E(r)- Aa • Use the information below to

answer the following questions.

Portfolio

Standard Bank hares

MTC shares

Capricorn Holding shares

Expected

Return

6%

10%

12%

Standard Deviation

4%

6%

8%

a. Assume an investor with risk aversion A=2, which portfolio yields the highest utility.

[4]

b. Assume an investor with risk aversion A=4, which portfolio yields the highest utility.

[4]

c. Use your answers in a) and b) above to comment on what happened to Utility when risk aversion

increases also advise an investor who is contemplating to invest in one of the three portfolios.[6]

1.3 Suppose the return on RMB Shares was quoted as 10% with a risk premium of 8%. Assume that

the Capital Asset Pricing Model (CAPM) is correct. Use the Security Market Line (SML) to

determine if RMB Shares are correctly prices. The current T-bill rate is 4% and RMB Beta is

estimated to be 0.85.

[6]

1.4 Suppose that a European call option price c= 4; spot price So= 40, T = 6 months; r = 10% per

annum; strike price K =35 and dividends D = 0. Use the put-call parity to calculate the

arbitrage possibilities when p = 5 and p = 4.

[6]

= 1.5 Consider a 20-year bond with the following characteristics. The bond was issued at time t 0

= with face value FV 1000, and annual coupon payment of N$ 10, the current price of the bond

is N$ 1200.77.

i) Calculate the yield to maturity

[5]

= ii) Suppose at t 10, the investor has faced liquidity constraints that prompted him/her to sell

the current. Similar bonds are currently offering 8% coupon rate. At what price should the

investor sell his/her bond?

[5]

3

|

5 Page 5 |

▲back to top |

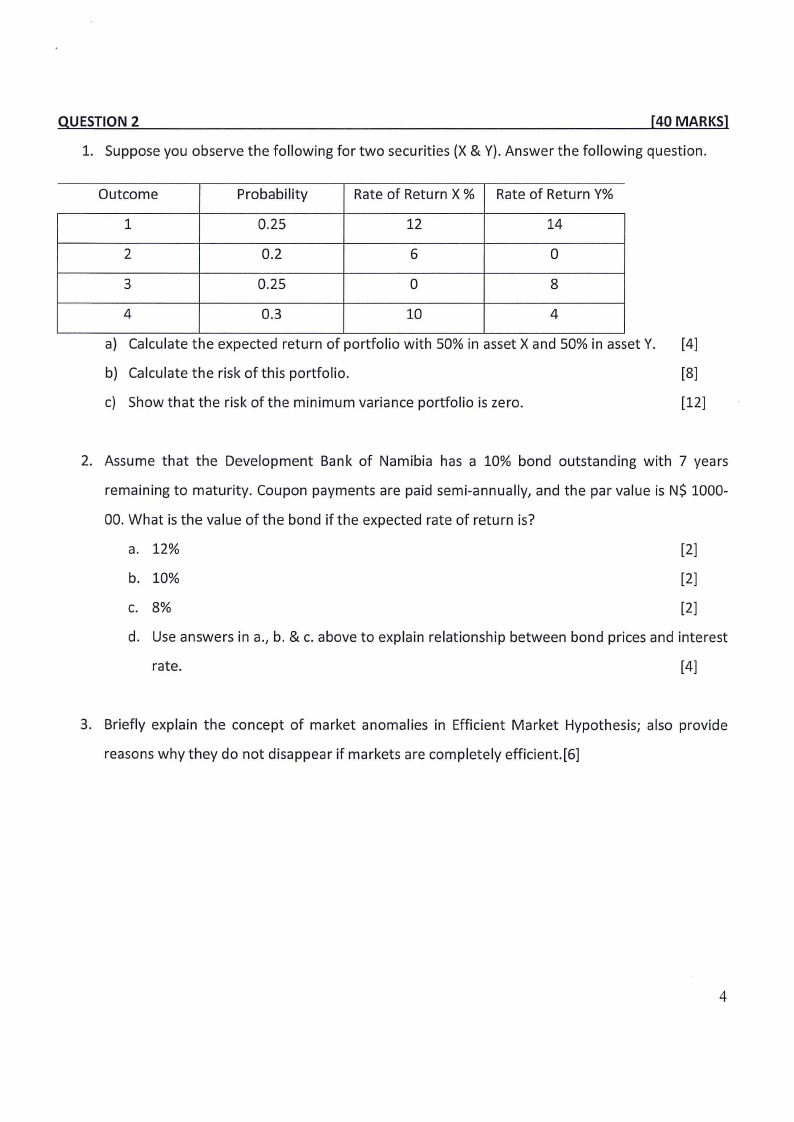

QUESTION 2

[40 MARKS]

1. Suppose you observe the following for two securities (X & Y). Answer the following question.

Outcome

Probability

Rate of Return X % Rate of Return Y%

1

0.25

12

14

2

0.2

6

0

3

0.25

0

8

4

0.3

10

4

a) Calculate the expected return of portfolio with 50% in asset X and 50% in asset Y. [4]

b) Calculate the risk of this portfolio.

[8]

c) Show that the risk of the minimum variance portfolio is zero.

[12]

2. Assume that the Development Bank of Namibia has a 10% bond outstanding with 7 years

remaining to maturity. Coupon payments are paid semi-annually, and the par value is N$ 1000-

00. What is the value of the bond if the expected rate of return is?

a. 12%

[2]

b. 10%

[2]

c. 8%

[2]

d. Use answers in a., b. & c. above to explain relationship between bond prices and interest

rate.

[4]

3. Briefly explain the concept of market anomalies in Efficient Market Hypothesis; also provide

reasons why they do not disappear if markets are completely efficient.[6]

4

|

6 Page 6 |

▲back to top |

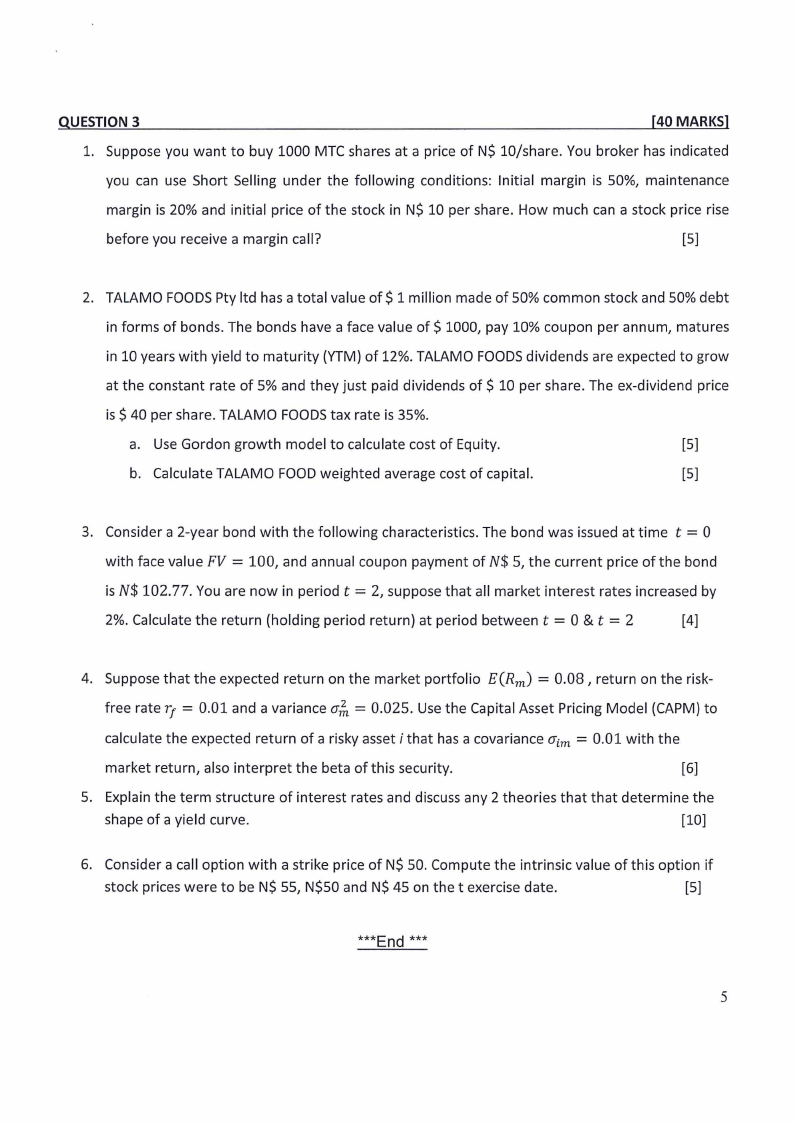

QUESTION 3

[40 MARKS]

1. Suppose you want to buy 1000 MTC shares at a price of N$ 10/share. You broker has indicated

you can use Short Selling under the following conditions: Initial margin is 50%, maintenance

margin is 20% and initial price of the stock in N$ 10 per share. How much can a stock price rise

before you receive a margin call?

[5]

2. TALAMO FOODSPty ltd has a total value of$ 1 million made of 50% common stock and 50% debt

in forms of bonds. The bonds have a face value of$ 1000, pay 10% coupon per annum, matures

in 10 years with yield to maturity (YTM} of 12%. TALAMO FOODSdividends are expected to grow

at the constant rate of 5% and they just paid dividends of$ 10 per share. The ex-dividend price

is$ 40 per share. TALAMO FOODStax rate is 35%.

a. Use Gordon growth model to calculate cost of Equity.

[5]

b. Calculate TALAMO FOODweighted average cost of capital.

[5]

= 3. Consider a 2-year bond with the following characteristics. The bond was issued at time t 0

= with face value FV 100, and annual coupon payment of N$ 5, the current price of the bond

= is N$ 102.77. You are now in period t 2, suppose that all market interest rates increased by

2%. Calculate the return (holding period return) at period between t = 0 & t = 2

[4]

= 4. Suppose that the expected return on the market portfolio E(Rm) 0.08, return on the risk-

= = free rate r1 0.01 and a variance er~ 0.025. Use the Capital Asset Pricing Model (CAPM) to

= calculate the expected return of a risky asset i that has a covariance crim 0.01 with the

market return, also interpret the beta of this security.

[6]

5. Explain the term structure of interest rates and discuss any 2 theories that that determine the

shape of a yield curve.

[10]

6. Consider a call option with a strike price of N$ 50. Compute the intrinsic value of this option if

stock prices were to be N$ 55, N$50 and N$ 45 on the t exercise date.

[5]

***End***

5

|

7 Page 7 |

▲back to top |

U

=

1

E(r)--Ao-

2

2

Formula Sheet

E~Jfw;E(r;)

i=l

f II a!=E~-PE~J= w,2+a/ w,w,a=,i,; w;a,i2;i+;w,w,p,,,a,a,

f,.1

J:o.lt"l

i"l

i::I ,,,1

J~I

nti

Re=

D0 (1 + g)

Po

+g

COV(x,y)

= Px,y

O"xO"y

COV(x,y) = E[(X - E(X))(Y - E(Y))]

FV = PV(l +r?

E(R,J=J/1>,,.

1

;•

[E(/1,,,)·l/1}

CT~

Divident payable

RP = Market value(ex - dividend)

R0 = Rd(l-Cr)

D

Re= WACC +E(WACC- R0 )

EBIT

R =WACC=--------

e

Market value of Equity

// =CT,. __ COV(R.-,R,,)

·' a;, VAR(R.,)

p =-(-1P-+M+-Ty-)-+·(·1·P++M-yT-)-+2 ----

PMT

(1 + y) 2

FV + PMT

(1 + Yr

P=--+ C

1 +i

C

(1+i'I

. +--O-++··i)·C'+---+1---

C

(l+i)"

F

(l+i)"

_

[1 - (1 + y)-n]

FV

P - PMT

Y

+ (l +yn)

RET = -C+

P -P

t+l

t

pt

pt

C + FV-PV

YTM = FV + ~V

2

Re

=

W ACC

+

D

E

(W

ACC

-

R0 )

Lower bound European Call Price= S0 - Ke-rT

Lower bound European Put Price= Ke-rT - S0

Put - call - parity: c + Ke-rT = p + S0