|

TAX621S-TAXATION 202-2ND OPP-JAN 2025 |

|

1 Page 1 |

▲back to top |

n Am I BI A u n IVE RS ITY

OF SCIEn CE Ano TECHn OLOGY

FACULTYOFCOMMERCEH, UMANSCIENCES& EDUCATION

DEPARTMENT OF ECONOMICS,ACCOUNTING AND FINANCE

QUALIFICATION:BACHELOROF ACCOUNTING

QUALIFICATIONCODE: 07BOAC

COURSE:TAXATION 202

SESSION: JANUARY 2025

DURATION: 3 HOURS

LEVEL: 6

COURSECODE: TAX621S

PAPER: THEORY& CALCULATIONS

MARKS: 100

SECOND OPPORTUNITY EXAMINATION

EXAMINERS:

Mrs. Y van Wyk; Mr. G Jansen; Ms. E Ndakondja and Ms. G Uises

MODERATOR: Dr. Z van der Walt

INSTRUCTIONSTO CANDIDATES

1. This paper consists of 5 pages (excluding cover page and the Annexure).

2. You are reminded that answers may NOT be written in pencil. NO tippex may be used.

3. Answer the questions by the use of:

- Effective structure and presentation; clear explanations.

- Logical arguments; and clear and concise language.

5. Show all calculations clearly. Round off calculated amounts to the nearest Rand.

6. Questions pertaining to this question paper should be raised in the initial 30 minutes after the

start of the paper. Thereafter candidates must use their initiative to deal with any perceived

error or ambiguities and any assumption made by the student should be clearly stated.

0

|

2 Page 2 |

▲back to top |

QUESTION 1

(40 MARKS)

The following statements pertain to South African tax legislation. Each statement should be analyzed

within the framework of South African tax laws and regulations. Consider how these laws apply to

individual taxpayers and businesses alike. Ensure that each scenario is understood in light of current

tax provisions in South Africa.

1. If a person's receipts or an accrual is of capital nature it is not included in his gross income.

2. The Supreme court of Appeal (previously the Appellate Division of the Supreme Court) has

confirmed that the term "accrued to" means 'due and payable' to the taxpayer.

3. The term "capital nature" is defined in the Income Tax Act.

4. The preamble to the so-called special inclusions to the definition of gross income results in an

amount that is of capital nature being included in gross income.

5. The world-wide receipts and accruals of a resident are subject to normal tax in the Republic of

South Africa.

6. Law books to a bookseller are his trading stock and when sold, the amount received or accrued

is gross income.

7. The preamble to the so-called special inclusions to the definition of gross income results in an

amount that accrues to a non-resident from a foreign source being subject to normal tax in the

Republic of South Africa.

8. All physical receipts of a taxpayer that are not of a capital nature will be included in his gross

income.

9. For an amount to be included in a taxpayer's gross income, it must be "received" by him.

10. Paragraph (c) of the definition of gross income applies only to transactions that result from an

employer- employee relationship.

11. A person who is ordinarily resident in the Republic of South Africa and has not lived in the

South Africa since 2021 is a resident for the 2024 year of assessment.

12. Adam Smith, an Australian resident, receives an annual royalty income of R600 000 from a

South African company which uses a patented process (invented by Adam in Australia) in South

Africa. This royalty is exempt.

13. Annuities received are exempt from normal tax.

14. The full amount expended for business purposes in respect of a travel allowance will be

deductible from the allowance received, if it exceeds such allowance received.

15. Local interest received by a natural person is fully exempt from normal tax.

1

|

3 Page 3 |

▲back to top |

16. Contributions made by the employer and the employee towards the pension fund will be a

fringe benefit in the hands of the employee (natural person).

17. Local dividends received by a natural person is fully exempt from normal tax.

18. The gross income definition clearly distinguishes between residents and non-residents.

19. The principle laid down in the Butcher Bros case is that the onus rests on the Commissioner to

determine the amount.

20. One of the elements of the gross income definition are "amount in cash or otherwise".

21. To determine the residency of a company, the place of effective management is applied when

the company is incorporated in the Republic of South Africa.

22. The compensation for damages received by a property dealer is capital in nature.

23. Receipts or accruals must be obtained in a legal manner for it to form part of gross income.

24. Subsequent disposal of amounts is irrelevant as laid down by the Geldenhuys court case.

REQUIRED:

For each of the statements above, write down the number and indicate whether the statement is

True or False. Provide reasons or the correct statement where a statement is regarded as False.

(40)

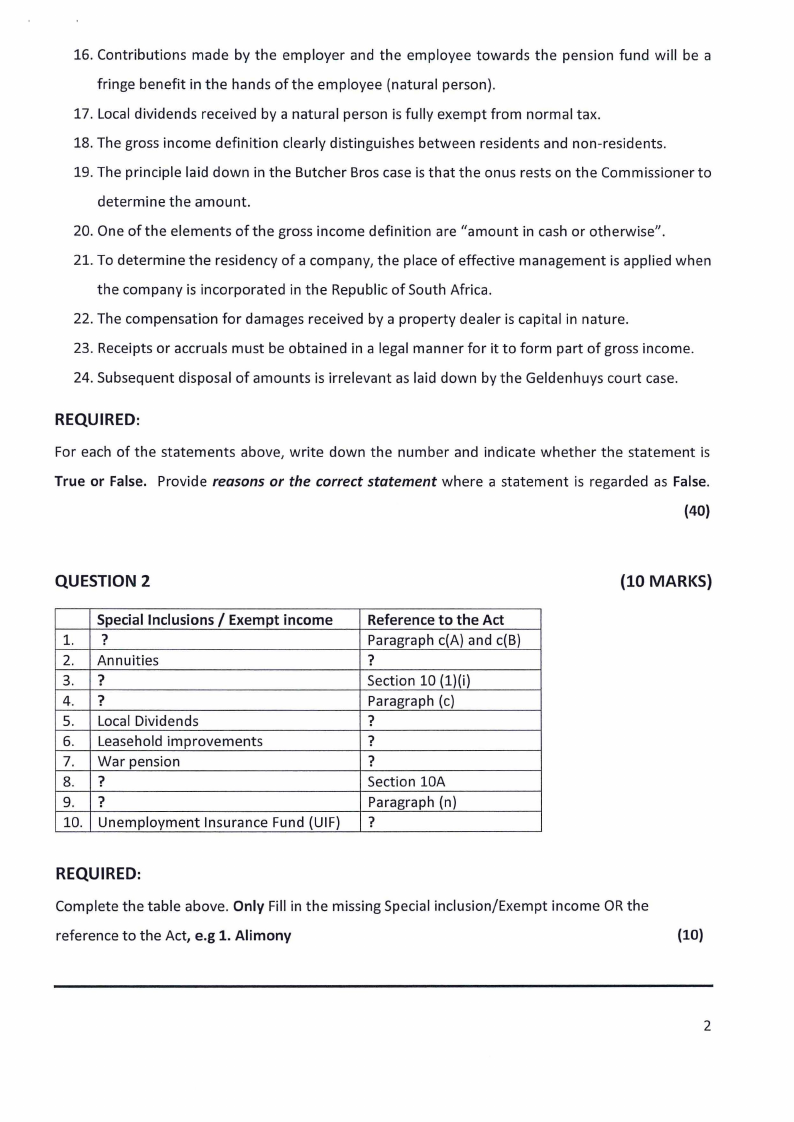

QUESTION 2

Special Inclusions / Exempt income

1. ?

2. Annuities

3. ?

4. ?

5. Local Dividends

6. Leasehold improvements

7. War pension

8. ?

9. ?

10. Unemployment Insurance Fund (UIF)

Reference to the Act

Paragraph c(A) and c(B)

?

Section 10 (l)(i)

Paragraph (c)

?

?

?

Section l0A

Paragraph (n)

?

(10 MARKS)

REQUIRED:

Complete the table above. Only Fill in the missing Special inclusion/Exempt income OR the

reference to the Act, e.g 1. Alimony

{10)

2

|

4 Page 4 |

▲back to top |

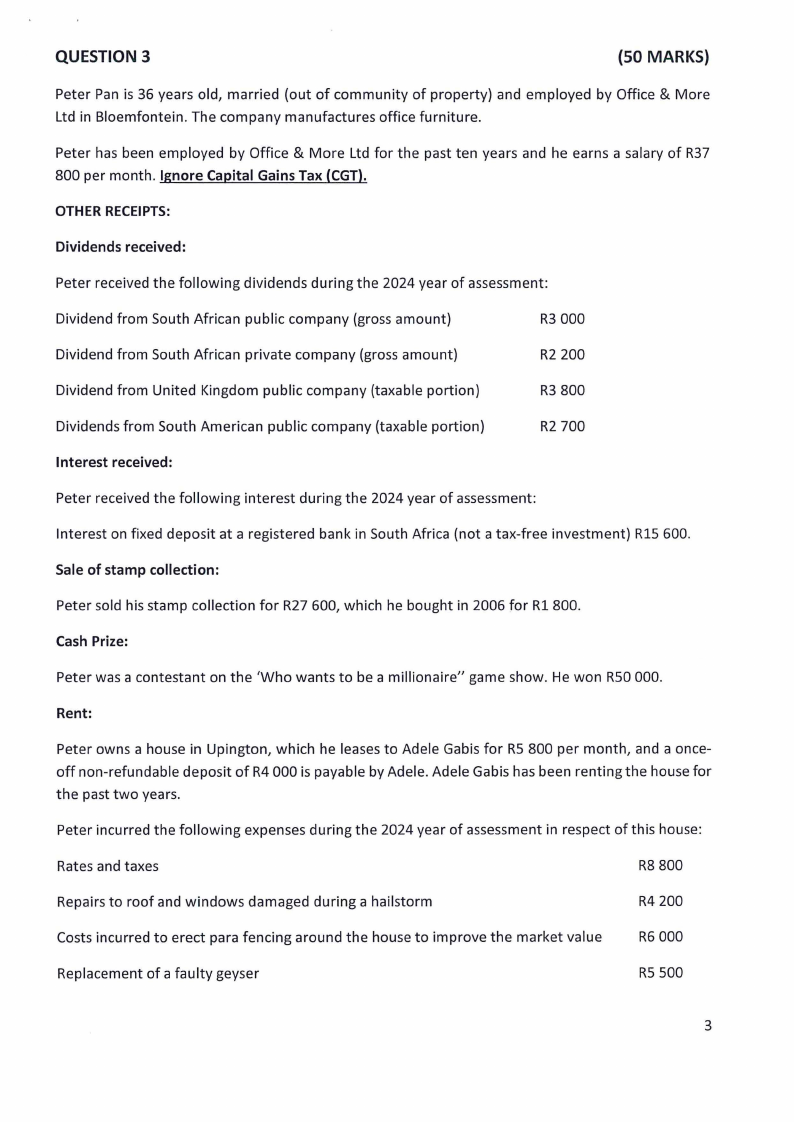

QUESTION 3

(SO MARKS)

Peter Pan is 36 years old, married (out of community of property) and employed by Office & More

Ltd in Bloemfontein. The company manufactures office furniture.

Peter has been employed by Office & More Ltd for the past ten years and he earns a salary of R37

800 per month. Ignore Capital Gains Tax (CGT).

OTHER RECEIPTS:

Dividends received:

Peter received the following dividends during the 2024 year of assessment:

Dividend from South African public company (gross amount)

R3 000

Dividend from South African private company (gross amount)

R2 200

Dividend from United Kingdom public company (taxable portion)

R3 800

Dividends from South American public company (taxable portion)

R2 700

Interest received:

Peter received the following interest during the 2024 year of assessment:

Interest on fixed deposit at a registered bank in South Africa (not a tax-free investment) R15 600.

Sale of stamp collection:

Peter sold his stamp collection for R27 600, which he bought in 2006 for Rl 800.

Cash Prize:

Peter was a contestant on the 'Who wants to be a millionaire" game show. He won RS0 000.

Rent:

Peter owns a house in Upington, which he leases to Adele Gabis for RS 800 per month, and a once-

off non-refundable deposit of R4 000 is payable by Adele. Adele Gabis has been renting the house for

the past two years.

Peter incurred the following expenses during the 2024 year of assessment in respect of this house:

Rates and taxes

R8 800

Repairs to roof and windows damaged during a hailstorm

R4 200

Costs incurred to erect para fencing around the house to improve the market value

R6 000

Replacement of a faulty geyser

RS 500

3

|

5 Page 5 |

▲back to top |

Painting costs

R6 500

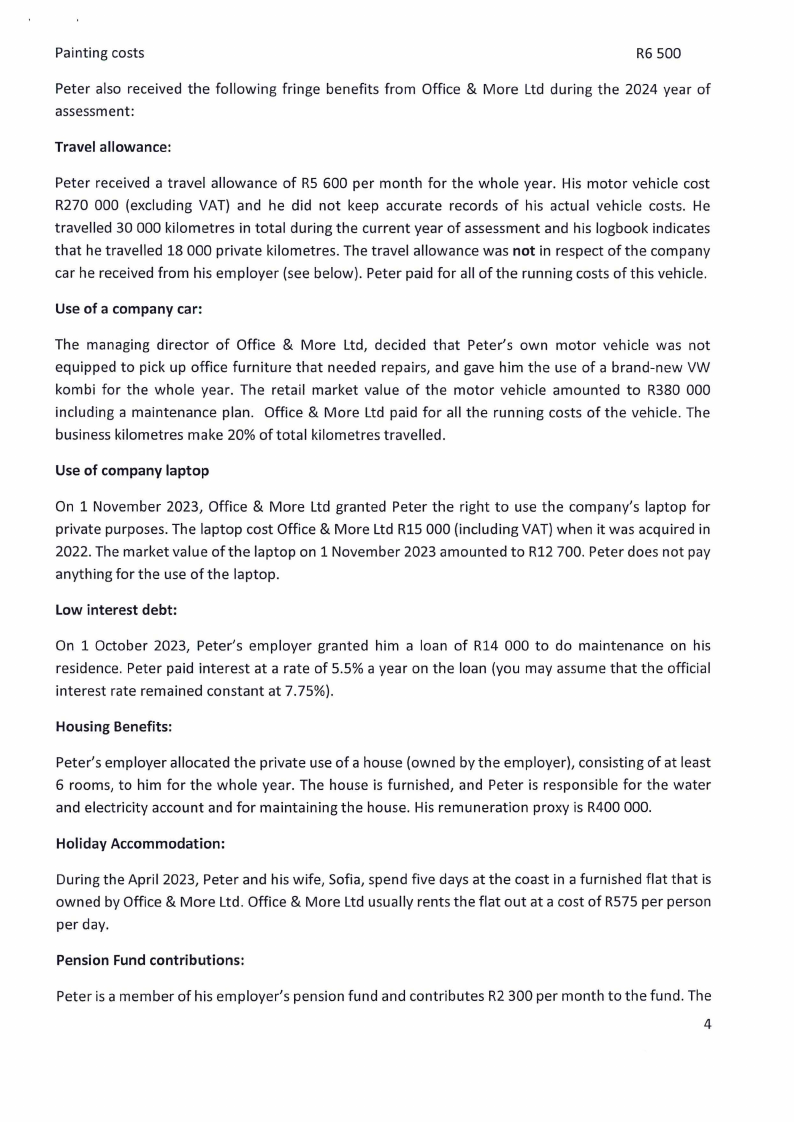

Peter also received the following fringe benefits from Office & More Ltd during the 2024 year of

assessment:

Travel allowance:

Peter received a travel allowance of RS 600 per month for the whole year. His motor vehicle cost

R270 000 (excluding VAT) and he did not keep accurate records of his actual vehicle costs. He

travelled 30 000 kilometres in total during the current year of assessment and his logbook indicates

that he travelled 18 000 private kilometres. The travel allowance was not in respect of the company

car he received from his employer (see below). Peter paid for all of the running costs of this vehicle.

Use of a company car:

The managing director of Office & More Ltd, decided that Peter's own motor vehicle was not

equipped to pick up office furniture that needed repairs, and gave him the use of a brand-new VW

kombi for the whole year. The retail market value of the motor vehicle amounted to R380 000

including a maintenance plan. Office & More Ltd paid for all the running costs of the vehicle. The

business kilometres make 20% of total kilometres travelled.

Use of company laptop

On 1 November 2023, Office & More Ltd granted Peter the right to use the company's laptop for

private purposes. The laptop cost Office & More Ltd RlS 000 (including VAT) when it was acquired in

2022. The market value of the laptop on 1 November 2023 amounted to R12 700. Peter does not pay

anything for the use of the laptop.

Low interest debt:

On 1 October 2023, Peter's employer granted him a loan of R14 000 to do maintenance on his

residence. Peter paid interest at a rate of 5.5% a year on the loan (you may assume that the official

interest rate remained constant at 7.75%).

Housing Benefits:

Peter's employer allocated the private use of a house (owned by the employer), consisting of at least

6 rooms, to him for the whole year. The house is furnished, and Peter is responsible for the water

and electricity account and for maintaining the house. His remuneration proxy is R400 000.

Holiday Accommodation:

During the April 2023, Peter and his wife, Sofia, spend five days at the coast in a furnished flat that is

owned by Office & More Ltd. Office & More Ltd usually rents the flat out at a cost of R575 per person

per day.

Pension Fund contributions:

Peter is a member of his employer's pension fund and contributes R2 300 per month to the fund. The

4

|

6 Page 6 |

▲back to top |

employer does not contribute towards the pension fund.

Donation:

On 1 January 2024, Peter donated R2 000 to the University of Limpopo. The University issued a

section 18A certificate.

Medical Aid:

Peter is a member of his employer's medical aid fund. According to the rules of this fund the employer

makes a contribution of R2 550 per month for Peter and his wife. Peter is obligated to make a

contribution of R600 per month.

Other information:

Office & More limited deducted R210 325 from Peter as Employees taxes during the year.

REQUIRED:

Calculate the normal tax liability for Peter Pan for the year of assessment ending 29 February 2024.

You are required to provide a short reason for the exclusion or non-deductibility of an amount from

your calculation. Round off all amounts to the nearest RAND. Ignore Capital Gains Tax.

(50)

END OF SECOND OPPORTUNITY EXAMINATION

5

|

7 Page 7 |

▲back to top |

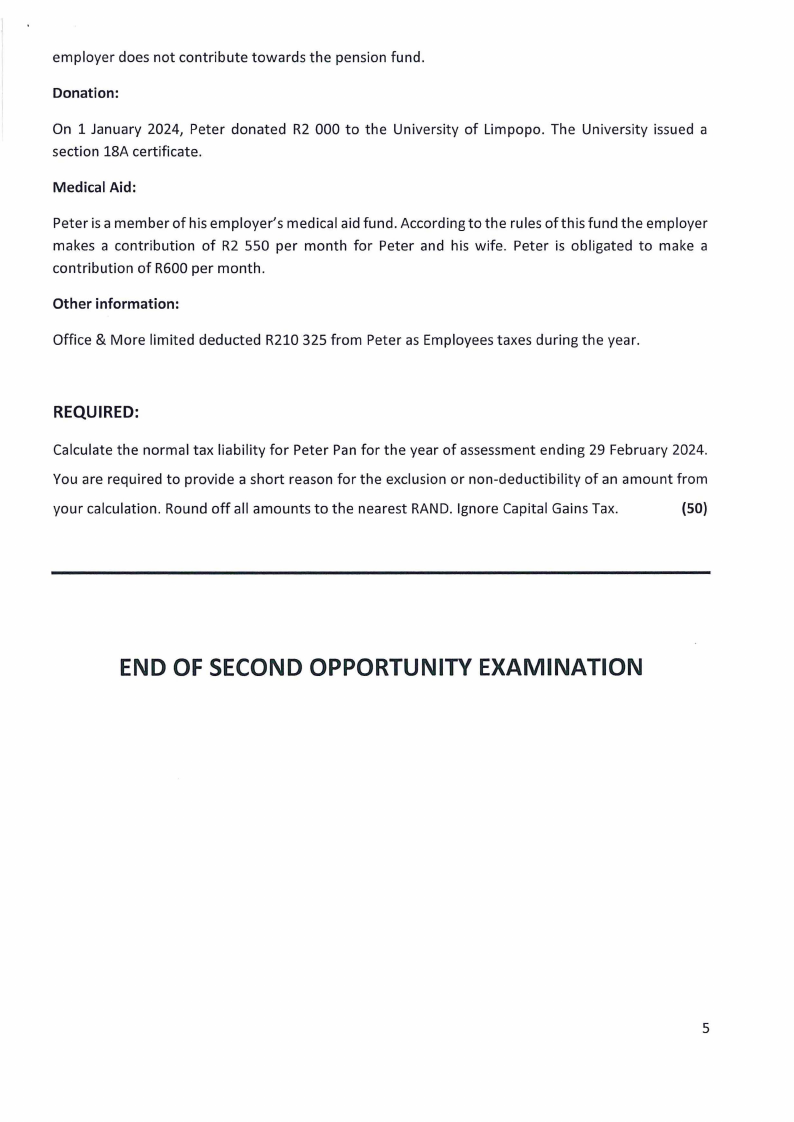

ANNEXURE

TAX RATES INDl'«l·DUAl:.-.S2024

Taxable income

R

0 - R 237 100

R 237 101 - R 370 500

R 370 501 - R 512 800

R 512 801 - R 673 000

R 673 001 - R 857 900

R 857 901 - R1 817 000

R1 817 001 +

Rates of tax

18% of each R1

R 42 678 + 26% of the amount over

R 77 362 + 31 % of the amount over

R121 475 + 36% of the amount over

R179 147 + 39% of the amount over

R251 258 + 41 % of the amount over

R644 489 + 45% of the amount over

R 237 100

R 370 500

R 512 800

R 673 000

R 857 900

R1 817 000

TAX RATES IN,DIVIDUALS- 2025

Taxable income

R

O- R 237 100

R 237 101 - R 370 500

R 370 501 - R 512 800

R 512 801 - R 673 000

R 673 001 - R 857 900

R 857 901 - R1817000

R1 817 001 +

Rates of tax

18% of each R1

R 42 678 + 26% of the amount over

R 77 362 + 31 % of the amount over

R121 475 + 36% of the amount over

R179 147 + 39% of the amount over

R251 258 + 41 % of the amount over

R644 489 + 45% of the amount over

R 237 100

R 370 500

R 512 800

R 673 000

R 857 900

R1 817 000

lm3 1iHRESHOLDS

Persons under 65

Persons 65 and under 75

Persons 75 and over

Taxable income

2024

2025

R 95 750

R 95 750

R148 217

R148 217

R165 689

R165 689

lm3·REBATES

Amounts deductible from the tax payable

Persons under 65

Persons 65 and under 75

Persons 75 and over

2024

R17 235

R26 679

R29 824

2025

R17 235

R26 679

R29 824

MEDICAL AID TAXCREDITS

Monthly amounts deductible from tax payable 2024

Main member

R364

Main member with one dependant

R728

Main member with two dependants

R97 4

2025

R364

R728

R97 4

Each additional dependant qualifies for a credit of R246 (2023: R234)

per month.

6

411 PKF

|

8 Page 8 |

▲back to top |

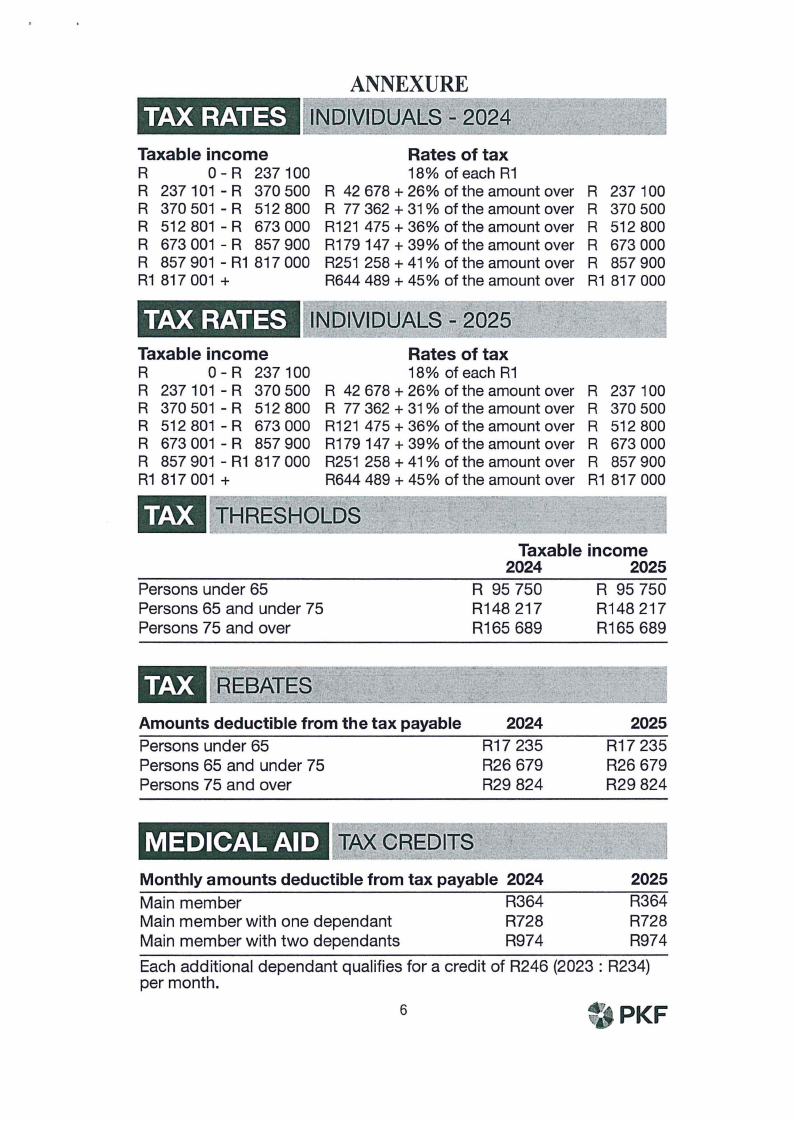

DEDUCTIONS TRAVELEXPENSES

The deduction in respect of business travel is limited to the allowance

granted and may be determined using actual expenditure incurred or on a

deemed cost per kilometre basis in accordance with the table below.

Accurate records of the opening and closing odometer readings must be

maintained in all circumstances.

As from 1 March 2010, the claim must be based on the actual distance

travelled for business purposes, supported by a detailed log book.

The cost of the vehicle includes VAT but excludes finance costs.

Where actual expenditure is used the value of the vehicle is limited to

R800 000 (2024 : R800 000) for purposes of calculating wear and tear, which

must be spread over a seven year period.

The finance costs are also limited to a debt of R800 000 (2024 : R800 000).

In the case of a leased vehicle, the instalments in any year of assessment

may not exceed the fixed cost component in the table.

DEEMED EXPENDITURE - 2024

Cost of vehicle

Does not exceed R100 000

Exceeds R100 000 but not R200 000

Exceeds R200 000 but not R300 000

Exceeds R300 000 but not R400 000

Exceeds R400 000 but not R500 000

Exceeds R500 000 but not R600 000

Exceeds R600 000 but not R700 000

Exceeds R700 000

Fixed

R

33 760

60 329

86 958

110 554

134 150

158 856

183 611

209 685

Fuel

C

141,5

158,0

171,7

184,6

197,6

226,6

230,5

234,3

Repairs

C

43,8

54,8

60,4

65,9

77,5

91,0

102,1

113,1

DEEMED EXPENDITURE - 2025 (updated table not available at time of publication)

Cost of vehicle

Does not exceed R100 000

Exceeds R100 000 but not R200 000

Exceeds R200 000 but not R300 000

Exceeds R300 000 but not R400 000

Exceeds R400 000 but not R500 000

Exceeds R500 000 but not R600 000

Exceeds R600 000 but not R700 000

Exceeds R700 000

Fixed

R

33 760

60 329

86 958

110 554

134 150

158 856

183 611

209 685

Fuel

C

141,5

158,0

171,7

184,6

197,6

226,6

230,5

234,3

Repairs

C

43,8

54,8

60,4

65,9

77,5

91,0

102,1

113,1

VARIABLE REM,UNERATION

Variable remuneration, such as commission, bonuses, overtime, leave pay,

night shift or standby allowances and reimbursive travel, is taxed on a

payment basis.

As from 1 March 2023, this includes performance-based remuneration. The

rule applies to the deduction of PAYE,the employee's gross income inclusion

and the employer's income tax deduction.

7

PKF