|

CAC710S - COMPUTERIZED ACCOUNTING - 2ND OPP - JAN 2020 |

|

1 Page 1 |

▲back to top |

NAMIBIA UNIVERSITY

OF SCIENCE AND TECHNOLOGY

FACULTY OF MANAGEMENT SCIENCES

DEPARTMENT: ACCOUNTING, ECONOMICS AND FINANCE

QUALIFICATION :

BACHELOR OF ACCOUNTING

QUALIFICATION CODE: 07BOAC/07BACC

LEVEL: 7

COURSE: COMPUTERISED ACCOUNTING 301

COURSE CODE: CAC710S

DATE: JAN/FEB 2020

DURATION: 3 Hours

SESSION: MORNING/AFTERNOON

MARKS: 100

2"? OPPORTUNITY/SUPPLEMENTARY EXAMINATION QUESTION PAPER

EXAMINER(S) | E KANGOOTUI & Y ELAGO

MODERATOR: | C.W. MILLER

THIS QUESTION PAPER CONSISTS OF 6 PAGES

(Excluding this front page)

INSTRUCTIONS

This examination is made up of three (3) questions which are related.

Make sure that your student number appears on the reports. (Computer printout)

It is your responsibility to see that all the reports are handed in.

The use of internet or any communication device is prohibited.

Questions relating to this paper may be raised in the initial 30 minutes after the start of the

paper. Thereafter, candidates must use their initiative to deal with any perceived error or

ambiguities & any assumption made by the candidate should be clearly stated.

6. Round off all workingS to two decimal places

PERMISSIBLE MATERIALS

1. Examination question paper

2. Examination answer script

3. Non-programmable calculator

|

2 Page 2 |

▲back to top |

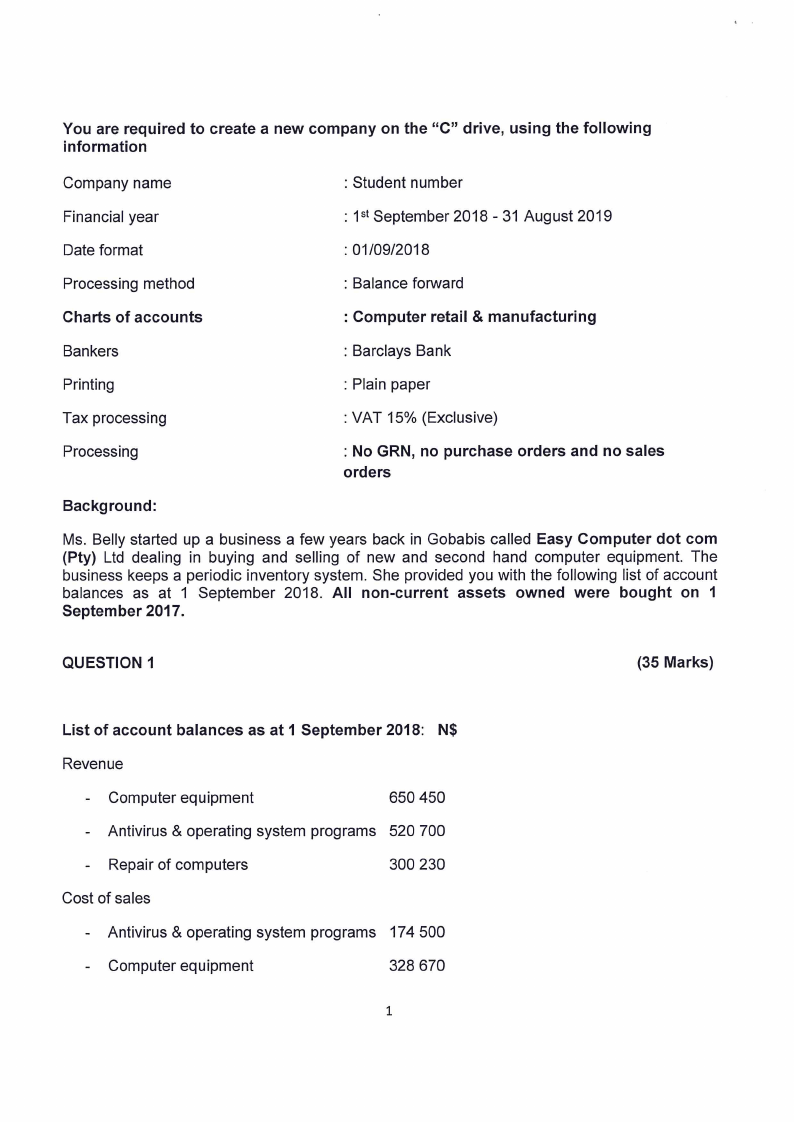

You are required to create a new company on the “C” drive, using the following

information

Company name

: Student number

Financial year

Date format

: 1st September 2018 - 31 August 2019

: 01/09/2018

Processing method

: Balance forward

Charts of accounts

: Computer retail & manufacturing

Bankers

: Barclays Bank

Printing

: Plain paper

Tax processing

: VAT 15% (Exclusive)

Processing

: No GRN, no purchase orders and no sales

orders

Background:

Ms. Belly started up a business a few years back in Gobabis called Easy Computer dot com

(Pty) Ltd dealing in buying and selling of new and second hand computer equipment. The

business keeps a periodic inventory system. She provided you with the following list of account

balances as at 1 September 2018. All non-current assets owned were bought on 1

September 2017.

QUESTION 1

(35 Marks)

List of account balances as at 1 September 2018: N$

Revenue

- Computer equipment

650 450

- Antivirus & operating system programs 520 700

- Repair of computers

300 230

Cost of sales

- Antivirus & operating system programs 174 500

- Computer equipment

328 670

|

3 Page 3 |

▲back to top |

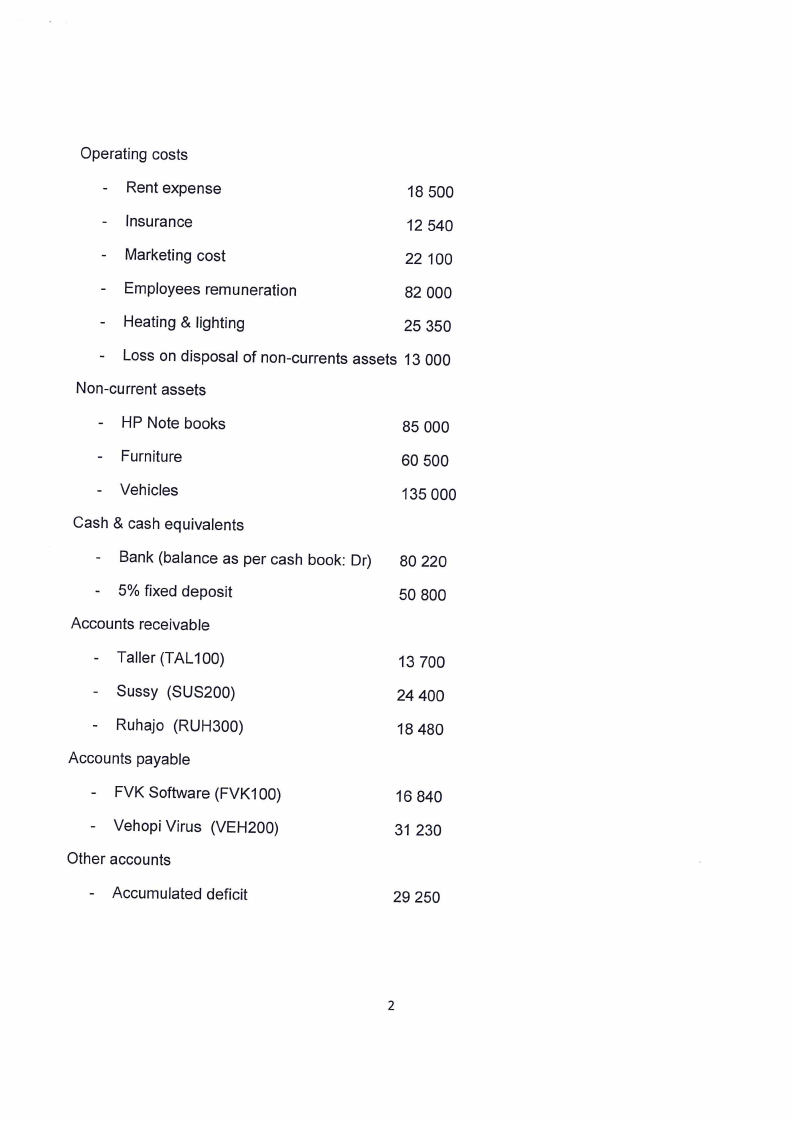

Operating costs

Rent expense

18 500

- Insurance

12 540

- Marketing cost

- Employees remuneration

22 100

82 000

- Heating & lighting

25 350

- Loss on disposal of non-currents assets 13 000

Non-current assets

- HP Note books

85 000

- Furniture

- Vehicles

Cash & cash equivalents

60 500

135 000

- Bank (balance as per cash book: Dr) 80 220

- 5% fixed deposit

Accounts receivable

50 800

- Taller (TAL100)

13 700

- Sussy (SUS200)

- Ruhajo (RUH300)

24 400

18 480

Accounts payable

- FVK Software (FVK100)

16 840

- Vehopi Virus (VEH200)

31 230

Other accounts

- Accumulated deficit

29 250

|

4 Page 4 |

▲back to top |

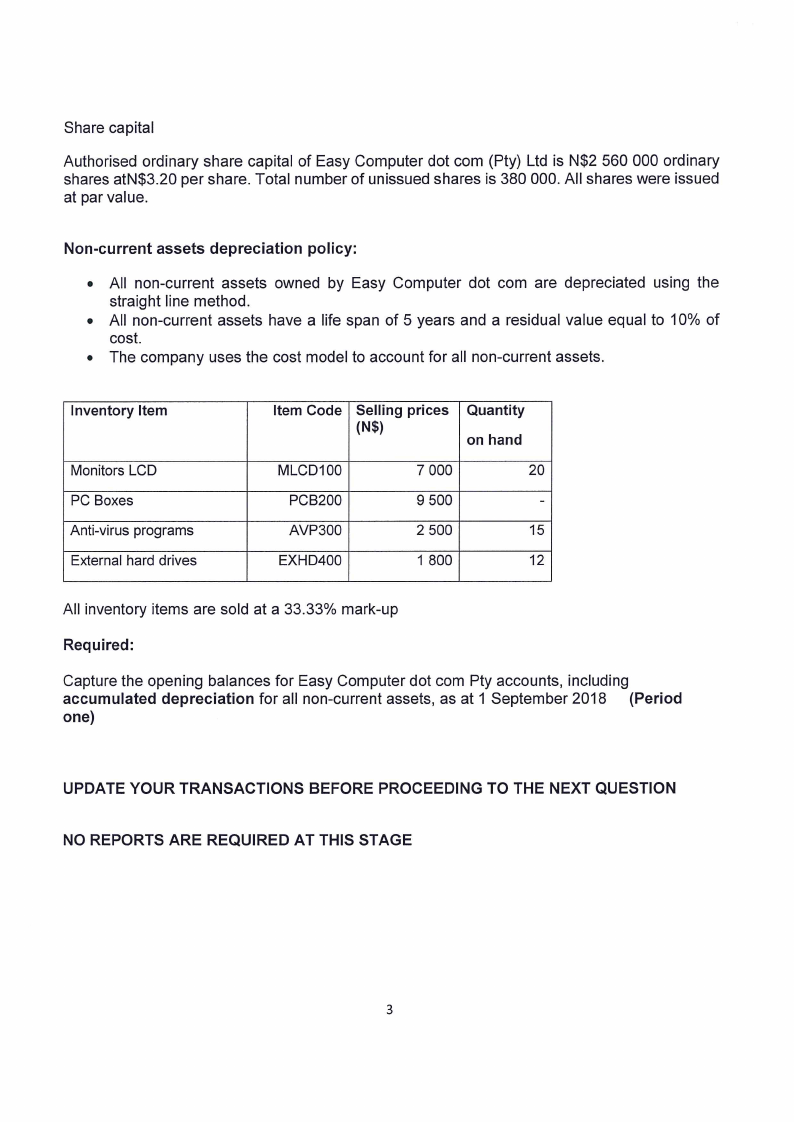

Share capital

Authorised ordinary share capital of Easy Computer dot com (Pty) Ltd is N$2 560 000 ordinary

shares atN$3.20 per share. Total number of unissued shares is 380 000. All shares were issued

at par value.

Non-current assets depreciation policy:

e All non-current assets owned by Easy Computer dot com are depreciated using the

straight line method.

e All non-current assets have a life span of 5 years and a residual value equal to 10% of

cost.

e The company uses the cost model to account for all non-current assets.

Inventory Item

Monitors LCD

PC Boxes

Anti-virus programs

External hard drives

Item Code | Selling prices | Quantity

(N$)

on hand

MLCD100

7 000

20

PCB200

9 500

-

AVP300

2 500

15

EXHD400

1 800

12

All inventory items are sold at a 33.33% mark-up

Required:

Capture the opening balances for Easy Computer dot com Pty accounts, including

accumulated depreciation for all non-current assets, as at 1 September 2018 (Period

one)

UPDATE YOUR TRANSACTIONS BEFORE PROCEEDING TO THE NEXT QUESTION

NO REPORTS ARE REQUIRED AT THIS STAGE

|

5 Page 5 |

▲back to top |

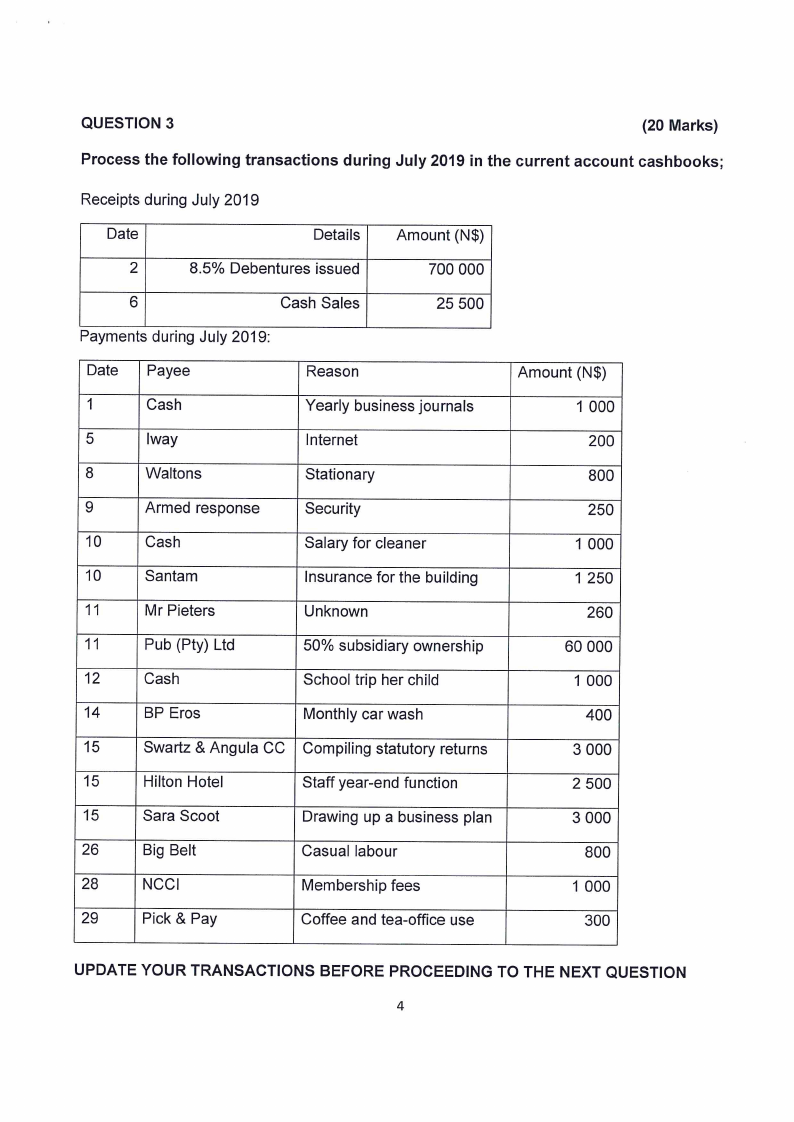

QUESTION 3

(20 Marks)

Process the following transactions during July 2019 in the current account cashbooks;

Receipts during July 2019

Date

Details

Amount (N$)

2

8.5% Debentures issued

700 000

6

Cash Sales

25 500

Payments during July 2019:

Date | Payee

Reason

1

Cash

Yearly business journals

5

lway

Internet

8

Waltons

Stationary

g

Armed response

Security

10

Cash

Salary for cleaner

10

Santam

Insurance for the building

11

Mr Pieters

Unknown

11

Pub (Pty) Ltd

50% subsidiary ownership

12

Cash

School trip her child

14

BP Eros

Monthly car wash

15

Swartz & Angula CC | Compiling statutory returns

15

Hilton Hotel

Staff year-end function

15

Sara Scoot

Drawing up a business plan

26

Big Belt

Casual labour

28

NCCI

Membership fees

29

Pick & Pay

Coffee and tea-office use

Amount (N$)

1 000

200

800

250

1 000

1 250

260

60 000

1 000

400

3 000

2 500

3 000

800

1 000

300

UPDATE YOUR TRANSACTIONS BEFORE PROCEEDING TO THE NEXT QUESTION

4

|

6 Page 6 |

▲back to top |

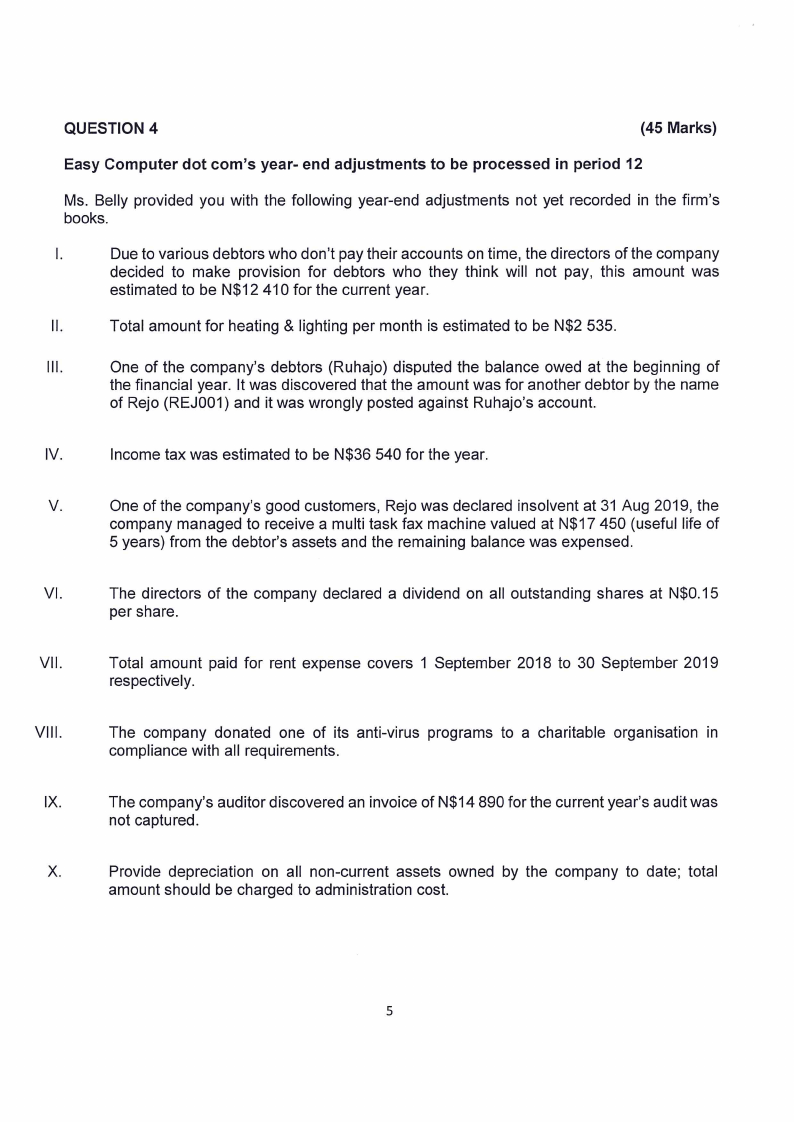

QUESTION 4

(45 Marks)

Easy Computer dot com’s year- end adjustments to be processed in period 12

Ms. Belly provided you with the following year-end adjustments not yet recorded in the firm’s

books.

Due to various debtors who don’t pay their accounts on time, the directors of the company

decided to make provision for debtors who they think will not pay, this amount was

estimated to be N$12 410 for the current year.

Total amount for heating & lighting per month is estimated to be N$2 535.

One of the company’s debtors (Ruhajo) disputed the balance owed at the beginning of

the financial year. It was discovered that the amount was for another debtor by the name

of Rejo (REJ001) and it was wrongly posted against Ruhajo’s account.

Income tax was estimated to be N$36 540 for the year.

One of the company’s good customers, Rejo was declared insolvent at 31 Aug 2019, the

company managed to receive a multi task fax machine valued at N$17 450 (useful life of

5 years) from the debtor’s assets and the remaining balance was expensed.

VI.

The directors of the company declared a dividend on all outstanding shares at N$0.15

per share.

VII.

Total amount paid for rent expense covers 1 September 2018 to 30 September 2019

respectively.

VIII.

The company donated one of its anti-virus programs to a charitable organisation in

compliance with all requirements.

The company’s auditor discovered an invoice of N$14 890 for the current year’s audit was

not captured.

Provide depreciation on all non-current assets owned by the company to date; total

amount should be charged to administration cost.

|

7 Page 7 |

▲back to top |

Xl.

Account for any interest payable or interest receivable for the current year.

Required:

Process the above transactions, update and print out the following reports:

1. A detailed ledger for Easy Computer dot com (Pty) Ltd.

(View — General ledger — Transaction — Detailed ledger)

e Period 1 — period 12

2. Print out the following detailed ledgers.

e Customers: View — Customers — Detailed ledger — By customer

e Suppliers: View — Suppliers — Detailed ledger — By supplier

e Period: 1 — Period 12

|

8 Page 8 |

▲back to top |