|

FAC511S- FINANCIAL ACCOUNTING 101- 1ST OP- JUNE 2023 |

|

1 Page 1 |

▲back to top |

n Am I BI A u n IVE Rs ITY

OF SCIEn CE Ano TECHn OLOGY

FACULTY OF COMMERCE, HUMAN SCIENCES AND EDUCATION

DEPARTMENT OF ECONOMICS, ACCOUNTING AND FINANCE

QUALIFICATION : BACHELOROF ACCOUNTING AND BACHELOROF LOGISTICSAND

SUPPLYCHAIN MANAGEMENT

QUALIFICATION CODE: 07BOAC AND

07BLSC

LEVEL: 5

COURSE: FINANCIAL ACCOUNTING 101 COURSE CODE: FAC511S

SESSION: JUNE/JULY 2023

PAPER: THEORY & CALCULATIONS

DURATION: 3 Hours

MARKS: 100

FIRST OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINERS:

Ms Y Andrew, Ms H Kangala, Mr L Odada, Mr Chikambi and Mr C

Simasiku

MODERATOR:

Mr C Mahindi

INSTRUCTIONS TO CANDIDATES

1. Answer all questions in blue or black ink.

2. Round off all amounts to the nearest Namibian Dollar, where applicable.

3. A silent, non-programmable calculator is permissible.

4. Show all your workings (where applicable).

This paper consists of 4 pages, excluding the cover page.

|

2 Page 2 |

▲back to top |

QUESTION 1

20 Marks

1.1 List one (1) primary user of financial statements as per Conceptual Framework for Financial

Reporting and also explain for what purpose they could use the financial statements.(2)

1.2 List six (6) Qualitative Characteristics of Financial Statements.

(6)

1.3 Explain what the underlying assumption of going concern means.

(1)

1.4 Explain the difference between input VAT and output VAT.

(2)

1.5 What does the abbreviation "VAT" stand for?

(1)

1.6 Explain briefly what you understand by the following accounting terms:

a) An accrual

(2)

b) A prepayment

(2)

c) Revenue

(2)

d) Balance of accounts

(2)

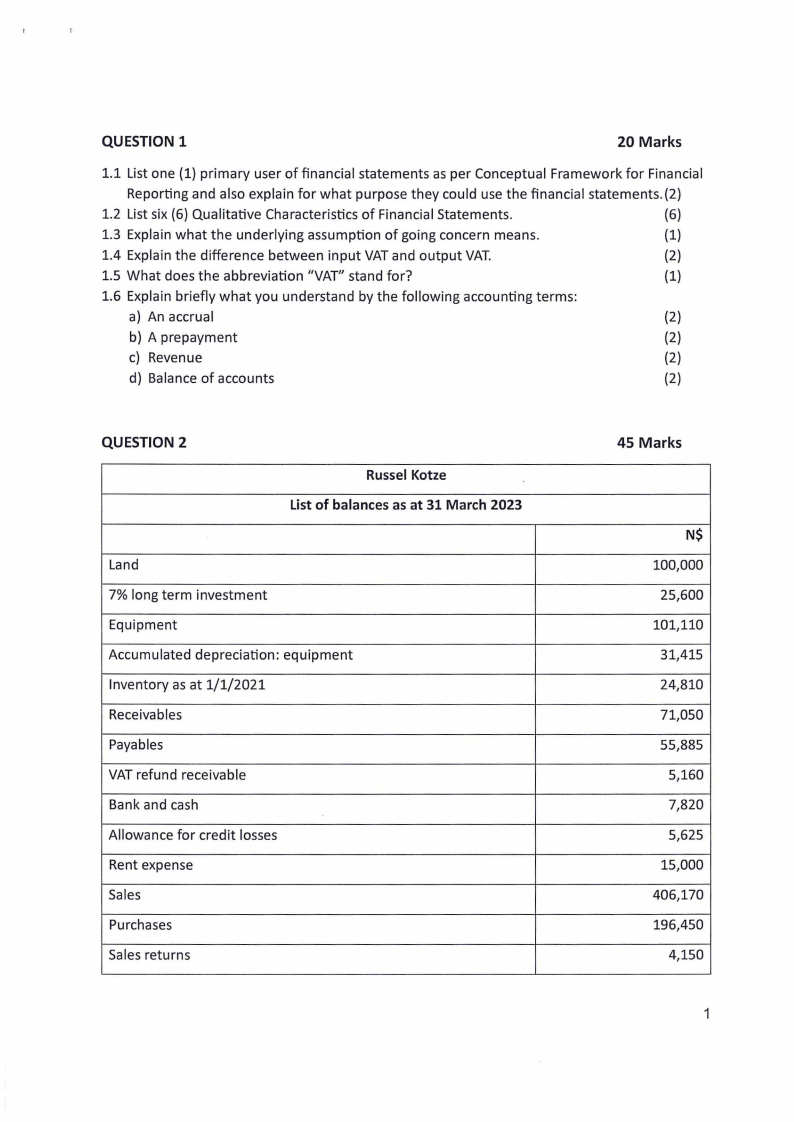

QUESTION 2

Russel Kotze

List of balances as at 31 March 2023

Land

7% long term investment

Equipment

Accumulated depreciation: equipment

Inventory as at 1/1/2021

Receivables

Payables

VAT refund receivable

Bank and cash

Allowance for credit losses

Rent expense

Sales

Purchases

Sales returns

45 Marks

N$

100,000

25,600

101,110

31,415

24,810

71,050

55,885

5,160

7,820

5,625

15,000

406,170

196,450

4,150

1

|

3 Page 3 |

▲back to top |

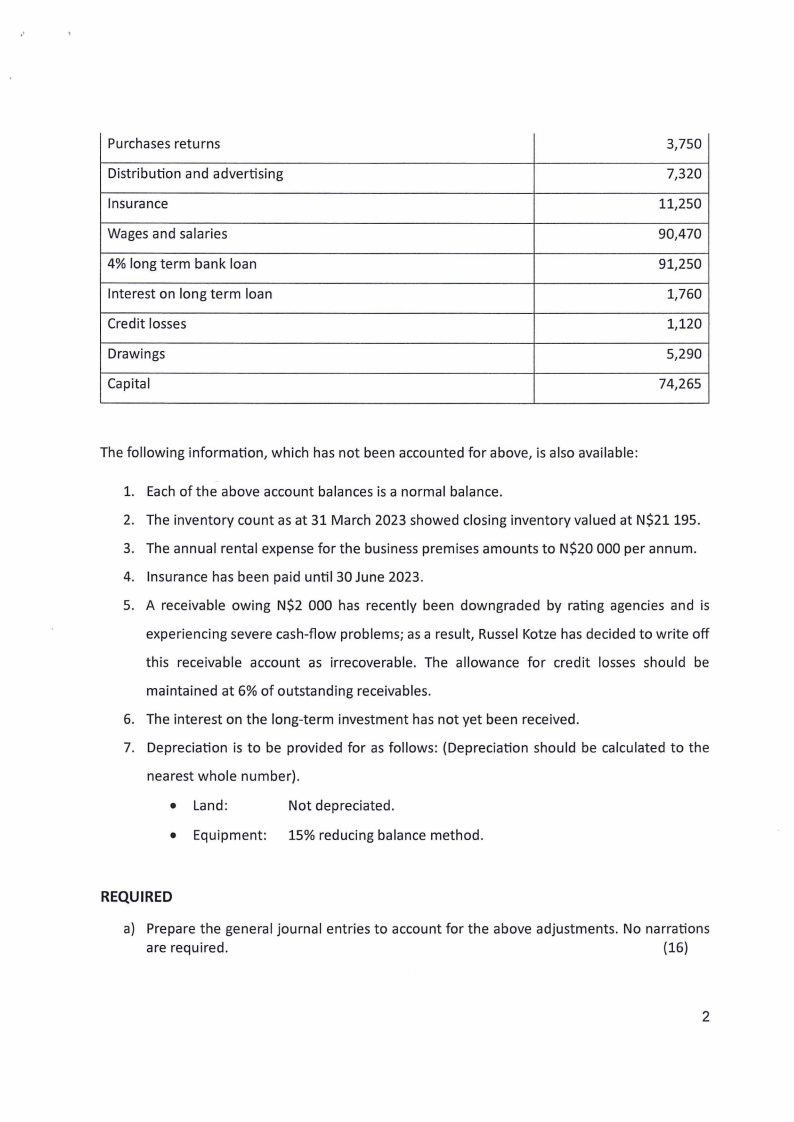

Purchases returns

Distribution and advertising

Insurance

Wages and salaries

4% long term bank loan

Interest on long term loan

Credit losses

Drawings

Capital

3,750

7,320

11,250

90,470

91,250

1,760

1,120

5,290

74,265

The following information, which has not been accounted for above, is also available:

1. Each of the above account balances is a normal balance.

2. The inventory count as at 31 March 2023 showed closing inventory valued at N$21195.

3. The annual rental expense for the business premises amounts to N$20 000 per annum.

4. Insurance has been paid until 30 June 2023.

5. A receivable owing N$2 000 has recently been downgraded by rating agencies and is

experiencing severe cash-flow problems; as a result, Russel Kotze has decided to write off

this receivable account as irrecoverable. The allowance for credit losses should be

maintained at 6% of outstanding receivables.

6. The interest on the long-term investment has not yet been received.

7. Depreciation is to be provided for as follows: (Depreciation should be calculated to the

nearest whole number).

• Land:

Not depreciated.

• Equipment: 15% reducing balance method.

REQUIRED

a) Prepare the general journal entries to account for the above adjustments. No narrations

are required.

(16)

2

|

4 Page 4 |

▲back to top |

b) Prepare the Statement of Profit or Loss of Russel Kotze for the year ended 31 March 2023.

(16)

c) Prepare the Statement of Financial Position of Russel Kotze as at 31 March 2023.

Show all workings and round off to the nearest N$.

(13)

QUESTION 3

20 Marks

Zeempie Samsodien is a sole proprietor who owns a corner shop that sells groceries and other

small household items and accounts for inventory by using the periodic system. Zeempie

Samsodien is a registered VATvendor and his VATliability as at 01 March 2023 was N$13 700 and

the standard rate of VAT is 15%. The balance on the bank account on 01 March 2023 was a debit

balance of N$ 12 500. Zeempie Samsodien deals with standard goods falling under the standard

VAT rate.

The following information is available for Zeempie Samsodien for the month of March 2023:

i) Sales on credit for the month of March 2023 amounted to N$164 250 net of VAT;

ii) Sales returns (all credit) for the month of March 2023 amounted to N$14 200 net of VAT;

iii) Purchases on credit for the month of March 2023 amounted to N$105 980 net of VAT;

iv) Purchases returns (all credit) for the month of March 2023 amounted to N$11200 net of VAT;

v) Zeempie Samsodien pays N$10 000 in VATto NAM RA (the Receiver of Revenue) monthly by

direct debit order on the 15th of every month.

REQUIRED

a) Prepare the relevant journal entries to account for VATfor March 2023.

(15)

b) Calculate the net VAT payable or receivable as at 31 March 2023.

(5)

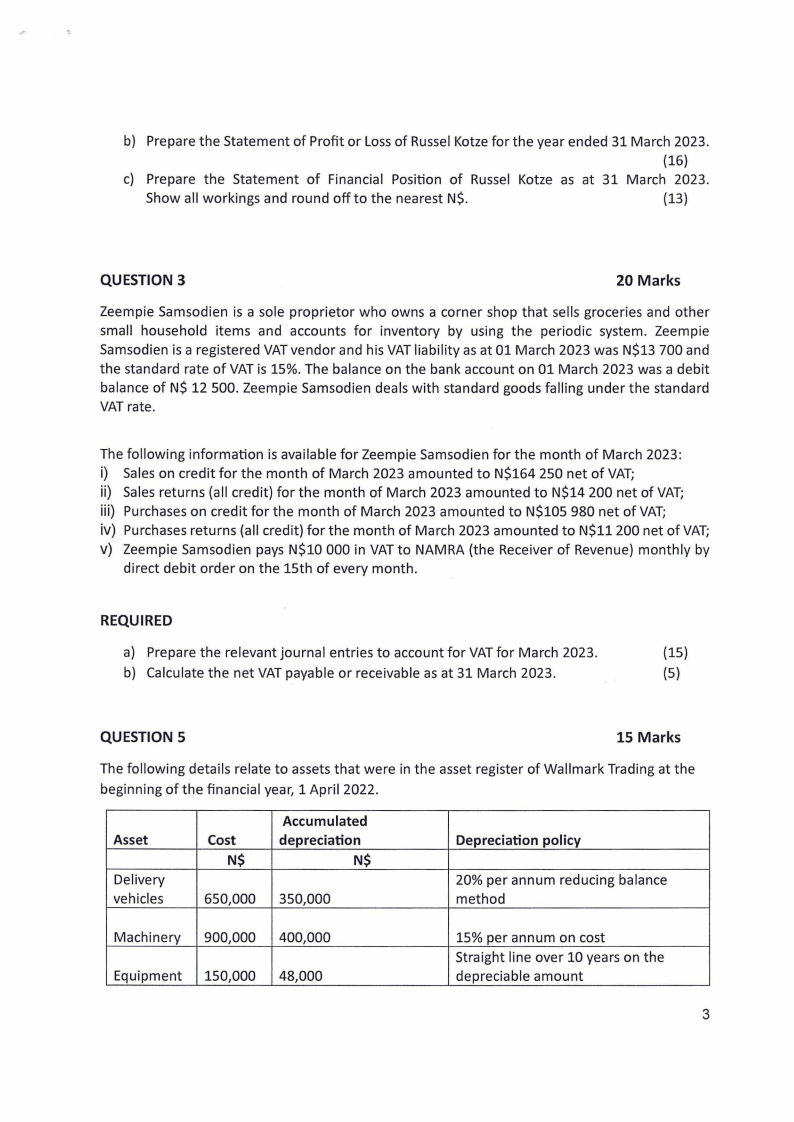

QUESTION S

15 Marks

The following details relate to assets that were in the asset register of Wallmark Trading at the

beginning of the financial year, 1 April 2022.

Asset

Delivery

vehicles

Cost

N$

Accumulated

depreciation

N$

650,000 350,000

Depreciation policy

20% per annum reducing balance

method

Machinery 900,000 400,000

Equipment 150,000 48,000

15% per annum on cost

Straight line over 10 years on the

depreciable amount

3

|

5 Page 5 |

▲back to top |

.r

The following occurred during the year ending 31 March 2023:

• A delivery vehicle which cost N$160 000 with an accumulated depreciation of N$120 000

on 31 March 2022 was destroyed in an accident on 30 September 2022. The vehicle was

insured and a cheque to the amount of N$34 500 was received from the insurance

company.

• On 30 November 2022, one of the old machines with a cost of N$300 000 and included in

the figure of N$900 000, was traded in on a new machine with a cost of N$575 000 (VAT

inclusive). On 31 March 2022 the accumulated depreciation on the old machine was

N$140 000 and an amount of N$138 000 was received for it as a traded in value. The

outstanding amount for the new machine was paid by cheque.

• Equipment will be disposed at the end of it useful life for an amount of N$30 000. As at

31 March 2023, the equipment had a remaining useful life of five years.

Assume a VAT rate of 15%.

REQUIRED

a) Calculate the profit or loss on the machine trade-in.

(4)

b) Disclose the item of property, plant and equipment in the notes to the financial position

as at 31 March 2023.

(11)

END OF EXAMINATION PAPER

4