|

FAC512S- FINANCIAL ACCOUNTING 102- 1ST OPP- NOV 2023 |

|

1 Page 1 |

▲back to top |

nAmI BI AunIVE RSITY

OF SCIEnCE Ano TECHnOLOGY

FACULTY OF COMMERCE, HUMAN SCIENCESAND EDUCATION

DEPARTMENTOF ACCOUNTING,ECONOMICSAND FINANCE

QUALIFICATION : BACHELOROF ACCOUNTING

QUALIFICATION CODE: 07BOAC

LEVEL: 5

COURSE: FINANCIALACCOUNTING102

COURSE CODE: FAC512S

DATE: NOVEMBER 2023

DURATION: 3 HOURS

SESSION: THEORYAND APPLICATION

MARKS: 100

FIRST OPPORTUNITY EXAMINATION

FIRST EXAMINER: Ms. H. Kangala, Ms. Y. Andrew, Mr. J Chikambi & Ms. M. Amakali

MODERATOR:

Mr. C. Mahindi

INSTRUCTIONS

1. This question paper is made up of FIVE{5} questions.

2. Answer All the questions and in blue or black ink.

3. You are advised to pay due attention to expression and presentation. Failure to do so will

cost you marks.

4. Start each question on a new page in your answer booklet and show all your workings.

5. Questions relating to this paper may be raised in the initial 30 minutes after the start of

the paper. Thereafter, candidates must use their initiative to deal with any perceived error

or ambiguities and any assumption made by the candidate should be clearly stated.

PERMISSIBLE MATERIALS

Non-programmable calculator/financial calculator

THIS QUESTION PAPER CONSISTS OF 7 PAGES (Excluding this front page)

|

2 Page 2 |

▲back to top |

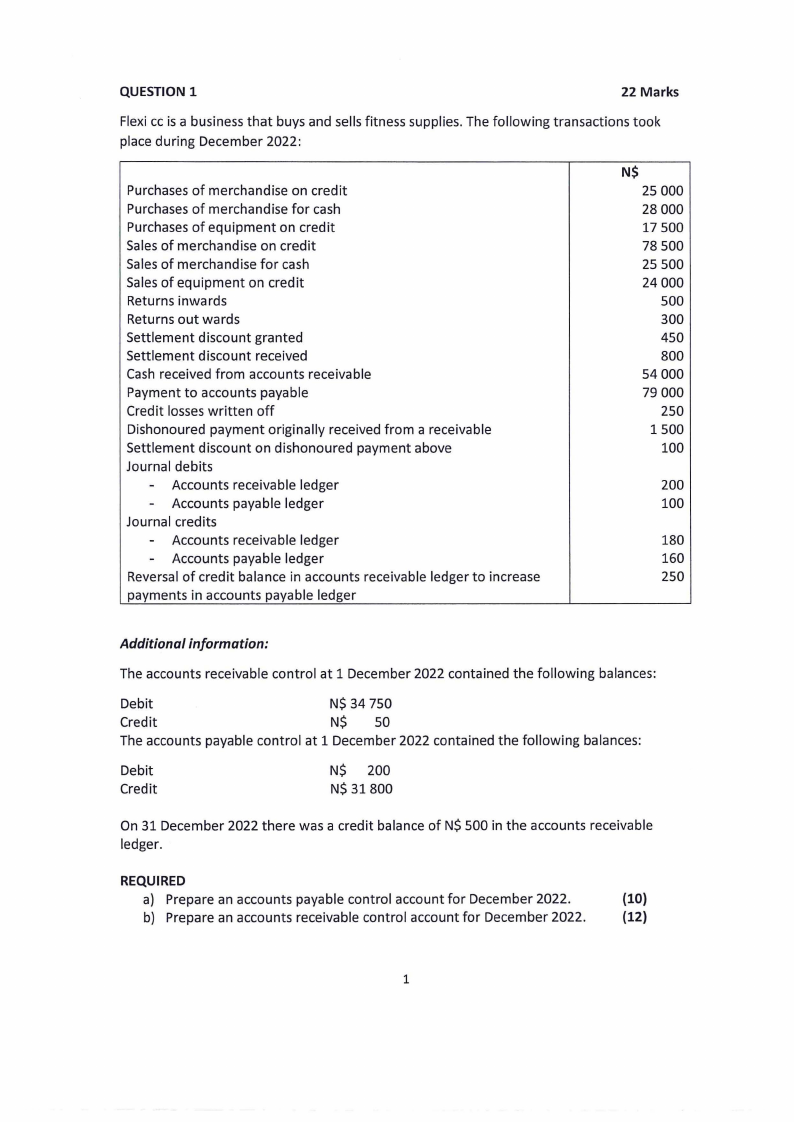

QUESTION 1

22 Marks

Flexi cc is a business that buys and sells fitness supplies. The following transactions took

place during December 2022:

Purchases of merchandise on credit

Purchases of merchandise for cash

Purchases of equipment on credit

Salesof merchandise on credit

Salesof merchandise for cash

Salesof equipment on credit

Returns inwards

Returns out wards

Settlement discount granted

Settlement discount received

Cash received from accounts receivable

Payment to accounts payable

Credit losses written off

Dishonoured payment originally received from a receivable

Settlement discount on dishonoured payment above

Journal debits

- Accounts receivable ledger

- Accounts payable ledger

Journal credits

- Accounts receivable ledger

- Accounts payable ledger

Reversal of credit balance in accounts receivable ledger to increase

payments in accounts payable ledger

N$

25 000

28 000

17 500

78 500

25 500

24000

500

300

450

800

54000

79 000

250

1500

100

200

100

180

160

250

Additional information:

The accounts receivable control at 1 December 2022 contained the following balances:

Debit

N$ 34 750

Credit

N$ 50

The accounts payable control at 1 December 2022 contained the following balances:

Debit

Credit

N$ 200

N$ 31800

On 31 December 2022 there was a credit balance of N$ 500 in the accounts receivable

ledger.

REQUIRED

a) Prepare an accounts payable control account for December 2022.

(10)

b) Prepare an accounts receivable control account for December 2022.

(12)

1

|

3 Page 3 |

▲back to top |

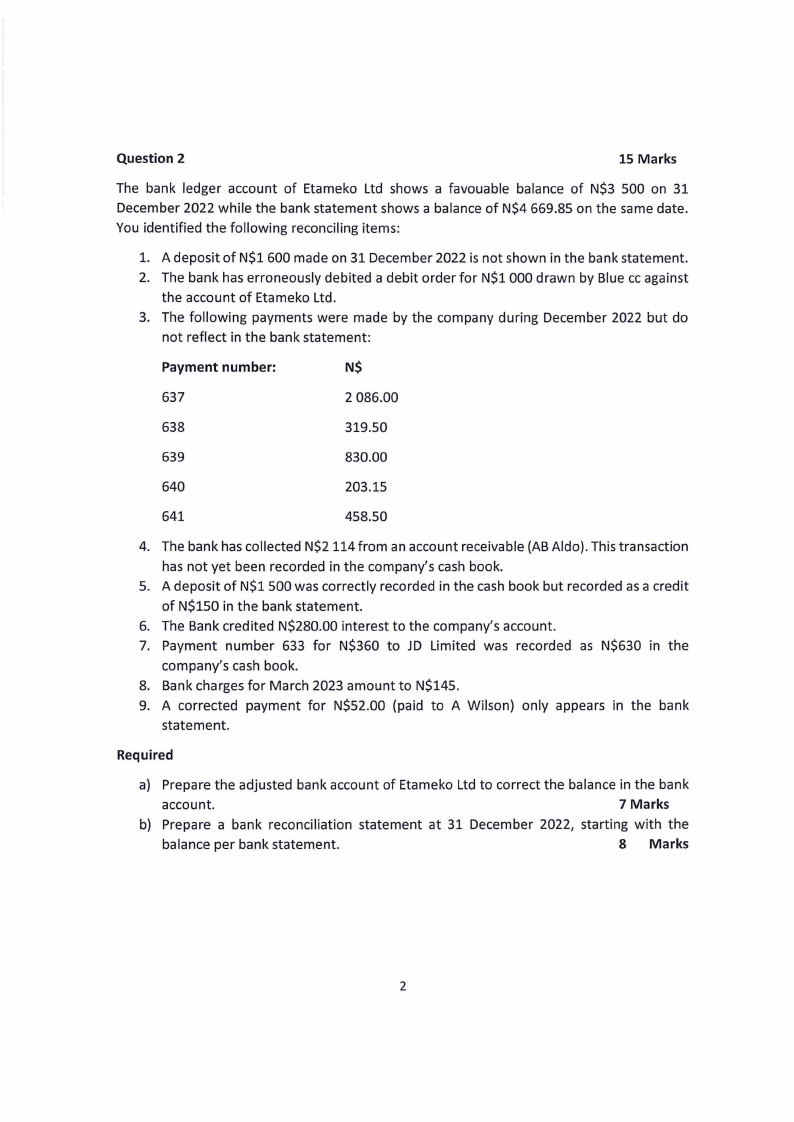

Question 2

15 Marks

The bank ledger account of Etameko Ltd shows a favouable balance of N$3 500 on 31

December 2022 while the bank statement shows a balance of N$4 669.85 on the same date.

You identified the following reconciling items:

1. A deposit of N$1 600 made on 31 December 2022 is not shown in the bank statement.

2. The bank has erroneously debited a debit order for N$1 000 drawn by Blue cc against

the account of Etameko Ltd.

3. The following payments were made by the company during December 2022 but do

not reflect in the bank statement:

Payment number:

N$

637

2 086.00

638

319.50

639

830.00

640

203.15

641

458.50

4. The bank has collected N$2 114 from an account receivable (AB Aldo). This transaction

has not yet been recorded in the company's cash book.

5. A deposit of N$1 500 was correctly recorded in the cash book but recorded as a credit

of N$150 in the bank statement.

6. The Bank credited N$280.00 interest to the company's account.

7. Payment number 633 for N$360 to JD Limited was recorded as N$630 in the

company's cash book.

8. Bank charges for March 2023 amount to N$145.

9. A corrected payment for N$52.00 (paid to A Wilson) only appears in the bank

statement.

Required

a) Prepare the adjusted bank account of Etameko Ltd to correct the balance in the bank

account.

7 Marks

b) Prepare a bank reconciliation statement at 31 December 2022, starting with the

balance per bank statement.

8 Marks

2

|

4 Page 4 |

▲back to top |

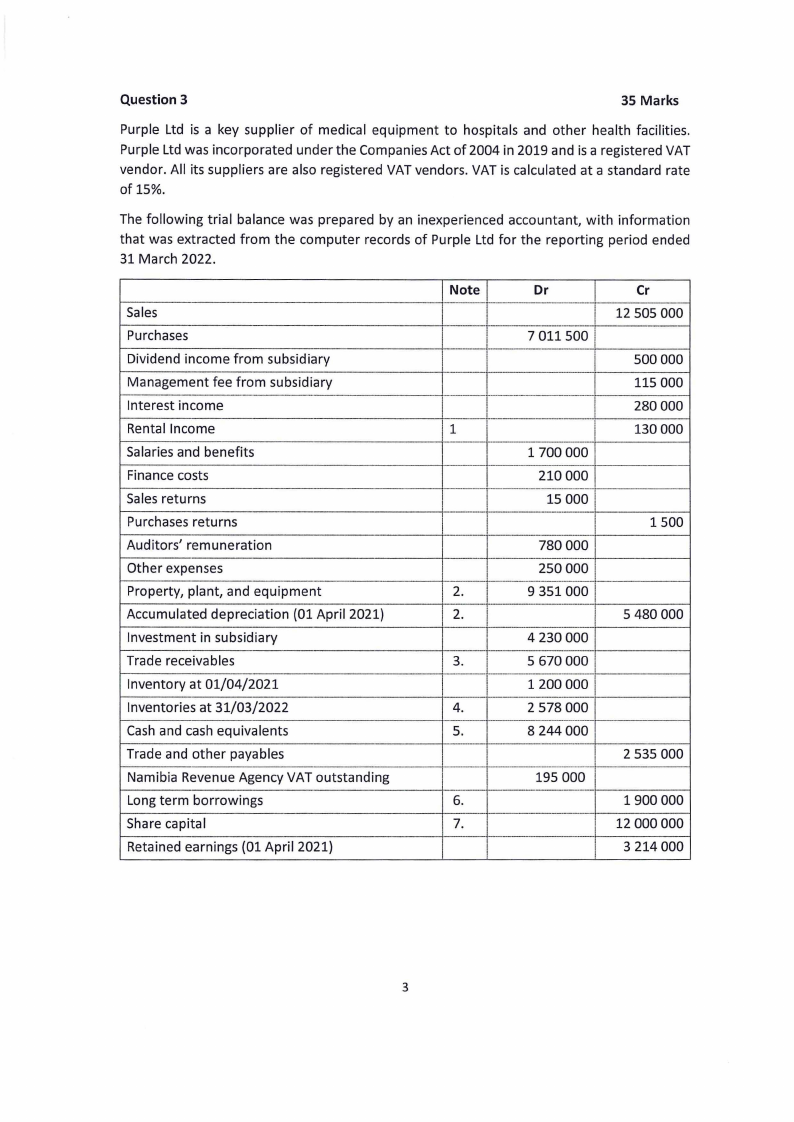

Question 3

35 Marks

Purple Ltd is a key supplier of medical equipment to hospitals and other health facilities.

Purple Ltd was incorporated under the Companies Act of 2004 in 2019 and is a registered VAT

vendor. All its suppliers are also registered VAT vendors. VAT is calculated at a standard rate

of 15%.

The following trial balance was prepared by an inexperienced accountant, with information

that was extracted from the computer records of Purple Ltd for the reporting period ended

31 March 2022.

Sales

Purchases

Dividend income from subsidiary

Management fee from subsidiary

Interest income

Rental Income

Salaries and benefits

Finance costs

Sales returns

Purchases returns

Auditors' remuneration

Other expenses

Property, plant, and equipment

Accumulated depreciation {01 April 2021)

Investment in subsidiary

Trade receivables

Inventory at 01/04/2021

Inventories at 31/03/2022

Cash and cash equivalents

Trade and other payables

Namibia Revenue Agency VAT outstanding

Long term borrowings

Share capital

Retained earnings {01 April 2021)

Note

1

2.

2.

3.

4.

5.

6.

7.

Dr

7 011500

1700000

210 000

15 000

780 000

250 000

9 351 000

4 230 000

5 670 000

1200000

2 578 000

8 244 000

195 000

Cr

12 505 000

500 000

115 000

280 000

130 000

1500

5 480 000

2 535 000

1900 000

12 000 000

3 214 000

3

|

5 Page 5 |

▲back to top |

The following transactions have not been recorded:

1. Rental Income

• Rental income relates to extra storage space to a local carpenter for N$10,000 per

month.

2. Property, plant, and equipment

• A plant with a carrying value of N$2 800 000 was discovered to have a recoverable

amount of N$2 000 000 after an impairment test was carried out.

• Total depreciation for the current reporting period was correctly calculated as

N$1 205 000 (plant N$900 000 and vehicles N$305 000).

• A vehicle with a cost of N$400 000 and accumulated depreciation of N$145 000 (up to

the date of the theft) was stolen during the year. The insurer paid a VAT inclusive

amount of N$368 000 on the claim.

• Purple Ltd sold another vehicle with a carrying value of N$325 000 to a secondhand

car dealer for N$345 000 (including VAT).

3. Trade receivables

• Wheeler cc, a receivable was deemed insolvent. The Finance director of Purple Ltd

authorized the action to write off the total balance of N$75 785 owed by Wheeler cc

as irrecoverable.

• Furthermore, after a review of the remainder of the account receivables, an increase

in allowance for doubtful debts by N$200 000 was authorized.

4. Inventories

• A review of the market on 31 March 2022 revealed that Product X, which has a cost

value of N$500 000, had a net realizable value of N$380 000. The cost of this item was

counted with the rest of inventory on stock-taking.

• It was also discovered that inventory with a total cost of N$85 000 was missing. Only

a Dr to other expenses account was accounted for regarding this lost inventory.

5. Cash and cash equivalents

• The bank statement for March 2022 was received on 1 April 2022 which reflected bank

charges of N$1 725 and interest income of N$2 400 still had to be recorded.

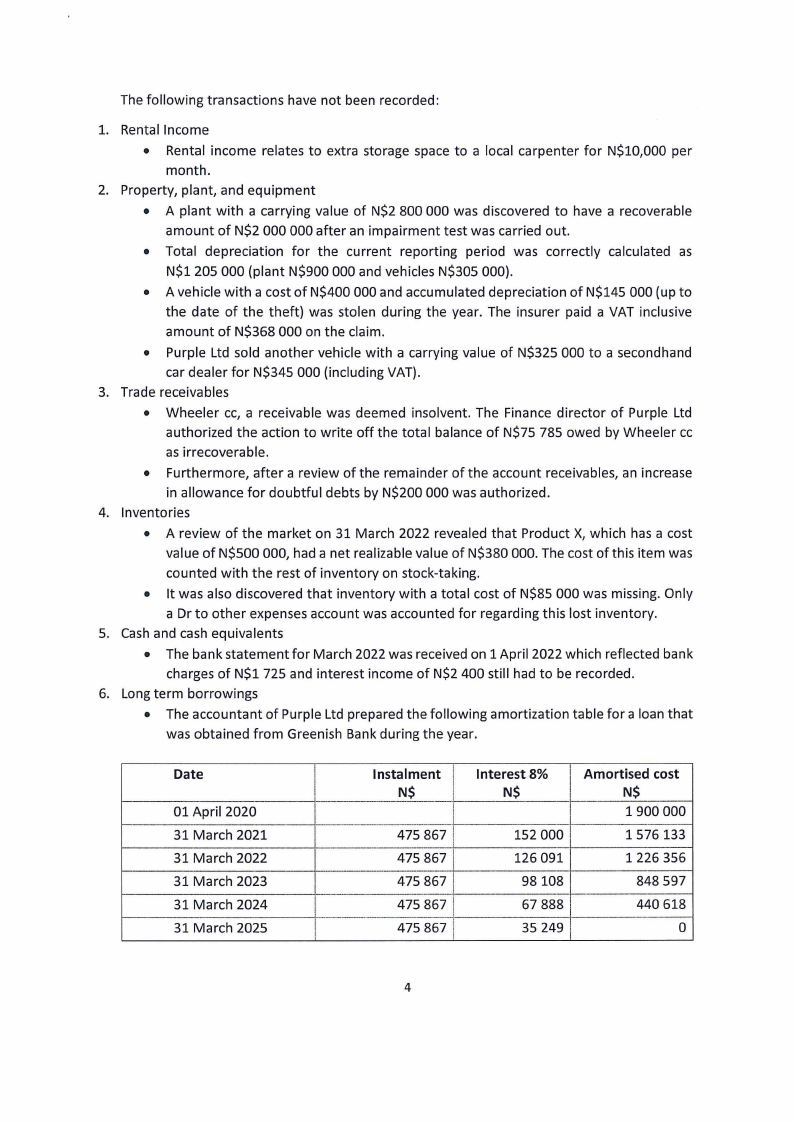

6. Long term borrowings

• The accountant of Purple Ltd prepared the following amortization table for a loan that

was obtained from Greenish Bank during the year.

Date

01 April 2020

31 March 2021

31 March 2022

31 March 2023

31 March 2024

31 March 2025

Instalment

N$

475 867

475 867

475 867

475 867

475 867

Interest 8%

N$

152 000

126 091

98108

67 888

35 249

Amortised cost

N$

1900 000

1576133

1 226 356

848 597

440 618

0

4

|

6 Page 6 |

▲back to top |

The loan attracts interest at 8% per annum and is secured by a building with a carrying value

of N$2 100 000. The instalment due on 31 March 2022 has been paid on time. This finance

cost is not included in the amount provided in the trial balance above.

7. Share capital

• The issued share capital comprises 100 000 ordinary shares issued at N$120 each and

200 000 5% preference shares issued at N$10 per share.

• On 1 October 2021, an additional 120 000 ordinary shares were issued at N$125 each

and were paid for on the same date. On the same date, an additional 100 000 5%

preference shares were issued at N$10 per share. Payment was received on the same

day.

• A dividend of 50 cents per ordinary share was declared on 31 March 2022.

8. Income tax

Purple Ltd applies the Namibian income tax rate at 32%.

Required

a) Present the statement of profit or loss for the reporting period ended 31 March 2022

using the function method in compliance with IFRS.

30 Marks

b) Calculate dividends per ordinary share. Show all your workings.

5 Marks

5

|

7 Page 7 |

▲back to top |

Question 4

20 Marks

Chaptersand Novels in Africa (CNA)is a partnership between Chikambi and Nellie. They both

love reading and decided to start CNA,a businessthat sells books and stationery to clients

across Namibia.

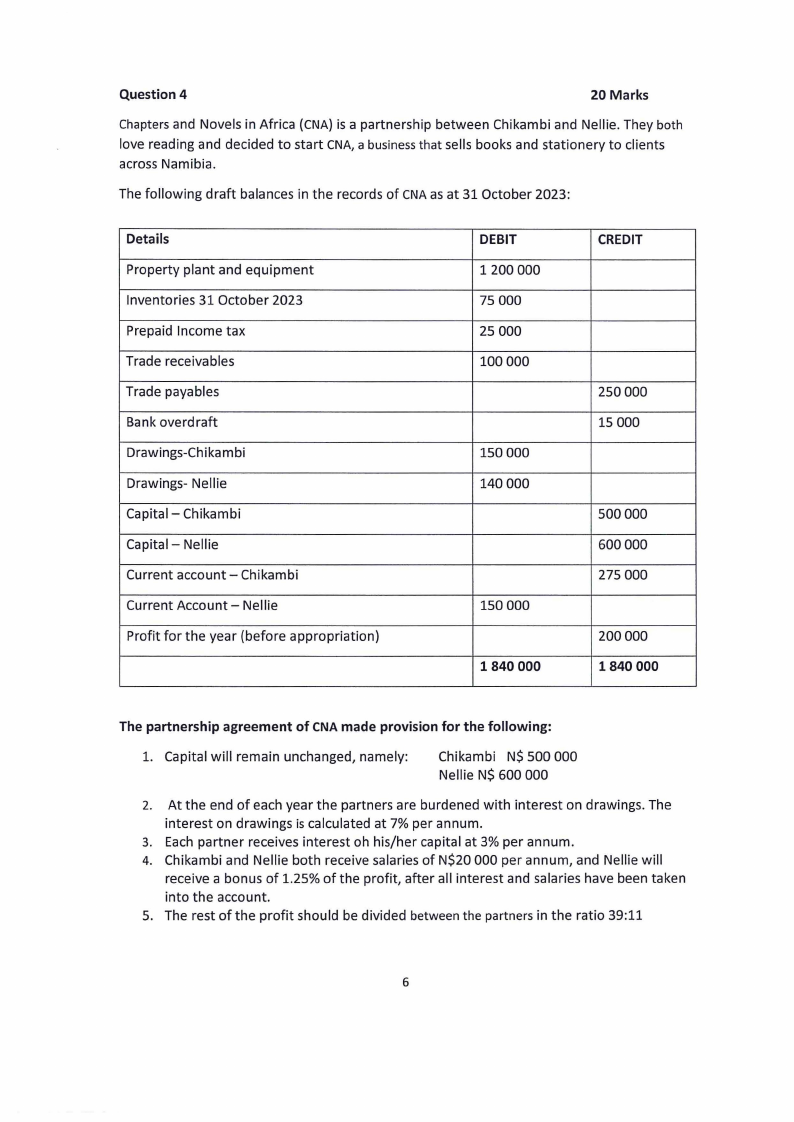

The following draft balances in the records of CNAas at 31 October 2023:

Details

Property plant and equipment

Inventories 31 October 2023

Prepaid Income tax

Trade receivables

Trade payables

Bank overdraft

Drawings-Chikambi

Drawings- Nellie

Capital - Chikambi

Capital - Nellie

Current account - Chikambi

Current Account - Nellie

Profit for the year (before appropriation)

DEBIT

1200000

75 000

25 000

100 000

150 000

140 000

150 000

1840 000

CREDIT

250 000

15 000

500 000

600 000

275 000

200 000

1840 000

The partnership agreement of CNA made provision for the following:

1. Capital will remain unchanged, namely:

Chikambi N$ 500 000

Nellie N$ 600 000

2. At the end of each year the partners are burdened with interest on drawings. The

interest on drawings is calculated at 7% per annum.

3. Each partner receives interest oh his/her capital at 3% per annum.

4. Chikambi and Nellie both receive salaries of N$20 000 per annum, and Nellie will

receive a bonus of 1.25% of the profit, after all interest and salaries have been taken

into the account.

5. The rest of the profit should be divided between the partners in the ratio 39:11

6

|

8 Page 8 |

▲back to top |

Required:

Prepare the statement of changes in equity of CNAfor the year ended 31 October 2023 (20)

Note: Clearly show and your calculations. Round of all amounts to the nearest Namibian dollar.

Question 5

8 Marks

4.1. Provide explanations for the application of the following internal controls over cash

receipts and payments.

2 Marks

a) Division of duties (1)

b) Electronic payments controls (1)

4.2. Answer the following questions:

i. Explain the qualitative characteristic of relevance.

ii. Explain the objective of general purpose of financial statements.

iii. Explain the accrual basis concept.

2 Marks

2 Marks

2 Marks

END OF EXAMINATION

7