|

MAB611S- MONEY AND BANKING- 1ST OPP- JUNE 2023 |

|

1 Page 1 |

▲back to top |

|

2 Page 2 |

▲back to top |

|

3 Page 3 |

▲back to top |

|

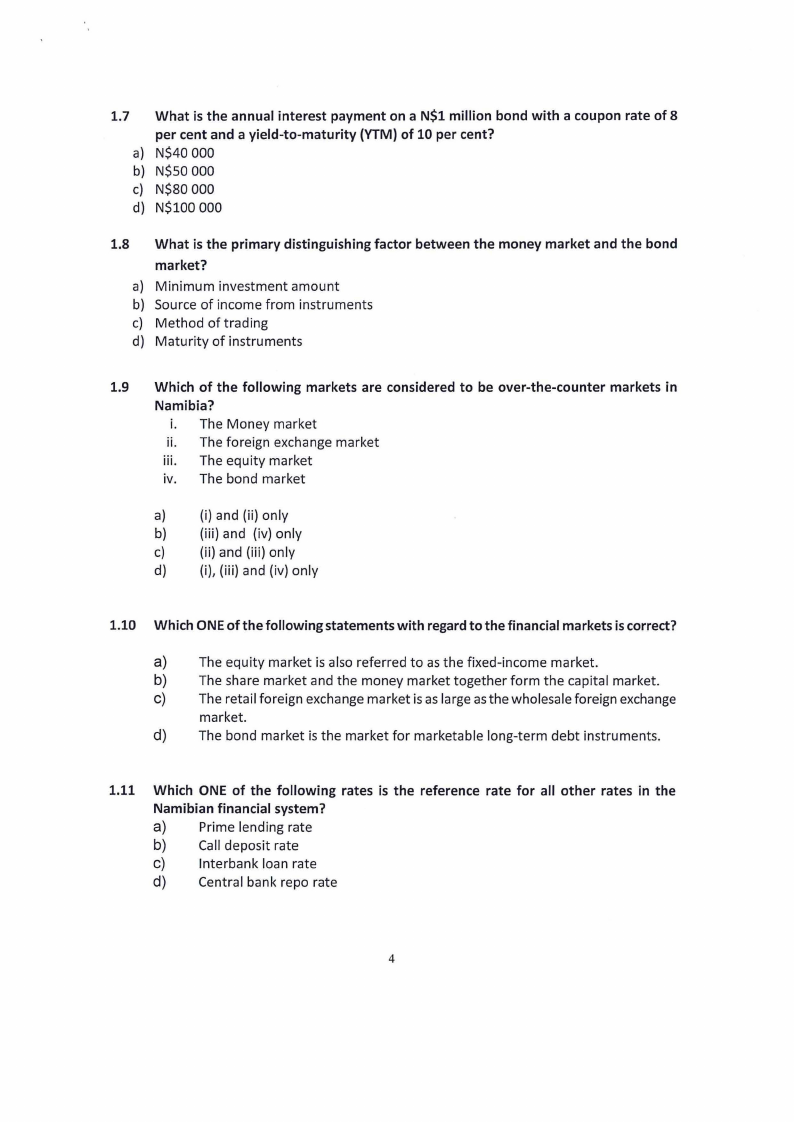

4 Page 4 |

▲back to top |

|

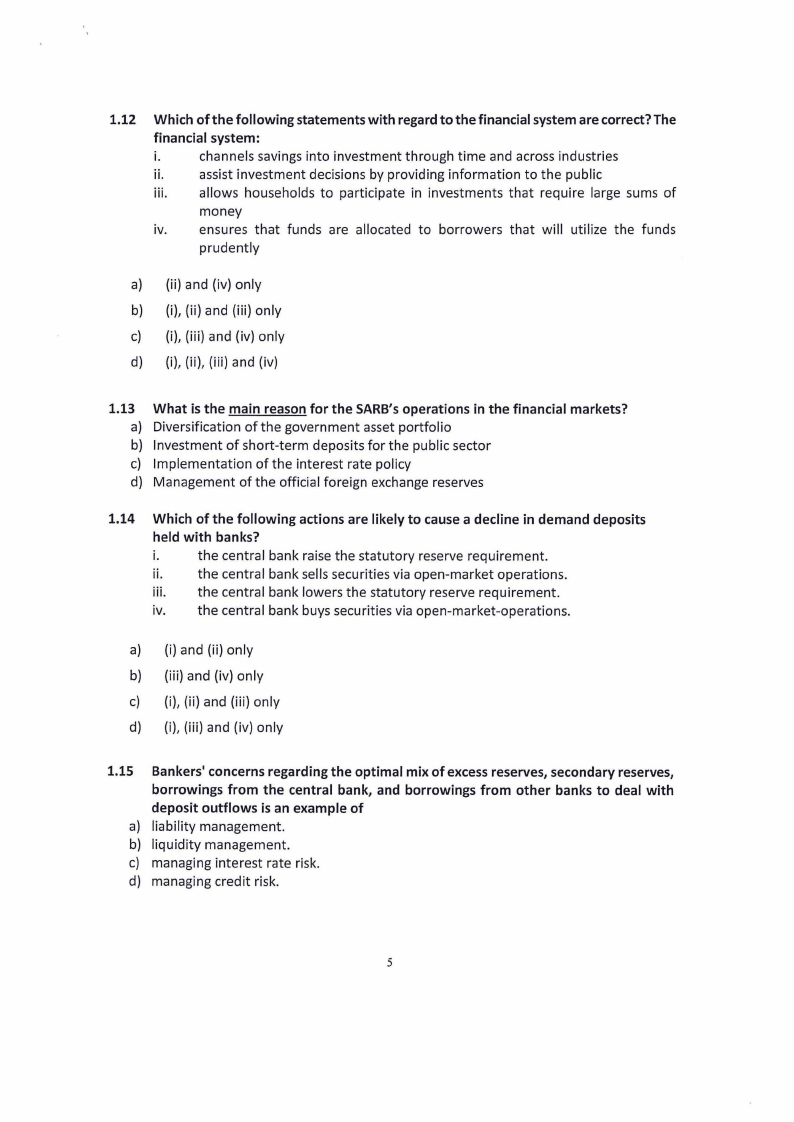

5 Page 5 |

▲back to top |

|

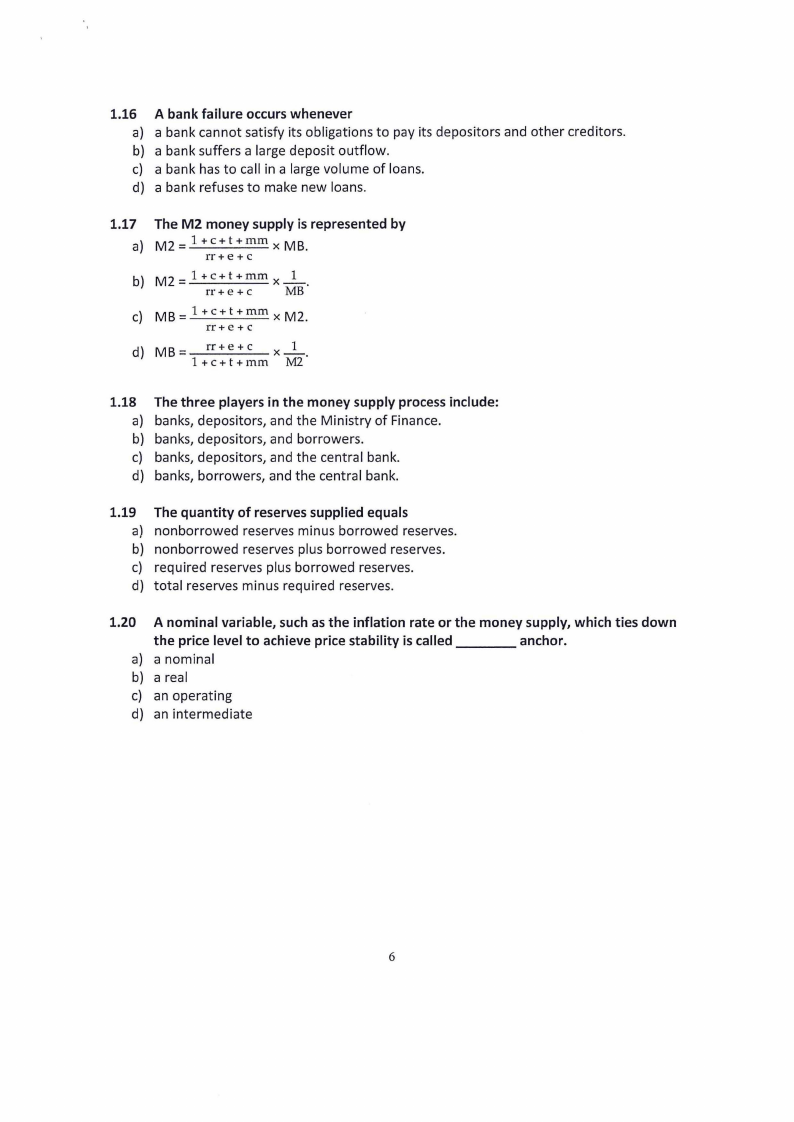

6 Page 6 |

▲back to top |

|

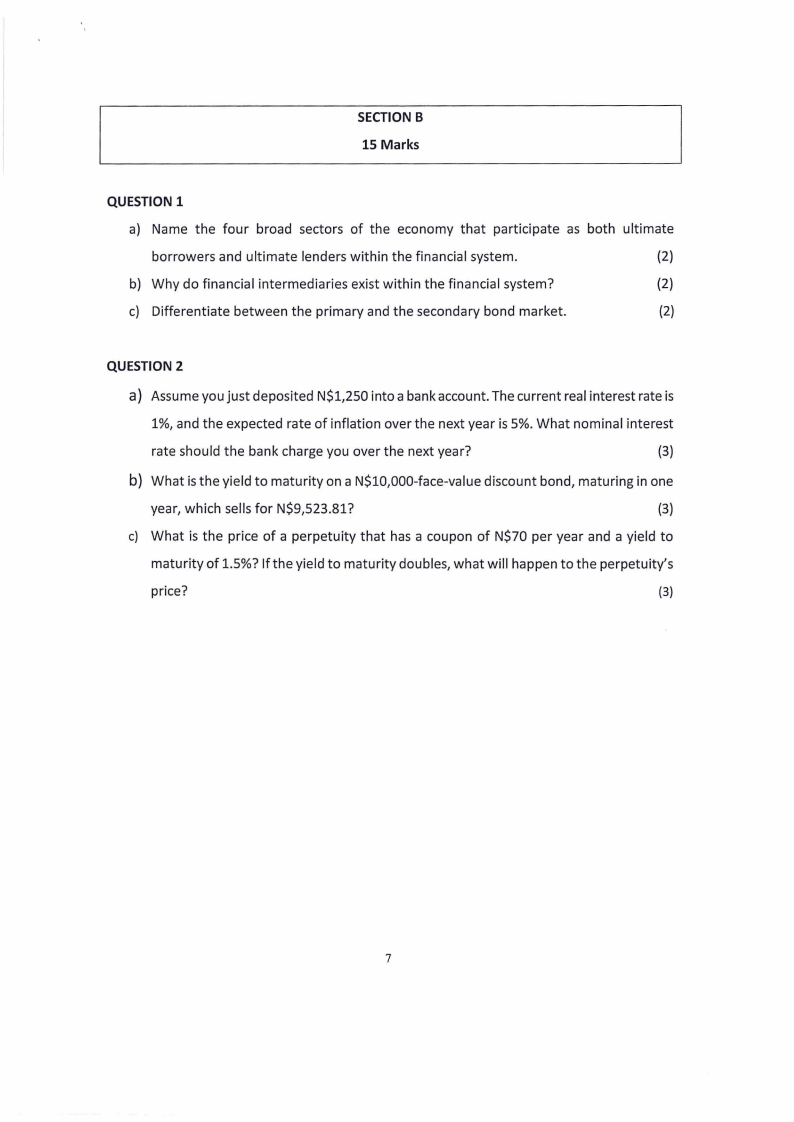

7 Page 7 |

▲back to top |

|

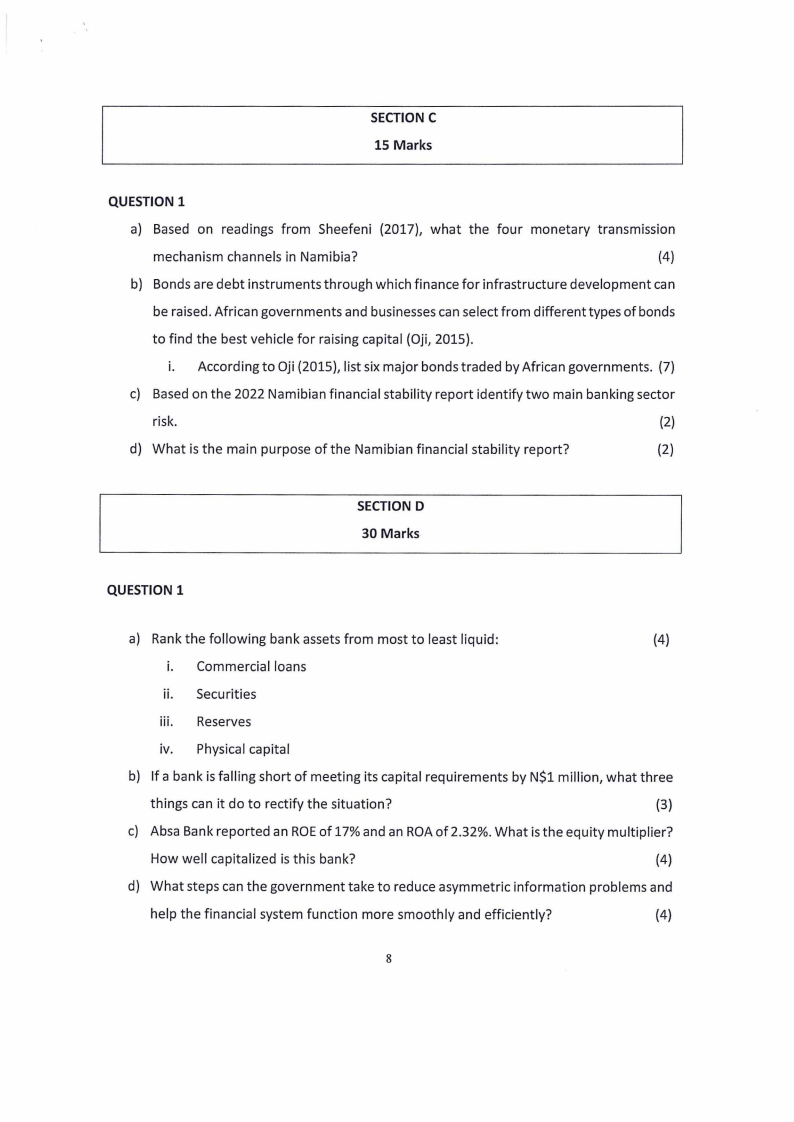

8 Page 8 |

▲back to top |

|

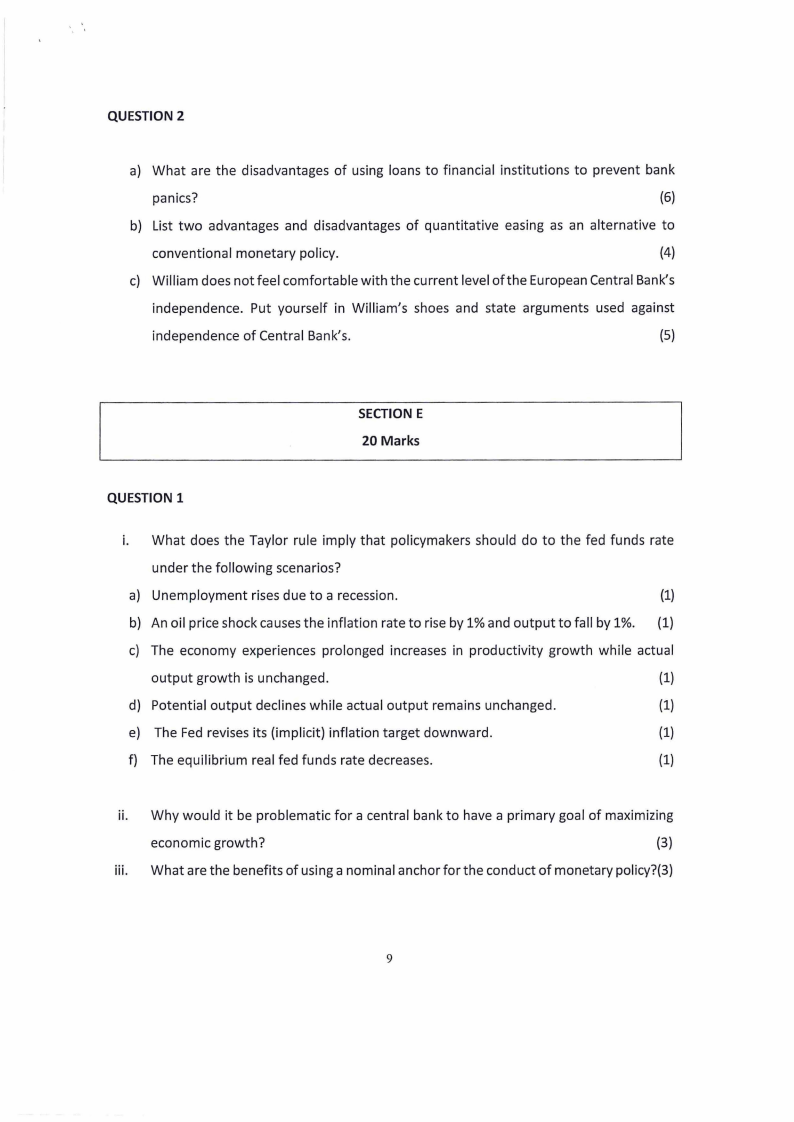

9 Page 9 |

▲back to top |

|

10 Page 10 |

▲back to top |