|

MAB611S- MONEY AND BANKING- 2ND OPP- JUNE 2023 |

|

1 Page 1 |

▲back to top |

n Am I BIA u n IVER s ITY

OF SCIEnCE TECHnOLOGY

FACULTY OF COMMERCE, HUMAN SCIENCES AND EDUCATION

DEPARTMENT OF ECONOMICS, ACCOUNTING AND FINANCE

QUALIFICATION : BACHELOR OF ECONOMICS

QUALIFICATION CODE: O7BEC0

LEVEL: 7

COURSE CODE: MAB611S

COURSE NAME: MONEY AND BANKING

SESSION: JUNE 2023

DURATION: 3 HOURS

PAPER: THEORY

MARKS: 100

SECOND OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINER(S) Mr Eslon Ngeendepi

MODERATOR: Mr Mally Likukela

INSTRUCTIONS

1. Answer ALL the questions.

2. Write clearly and neatly.

3. Number the answers clearly.

PERMISSIBLE MATERIALS

1. Pens/pencils/erasers

2. Calculator

3. Ruler

THIS QUESTION PAPER CONSISTS OF 6 PAGES (Including this front page)

|

2 Page 2 |

▲back to top |

QUESTION 1

[20 Marks]

Select the letter that best represents your choice.

1.

Financial markets promote greater economic efficiency by channeling funds from

____

to ___ _

A) investors; savers

B) borrowers; savers

C) savers; borrowers

D) savers; lenders

2.

An increase in interest rates might ____

saving because more can be earned in

interest income.

A) encourage

B) discourage

C) disallow

D) invalidate

3.

A financial market in which previously issued securities can be resold is called a

____

market.

A) primary

B) secondary

C) tertiary

D) used securities

4.

Equity instruments are traded in the ____

market.

A) money

B)bond

C) capital

D) commodities

5.

Economies of scale enable financial institutions to

A) reduce transactions costs.

B) avoid the asymmetric information problem.

C) avoid adverse selection problems.

D) reduce moral hazard.

6.

The total collection of pieces of property that serve to store value is a person's

A) wealth.

B) income.

C) money.

D) credit.

2

|

3 Page 3 |

▲back to top |

7. When money prices are used to facilitate comparisons of value, money is said to

function as a

A) unit of account.

B) medium of exchange.

C) store of value.

D) payments-system ruler.

8.

Which of the following sequences accurately describes the evolution of the

payments system?

A) barter, coins made of precious metals, paper currency, checks, electronic funds

transfers

B) barter, coins made of precious metals, checks, paper currency, electronic funds

transfers

C) barter, checks, paper currency, coins made of precious metals, electronic funds

transfers

D) barter, checks, paper currency, electronic funds transfers

9.

A credit market instrument that requires the borrower to make the same payment

every period until the maturity date is known as a

A) simple loan.

B) fixed-payment loan.

C) coupon bond.

D) discount bond.

10. If a N$5,000 coupon bond has a coupon rate of 13 percent, then the coupon payment

every year is

A) N$650.

B) N$1,300.

C) N$130.

D) N$13.

11. A bond that is bought at a price below its face value and the face value is repaid at

a maturity date is called a

A) simple loan.

B) fixed-payment loan.

C) coupon bond.

D) discount bond.

12. The price of a consol equals the coupon payment

A) times the interest rate.

B) plus the interest rate.

C) minus the interest rate.

D) divided by the interest rate.

3

|

4 Page 4 |

▲back to top |

13. If the expected return on bonds increases, all else equal, the demand for bonds

increases,the price of bonds___ _, and the interest rate ___ _

A) increases; decreases

B) increases; increases

C) decreases; decreases

D) decreases; increases

14. If people expect real estate prices to increase significantly, the ____

bonds will shift to the---~

everything else held constant.

A) demand; right

B) demand; left

C) supply; left

D) supply; right

curve for

15. Property that is pledged to the lender in the event that a borrower cannot make his

or her debt payment is called

A) collateral.

B) points.

C) interest.

D) good faith money.

16. All of the following are nontransaction deposits EXCEPT

A) savings accounts.

B) small-denomination time deposits.

C) checkable deposits.

D) certificates of deposit.

17. High-powered money minus reserves equals

A) reserves.

B) currency in circulation.

C) the monetary base.

D) the nonborrowed base.

18. If the Bank of Namibia decides to reduce bank reserves, it can:

A) purchase government bonds.

B) extend discount loans to banks.

C) sell government bonds.

D) print more currency.

19. Banksearn profits by selling____

with attractive combinations of liquidity, risk,

and return, and using the proceeds to buy ____

with a different set of

characteristics.

A) loans; deposits

B) securities; deposits

C) liabilities; assets

D) assets; liabilities

4

|

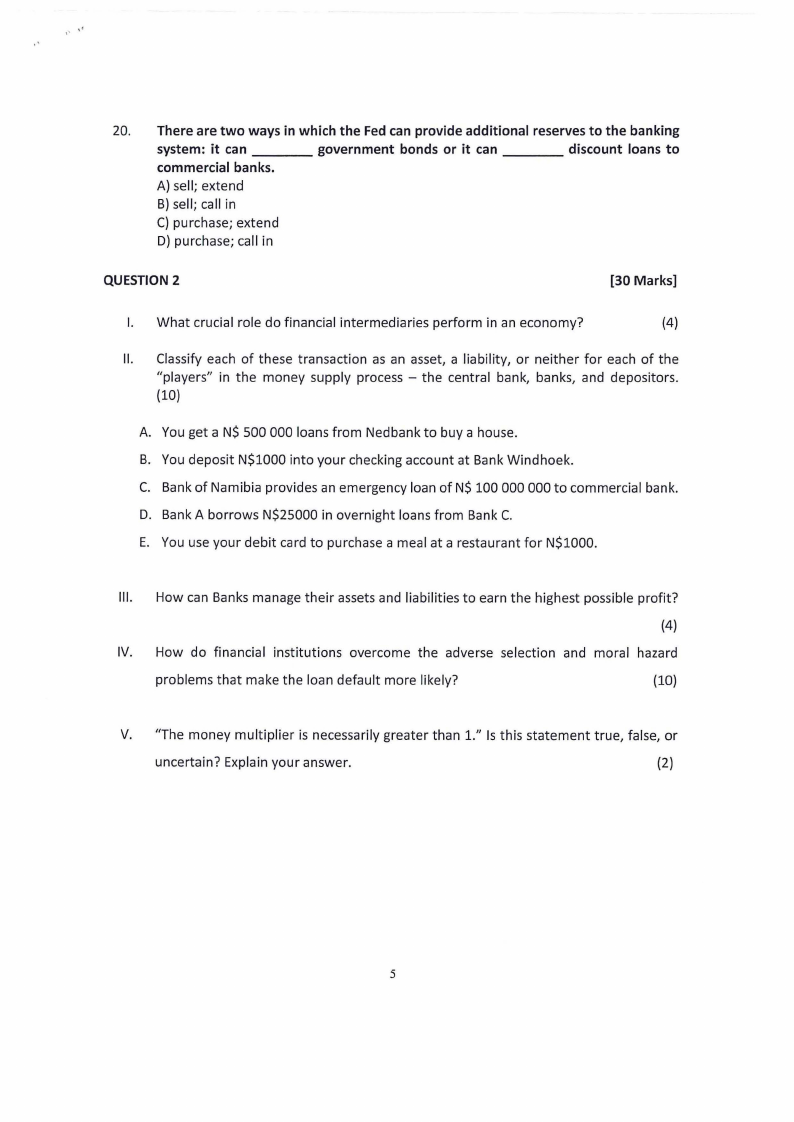

5 Page 5 |

▲back to top |

20. There are two ways in which the Fed can provide additional reserves to the banking

system: it can ____

government bonds or it can ____

discount loans to

commercial banks.

A) sell; extend

B) sell; call in

C) purchase; extend

D) purchase; call in

QUESTION 2

[30 Marks]

I. What crucial role do financial intermediaries perform in an economy?

(4)

II. Classify each of these transaction as an asset, a liability, or neither for each of the

"players" in the money supply process - the central bank, banks, and depositors.

(10)

A. You get a N$ 500 000 loans from Nedbank to buy a house.

B. You deposit N$1000 into your checking account at Bank Windhoek.

C. Bank of Namibia provides an emergency loan of N$ 100 000 000 to commercial bank.

D. Bank A borrows N$25000 in overnight loans from Bank C.

E. You use your debit card to purchase a meal at a restaurant for N$1000.

111. How can Banks manage their assets and liabilities to earn the highest possible profit?

(4)

IV. How do financial institutions overcome the adverse selection and moral hazard

problems that make the loan default more likely?

(10)

V. "The money multiplier is necessarily greater than 1." Is this statement true, false, or

uncertain? Explain your answer.

(2)

5

|

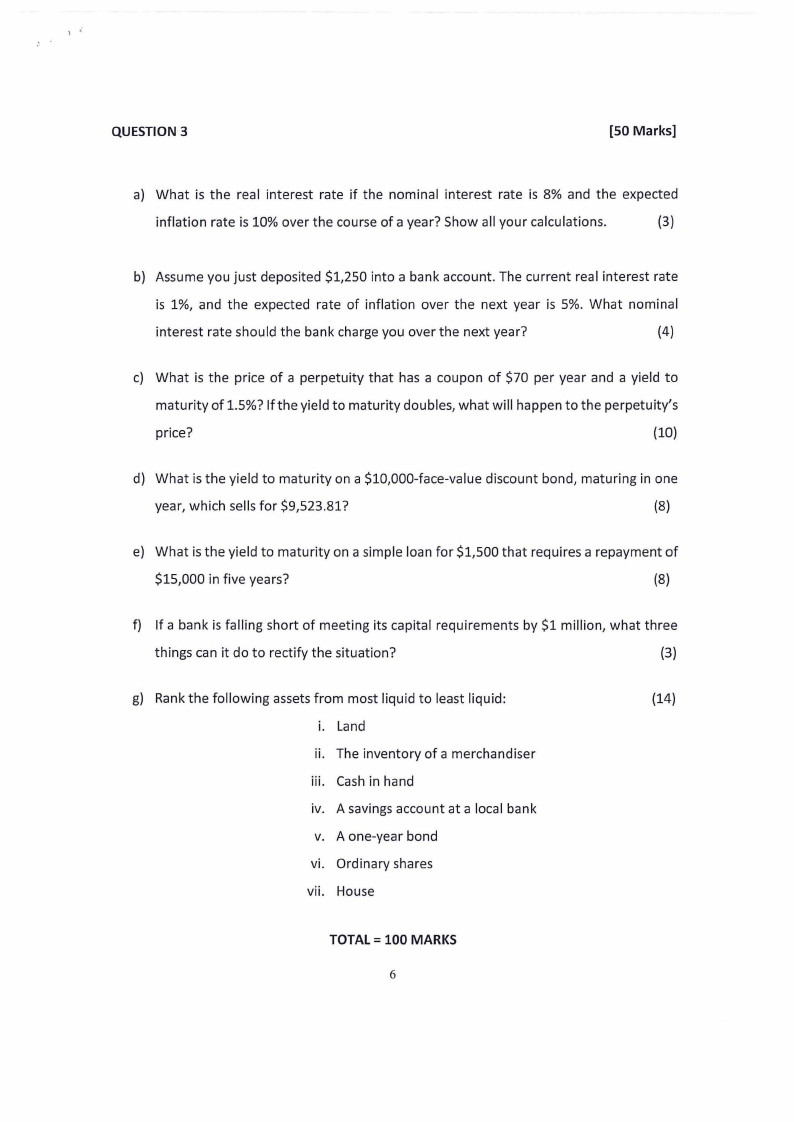

6 Page 6 |

▲back to top |

QUESTION 3

[SO Marks]

a) What is the real interest rate if the nominal interest rate is 8% and the expected

inflation rate is 10% over the course of a year? Show all your calculations.

(3)

b) Assume you just deposited $1,250 into a bank account. The current real interest rate

is 1%, and the expected rate of inflation over the next year is 5%. What nominal

interest rate should the bank charge you over the next year?

(4)

c) What is the price of a perpetuity that has a coupon of $70 per year and a yield to

maturity of 1.5%? If the yield to maturity doubles, what will happen to the perpetuity's

price?

{10)

d) What is the yield to maturity on a $10,000-face-value discount bond, maturing in one

year, which sells for $9,523.81?

(8)

e) What is the yield to maturity on a simple loan for $1,500 that requires a repayment of

$15,000 in five years?

(8)

f) If a bank is falling short of meeting its capital requirements by $1 million, what three

things can it do to rectify the situation?

(3)

g) Rank the following assets from most liquid to least liquid:

{14)

i. Land

ii. The inventory of a merchandiser

iii. Cash in hand

iv. A savings account at a local bank

V. A one-year bond

vi. Ordinary shares

vii. House

TOTAL= 100 MARKS

6