|

PAR812S-PUBLIC SECTOR FINANCIAL ACCOUNTING AND REPORTING-2ND OPP-JAN 2025 |

|

1 Page 1 |

▲back to top |

n Am I BI A u n IVER s I TY

OF SCIEnCE Ano TECHnOLOGY

FACULTY OF COMMERCE, HUMAN SCIENCES AND EDUCATION

DEPARTMENT OF ACCOUNTING, ECONOMICS AND FINANCE

QUALIFICATION: BACHELOR OF ACCOUNTING HONORS

QUALIFICATION CODE: 08BOAH LEVEL: 8

COURSE CODE: PAR812S

COURSE NAME: PUBLIC SECTOR FINANCIAL

ACCOUNTING AND REPORTING

DATE: January 2025

DURATION: 3 HOURS

PAPER:THEORYAND CALCULATIONS

MARKS: 100

2nd OPPORTUNITY EXAMINATION

EXAMINER(S) Dr. S. Dzomira

MODERATOR: Mr. Mutonga Samuel Mukelebai

INSTRUCTIONS

1. Capture your full name, student number and assessment number on the first page

2. Answer ALL the questions and manage your time properly.

3. Number each page correctly

4. Write clearly and neatly.

5. Do not write in pencil and do not use tip-ex, as this will not be marked.

6. The names of people and businesses used throughout this assessment do not reflect

the reality and may be purely coincidental.

7. Use a non-programmable calculator

8. SHOW ALL WORKINGS!

THIS QUESTION PAPER CONSISTS OF 4 PAGES (excluding this front page)

Page 1 of 5

|

2 Page 2 |

▲back to top |

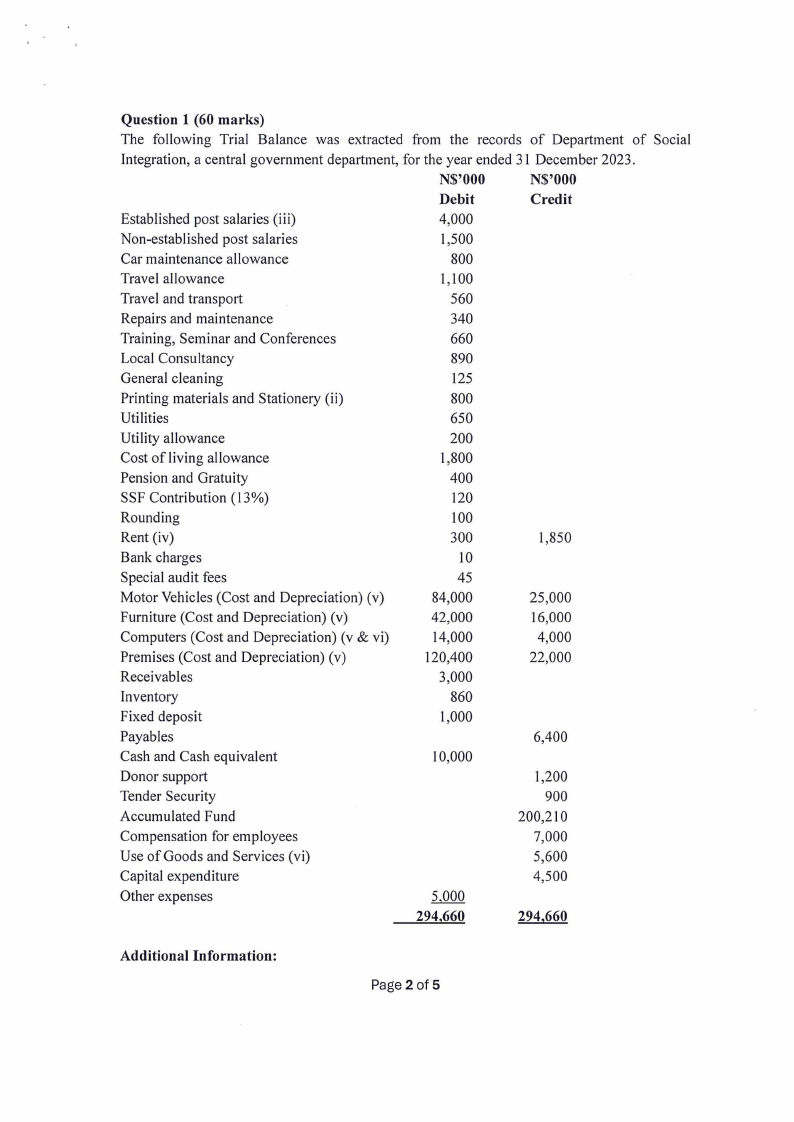

Question 1 (60 marks)

The following Trial Balance was extracted from the records of Department of Social

Integration, a central government department, for the year ended 31 December 2023.

N$'000

N$'000

Debit

Credit

Established post salaries (iii)

4,000

Non-established post salaries

1,500

Car maintenance allowance

800

Travel allowance

1,100

Travel and transport

560

Repairs and maintenance

340

Training, Seminar and Conferences

660

Local Consultancy

890

General cleaning

125

Printing materials and Stationery (ii)

800

Utilities

650

Utility allowance

200

Cost of living allowance

1,800

Pension and Gratuity

400

SSF Contribution (13%)

120

Rounding

100

Rent (iv)

300

1,850

Bank charges

10

Special audit fees

45

Motor Vehicles (Cost and Depreciation) (v)

84,000

25,000

Furniture (Cost and Depreciation) (v)

42,000

16,000

Computers (Cost and Depreciation) (v & vi)

14,000

4,000

Premises (Cost and Depreciation) (v)

120,400

22,000

Receivables

3,000

Inventory

860

Fixed deposit

1,000

Payables

6,400

Cash and Cash equivalent

10,000

Donor support

1,200

Tender Security

900

Accumulated Fund

200,210

Compensation for employees

7,000

Use of Goods and Services (vi)

5,600

Capital expenditure

4,500

Other expenses

5,000

294,660

294,660

Additional Information:

Page 2 of 5

|

3 Page 3 |

▲back to top |

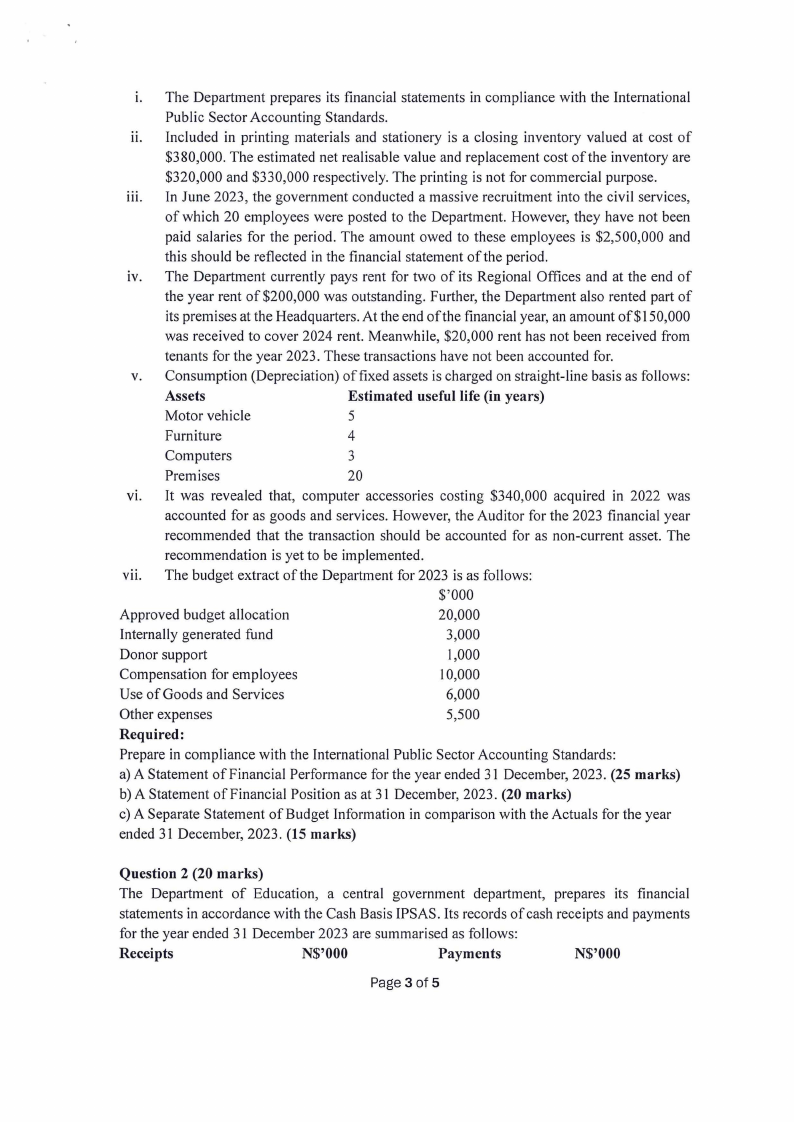

1. The Department prepares its financial statements in compliance with the International

Public Sector Accounting Standards.

ii. Included in printing materials and stationery is a closing inventory valued at cost of

$380,000. The estimated net realisable value and replacement cost of the inventory are

$320,000 and $330,000 respectively. The printing is not for commercial purpose.

iii. In June 2023, the government conducted a massive recruitment into the civil services,

of which 20 employees were posted to the Department. However, they have not been

paid salaries for the period. The amount owed to these employees is $2,500,000 and

this should be reflected in the financial statement of the period.

iv. The Department currently pays rent for two of its Regional Offices and at the end of

the year rent of $200,000 was outstanding. Further, the Department also rented part of

its premises at the Headquaiters. At the end of the financial year, an amount of $150,000

was received to cover 2024 rent. Meanwhile, $20,000 rent has not been received from

tenants for the year 2023. These transactions have not been accounted for.

v. Consumption (Depreciation) of fixed assets is charged on straight-line basis as follows:

Assets

Estimated useful life (in years)

Motor vehicle

5

Furniture

4

Computers

3

Premises

20

v1. It was revealed that, computer accessories costing $340,000 acquired in 2022 was

accounted for as goods and services. However, the Auditor for the 2023 financial year

recommended that the transaction should be accounted for as non-current asset. The

recommendation is yet to be implemented.

vii. The budget extract of the Department for 2023 is as follows:

$'000

Approved budget allocation

20,000

Internally generated fund

3,000

Donor support

1,000

Compensation for employees

10,000

Use of Goods and Services

6,000

Other expenses

5,500

Required:

Prepare in compliance with the International Public Sector Accounting Standards:

a) A Statement of Financial Performance for the year ended 31 December, 2023. (25 marks)

b) A Statement of Financial Position as at 31 December, 2023. (20 marks)

c) A Separate Statement of Budget Information in comparison with the Actuals for the year

ended 31 December, 2023. (15 marks)

Question 2 (20 marks)

The Department of Education, a central government department, prepares its financial

statements in accordance with the Cash Basis IPSAS. Its records of cash receipts and payments

for the year ended 31 December 2023 are summarised as follows:

Receipts

N$'000

Payments

N$'000

Page 3 of 5

|

4 Page 4 |

▲back to top |

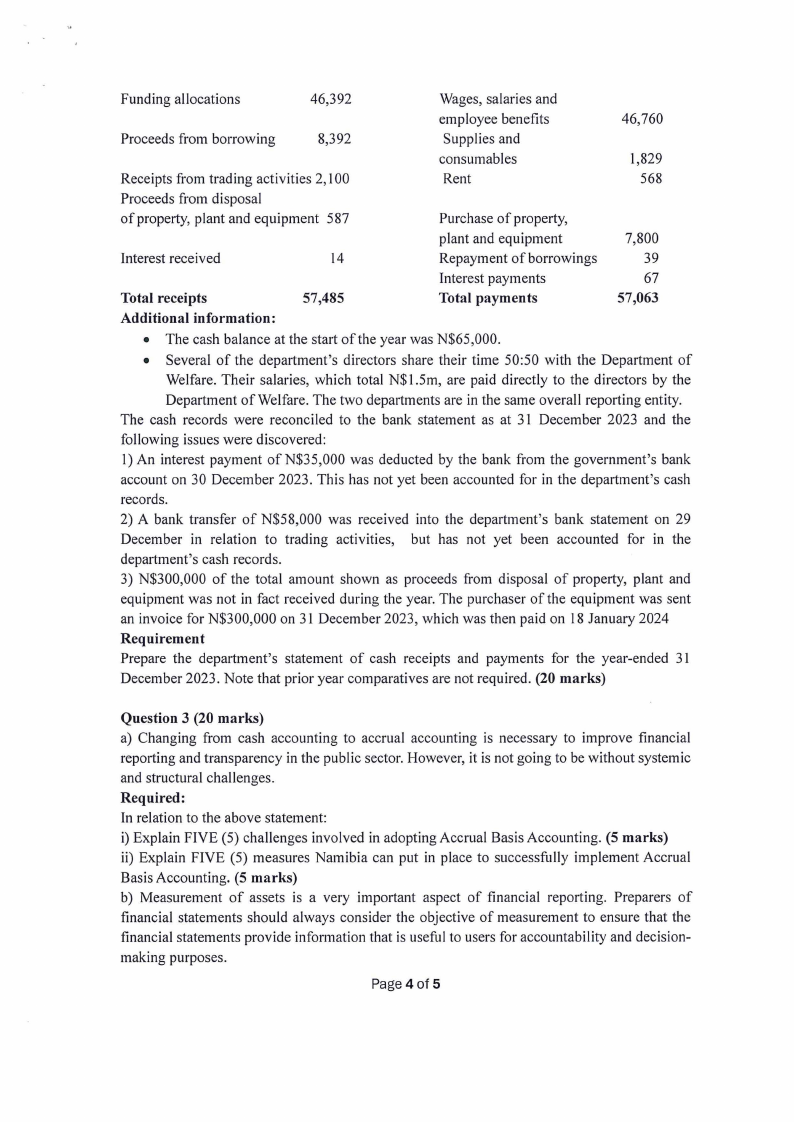

Funding allocations

46,392

Wages, salaries and

employee benefits

46,760

Proceeds from borrowing

8,392

Supplies and

consumables

1,829

Receipts from trading activities 2, l 00

Rent

568

Proceeds from disposal

of property, plant and equipment 587

Purchase of property,

plant and equipment

7,800

Interest received

14

Repayment of borrowings

39

Interest payments

67

Total receipts

57,485

Total payments

57,063

Additional information:

• The cash balance at the start of the year was N$65,000.

• Several of the department's directors share their time 50:50 with the Department of

Welfare. Their salaries, which total N$1.5m, are paid directly to the directors by the

Department of Welfare. The two depaitments are in the same overall reporting entity.

The cash records were reconciled to the bank statement as at 31 December 2023 and the

following issues were discovered:

1) An interest payment of N$35,000 was deducted by the bank from the government's bank

account on 30 December 2023. This has not yet been accounted for in the department's cash

records.

2) A bank transfer of N$58,000 was received into the department's bank statement on 29

December in relation to trading activities, but has not yet been accounted for in the

department's cash records.

3) N$300,000 of the total amount shown as proceeds from disposal of property, plant and

equipment was not in fact received during the year. The purchaser of the equipment was sent

an invoice for N$300,000 on 31 December 2023, which was then paid on 18 January 2024

Requirement

Prepare the department's statement of cash receipts and payments for the year-ended 31

December 2023. Note that prior year comparatives are not required. (20 marks)

Question 3 (20 marks)

a) Changing from cash accounting to accrual accounting is necessary to improve financial

reporting and transparency in the public sector. However, it is not going to be without systemic

and structural challenges.

Required:

In relation to the above statement:

i) Explain FIVE (5) challenges involved in adopting Accrual Basis Accounting. (5 marks)

ii) Explain FIVE (5) measures Namibia can put in place to successfully implement Accrual

Basis Accounting. (5 marks)

b) Measurement of assets is a very important aspect of financial reporting. Preparers of

financial statements should always consider the objective of measurement to ensure that the

financial statements provide information that is useful to users for accountability and decision-

making purposes.

Page 4 of 5

|

5 Page 5 |

▲back to top |

.,,

Required:

i) Explain the objectives of measurement in financial reporting of public sector entities.

(4 marks)

ii) Explain FOUR (4) bases of measurement of assets and provide in each situation where it

is applied in financial repo11ing. (6 marks)

Page 5 of 5