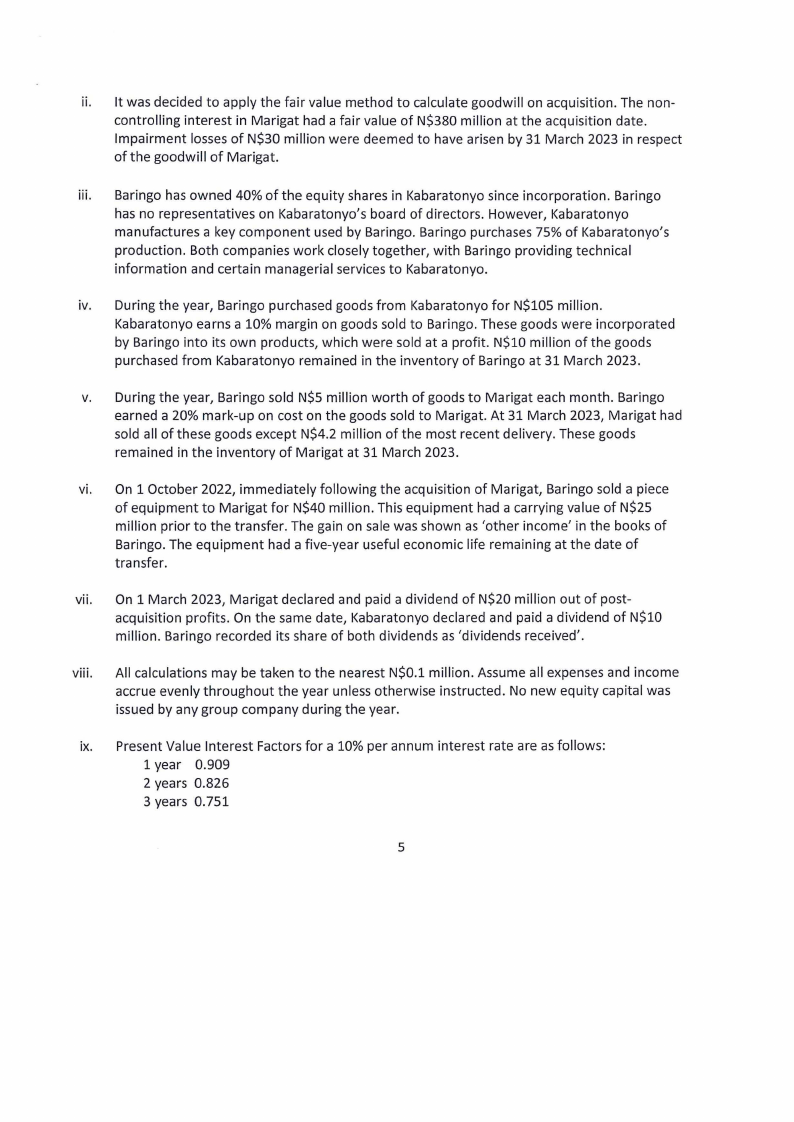

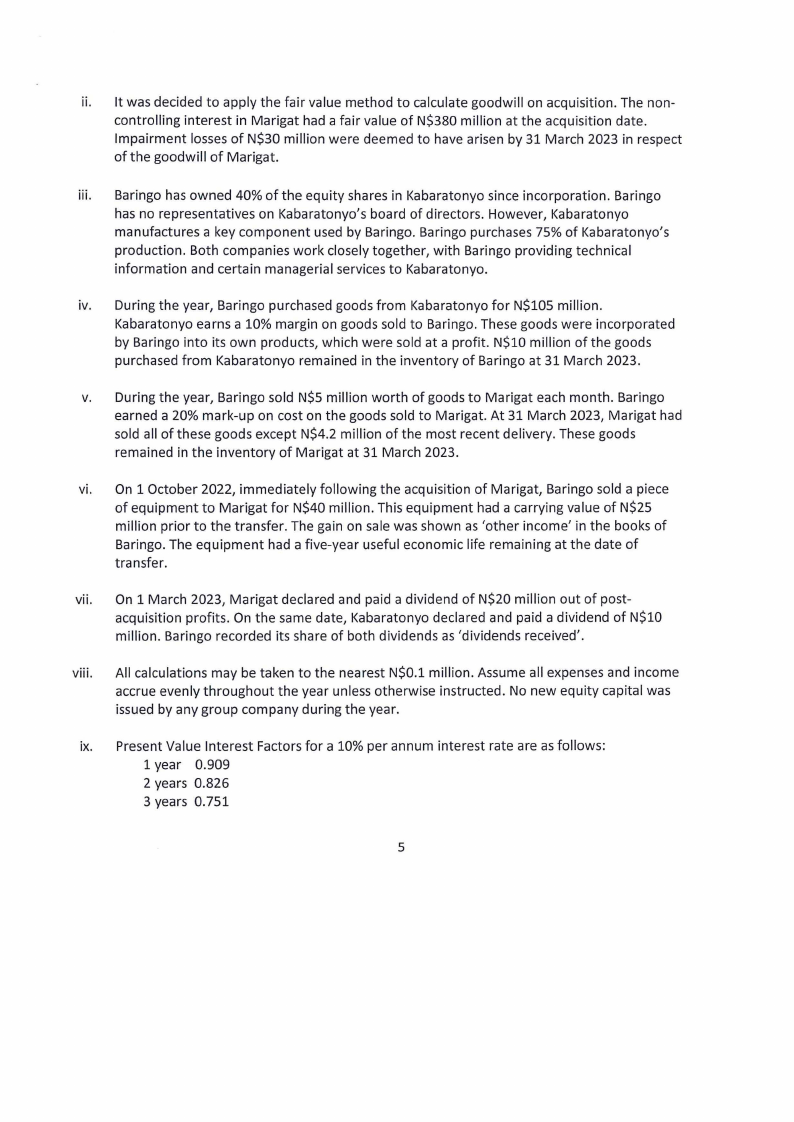

ii. It was decided to apply the fair value method to calculate goodwill on acquisition. The non-

controlling interest in Marigat had a fair value of N$380 million at the acquisition date.

Impairment losses of N$30 million were deemed to have arisen by 31 March 2023 in respect

of the goodwill of Marigat.

iii. Baringo has owned 40% of the equity shares in Kabaratonyo since incorporation. Baringo

has no representatives on Kabaratonyo's board of directors. However, Kabaratonyo

manufactures a key component used by Baringo. Baringo purchases 75% of Kabaratonyo's

production. Both companies work closely together, with Baringo providing technical

information and certain managerial services to Kabaratonyo.

iv. During the year, Baringo purchased goods from Kabaratonyo for N$105 million.

Kabaratonyo earns a 10% margin on goods sold to Baringo. These goods were incorporated

by Baringo into its own products, which were sold at a profit. N$10 million of the goods

purchased from Kabaratonyo remained in the inventory of Baringo at 31 March 2023.

v. During the year, Baringo sold N$5 million worth of goods to Marigat each month. Baringo

earned a 20% mark-up on cost on the goods sold to Marigat. At 31 March 2023, Marigat had

sold all of these goods except N$4.2 million of the most recent delivery. These goods

remained in the inventory of Marigat at 31 March 2023.

vi. On 1 October 2022, immediately following the acquisition of Marigat, Baringo sold a piece

of equipment to Marigat for N$40 million. This equipment had a carrying value of N$25

million prior to the transfer. The gain on sale was shown as 'other income' in the books of

Baringo. The equipment had a five-year useful economic life remaining at the date of

transfer.

vii. On 1 March 2023, Marigat declared and paid a dividend of N$20 million out of post-

acquisition profits. On the same date, Kabaratonyo declared and paid a dividend of N$10

million. Baringo recorded its share of both dividends as 'dividends received'.

viii. All calculations may be taken to the nearest N$0.l million. Assume all expenses and income

accrue evenly throughout the year unless otherwise instructed. No new equity capital was

issued by any group company during the year.

ix. Present Value Interest Factors for a 10% per annum interest rate are as follows:

1 year 0.909

2 years 0.826

3 years 0.751

5