|

BAC621C- BUSINESS ACCOUNTING 2B CATS- 1ST OPP- JUNE 2023 |

|

1 Page 1 |

▲back to top |

nAmlBIA

UnlVERSITY

OF SCIEnCE Ano

TECHnOLOGY

HAROLDPUPKEWITZ

GraduateSchoolof Business

FACULTYOF COMMERCE, HUMAN SCIENCESAND EDUCATION

HAROLD PUPKEWITZGRADUATESCHOOLOF BUSINESS(HP-GSB)

HAROLD PUPKEWITZ GRADUATE SCHOOL OF BUSINESS

QUALIFICATION: DIPLOMA IN BUSINESS PROCESS MANAGEMENT

QUALIFICATION CODE: 06DBPM LEVEL: 6

COURSE CODE: BAC621C

COURSE NAME: INTRODUCTION TO

BUSINESS MANAGEMENT

SESSION: JUNE 2023

DURATION: 3 HOURS

PAPER: PAPER 1

MARKS: 100

FIRST OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINER Sheehama, K.G.H.

MODERATOR Odada, L

INSTRUCTIONS

1. Answer ALL the questions.

2. Write clearly and neatly, showing all your workings

3. Number the answers clearly.

4. Round off your final answers to 2 decimal places

PERMISSIBLE MATERIALS

1. Examination paper

2. Examination script

3. Non-programmable calculator

THIS QUESTION PAPER CONSISTS OF 5 PAGES (including this front page)

|

2 Page 2 |

▲back to top |

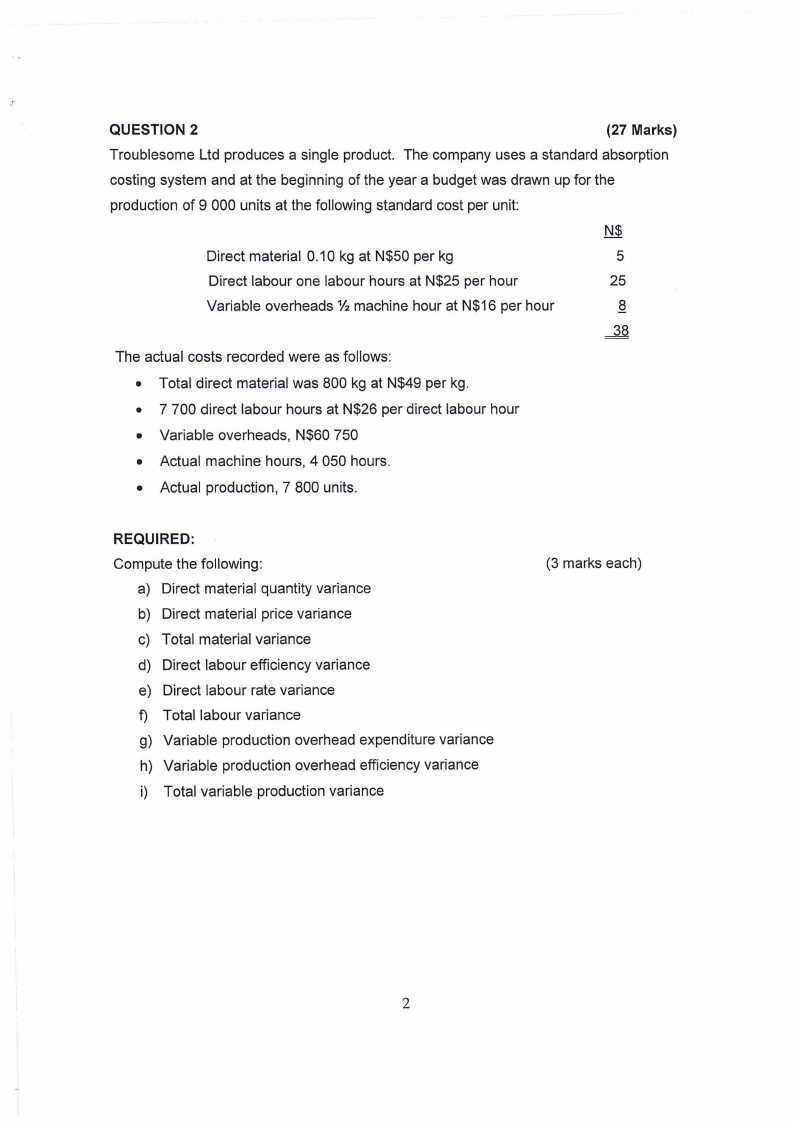

QUESTION 2

(27 Marks)

Troublesome Ltd produces a single product. The company uses a standard absorption

costing system and at the beginning of the year a budget was drawn up for the

production of 9 000 units at the following standard cost per unit:

Direct material 0.10 kg at N$50 per kg

Direct labour one labour hours at N$25 per hour

Variable overheads½ machine hour at N$16 per hour

The actual costs recorded were as follows:

• Total direct material was 800 kg at N$49 per kg.

• 7 700 direct labour hours at N$26 per direct labour hour

• Variable overheads, N$60 750

• Actual machine hours, 4 050 hours.

• Actual production, 7 800 units.

5

25

§

---3..8

REQUIRED:

Compute the following:

a) Direct material quantity variance

b) Direct material price variance

c) Total material variance

d) Direct labour efficiency variance

e) Direct labour rate variance

f) Total labour variance

g) Variable production overhead expenditure variance

h) Variable production overhead efficiency variance

i) Total variable production variance

(3 marks each)

2

|

3 Page 3 |

▲back to top |

r

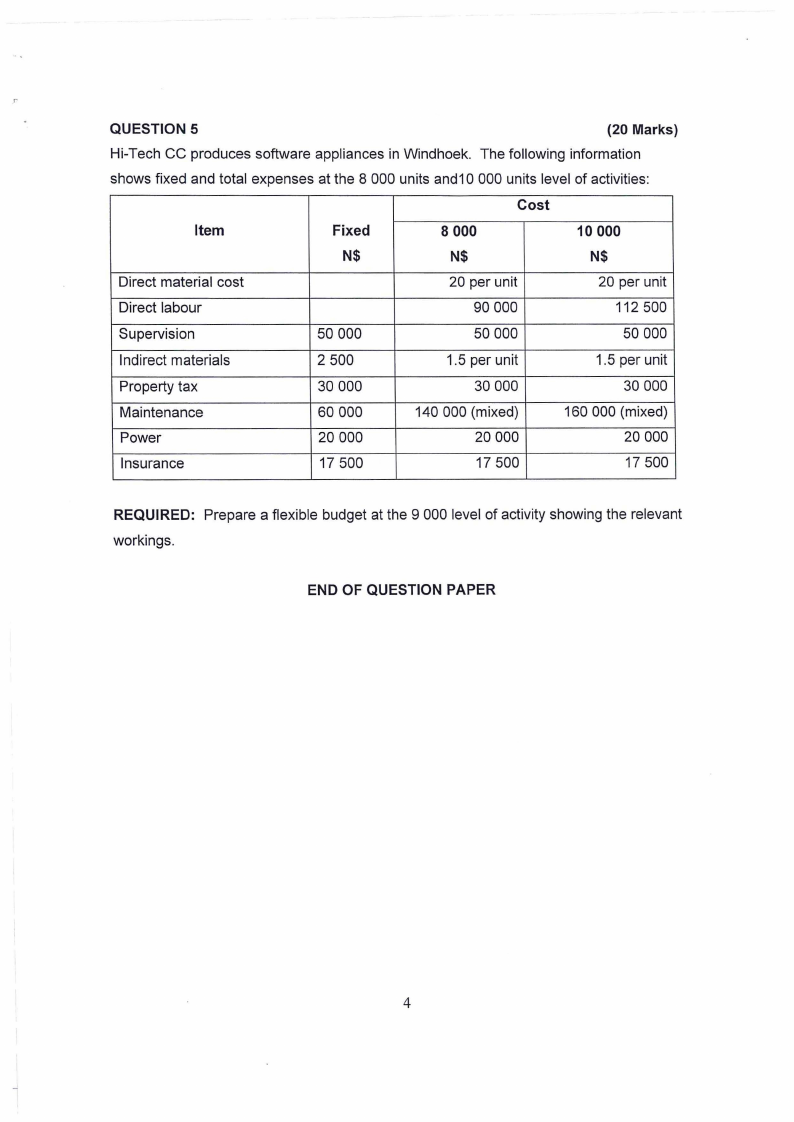

QUESTION 5

(20 Marks)

Hi-Tech CC produces software appliances in Windhoek. The following information

shows fixed and total expenses at the 8 000 units and1 0 000 units level of activities:

Cost

Item

Fixed

8 000

10 000

N$

N$

N$

Direct material cost

20 per unit

20 per unit

Direct labour

90 000

112 500

Supervision

50 000

50 000

50 000

Indirect materials

2 500

1.5 per unit

1.5 per unit

Property tax

30 000

30 000

30 000

Maintenance

60 000

140 000 (mixed)

160 000 (mixed)

Power

20 000

20 000

20 000

Insurance

17 500

17 500

17 500

REQUIRED: Prepare a flexible budget at the 9 000 level of activity showing the relevant

workings.

END OF QUESTION PAPER

4