|

PMV611S - PRINCIPLES AND METHODS OF VALUATION - 2ND OPP - JULY 2023 |

|

1 Page 1 |

▲back to top |

n Am I BI A u n IVER s I TY

OF SCIEnCE Ano TECHnOLOGY

FACULTY OF ENGINEERING AND THE BUILT ENVIRONMENT

DEPARTMENT OF LAND AND SPATIAL SCIENCES

QUALIFICATION(S): BACHELOROF PROPERTYSTUDIES

DIPLOMA IN PROPERTYSTUDIES

QUALIFICATION(S) CODE: 08BPRS

06DPRS

NQF LEVEL: 6

COURSE CODE: PMV611S

COURSE NAME: PRINCIPLESAND METHODS OF

VALUATION

EXAMS SESSION: JULY 2023

PAPER:

THEORY

DURATION:

3 HOURS

MARKS:

100

SECOND OPPORTUNITY/SUPPLEMENTARY EXAMINATION QUESTION PAPER

EXAMINER(S)

SAM M. MWANDO

MODERATOR:

SAMUEL ATO K. HAYFORD

INSTRUCTIONS

1. Read the entire question paper before answering the Questions.

2. Please write clearly and legibly!

3. The question paper contains a total of 5 questions.

4. You must answer ALL QUESTIONS.

5. Make sure your Student Number is on the EXAMINATION BOOK(S).

PERMISSIBLE MATERIALS

1. Non-programmable Scientific Calculator

THIS QUESTION PAPER CONSISTS OF 6 PAGES (Including this front page)

|

2 Page 2 |

▲back to top |

Principles and Methods of Valuation

PMV611S

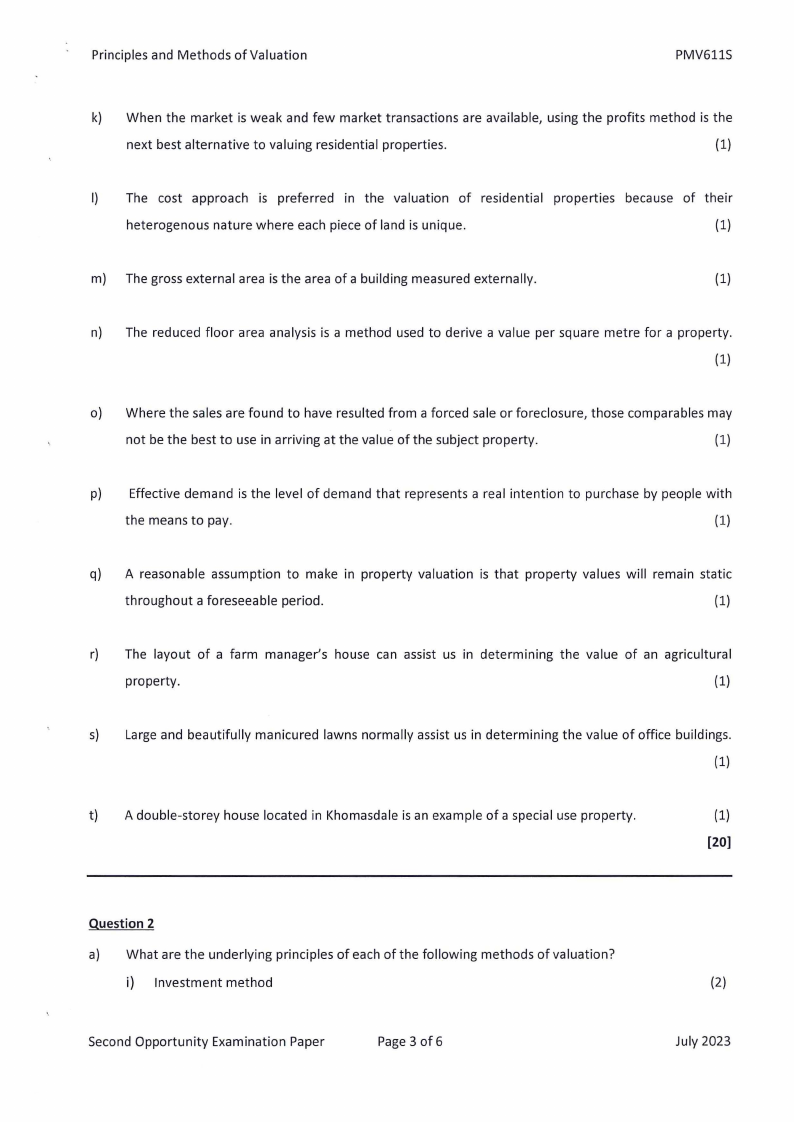

Question 1

For each of the following statements indicate whether it is 'TRUE' or 'FALSE'. Each correct answer carries 1

mark.

(20)

a) In the calculation of depreciation using the cost approach, remaining economic life is economic life

plus the effective age of a building.

(1)

b) The profits method of valuation is applicable to properties such as service stations and religious

buildings in an active market.

(1)

c) The actual age of a building is defined as the number of years which have elapsed since the

construction was completed.

(1)

d) Of the three causes of depreciation on buildings, only functional obsolescence cannot be cured.

(1)

e) In valuing income producing properties, they are two main approaches we can use, the direct

capitalization and the capital flow method.

(1)

f) The gross operating income includes insurance, utilities, management fees, dividends, and vacancies.

(1)

g) In determining the yield on a property, we consider the risk-free rate, the sector risk, illiquidity risk

premium, management premium and expected capital gain.

(1)

h) In applying the comparative method of valuation, we compare unique properties which have sold in

the past and using evidence of those transactions to assessthe value of the subject property.

(1)

i) The comparative method of valuation is most suited for residential properties where there is a

freehold interest or a long leasehold interest.

(1)

j) The Amount of N$1 Per Annum refers to the amount to which annual deposits of N$1 each will grow

in each number of years and at a stated rate of interest.

(1)

Second Opportunity Examination Paper

Page 2 of 6

July 2023

|

3 Page 3 |

▲back to top |

Principles and Methods of Valuation

PMV611S

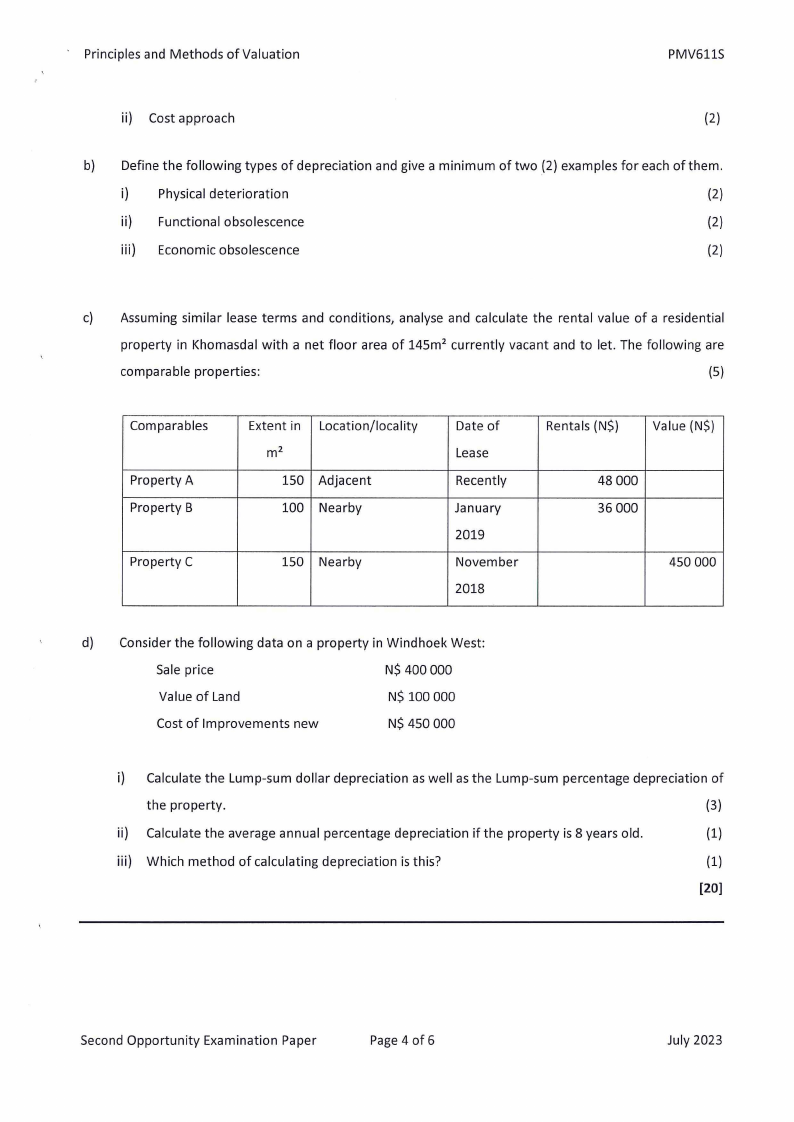

k) When the market is weak and few market transactions are available, using the profits method is the

next best alternative to valuing residential properties.

(1)

I) The cost approach is preferred in the valuation of residential properties because of their

heterogenous nature where each piece of land is unique.

(1)

m) The gross external area is the area of a building measured externally.

(1)

n) The reduced floor area analysis is a method used to derive a value per square metre for a property.

(1)

o) Where the sales are found to have resulted from a forced sale or foreclosure, those com parables may

not be the best to use in arriving at the value of the subject property.

(1)

p) Effective demand is the level of demand that represents a real intention to purchase by people with

the means to pay.

(1)

q) A reasonable assumption to make in property valuation is that property values will remain static

throughout a foreseeable period.

(1)

r) The layout of a farm manager's house can assist us in determining the value of an agricultural

property.

(1)

s) Large and beautifully manicured lawns normally assist us in determining the value of office buildings.

(1)

t) A double-storey house located in Khomasdale is an example of a special use property.

(1)

[20)

Question 2

a) What are the underlying principles of each of the following methods of valuation?

i) Investment method

Second Opportunity Examination Paper

Page3 of 6

(2)

July 2023

|

4 Page 4 |

▲back to top |

· Principles and Methods of Valuation

PMV611S

ii) Cost approach

(2)

b) Define the following types of depreciation and give a minimum of two _(2)examples for each of them.

i) Physical deterioration

(2)

ii) Functional obsolescence

(2)

iii) Economic obsolescence

(2)

c) Assuming similar lease terms and conditions, analyse and calculate the rental value of a residential

property in Khomasdal with a net floor area of 145m2 currently vacant and to let. The following are

comparable properties:

(5)

Comparables

Property A

Property B

Property C

Extent in Location/locality

m2

150 Adjacent

100 Nearby

150 Nearby

Date of

Lease

Recently

January

2019

November

2018

Rentals (N$)

Value (N$)

48 000

36 000

450 000

d) Consider the following data on a property in Windhoek West:

Sale price

N$ 400 000

Value of Land

N$ 100 000

Cost of Improvements new

N$ 450 000

i) Calculate the Lump-sum dollar depreciation as well as the Lump-sum percentage depreciation of

the property.

(3)

ii) Calculate the average annual percentage depreciation if the property is 8 years old.

(1)

iii) Which method of calculating depreciation is this?

(1)

[20)

Second Opportunity Examination Paper

Page4 of 6

July 2023

|

5 Page 5 |

▲back to top |

Principles and Methods of Valuation

r

r

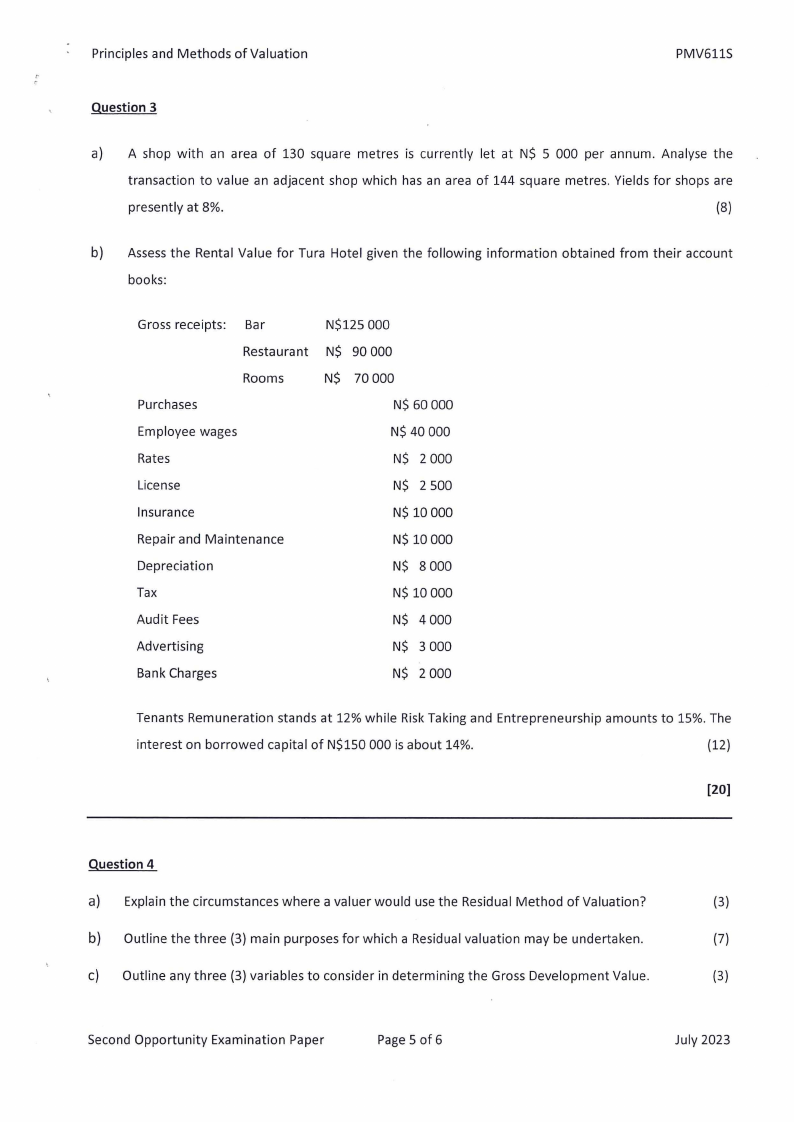

Question 3

PMV611S

a) A shop with an area of 130 square metres is currently let at N$ 5 000 per annum. Analyse the

transaction to value an adjacent shop which has an area of 144 square metres. Yields for shops are

presently at 8%.

(8)

b) Assessthe Rental Value for Tura Hotel given the following information obtained from their account

books:

Gross receipts: Bar

N$125 000

Restaurant N$ 90 000

Rooms

N$ 70 000

Purchases

N$ 60 000

Employee wages

N$ 40 000

Rates

N$ 2 000

License

N$ 2 500

Insurance

N$ 10 000

Repair and Maintenance

N$ 10 000

Depreciation

N$ 8 000

Tax

N$ 10 000

Audit Fees

N$ 4 000

Advertising

N$ 3 000

Bank Charges

N$ 2 000

Tenants Remuneration stands at 12% while RiskTaking and Entrepreneurship amounts to 15%. The

interest on borrowed capital of N$150 000 is about 14%.

(12)

[20)

Question 4

a) Explain the circumstances where a valuer would use the Residual Method of Valuation?

(3)

b) Outline the three (3) main purposes for which a Residual valuation may be undertaken.

(7)

c) Outline any three (3) variables to consider in determining the Gross Development Value.

(3)

Second Opportunity Examination Paper

Page 5 of 6

July 2023

|

6 Page 6 |

▲back to top |

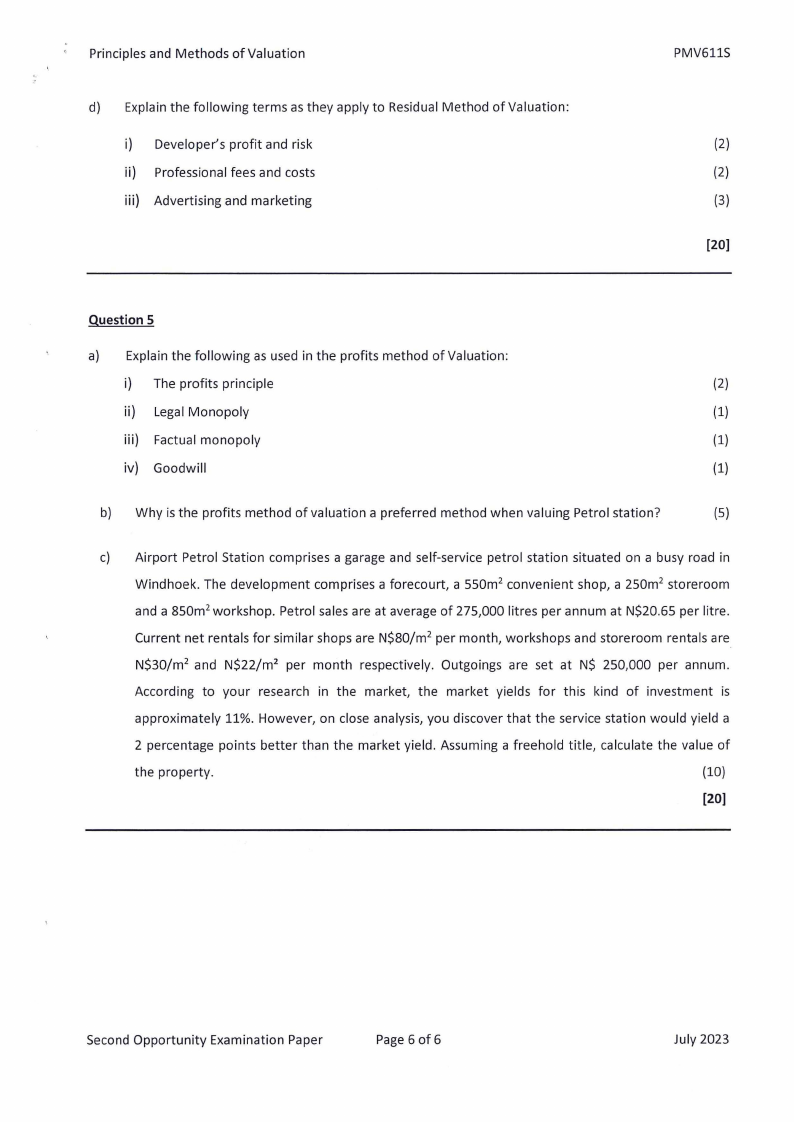

Principles and Methods of Valuation

d) Explain the following terms as they apply to Residual Method of Valuation:

i) Developer's profit and risk

ii) Professional fees and costs

iii) Advertising and marketing

PMV611S

(2)

(2)

(3)

[20]

Question 5

a) Explain the following as used in the profits method of Valuation:

i) The profits principle

(2)

ii) Legal Monopoly

(1)

iii) Factual monopoly

(1)

iv) Goodwill

(1)

b) Why is the profits method of valuation a preferred method when valuing Petrol station?

(5)

c) Airport Petrol Station comprises a garage and self-service petrol station situated on a busy road in

Windhoek. The development comprises a forecourt, a 550m 2 convenient shop, a 250m2 storeroom

and a 850m 2 workshop. Petrol sales are at average of 275,000 litres per annum at N$20.65 per litre.

Current net rentals for similar shops are N$80/m 2 per month, workshops and storeroom rentals are

N$30/m 2 and N$22/m 2 per month respectively. Outgoings are set at N$ 250,000 per annum.

According to your research in the market, the market yields for this kind of investment is

approximately 11%. However, on close analysis, you discover that the service station would yield a

2 percentage points better than the market yield. Assuming a freehold title, calculate the value of

the property.

(10)

[20]

Second Opportunity Examination Paper

Page 6 of 6

July 2023