|

ECM712S- ECONOMETRICS- 1ST OPP- JUNE 2023 |

|

1 Page 1 |

▲back to top |

nAm I BI A un IVERS ITV

OF S.CEI nCE Ano TECHn OLOGY

FACULTY OFCOMMERCE, HUMAN SCIENCE AND EDUCATION

DEPARTMENT OF ECONOMICS, ACCOUNTING AND FINANCE

QUALIFICATION: BACHELOR OF ECONOMICS

QUALIFICATION CODE:

07BECO

LEVEL: 7

COURSE CODE: ECM712S

COURSE NAME: ECONOMETRICS

SESSION: JUNE 2023

DURATION: 3 HOURS

PAPER:THEORY

MARKS: 100

FIRST OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINER(S) MR. PINEHAS NANGULA

MODERATOR: Dr R. KAMAT!

INSTRUCTIONS

1. Answer ALL the questions in section A and B

2. Write clearly and neatly.

3. Number the answers clearly.

PERMISSIBLE MATERIALS

I. Scientific calculator

2. Pen and Pencil

3. Ruler

This question paper consists of _6_ pages (including this front page)

|

2 Page 2 |

▲back to top |

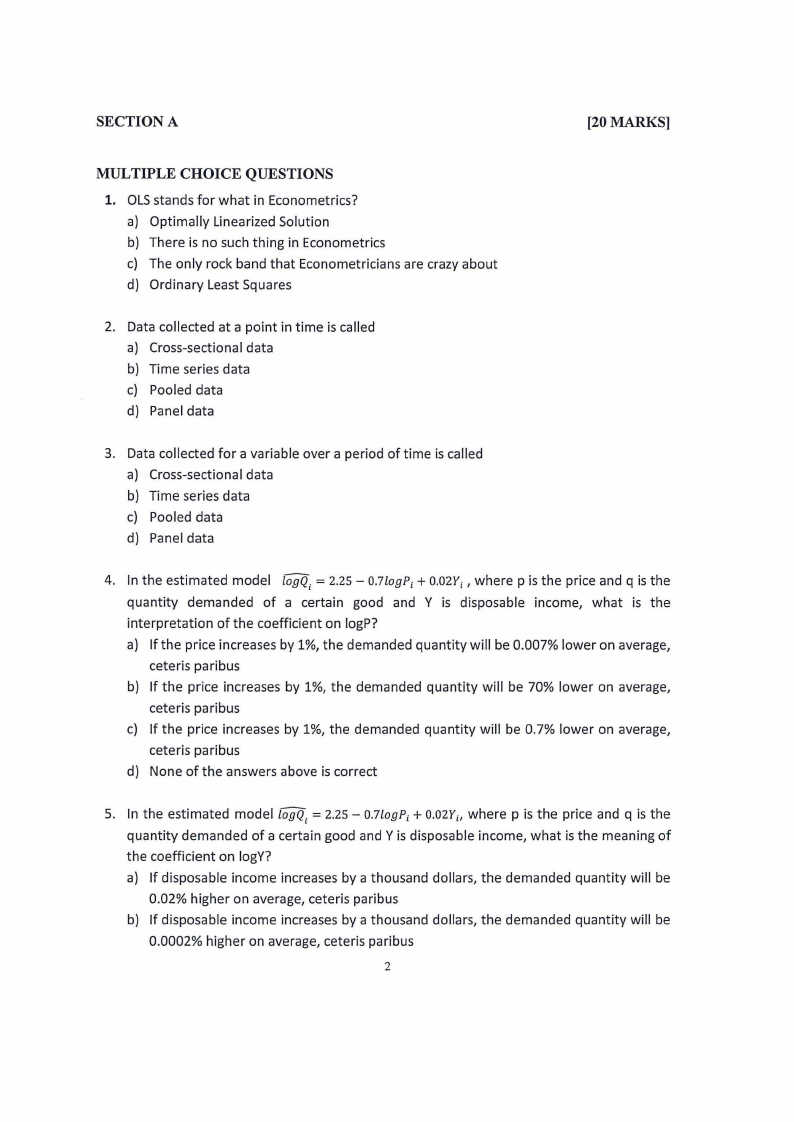

SECTION A

[20MARKS]

MULTIPLE CHOICE QUESTIONS

1. OLSstands for what in Econometrics?

a) Optimally Linearized Solution

b) There is no such thing in Econometrics

c) The only rock band that Econometricians are crazy about

d) Ordinary Least Squares

2. Data collected at a point in time is called

a) Cross-sectional data

b) Time series data

c) Pooled data

d) Panel data

3. Data collected for a variable over a period of time is called

a) Cross-sectional data

b) Time series data

c) Pooled data

d) Panel data

4. In the estimated model logQi = 2.25 - 0.7/ogP; + 0.02Y;, where pis the price and q is the

quantity demanded of a certain good and Y is disposable income, what is the

interpretation of the coefficient on logP?

a) If the price increases by 1%, the demanded quantity will be 0.007% lower on average,

ceteris paribus

b) If the price increases by 1%, the demanded quantity will be 70% lower on average,

ceteris paribus

c) If the price increases by 1%, the demanded quantity will be 0.7% lower on average,

ceteris paribus

d) None of the answers above is correct

5. In the estimated model logQ. = 2.25 - 0.7logP; + 0.02Y;, where pis the price and q is the

l

quantity demanded of a certain good and Y is disposable income, what is the meaning of

the coefficient on logY?

a) If disposable income increases by a thousand dollars, the demanded quantity will be

0.02% higher on average, ceteris paribus

b) If disposable income increases by a thousand dollars, the demanded quantity will be

0.0002% higher on average, ceteris paribus

2

|

3 Page 3 |

▲back to top |

c) If disposable income increases by a thousand dollars, the demanded quantity will be

2% higher on average, ceteris paribus

d) None of the answers above is correct

6. Which of the following are alternative names for the dependent variable {usually denoted

by y) in linear regression analysis?

a) The regressand

b) The regressor

c) The explanatory variable

d) None of the above

7. Which of the following statements is TRUEconcerning OLSestimation?

a) OLSminimises the sum of the vertical distances from the points to the line

b) OLSminimises the sum of the squares of the vertical distances from the points to the

line

c) OLSminimises the sum of the horizontal distances from the points to the line

d) OLS minimises the sum of the squares of the horizontal distances from the points to

the line.

8. The residual from a standard regression model is defined as

a) The difference between the actual value, y, and the mean, y-bar

b) The difference between the fitted value, y-hat, and the mean, y-bar

c) The difference between the actual value, y, and the fitted value, y-hat

d) The square of the difference between the fitted value, y-hat, and the mean, y-bar

9. Which one of the following statements best describes the algebraic representation of the

fitted regression line?

a)

"

Yr

=a,.+.

f;.i. x,+u,.,.

b)

YA r=

aA +

fo

t

c) YA , =aA + /AJ,x+ui

d) Y, =a+fix+, u,

10. Which one of the following statements best describes a Type II error?

a. It is the probability of incorrectly rejecting the null hypothesis

b. It is equivalent to the power of the test

c. It is equivalent to the size of the test

d. It is the probability of failing to reject a null hypothesis that was wrong

3

|

4 Page 4 |

▲back to top |

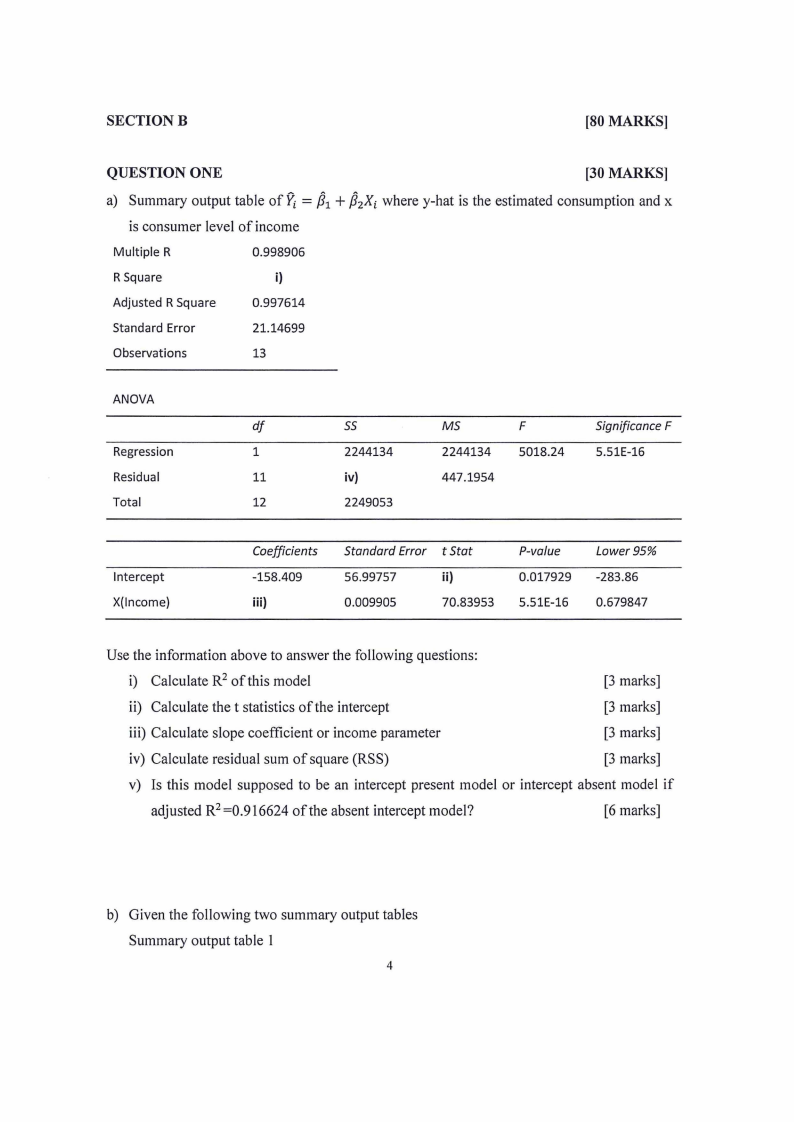

SECTIONB

[80 MARKS]

QUESTION ONE

[30 MARKS]

p a) Summary output table of Yi = 1 + PzXi where y-hat is the estimated consumption and x

is consumer level of income

Multiple R

0.998906

R Square

i)

Adjusted R Square

0.997614

Standard Error

21.14699

Observations

13

ANOVA

df

55

MS

F

Significance F

Regression

1

2244134

2244134 5018.24

5.51E-16

Residual

11

iv)

447.1954

Total

12

2249053

Intercept

X(lncome)

Coefficients

-158.409

iii)

Standard Error t Stat

56.99757

ii)

0.009905

70.83953

P-va/ue

0.017929

5.51E-16

Lower 95%

-283.86

0.679847

Use the information above to answer the following questions:

i) Calculate R2 of this model

[3 marks]

ii) Calculate the t statistics of the intercept

[3 marks]

iii) Calculate slope coefficient or income parameter

[3 marks]

iv) Calculate residual sum of square (RSS)

[3 marks]

v) Is this model supposed to be an intercept present model or intercept absent model if

adjusted R2 =0.916624 of the absent intercept model?

[6 marks]

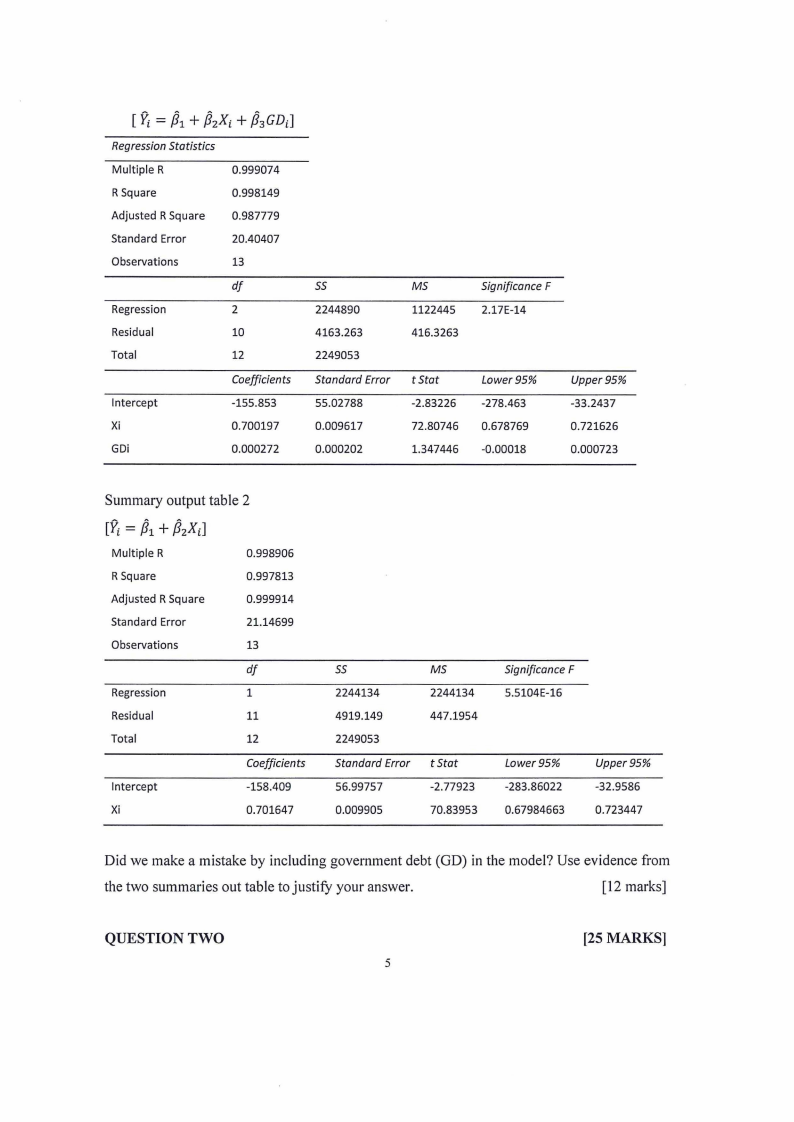

b) Given the following two summary output tables

Summary output table 1

4

|

5 Page 5 |

▲back to top |

[ = /J1+ /J2Xi+ /J3GDi]

Regression Statistics

Multiple R

0.999074

R Square

0.998149

Adjusted R Square 0.987779

Standard Error

20.40407

Observations

13

df

ss

Regression

2

2244890

Residual

10

4163.263

Total

12

2249053

Coefficients Standard Error

Intercept

-155.853

55.02788

Xi

0.700197

0.009617

GDi

0.000272

0.000202

MS

1122445

416.3263

t Stat

-2.83226

72.80746

1.347446

Significance F

2.17E-14

Lower95%

-278.463

0.678769

-0.00018

Upper95%

-33.2437

0.721626

0.000723

Summary output table 2

[Yi= /J1+ /J2Xi]

Multiple R

0.998906

R Square

0.997813

Adjusted R Square

0.999914

Standard Error

21.14699

Observations

13

df

Regression

1

Residual

11

Total

12

Coefficients

Intercept

-158.409

Xi

0.701647

ss

MS

2244134

2244134

4919.149

447.1954

2249053

Standard Error t Stat

56.99757

-2.77923

0.009905

70.83953

Significance F

5.5104E-16

Lower95%

-283.86022

0.67984663

Upper95%

-32.9586

0.723447

Did we make a mistake by including government debt (GD) in the model? Use evidence from

the two summaries out table to justify your answer.

[12 marks]

QUESTION TWO

5

[25 MARKS]

|

6 Page 6 |

▲back to top |

A researcher is using data for a sample of 10consumers to investigate the relationship

between the annual consumption C; and annual income l;.

Year

Income, /1

Consumption, C,

2010

12003

10810

2011

13307

11000

2012

14001

13706

2013

15305

14605

2014

18707

16807

2015

19905

18203

2016

21502

20207

2017

23202

22406

2018

25603

24202

2019

27904

25508

Use the information in the table above to compute the following:

a) If=1i2 i =?

b) If=1c/ =?

c} If=1ct=?

[5 marks]

[5 marks]

[15 marks]

QUESTION THREE

[25MARKS]

a) With proper examples draw a distinction between mathematical and econometric model?

[6 marks]

b) Discuss the two types of error that arise in hypothetical conclusions

[4 marks]

c) Explain four differences between model with intercept and model without intercept

[8 marks]

d) Given~ = 7.6182 + 0.08145Xiand Y = 29, X = 262.5.Use elasticity of expenditure to

interpret the model above.

[4 marks]

e) What do we mean by a linear regression model in parameters?

[3 marks]

All the best

'I,,

6

|

7 Page 7 |

▲back to top |

j Tables

T-11

Table entry for p and C is

the critical value t· with

probability plying to its

right and probability C lying

between -t• and t'.

=a If, 1 :ii :Ill t

t distribution critical values

"~~'!'~ITT

t*

.. ' ..

Upper-Lail prnbability p

df

.25

.20

.IS

.10

.05

.025

.02

.01

.005

.0025

.001

1 1.000 1.376

2

0.816

1.061

3 0.765 0.978

4 0.741 0.941

5

0.727

0.920

6 0.718 0.906

.. 7

0.711

0.896

8 0.706 0.889

9 0.703 0.88'3

10 0. 7.QO.. , 0.879

11 0.697 0.876

12 0.695 0.873

13 0.694 0.870

14 0.692

0.868

..

15

16''

": 17

' 18

0.691

-~'6.69b

0.689

0.688

0.866

o,sc5

0'.863

J'.9,862

19 0.688 '0.861

-~s20

> , ii

0.687

0.686

0.890

0.859

22

0,686

0.858

23

0,685

0.858

24 0.685 0.857

25 0.684 0.856

26 '0.684

o:8s6

,, . 2278

-0.684' 0.855

0.683, . 0.855

:t~g:·~;{.0,68,:,. ,· '0.854

__0_.__91!_~-;1'0,~5'1

40 0.681 0.851

50

0.679

0.849

60 0.679 0.848

80 0.678 0.846

100 0.677 0.845

1000

0.675

0.842

z'

0.674

0.841

1.963

3.078

6.314

12.71

15.89

1.386 1.886 2.920 4.303 4.849

1.250 1.638 2.353 3.182 3.482

1.190

1.533

2.132

2.776

2.999

1.156 1.476 2.015 2.571 2.757

1.134

1.440

L943

2.447

2.612

1.119 1.415 1.895 2.365 2.517

1.108

1.39=7 1.860 . 2.306

2.449

1.100

1.383

1.833

2.262

2.398

1.093

1.372

1.812 2.228

2.359

1.088 1.363

1.796 2.2oi

2.328

1.083

1.356

1.782

2.179

2.303

1.079

1.350

1.771 2.160

2.282

1.076 1.345 1.761 2.145 2.264

1.074

1.341

1.753

2.131

2.249

1.071 1.337 1.746. . 2.120 2.235

1.969

l'.333 \\ 1.740

2.IJO

2.224

1.067

1.330 ' T.734

2_.101 2.214

1.066

1.328

1.7:29 2.093 · 2.205

1,064

1.325

1.725 . '2,086

2.1·97

1.063

1.323

1.721

2.080

2.189

1.061

1.321

1.717

2.074

2.183

1.060

1.319

1.714

2.069

2.177

1.059

1.318

1.711

2.064

2.172

1.058 1.316 1.708 2.060 2.167

1.058

1.315

l..?Op 2.056

2.162

1.057

1.314

1.703 ·' 2.052

2.158

1.056 '1.313

1.701.

, 1.05s·, .,· 'u 1.1 ·· ,1,699

L.05?, •.''•·u-10,. ·. 1.697

2.048 ''2)54

2,045 ,,, 2,;150

2.042 .• ',2:147

1.050

1.303

i.684

2.021

2.123

1.047

1.299

1.676

2.009

2.109

1.045

1.296

1.671

2.000

2.099

1.043

1.292

1.664

1.990

2.088

1.042

1.290

1.660

1.984

2.081

1.037

1.282

1.646

1.962

2.056

1.036

1.282

1.645

1.960

2.054

31.82

6.965

4.541

3.747

3.365

3.143

2.998

2.896

2.8:21

·2.764

2.718

2.681

2.650

2.624

2.602

2.583

2.567

2.,552

2.539

2.528

2.518

2.508

2.500

2.492

2.485

2:479

2.473

· 2.467

2:462

'

2·.457

2.423

2.403

2.390

2.374

2.364

2.330

2.326

63.66

9.925

5.841

4.604

4.032

3.707

3.499

3.355

3.250

,3.1,69

3.106

3.055

3.012

2.977

2.947

2.921

2.898

2.878

2.&61

2:845

2.h1·

2.819

2.807

2.797

2.787

2.779

2.771

2,763

•2:156

' ·'2.7-50

2.704

2.678

2.660

2.639

2.626

2.581

2.576

127.3

318.3

14.09

22.33

7.453

10.21

5.598

7.173

4.773

5.893

4.317

5.208

4.029

4.785

3.833

4:SOI

3.690

4.297

3.581

4.144

3.497

4.025

3.428

3.930

3.372

3.852

3.326

3.787

3.286

3.733

J:252.

3:686

3.222

3.646

3.197

·'.3.174.

,.

,,

;3.61-l

:l.579

3.153 ·..3_552

3°.135 3.527

3.119

3.505

3.104

3.485

3.091

3.467

3.078

3.450

3:067

3:435

~.057. . 3.421

3:047 ''3A08

-3.038';,, J\\3.396:

}_.0,30- 3.385

2.971

3.307

2.937

3.261

2.915

3.232

2.887

3.195

2.871

3.174

2.813

3.098

2.807

3.091

50%

60%

70%

80%

90%

95%

96%

98%

99%

99.5%

99.8%

Confidence level C

.0005

636.6

31.60

12.92

8.610

6.869

5.959

5.408

5.041

4.781

4.587

4.437

4.318

4.221

4.140

4.073

4.015

3:965

3.922

''3.883

'3,85'o ·

3.819

3.792

3.768

3,745

3.725

3.707

3.690

3.674

.3. ·:659,

J.646

3.551

3.496

3.460

3.416

3.390

3.300

3.291

99.9%