|

IFN712S- INTERNATIONAL FINANCE- 2ND OPP- NOV 2023 |

|

1 Page 1 |

▲back to top |

nAm I BI A u n IVE RS ITY

OF SCIEnCE Ano TECHnOLOGY

FACULTY OF FACULTY OF COMMERCE, HUMAN SCIENCES AND EDUCATION

DEPARTMENT OF ACCOUNTING, ECONOMICS AND FINANCE

QUALIFICATION: BACHELOR OF ECONOMICS

QUALIFICATION CODE: 07BECO

LEVEL: 7

COURSE CODE: IFN712S

COURSE NAME: INTERNATIONAL FINANCE

SESSION: JANUARY 2024

DURATION: 3 HOURS

PAPER: THEORY

MARKS: 100

EXAMINER(S)

MODERATOR:

SECOND OPPORTUNITY EXAMINATION PAPER

MR. MALLY LIKUKELA

DR. GIFT KAVARI

MR. IMMANUEL NASHIVELA

INSTRUCTIONS

1. This paper consist of 4 sections; A, B, C, and D.

2. Number your answers in accordance with the question paper.

3. Start each section answer on a new page

4. Write clearly and legibly

PERMISSIBLE MATERIALS

1. Pen

2. Ruler

3. Calculator (Programmable calculators are not allowed)

THIS PAPER CONSISTS OF 11 PAGES (Including this front page)

|

2 Page 2 |

▲back to top |

SECTION A:

[Answer questions 1{a-c) or 2]

QUESTION l(a): MULTIPLE CHOICE QUESTIONS

(10 Marks]

1. The rate of exchange is determined by the:

a) Demand and supply of foreign exchange

b) Import and export

c) Interest rate

d) Alloftheabove

2. The following is not a cause of rising external debt in LDCs

a) Capital flight

b) Exportation of raw material

c) The oil crises that took place in 1973-1974 and that of 1979-1980

d) Economic recessions in the industrialized countries

3. The following is not a factor that can hum per FDI

a) High cost of compliance to regulations and laws

b) Low levels of infrastructure development

c) Corruption

d) None of the above

4. Greenfield investments refers to:

a) The establishment of a wholly new operation in a foreign country

b) The refurbishment of a wholly operational in a foreign country

c) The establishment of an old operation from a new foreign country

d) None of the above

5. The eurocurrency market is utilized by:

a) Banks,

b) Multinational corporations,

c) Mutual funds and hedge funds

d) All of the above

6. When both countries are on Inconvertible Paper Currency standard:

a) The rate of exchange between them is determined according to the Mint Parity Theory

b) The rate of exchange rate is determined on the basis of the Purchasing Power Parity theory

c) The mint parity is determined by the gold purchased by the two countries, taken

individually

d) None of the above

1

|

3 Page 3 |

▲back to top |

7. The..........Maintain a systematic record of all economic transactions between the home country

and the rest of the world for a specific period of time, usually a year.

a) Foreign transaction statement

b) Exchange rate parity

c) Balance of Payment

d) Terms of Trade

8. A country is said to be on the gold standard if the following conditions are satisfied:

a) The standard monetary unit is defined in terms of gold of given purity and weight, or it

is convertible into gold at fixed rate.

b) The government buys and sells gold in unlimited quantity at officially fixed price

c) The are no restrictions on the export and import of gold

d) All of the above

9. The following is not an objectives of foreign exchange

a) To correct adverse

b) To check flight of capital

c) To stabilize exchange rate

d) To undermine foreign exchange

10. The following is part of the International Financial Institution

a) International Centre for Settlement of Investment Disputes

b) The Multilateral Investment Guarantee Agency

c) International Monetary Fund

d) All of the above

QUESTION l(b): TRUE OR FALSE

[10 Marks]

1. PPPs are the rates of currency conversion that equalize the purchasing power of different

currencies by eliminating the differences in price levels between countries.

2. Relative PPPrefers to rates of changes of price levels, that is, inflation rates.

3. The balance of payments theory of exchange rate holds that the price of domestic money in terms

of national money is determined by the free forces of demand and supply.

4. The IMF is largest external funder of Education in the World.

5. Exchangecontrol refers to the policy adopted by any country to maintain the value of its currency

at a level different from the one that would prevail in a free exchange market.

6. Both the flow and stock of FDI have never increased over the last 30 years.

7. Economic recessions in the industrialized countries can never cause external debt to rise.

8. The unemployment rate measures the percentage of the working populatiOn in a country who

would like to be working but are currently unemployed.

9. Euro-dollar has rendered official monetary policies less effective for the countries involved.

10. Capital Account measure the "visible" trade balance (Balance of Trade), indicates the balance (X-

M).

2

|

4 Page 4 |

▲back to top |

QUESTION l(c):

[10 Marks]

Define the following concepts that are commonly used in international finance.

a. Current account

b. Trade balance

c. Official reserve assets

d. Eurobond

e. Foreign exchange market.

QUESTION 2:

[30 Marks]

(a) Use a graph to demonstrate the relationship between the dollar/euro exchange rate and

expected dollar return on euro deposits.

(5)

(b) Use a graph to demonstrate the effect of a rise in the Dollar interest rate on the US$.

What will happen to capital inflows into the USeconomy and return on US$denominated

assets?

(10)

(c) Use a graph to demonstrate the effect of a rise in the Euro interest rate on the US$.

What will happen to capital inflows into the Eurozone economy and return on Euro

denominated assets?

(10)

(d)

Use a graph to demonstrate the relationship between real money demand

and interest rate.

(5)

SECTION B

[Answer question 1 or 2 from the following section]

QUESTION 1

Discussthe internal factors that causes a disequilibria in Balance of payment.

[30 Marks]

QUESTION 2

[30 Marks]

The Fisher effect (named affect Irving Fisher) describes the relationship between nominal interest

rates and inflation. Interest parity implies that arbitrage in the foreign exchange market is not possible.

REQUIRED:

i) State the equation for the Fisher effect

(4)

3

|

5 Page 5 |

▲back to top |

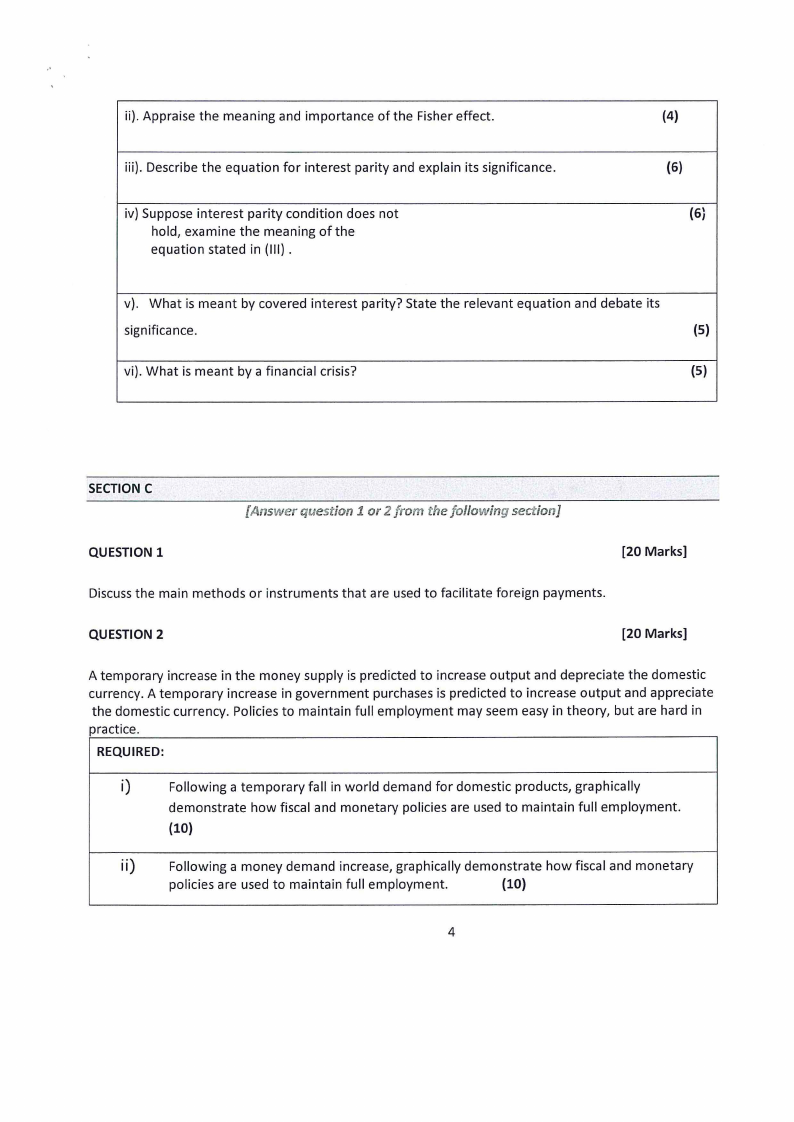

ii). Appraise the meaning and importance of the Fisher effect.

iii). Describe the equation for interest parity and explain its significance.

iv) Suppose interest parity condition does not

hold, examine the meaning of the

equation stated in (Ill) .

(4)

(6)

{6}

v). What is meant by covered interest parity? State the relevant equation and debate its

significance.

(5)

vi). What is meant by a financial crisis?

{5)

SECTION C

[Answer question 1 or l from the following section]

QUESTION 1

(20 Marks]

Discussthe main methods or instruments that are used to facilitate foreign payments.

QUESTION 2

(20 Marks]

A temporary increase in the money supply is predicted to increase output and depreciate the domestic

currency. A temporary increase in government purchases is predicted to increase output and appreciate

the domestic currency. Policies to maintain full employment may seem easy in theory, but are hard in

practice.

REQUIRED:

i)

Following a temporary fall in world demand for domestic products, graphically

demonstrate how fiscal and monetary policies are used to maintain full employment.

{10)

ii)

Following a money demand increase, graphically demonstrate how fiscal and monetary

policies are used to maintain full employment.

{10)

4

|

6 Page 6 |

▲back to top |

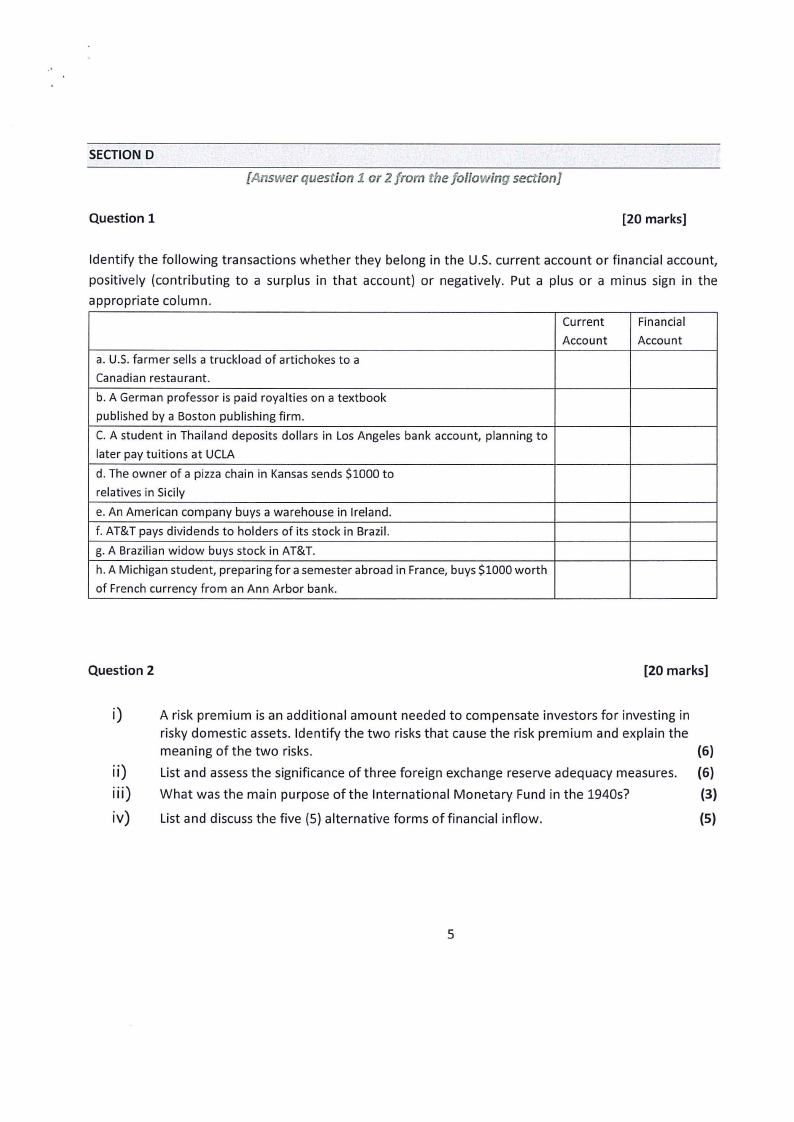

SECTION D

[Answer question 1 or 2 from the following section]

Question 1

[20 marks]

Identify the following transactions whether they belong in the U.S. current account or financial account,

positively (contributing to a surplus in that account) or negatively. Put a plus or a minus sign in the

appropriate column.

Current

Account

Financial

Account

a. U.S.farmer sells a truckload of artichokes to a

Canadian restaurant.

b. A German professor is paid royalties on a textbook

published by a Boston publishing firm.

C. A student in Thailand deposits dollars in Los Angeles bank account, planning to

later pay tuitions at UCLA

d. The owner of a pizza chain in Kansas sends $1000 to

relatives in Sicily

e. An American company buys a warehouse in Ireland.

f. AT&T pays dividends to holders of its stock in Brazil.

g. A Brazilian widow buys stock in AT&T.

h. A Michigan student, preparing for a semester abroad in France, buys $1000 worth

of French currency from an Ann Arbor bank.

Question 2

[20 marks]

i)

A risk premium is an additional amount needed to compensate investors for investing in

risky domestic assets. Identify the two risks that cause the risk premium and explain the

meaning of the two risks.

(6)

ii)

List and assessthe significance of three foreign exchange reserve adequacy measures. (6)

iii) What was the main purpose of the International Monetary Fund in the 1940s?

(3)

iv) List and discuss the five (S) alternative forms offinancial inflow.

(5)

5