|

CMA612S - COST MANAGEMENT ACCOUNTING 202 - 2ND OPP - JAN 2020 |

|

1 Page 1 |

▲back to top |

NAMIBIA UNIVERSITY

OF SCIENCE AND TECHNOLOGY

FACULTY OF MANAGEMENT SCIENCES

DEPARTMENT OF ACCOUNTING, ECONOMICS & FINANCE

QUALIFICATION: BACHELOR OF ACCOUNTING

QUALIFICATION CODE: 07BOAC

COURSE CODE: CMA612S

LEVEL: 6

COURSE NAME: COST AND MANAGEMENT

ACCOUNTING 202

SESSION: JANUARY 2020

DURATION: 3 HOURS

PAPER: PRACTICAL AND THEORY

MARKS: 100

EXAMINERS:

SECOND OPPORTUNITY QUESTION PAPER

H Namwandi, K Tjondu and A Makosa

MODERATOR:

K Boamah

INSTRUCTIONS

e This examination paper is made up of four (4) questions.

e Answer All the questions and in blue or black ink.

e Show all your workings.

e Start each question on a new page in your answer booklet and show all your workings.

e Questions relating to this paper may be raised in the initial 30 minutes after the start of

the paper. Thereafter, candidates must use their initiative to deal with any perceived error

or ambiguities and any assumption made by the candidate should be clearly stated.

PERMISSIBLE MATERIALS

Non-programmable calculator

THIS QUESTION PAPER CONSISTS OF 6 PAGES (Excluding this front page)

|

2 Page 2 |

▲back to top |

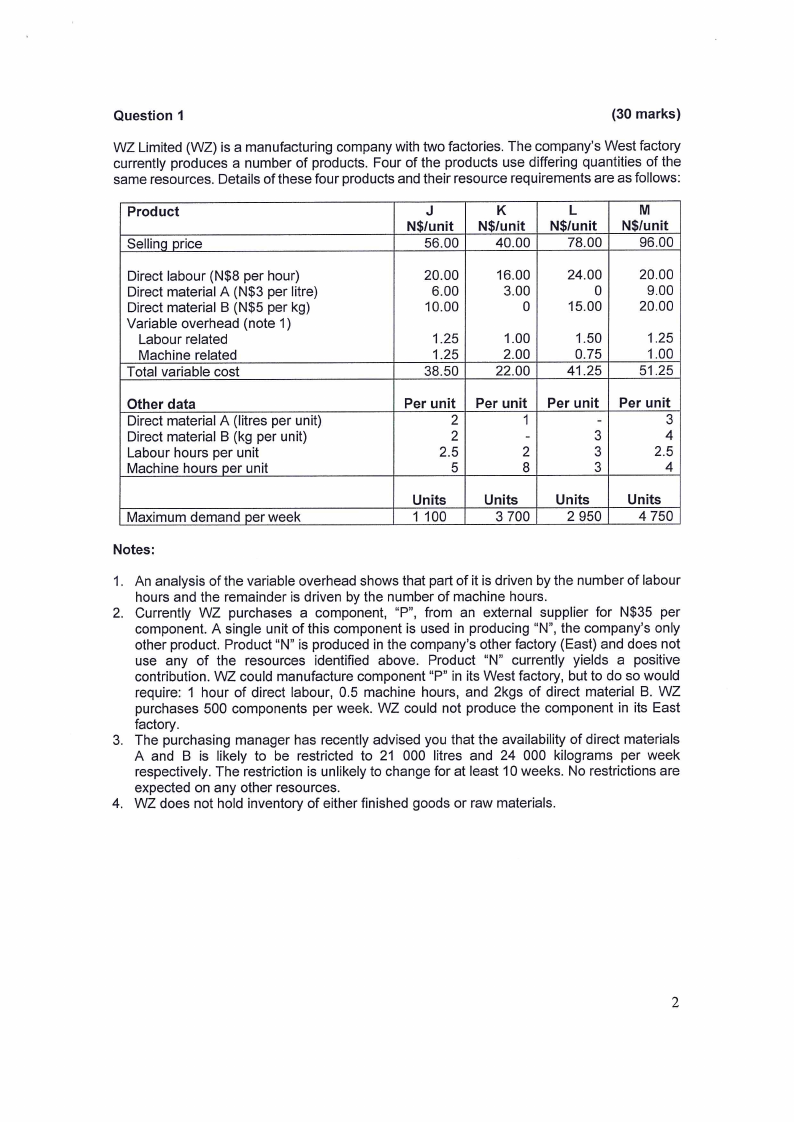

Question 1

(30 marks)

WZ Limited (WZ) is a manufacturing company with two factories. The company’s West factory

currently produces a number of products. Four of the products use differing quantities of the

same resources. Details of these four products and their resource requirements are as follows:

Product

Selling price

J

K

L

M

N$/unit | N$/unit | N$/unit | N$/unit

56.00

40.00

78.00

96.00

Direct labour (N$8 per hour)

Direct material A (N$3 per litre)

Direct material B (N$5 per kg)

Variable overhead (note 1)

Labour related

Machine related

Total variable cost

20.00

6.00

10.00

1.25

1.25

38.50

16.00

3.00

0

1.00

2.00

22.00

24.00

0

15.00

1.50

0.75

41.25

20.00

9.00

20.00

1.25

1.00

51.25

Other data

Direct material A (litres per unit)

Direct material B (kg per unit)

Labour hours per unit

Machine hours per unit

Per unit | Per unit | Per unit | Per unit

2

1

-

3

2

-

3

4

2.5

2

3

2.5

5

8

3

4

Maximum demand per week

Units

1100

Units

3 700

Units

2 950

Units

4750

Notes:

1. An analysis of the variable overhead shows that part of it is driven by the number of labour

hours and the remainder is driven by the number of machine hours.

2. Currently WZ purchases a component, “P”, from an external supplier for N$35 per

component. A single unit of this component is used in producing “N”, the company’s only

other product. Product “N” is produced in the company’s other factory (East) and does not

use any of the resources identified above. Product “N” currently yields a positive

contribution. WZ could manufacture component “P” in its West factory, but to do so would

require: 1 hour of direct labour, 0.5 machine hours, and 2kgs of direct material B. WZ

purchases 500 components per week. WZ could not produce the component in its East

factory.

The purchasing manager has recently advised you that the availability of direct materials

A and B is likely to be restricted to 21 000 litres and 24 000 kilograms per week

respectively. The restriction is unlikely to change for at least 10 weeks. No restrictions are

expected on any other resources.

WZ does not hold inventory of either finished goods or raw materials.

|

3 Page 3 |

▲back to top |

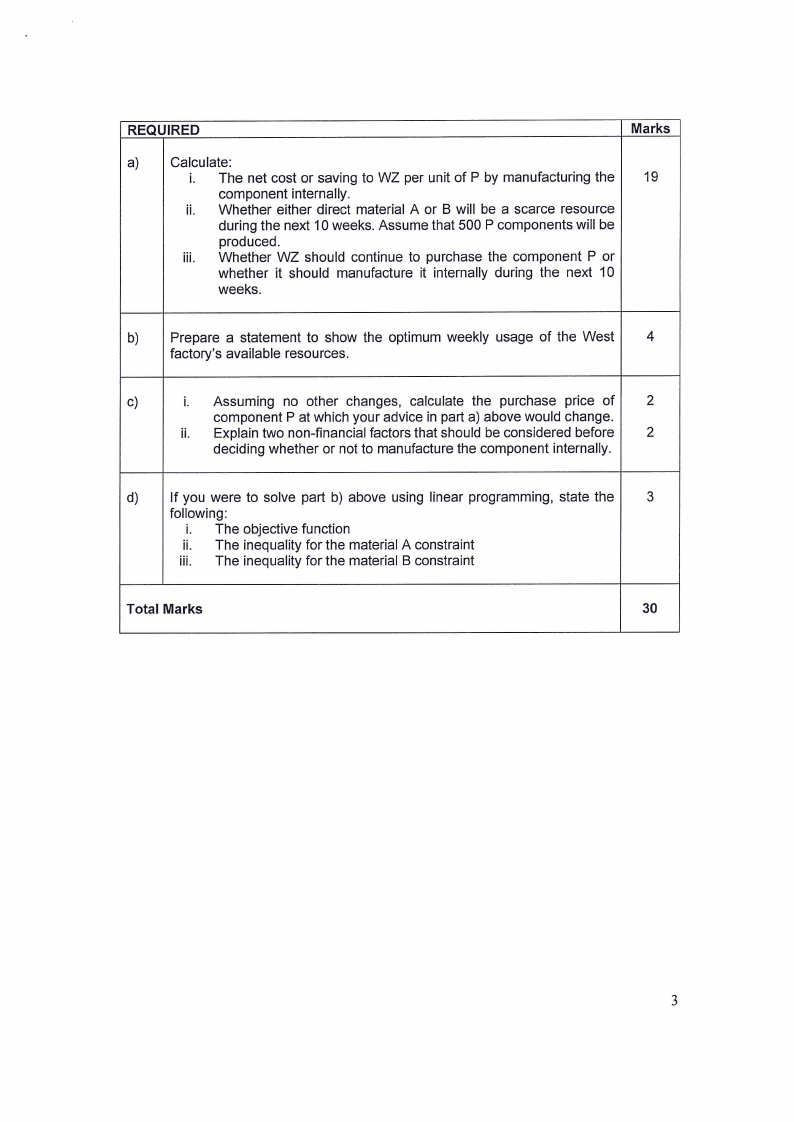

REQUIRED

Marks

a)

Calculate:

i. |The net cost or saving to WZ per unit of P by manufacturing the

19

component internally.

ii. | Whether either direct material A or B will be a scarce resource

during the next 10 weeks. Assume that 500 P components will be

produced.

iii, | Whether WZ should continue to purchase the component P or

whether it should manufacture it internally during the next 10

weeks.

Prepare a statement to show the optimum weekly usage of the West

factory’s available resources.

Cc)

i. Assuming no other changes, calculate the purchase price of

component P at which your advice in part a) above would change.

ii. | Explain two non-financial factors that should be considered before

deciding whether or not to manufacture the component internally.

If you were to solve part b) above using linear programming,

following:

i. | The objective function

ii. | The inequality for the material A constraint

iii. | The inequality for the material B constraint

state the

Total Marks

30

|

4 Page 4 |

▲back to top |

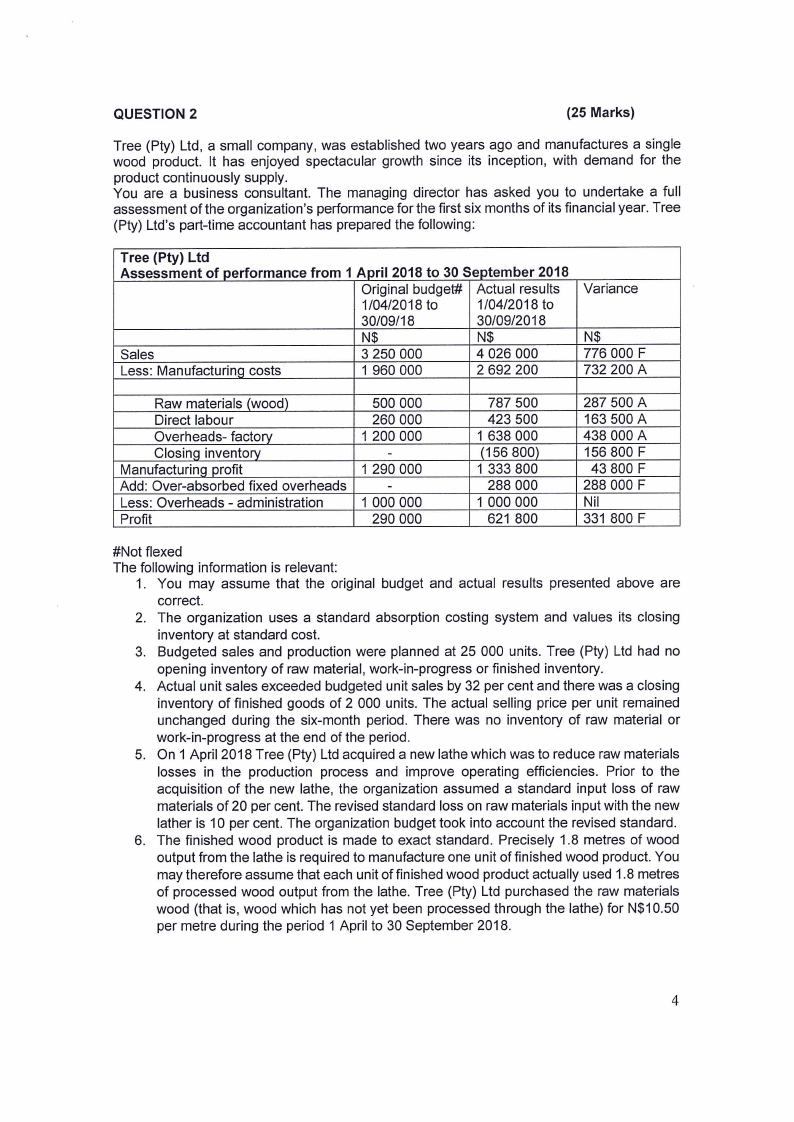

QUESTION 2

(25 Marks)

Tree (Pty) Ltd, a small company, was established two years ago and manufactures a single

wood product. It has enjoyed spectacular growth since its inception, with demand for the

product continuously supply.

You are a business consultant. The managing director has asked you to undertake a full

assessment of the organization’s performance for the first six months of its financial year. Tree

(Pty) Ltd’s part-time accountant has prepared the following:

Tree (Pty) Ltd

Assessment of performance from 1 April 2018 to 30 September 2018

Original budget# | Actual results | Variance

1/04/2018 to

1/04/2018 to

30/09/18

30/09/2018

NS

NS

NS

Sales

3 250 000

4 026 000

776 000 F

Less: Manufacturing costs

1 960 000

2 692 200

732 200A

Raw materials (wood)

Direct labour

Overheads- factory

Closing inventory

Manufacturing profit

Add: Over-absorbed fixed overheads

Less: Overheads - administration

Profit

500 000

260 000

1.200 000

-

1 290 000

-

1.000 000

290 000

787 500

423 500

1 638 000

(156 800)

1 333 800

288 000

1.000 000

621 800

287 500 A

163 500 A

438 000 A

156 800 F

43 800 F

288 000 F

Nil

331 800 F

#Not flexed

The following information is relevant:

1. You may assume that the original budget and actual results presented above are

correct.

2. The organization uses a standard absorption costing system and values its closing

inventory at standard cost.

3. Budgeted sales and production were planned at 25 000 units. Tree (Pty) Ltd had no

opening inventory of raw material, work-in-progress or finished inventory.

Actual unit sales exceeded budgeted unit sales by 32 per cent and there was a closing

inventory of finished goods of 2 000 units. The actual selling price per unit remained

unchanged during the six-month period. There was no inventory of raw material or

work-in-progress at the end of the period.

On 1 April 2018 Tree (Pty) Ltd acquired a new lathe which was to reduce raw materials

losses in the production process and improve operating efficiencies. Prior to the

acquisition of the new lathe, the organization assumed a standard input loss of raw

materials of 20 per cent. The revised standard loss on raw materials input with the new

lather is 10 per cent. The organization budget took into account the revised standard.

The finished wood product is made to exact standard. Precisely 1.8 metres of wood

output from the lathe is required to manufacture one unit of finished wood product. You

may therefore assume that each unit of finished wood product actually used 1.8 metres

of processed wood output from the lathe. Tree (Pty) Ltd purchased the raw materials

wood (that is, wood which has not yet been processed through the lathe) for N$10.50

per metre during the period 1 April to 30 September 2018.

|

5 Page 5 |

▲back to top |

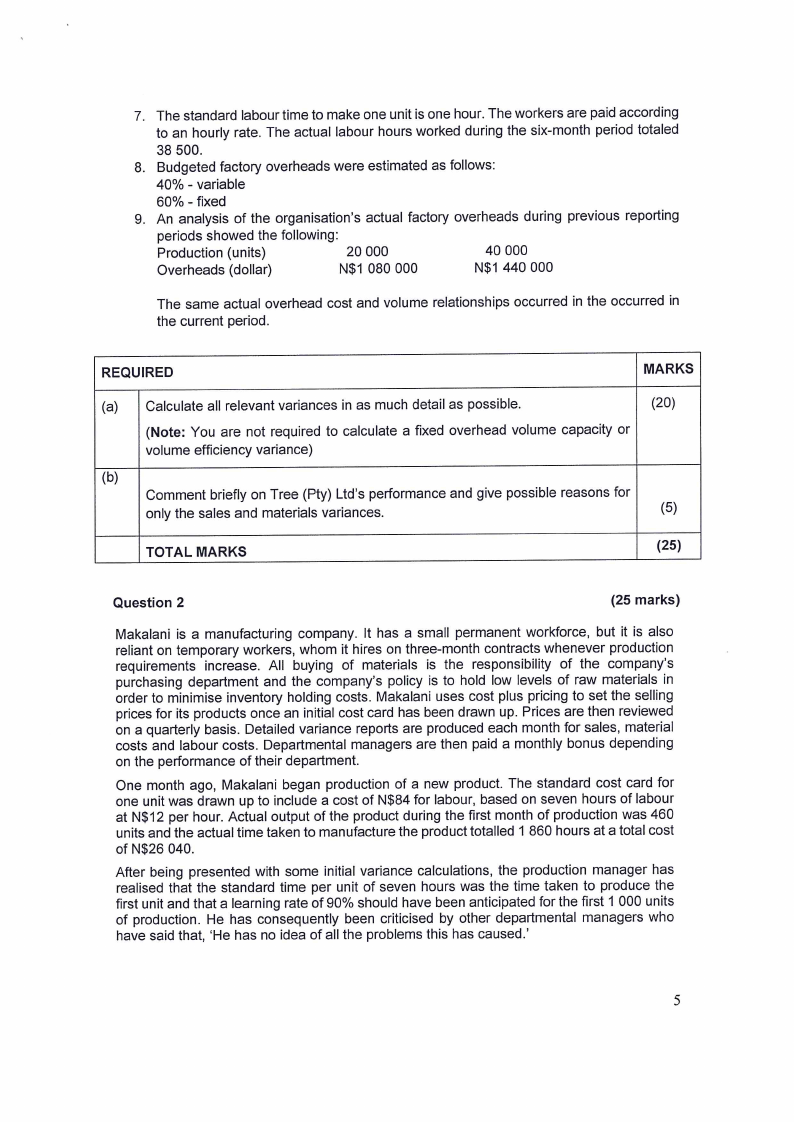

7. The standard labour time to make one unit is one hour. The workers are paid according

to an hourly rate. The actual labour hours worked during the six-month period totaled

38 500.

8. Budgeted factory overheads were estimated as follows:

40% - variable

60% - fixed

9. An analysis of the organisation’s actual factory overheads during previous reporting

periods showed the following:

Production (units)

20 000

Overheads (dollar)

N$1 080 000

40 000

N$1 440 000

The same actual overhead cost and volume relationships occurred in the occurred in

the current period.

REQUIRED

MARKS

(a) Calculate all relevant variances in as much detail as possible.

(20)

(Note: You are not required to calculate a fixed overhead volume capacity or

volume efficiency variance)

(b)

Comment briefly on Tree (Pty) Ltd’s performance and give possible reasons for

only the sales and materials variances.

(5)

TOTAL MARKS

(25)

Question 2

(25 marks)

Makalani is a manufacturing company. It has a small permanent workforce, but it is also

reliant on temporary workers, whom it hires on three-month contracts whenever production

requirements increase. All buying of materials is the responsibility of the company’s

purchasing department and the company’s policy is to hold low levels of raw materials in

order to minimise inventory holding costs. Makalani uses cost plus pricing to set the selling

prices for its products once an initial cost card has been drawn up. Prices are then reviewed

on a quarterly basis. Detailed variance reports are produced each month for sales, material

costs and labour costs. Departmental managers are then paid a monthly bonus depending

on the performance of their department.

One month ago, Makalani began production of a new product. The standard cost card for

one unit was drawn up to include a cost of N$84 for labour, based on seven hours of labour

at N$12 per hour. Actual output of the product during the first month of production was 460

units and the actual time taken to manufacture the product totalled 1 860 hours at a total cost

of N$26 040.

After being presented with some initial variance calculations, the production manager has

realised that the standard time per unit of seven hours was the time taken to produce the

first unit and that a learning rate of 90% should have been anticipated for the first 1 000 units

of production. He has consequently been criticised by other departmental managers who

have said that, ‘He has no idea of all the problems this has caused.’

|

6 Page 6 |

▲back to top |

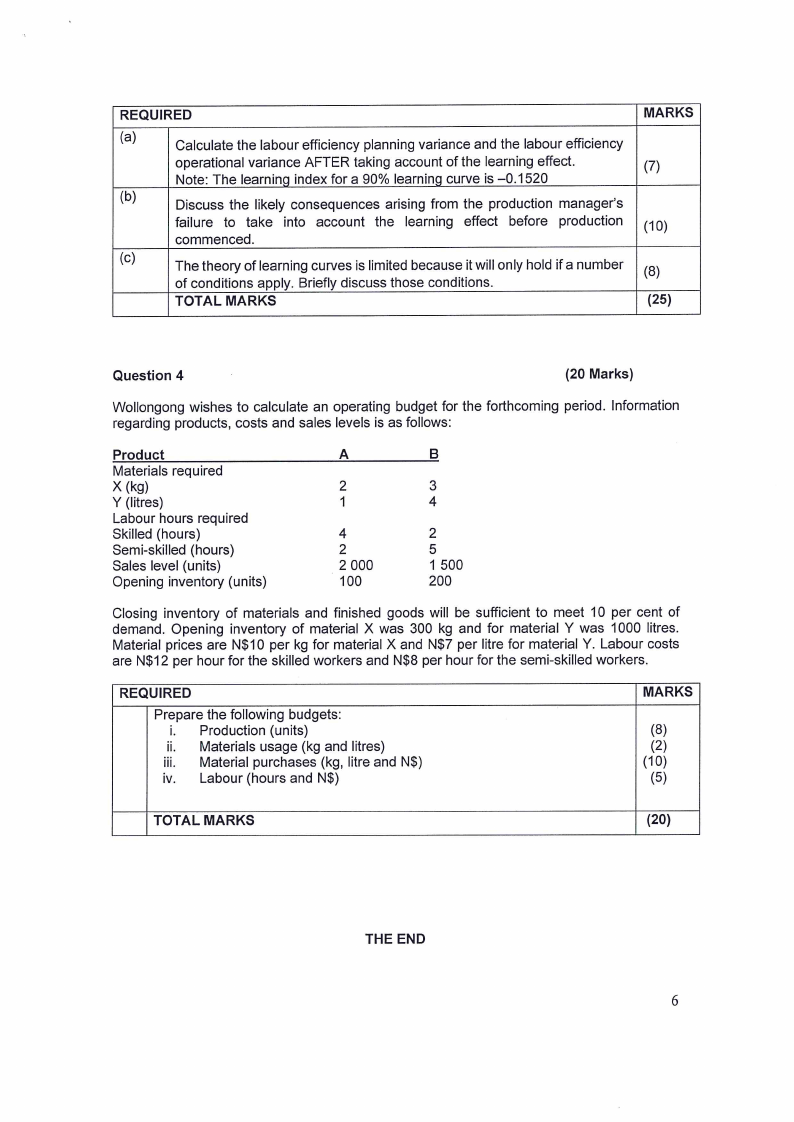

REQUIRED

(a)

Calculate the labour efficiency planning variance and the labour efficiency

operational variance AFTER taking account of the learning effect.

Note: The learning index for a 90% learning curve is —0.1520

(0)

Discuss the likely consequences arising from the production manager's

failure to take into account the learning effect before production

commenced.

(c)

The theory of learning curves is limited because it will only hold if a number

of conditions apply. Briefly discuss those conditions.

TOTAL MARKS

MARKS

(7)

(10)

(8)

(25)

Question 4

(20 Marks)

Wollongong wishes to calculate an operating budget for the forthcoming period. Information

regarding products, costs and sales levels is as follows:

Product

Materials required

X (kg)

Y (litres)

Labour hours required

Skilled (hours)

Semi-skilled (hours)

Sales level (units)

Opening inventory (units)

A

2

1

4

2

2 000

100

B

3

4

2

5

1 500

200

Closing inventory of materials and finished goods will be sufficient to meet 10 per cent of

demand. Opening inventory of material X was 300 kg and for material Y was 1000 litres.

Material prices are N$10 per kg for material X and N$7 per litre for material Y. Labour costs

are N$12 per hour for the skilled workers and N$8 per hour for the semi-skilled workers.

REQUIRED

Prepare the following budgets:

i. | Production (units)

ii. | Materials usage (kg and litres)

iii. | Material purchases (kg, litre and N$)

iv. Labour (hours and N$)

MARKS

(8)

(2)

(10)

(5)

TOTAL MARKS

(20)

THE END