|

PFN712S-PUBLIC FINANCE-2ND OPP-JULY 2022 |

|

1 Page 1 |

▲back to top |

nAm I BIA UnlVERSITY

OF SCIEnCE Ano TECHnOLOGY

FACULTY OF MANAGEMENT SCIENCES

DEPARTMENT OF ACCOUNTING,ECONOMICSAND FINANCE

QUALIFICATIONB:ACHELOROF ECONOMICS

QUALIFICATIOCNODE:07BECO

LEVEL: 7

COURSECODE:PFN712S

COURSENAME:PUBLIC FINANCE

SESSIONJ: UNE 2022

DURATION:3 HOURS

PAPER:THEORY

MARKS:100

SECONDOPPORTUNITEYXAMNATION_PAPER

EXAMINER(S) MR. MALLY LIKUKELA

MODERATOR: MR. M MBAHA

INSTRUCTIONS

1. This paper consist of section A,B,Cand D

2. Answer ALL questions

3. Number your answers in accordance with the question paper.

4. Start each section answer on a new page

5. Write clearly and leqibly

PERMISSIBLEMATERIALS

1. Pen/pencil/eraser

2. Ruler

3. Calculator

THISEXAMNATIONMEMORANDACONSISTSOF3 PAGES(Including this front page)

|

2 Page 2 |

▲back to top |

,SECTIONA

QUESTION1

Define and explain the scope for Public Finance.

QUESTION2

Describe the five solutions to the problem of externalities.

20 MARKS

[10MARKS]

[10MARKS]

SECTION8

QUESTION1

1. List five sources of government revenue in Namibia

ii. List the main sectors in which the Namibian budget is distributed

30 MARKS

[10MARKS]

[5]

[5]

QUESTION2

Describe the main disadvantages of Value Added Tax (VAT).

[10MARKS]

QUESTION3

i. Define tax incidence

ii. Explain the four important principles of tax incidence:

[10MARKS]

[2]

[8]

SECTIONC

QUESTION1

With the help of a diagram discuss the deadweight loss of taxation

20 MARKS

[10MARKS]

QUESTION2

[10MARKS]

Discuss the main rationale for tax reform in an economy's tax system and relate to

Namibian situation.

1

|

3 Page 3 |

▲back to top |

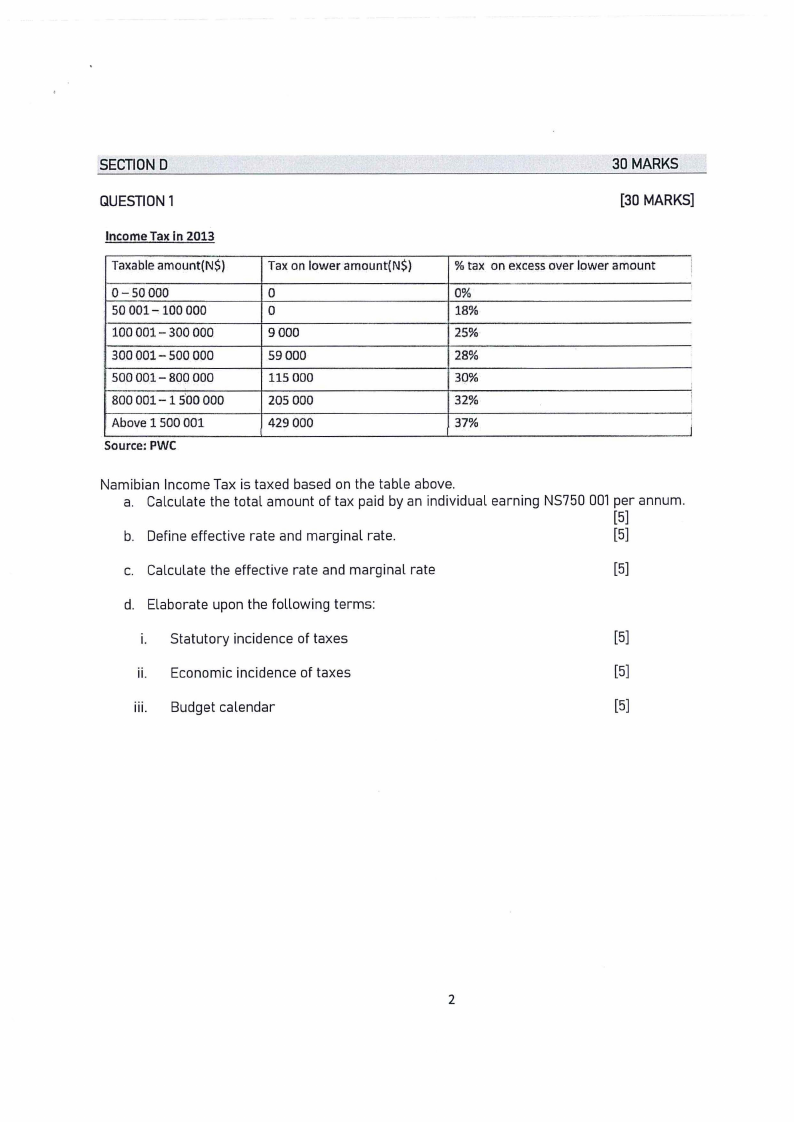

SECTIOND

QUESTION1

Income Tax In 2013

Taxable amount(N$)

0-50 000

. 50 001- 100 000

100 001 - 300 000

300 001- 500 000

500 001- 800 000

aoo001- 1 s·oooo

Above1 500 001

Source:PWC

Tax on loweramount(N$)

0

0

9000

59000

115 000

205 000

429 000

30 MARKS

[30 MARKS]

% tax on excessover loweramount

I

0%

18%

25%

28%

30%

32%

''

37%

i

Namibian Income Tax is taxed based on the table above.

a. Calculate the total amount of tax paid by an individual earning NS750 001 per annum.

[5]

b. Define effective rate and marginal rate.

[5]

c. Calculate the effective rate and marginal rate

[5]

d. Elaborate upon the following terms:

i. Statutory incidence of taxes

[5]

ii. Economic incidence of taxes

[5]

iii. Budget calendar

[5]

2

|

4 Page 4 |

▲back to top |