|

FAM601Y-FINANCIAL MANAGEMENT 200- 2ND OPP- JAN 2025 |

|

1 Page 1 |

▲back to top |

Financial Management 200 (FAM601Y) January 2025 Assessment 2nd Opp

n Am I BI A u n IVER s I TY

OF SCIEnCE

TECHnOLOGY

FACULTY OF COMMERCE, HUMAN SCIENCES & EDUCATION

DEPARTMENT OF ECONOMICS, ACCOUNTING & FINANCE

QUALIFICATION: BACHELOR OF ACCOUNTING (CHARTERED ACCOUNTANCY)

QUALIFICATION CODE: 07BACC

LEVEL: 6

COURSE CODE: FAM601 Y

COURSE NAME: FINANCIAL MANAGEMENT 200

DATE: JANUARY 2025

DURATION: 3 HOURS 8 Minutes

COMPRISING:

READING TIME: 25 MINUTES

WRITING TIME: 2 HOURS & 43 MINUTES

PAPER: PRACTICAL AND THEORY

MARKS: 125

EXAMINER:

JANUARY 2025 ASSESSMENT 2nd Opp QUESTION PAPER

Mr. S. Nghiwilepo

MODERATOR: Mr. H. Namwandi

INSTRUCTIONS

• This question paper is made up of four (4) questions.

• Answer All the questions in blue or black ink.

• Show all your workings in the answer sheet.

• Start each question on a new page in your answer booklet and show all your workings.

• Questions relating to this paper may be raised in the initial 30 minutes after the start of

the paper. Thereafter, candidates must use their initiative to deal with any perceived error

or ambiguities and any assumption made by the candidate should be clearly stated.

PERMISSIBLE MATERIALS

Non-programmable calculator/financial calculator

THIS QUESTION PAPER CONSISTS OF 5 PAGES (Including this front page)

1

|

2 Page 2 |

▲back to top |

Financial Management 200 (FAM601Y) January 2025 Assessment 2nd Opp

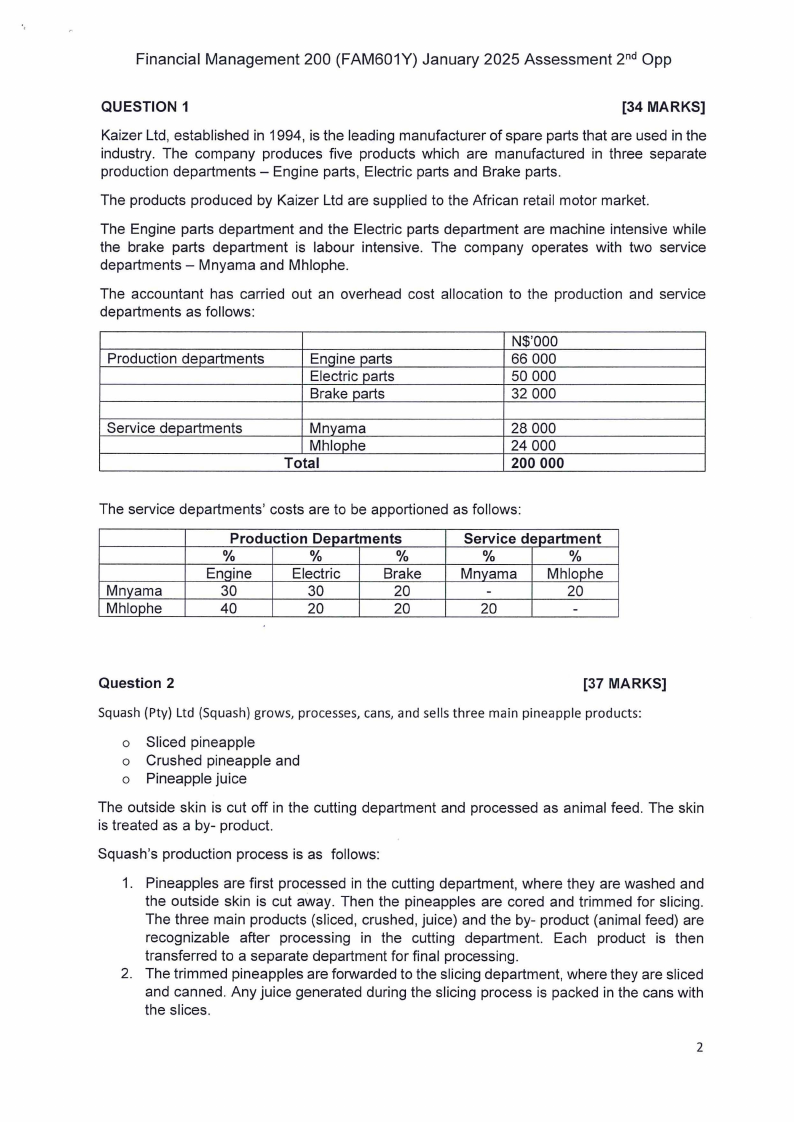

QUESTION 1

[34 MARKS]

Kaizer Ltd, established in 1994, is the leading manufacturer of spare parts that are used in the

industry. The company produces five products which are manufactured in three separate

production departments - Engine parts, Electric parts and Brake parts.

The products produced by Kaizer Ltd are supplied to the African retail motor market.

The Engine parts department and the Electric parts department are machine intensive while

the brake parts department is labour intensive. The company operates with two service

departments - Mnyama and Mhlophe.

The accountant has carried out an overhead cost allocation to the production and service

departments as follows:

Production departments

Engine parts

Electric parts

Brake parts

N$'000

66 000

50 000

32 000

Service departments

Mnyama

Mhlophe

Total

28 000

24 000

200 000

The service departments' costs are to be apportioned as follows:

Mnyama

Mhlophe

Production Departments

%

%

%

EnQine

Electric

Brake

30

30

20

40

20

20

Service department

%

%

Mnvama Mhlophe

-

20

20

-

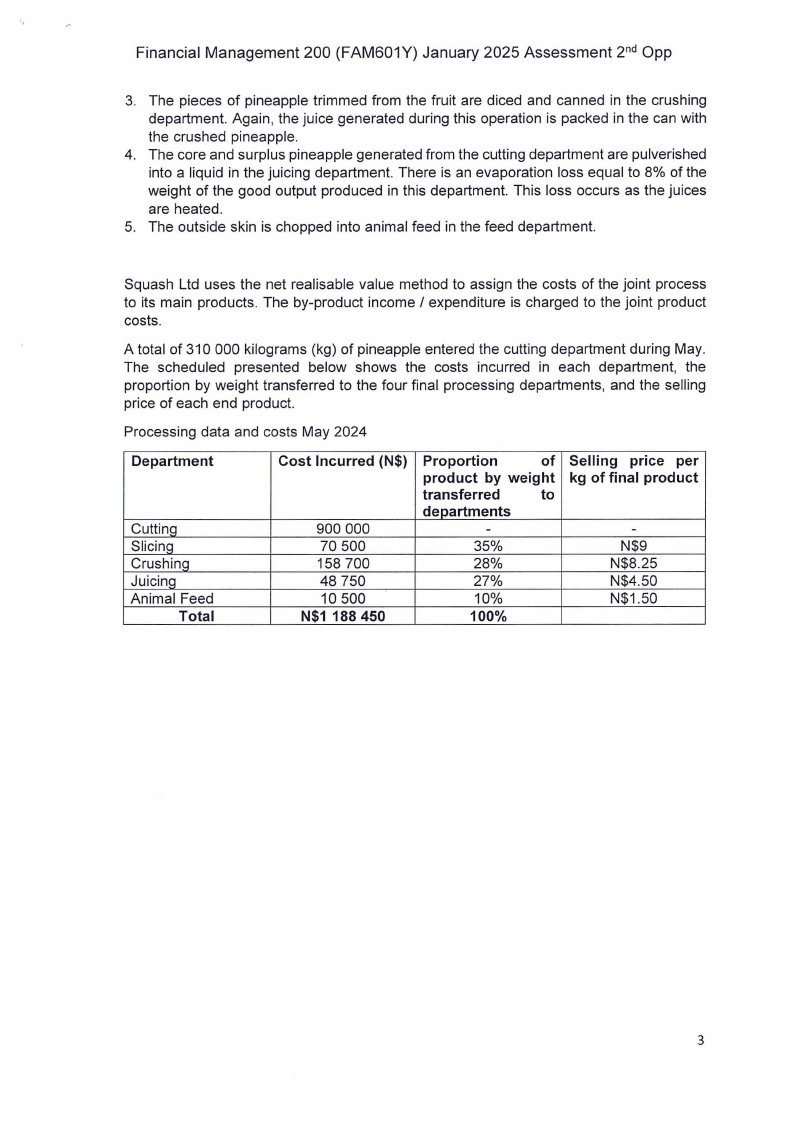

Question 2

[37 MARKS]

Squash (Pty) Ltd (Squash) grows, processes, cans, and sells three main pineapple products:

o Sliced pineapple

o Crushed pineapple and

o Pineapple juice

The outside skin is cut off in the cutting department and processed as animal feed. The skin

is treated as a by- product.

Squash's production process is as follows:

1. Pineapples are first processed in the cutting department, where they are washed and

the outside skin is cut away. Then the pineapples are cored and trimmed for slicing.

The three main products (sliced, crushed, juice) and the by- product (animal feed) are

recognizable after processing in the cutting department. Each product is then

transferred to a separate department for final processing.

2. The trimmed pineapples are forwarded to the slicing department, where they are sliced

and canned. Any juice generated during the slicing process is packed in the cans with

the slices.

2

|

3 Page 3 |

▲back to top |

Financial Management 200 (FAM601Y) January 2025 Assessment 2nd Opp

3. The pieces of pineapple trimmed from the fruit are diced and canned in the crushing

department. Again, the juice generated during this operation is packed in the can with

the crushed pineapple.

4. The core and surplus pineapple generated from the cutting department are pulverished

into a liquid in the juicing department. There is an evaporation loss equal to 8% of the

weight of the good output produced in this department. This loss occurs as the juices

are heated.

5. The outside skin is chopped into animal feed in the feed department.

Squash Ltd uses the net realisable value method to assign the costs of the joint process

to its main products. The by-product income I expenditure is charged to the joint product

costs.

A total of 310 000 kilograms (kg) of pineapple entered the cutting department during May.

The scheduled presented below shows the costs incurred in each department, the

proportion by weight transferred to the four final processing departments, and the selling

price of each end product.

Processing data and costs May 2024

Department

Cuttinq

Slicing

Crushinq

Juicing

Animal Feed

Total

Cost Incurred (N$)

900 000

70 500

158 700

48 750

10 500

N$1 188 450

Proportion

of

product by weight

transferred

to

departments

-

35%

28%

27%

10%

100%

Selling price per

kg of final product

-

N$9

N$8.25

N$4.50

N$1.50

3

|

4 Page 4 |

▲back to top |

Financial Management 200 (FAM601Y) January 2025 Assessment 2nd Opp

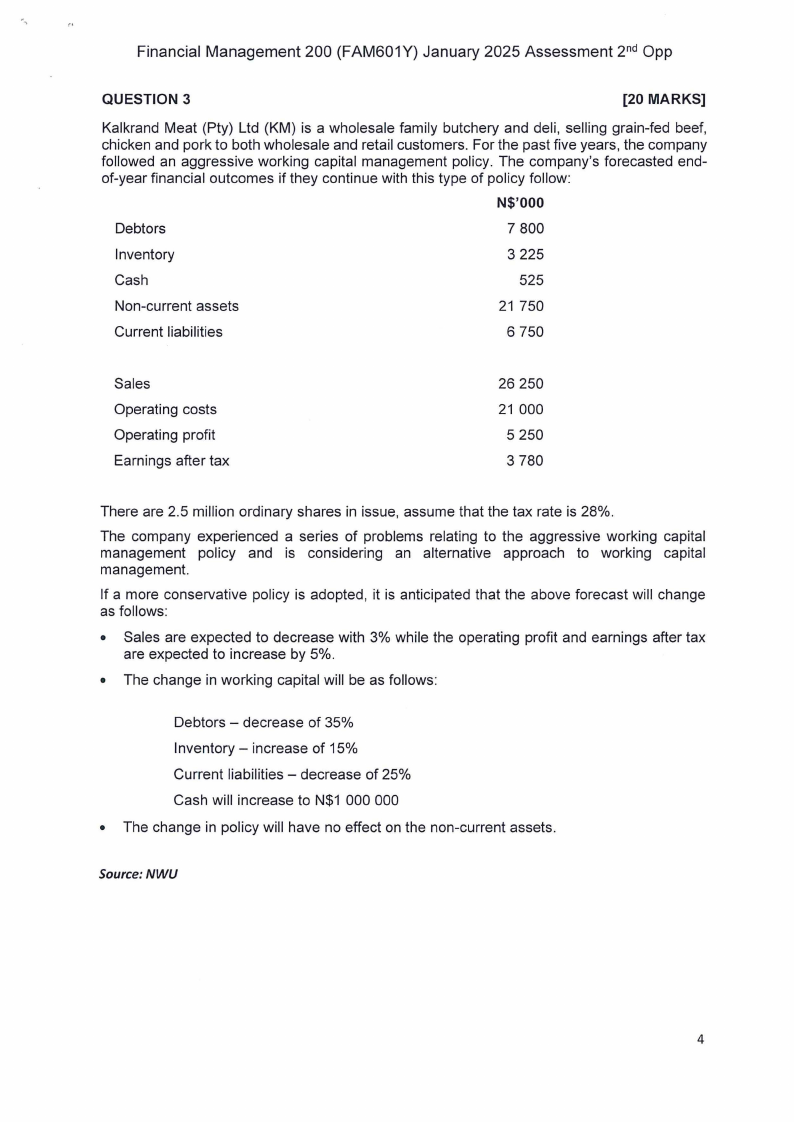

QUESTION 3

[20 MARKS]

Kalkrand Meat (Pty) Ltd (KM) is a wholesale family butchery and deli, selling grain-fed beef,

chicken and pork to both wholesale and retail customers. For the past five years, the company

followed an aggressive working capital management policy. The company's forecasted end-

of-year financial outcomes if they continue with this type of policy follow:

N$'000

Debtors

7 800

Inventory

3 225

Cash

525

Non-current assets

21 750

Current liabilities

6 750

Sales

Operating costs

Operating profit

Earnings after tax

26 250

21 000

5 250

3 780

There are 2.5 million ordinary shares in issue, assume that the tax rate is 28%.

The company experienced a series of problems relating to the aggressive working capital

management policy and is considering an alternative approach to working capital

management.

If a more conservative policy is adopted, it is anticipated that the above forecast will change

as follows:

• Sales are expected to decrease with 3% while the operating profit and earnings after tax

are expected to increase by 5%.

• The change in working capital will be as follows:

Debtors - decrease of 35%

Inventory - increase of 15%

Current liabilities - decrease of 25%

Cash will increase to N$1 000 000

• The change in policy will have no effect on the non-current assets.

Source:NWU

4

|

5 Page 5 |

▲back to top |

Financial Management 200 (FAM601Y) January 2025 Assessment 2nd Opp

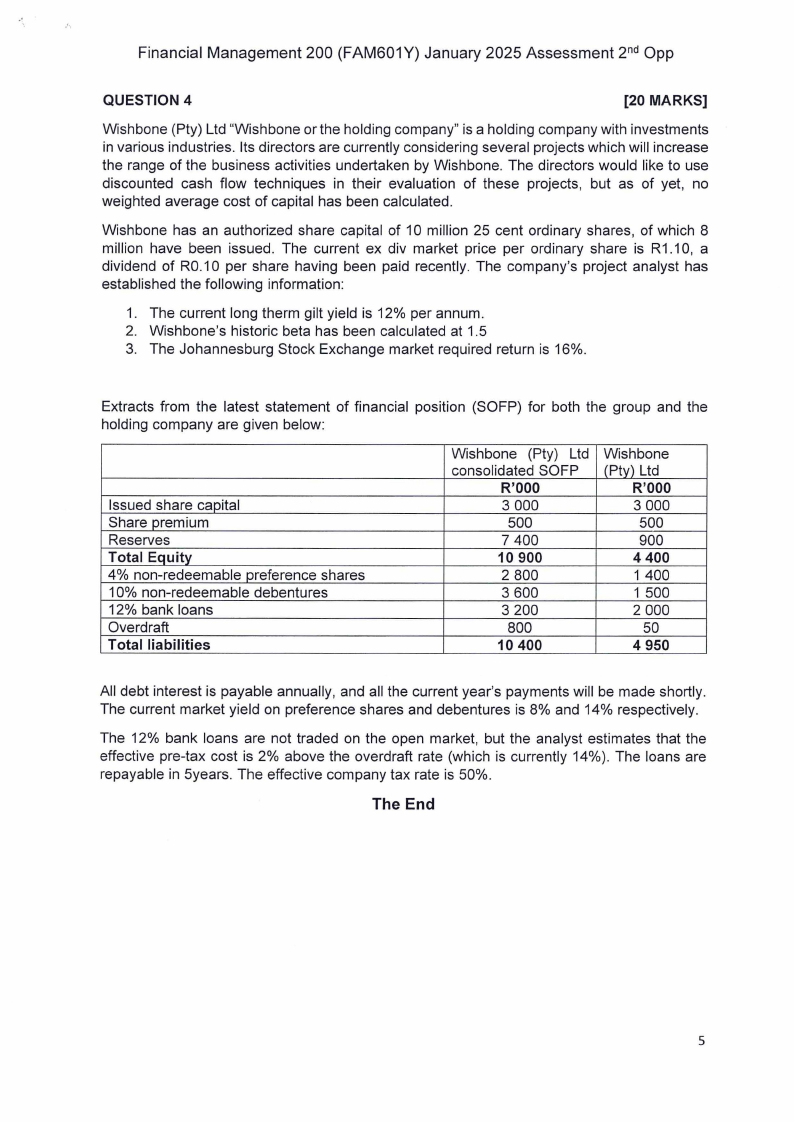

QUESTION 4

[20 MARKS]

Wishbone (Pty) Ltd "Wishbone or the holding company" is a holding company with investments

in various industries. Its directors are currently considering several projects which will increase

the range of the business activities undertaken by Wishbone. The directors would like to use

discounted cash flow techniques in their evaluation of these projects, but as of yet, no

weighted average cost of capital has been calculated.

Wishbone has an authorized share capital of 10 million 25 cent ordinary shares, of which 8

million have been issued. The current ex div market price per ordinary share is R1.10, a

dividend of R0.10 per share having been paid recently. The company's project analyst has

established the following information:

1. The current long therm gilt yield is 12% per annum.

2. Wishbone's historic beta has been calculated at 1.5

3. The Johannesburg Stock Exchange market required return is 16%.

Extracts from the latest statement of financial position (SOFP) for both the group and the

holding company are given below:

Issued share capital

Share premium

Reserves

Total Equity

4% non-redeemable preference shares

10% non-redeemable debentures

12% bank loans

Overdraft

Total liabilities

Wishbone (Pty) Ltd

consolidated SOFP

R'000

3 000

500

7 400

10 900

2 800

3 600

3 200

800

10 400

Wishbone

(Pty) Ltd

R'000

3 000

500

900

4400

1 400

1 500

2 000

50

4 950

All debt interest is payable annually, and all the current year's payments will be made shortly.

The current market yield on preference shares and debentures is 8% and 14% respectively.

The 12% bank loans are not traded on the open market, but the analyst estimates that the

effective pre-tax cost is 2% above the overdraft rate (which is currently 14%). The loans are

repayable in 5years. The effective company tax rate is 50%.

The End

5

|

6 Page 6 |

▲back to top |

Financial Management 200 (FAM601Y) January 2025 Assessment 2nd Opp

nAmI BI AunIVE RSITY

OF SCIEnCE Ano TECHnOLOGY

FACULTY OF COMMERCE, HUMAN SCIENCES & EDUCATION

DEPARTMENT OF ECONOMICS, ACCOUNTING & FINANCE

QUALIFICATION: BACHELOR OF ACCOUNTING (CHARTERTED ACCOUNTANCY)

COURSE CODE: FAM601Y

DATE: JANUARY 2025

DURATION: 3 HOURS 8 MINUTES

COURSE NAME: FINANCIAL MANAGEMENT

200

PAPER: PRACTICAL AND THEORY

MARKS: 125

JANUARY 2025 2nd Opp ASSESSMENT REQUIRED

|

7 Page 7 |

▲back to top |

Financial Management 200 (FAM601Y) January 2025 Assessment 2nd Opp

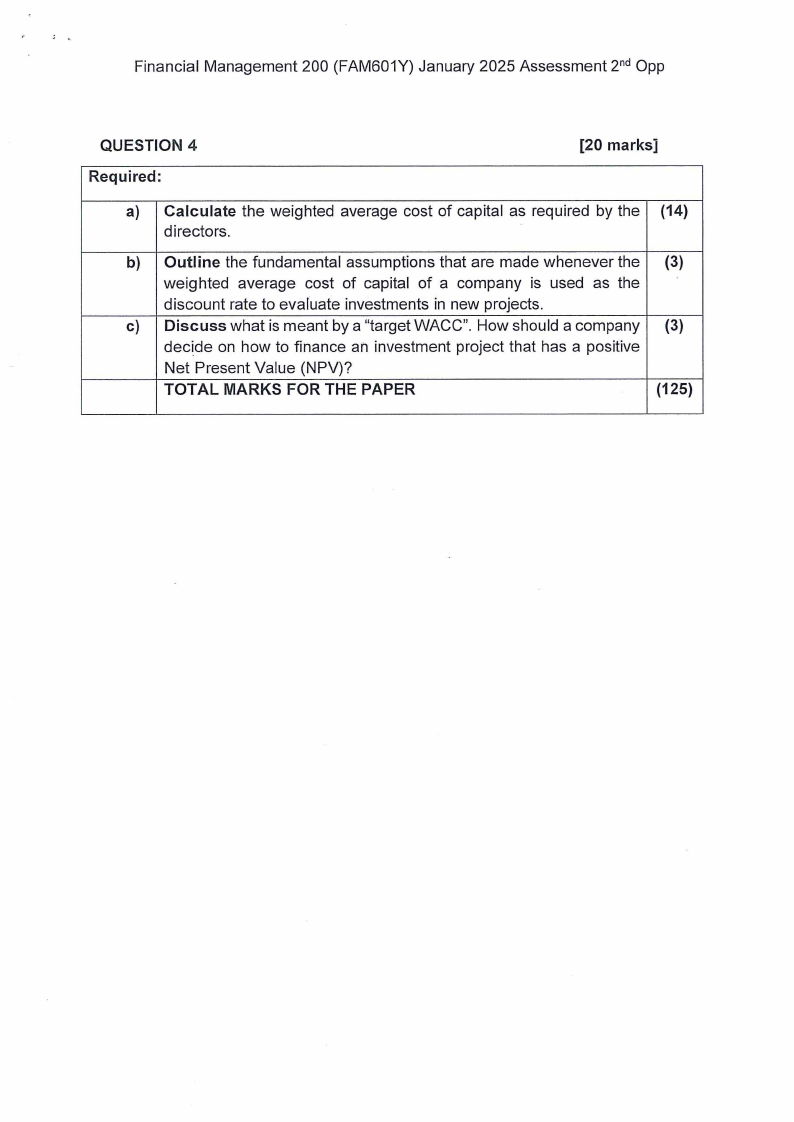

QUESTION 4

[20 marksj

Required:

a) Calculate the weighted average cost of capital as required by the (14)

directors.

b) Outline the fundamental assumptions that are made whenever the (3)

weighted average cost of capital of a company is used as the

discount rate to evaluate investments in new projects.

c) Discuss what is meant by a "target WACC". How should a company (3)

decide on how to finance ah investment project that has a positive

Net Present Value (NPV)?

TOTAL MARKS FOR THE PAPER

(125)