|

ATX812S-ADVANCED TAXATION-1ST OPP-NOV 2024 |

|

1 Page 1 |

▲back to top |

nAmlBIA UnlVERSITY

OF SCIEnCE Ano TECHnOLOGY

FACULTY OF COMMERCE, HUMAN SCIENCES AND EDUCATION

DEPARTMENT OF ECONOMICS, ACCOUNTING AND FINANCE

QUALIFICATION: BACHELOR OF ACCOUNTING

QUALIFICATION CODE: 08BOAH LEVEL: 8

COURSE CODE: ATX812S

COURSE NAME: ADVANCED TAXATION

DATE: November 2024

DURATION: 3 HOURS

PAPER:THEORYAND CALCULATIONS

MARl<S: 100

1st OPPORTUNITY EXAMINATION

EXAMINER(S) Dr. Moses Nyakuwanika

MODERATOR: Mrs. Marian Amakali

INSTRUCTIONS

1. Capture your full name, student number, mode of entry and assessment number on

the first page

2. Answer ALL the questions and manage your time properly.

3. Number each page correctly

4. Write clearly and neatly.

5. Do not write in pencil and do not use tip-ex, as this will not be marked.

6. The names of people and businesses used throughout this assessment do not reflect

the reality and may be purely coincidental.

7. SHOW ALL WORl<INGS!

THIS QUESTION PAPER CONSISTS OF 6 PAGES (including the front page)

|

2 Page 2 |

▲back to top |

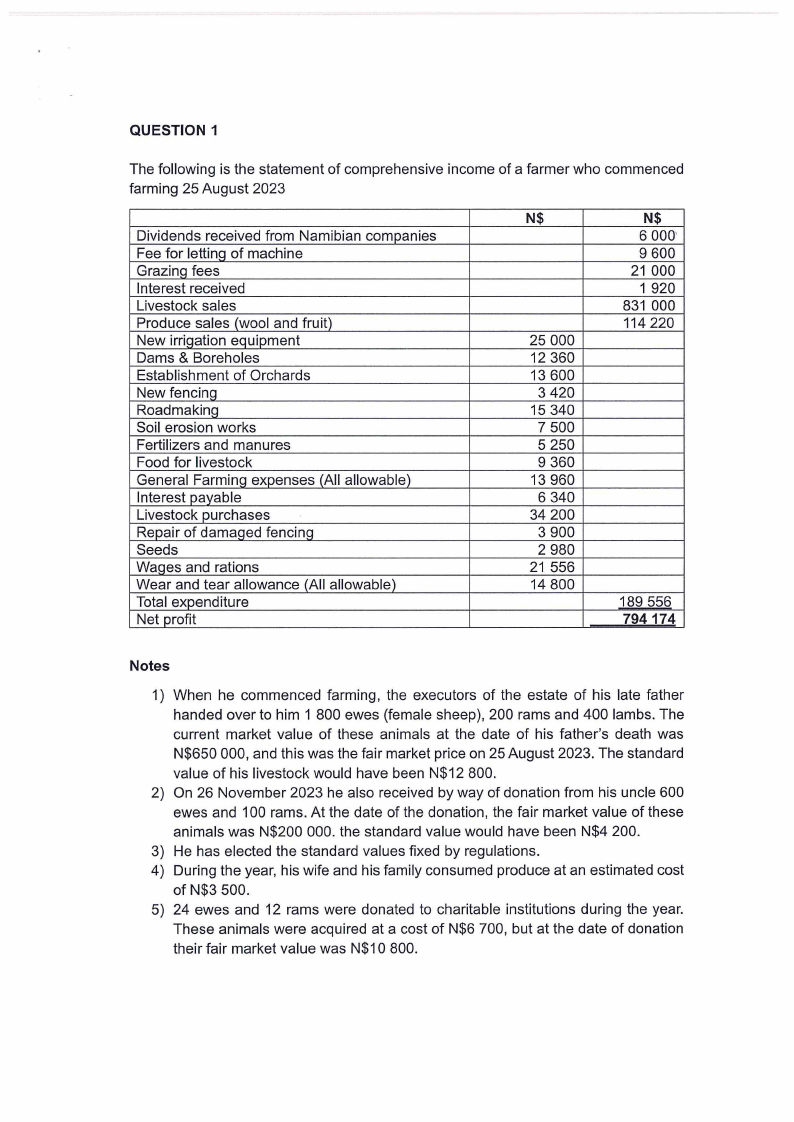

QUESTION 1

The following is the statement of comprehensive income of a farmer who commenced

farming 25 August 2023

Dividends received from Namibian companies

Fee for letting of machine

Grazinq fees

Interest received

Livestock sales

Produce sales (wool and fruit)

New irrigation equipment

Dams & Boreholes

Establishment of Orchards

New fencing

Roadmakinq

Soil erosion works

Fertilizers and manures

Food for livestock

General Farming expenses (All allowable)

Interest payable

Livestock purchases

Repair of damaged fencing

Seeds

Wages and rations

Wear and tear allowance (All allowable)

Total expenditure

Net profit

N$

25 000

12 360

13 600

3 420

15 340

7 500

5 250

9 360

13 960

6 340

34 200

3 900

2 980

21 556

14 800

N$

6 000'

9 600

21 000

1 920

831 000

114 220

189 556

794174

Notes

1) When he commenced farming, the executors of the estate of his late father

handed over to him 1 800 ewes (female sheep), 200 rams and 400 lambs. The

current market value of these animals at the date of his father's death was

N$650 000, and this was the fair market price on 25 August 2023. The standard

value of his livestock would have been N$12 800.

2) On 26 November 2023 he also received by way of donation from his uncle 600

ewes and 100 rams. At the date of the donation, the fair market value of these

animals was N$200 000. the standard value would have been N$4 200.

3) He has elected the standard values fixed by regulations.

4) During the year, his wife and his family consumed produce at an estimated cost

of N$3 500.

5) 24 ewes and 12 rams were donated to charitable institutions during the year.

These animals were acquired at a cost of N$6 700, but at the date of donation

their fair market value was N$10 800.

|

3 Page 3 |

▲back to top |

- - -------------------

6) On 28 February 2024 the numbers of livestock on hand were as follows: ewes

1 500, Rams 250, Lambs 400.

7) The estimated cost of production of wool and fruit on hand on 28 February 2024

was N$9 100.

REQUIREMENT

You are required to calculate the taxable income of the farmer for the year of

assessment ended 28 February 2024

[25 marks]

QUESTION 2

a) What are the duties of the master of High Court in the administration of

deceased estate

[5 marks]

b) What is the purpose and what are the benefits of forming a trust [8 marks]

c) Describe the types of trusts that can be created

[7 marks]

TOTAL MARKS

[20 marks]

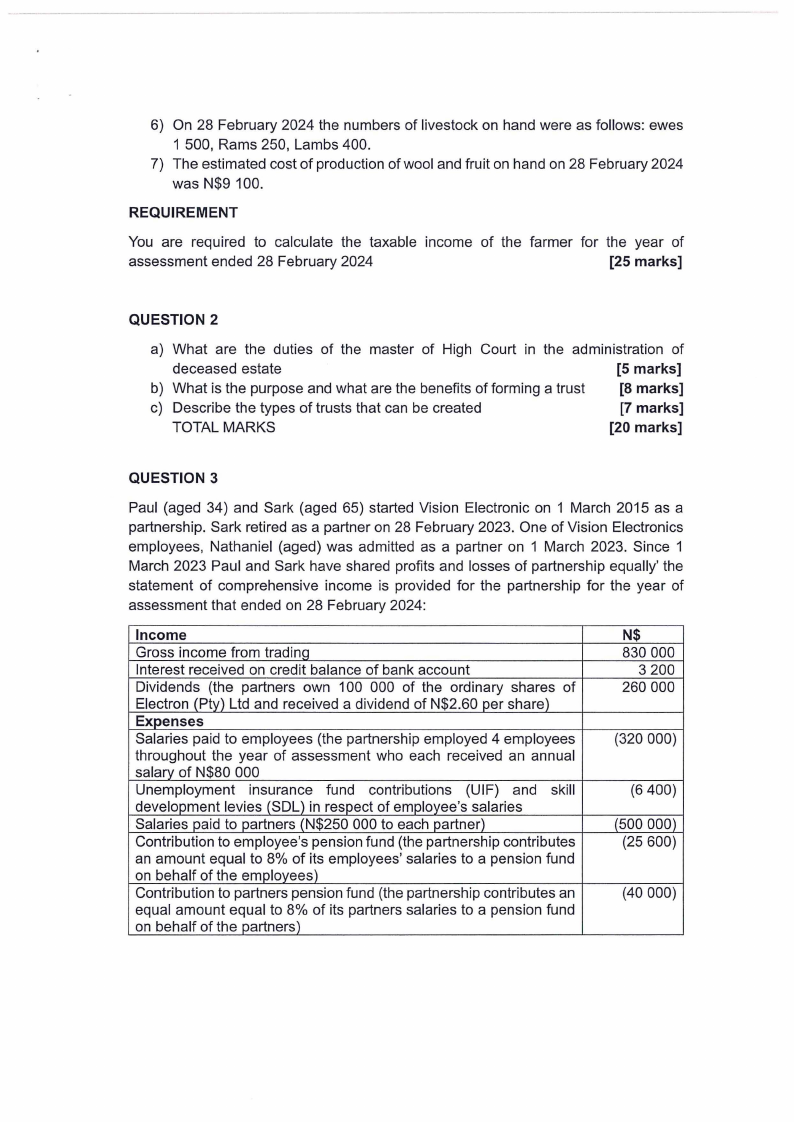

QUESTION 3

Paul (aged 34) and Sark (aged 65) started Vision Electronic on 1 March 2015 as a

partnership. Sark retired as a partner on 28 February 2023. One of Vision Electronics

employees, Nathaniel (aged) was admitted as a partner on 1 March 2023. Since 1

March 2023 Paul and Sark have shared profits and losses of partnership equally' the

statement of comprehensive income is provided for the partnership for the year of

assessment that ended on 28 February 2024:

Income

Gross income from tradinQ

Interest received on credit balance of bank account

Dividends (the partners own 100 000 of the ordinary shares of

Electron (Ptv) Ltd and received a dividend of N$2.60 per share)

Expenses

Salaries paid to employees (the partnership employed 4 employees

throughout the year of assessment who each received an annual

salary of N$80 000

Unemployment insurance fund contributions (UIF) and skill

development levies (SOL) in respect of employee's salaries

Salaries paid to partners (N$250 000 to each partner)

Contribution to employee's pension fund (the partnership contributes

an amount equal to 8% of its employees' salaries to a pension fund

on behalf of the employees)

Contribution to partners pension fund (the partnership contributes an

equal amount equal to 8% of its partners salaries to a pension fund

on behalf of the partners)

N$

830 000

3 200

260 000

(320 000)

(6 400)

(500 000)

(25 600)

(40 000)

|

4 Page 4 |

▲back to top |

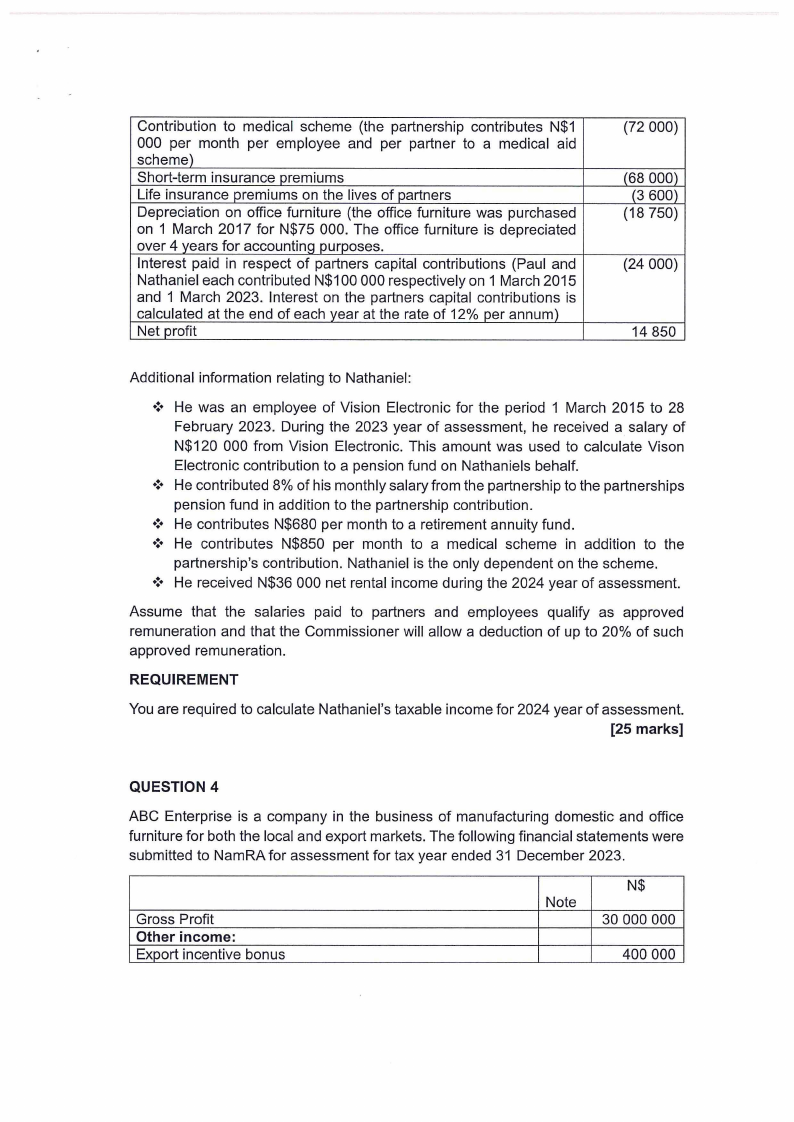

Contribution to medical scheme (the partnership contributes N$1

000 per month per employee and per partner to a medical aid

scheme)

Short-term insurance premiums

Life insurance premiums on the lives of partners

Depreciation on office furniture (the office furniture was purchased

on 1 March 2017 for N$75 000. The office furniture is depreciated

over 4 years for accountinQ purposes.

Interest paid in respect of partners capital contributions (Paul and

Nathaniel each contributed N$100 000 respectively on 1 March 2015

and 1 March 2023. Interest on the partners capital contributions is

calculated at the end of each year at the rate of 12% per annum)

Net profit

(72 000)

(68 000)

(3 600)

(18750)

(24 000)

14 850

Additional information relating to Nathaniel:

He was an employee of Vision Electronic for the period 1 March 2015 to 28

February 2023. During the 2023 year of assessment, he received a salary of

N$120 000 from Vision Electronic. This amount was used to calculate Vison

Electronic contribution to a pension fund on Nathaniels behalf.

He contributed 8% of his monthly salary from the partnership to the partnerships

pension fund in addition to the partnership contribution.

He contributes N$680 per month to a retirement annuity fund.

He contributes N$850 per month to a medical scheme in addition to the

partnership's contribution. Nathaniel is the only dependent on the scheme.

He received N$36 000 net rental income during the 2024 year of assessment.

Assume that the salaries paid to partners and employees qualify as approved

remuneration and that the Commissioner will allow a deduction of up to 20% of such

approved remuneration.

REQUIREMENT

You are required to calculate Nathaniel's taxable income for 2024 year of assessment.

[25 marks]

QUESTION 4

ABC Enterprise is a company in the business of manufacturing domestic and office

furniture for both the local and export markets. The following financial statements were

submitted to NamRA for assessment for tax year ended 31 December 2023.

Gross Profit

Other income:

Export incentive bonus

Note

N$

30 000 000

400 000

|

5 Page 5 |

▲back to top |

Interest from commercial bank

Dividends: Ok Namibia Ltd

Profit on disposal of Mercedes Benz

Less expenses:

Administration expenses

Distribution Expenses

Other expenses

Repairs and maintenance

Miscellaneous

Bad debts

Donations

Net profit

100 000

105 000

2

20 000

3

2 390 500

4

4 200 000

5

1 320 500

2 800 000

6

870 000

720 000

7

1 000 000

17 324 000

Additional information

1. The company had the following assets in its asset register as at 1 January 2023.

Asset

Freehold land

Date acquired/Constructed

1 March 2019

Cost N$

800 000

Manufacturing building

1 March 2019

850 000

Administration block

Computer Equipment

10 September 2020

June 2021

700 000

180 000

5 passenger motor vehicles August2022

700 000

Commercial vehicle

1 April 2021

600 000

Staff bus

30 November 2022

540 000

The manufacturing building was acquired together with business stand, the

administration block was however, constructed. The company had a policy of

claiming maximum capital allowances possible on fixed assets.

2. A Mercedes Benz with a book value of N$90 000 was involved in an accident

on 31 October 2023. The company received N$110 000 as compensation from

Insurance Company. The car was bought for N$150 000. The Mercedes Benz

is of the passenger motor vehicles, two of the passenger Motor Vehicle were

bought for N$140 000 each and the other two cars were bought for N$270 000.

3. Administration expenses

Extension of administration building

Depreciation

General repairs and maintenance

General entertainment costs

Salaries and wages

Total

430 000

720 000

70 500

150 000

1 020 000

2 390 500

4. Distribution costs

ISelling and marketing

1 920 oooI

|

6 Page 6 |

▲back to top |

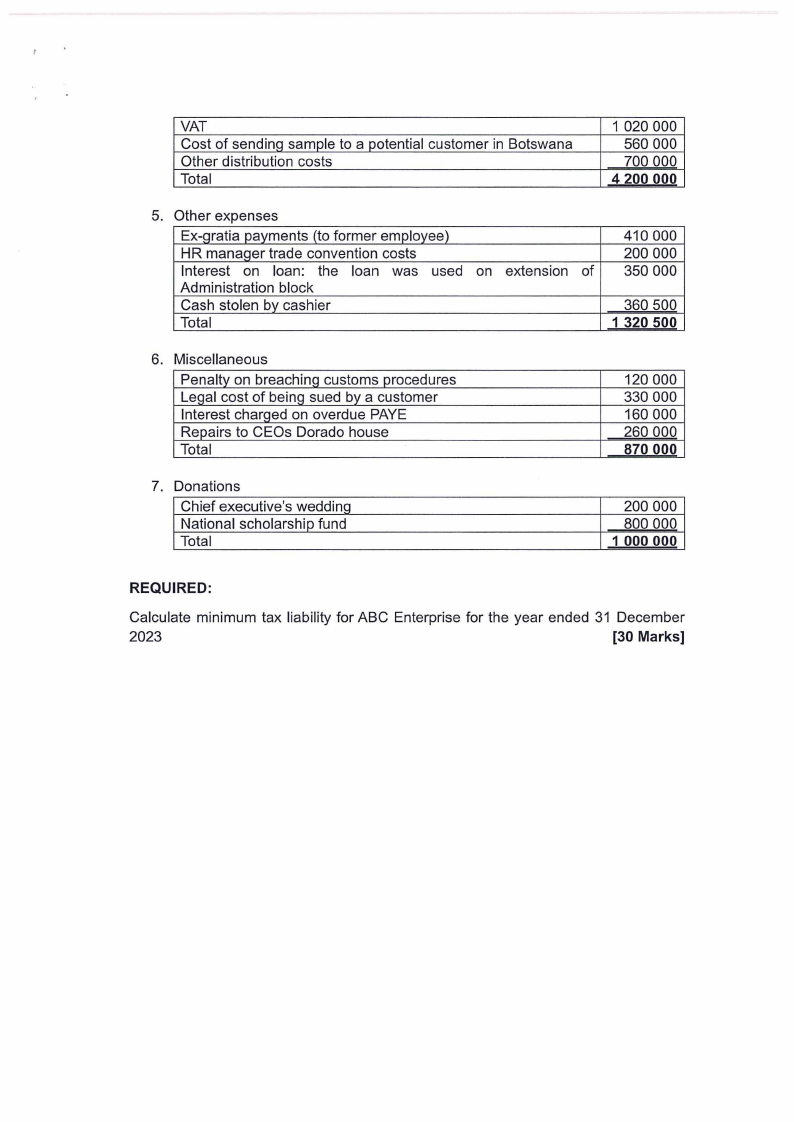

VAT

Cost of sending sample to a potential customer in Botswana

Other distribution costs

Total

1 020 000

560 000

700 000

4 200 000

5. Other expenses

Ex-gratia payments (to former employee)

HR manaqer trade convention costs

Interest on loan: the loan was used on extension of

Administration block

Cash stolen by cashier

Total

410 000

200 000

350 000

360 500

1 320 500

6. Miscellaneous

Penalty on breaching customs procedures

Legal cost of being sued by a customer

Interest charqed on overdue PAYE

Repairs to CEOs Dorado house

Total

120 000

330 000

160 000

260 000

870 000

7. Donations

Chief executive's wedding

National scholarship fund

Total

200 000

800 000

1 000 000

REQUIRED:

Calculate minimum tax liability for ABC Enterprise for the year ended 31 December

2023

[30 Marks]